Turkey – like Argentina – likes watching the same movie again and again. In the case of Argentina, every time there’s a currency crisis, the Peso gets repegged to the Dollar once things calm down, which invariably plants the seeds for the next crisis. President Milei is doubling down on that approach at the moment. It’s similar for Turkey. In the past decade, President Erdogan has abused the banking system to engineer one credit boom after another. That’s caused Turkey to grow far above its speed limit – allowing Erdogan to stay in power – but at the cost of periodic currency crises. This crisis cycle will only end once Erdogan finally leaves the political stage.

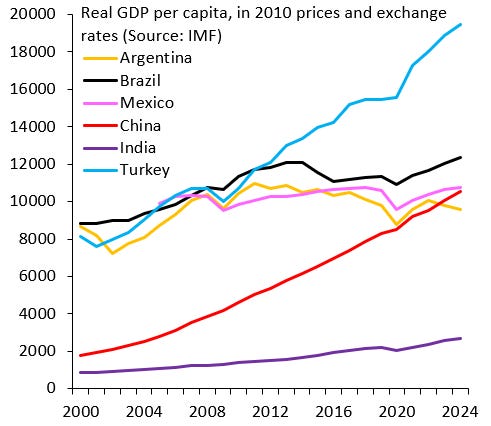

The chart above shows real per capital GDP across key emerging markets (EM). There’s a cluster of middle-income EMs – countries like Argentina (orange), Brazil (black) and Mexico (pink) – that look similar to Turkey (blue) until 2010, whereafter Turkey took off and grew its per capita GDP at almost the same pace as China (red).

If that sounds too good to be true, it is. In the decade since the global financial crisis, Erdogan began using the banking system to engineer one credit boom after another. Those credit booms lifted consumption, sucking in huge amounts of imports, which is why Turkey has a chronic current account deficit. Whenever global risk appetite falters or Erdogan arrests an opposition leader, the Lira blows up.

The chart above shows just how nuts Turkey’s credit booms have become. It shows a 13-week centered moving average for bank lending, breaking this down into local- and hard-currency lending and distinguishing between state-owned and private banks. The credit booms that started happening in 2017 and 2018 were huge at the time, but they’re tiny compared to what’s happening now. I should note I’m looking at nominal, Lira-denominated credit, which strikes many as odd given that Turkey has double-digit inflation. The reason I’m doing this is because the Lira is heavily managed against the Dollar. Lira-denominated credit goes straight into imports where its purchasing power is greatest. Deflating this would be wrong.

Turkey is deeply divided politically. Erdogan’s only hope for staying in power is to goose growth as much as possible. His only tool to do that is credit, so there’s no hope that Turkey’s endless boom-bust cycle ends anytime soon. Turkey will only regain its macroeconomic stability once Erdogan finally leaves the political stage.