Content supplied by Rabobank.

With global milk supply growth on the rise, the global dairy market looks set to face a period of increasing exportable surpluses which will ‘test the market balance’ over the year ahead, according to a new report by food and agribusiness banking specialist Rabobank.

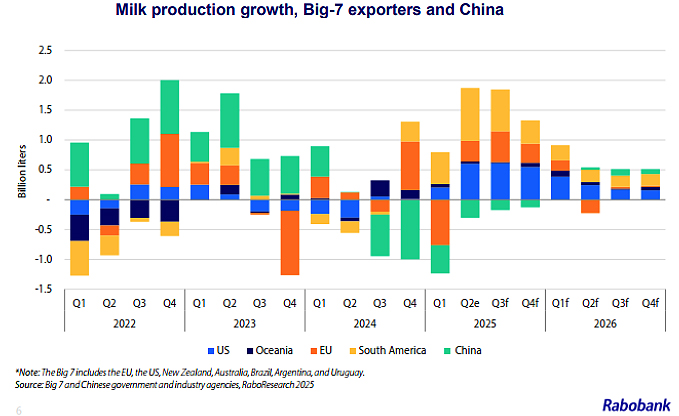

In its Q3 Global Dairy Quarterly Report, Rabobank says the velocity in milk supply growth across most of the key dairy export regions has shifted, outperforming previous expectations.

“For example, July milk production in the US was up by 3.4% year-on-year (YOY), and this is the highest growth rate we’ve seen since 2021,” report co-author RaboResearch senior analyst Emma Higgins said. “We’ve also seen really strong New Zealand production following a record start to the new 2025/26 season.”

Ms Higgins said improving farm margins, recovery from last year’s disease outbreaks, and the absence of disruptive weather are expected to drive milk supplies higher in the coming months.

“Across the Big 7 exporting regions – New Zealand, Australia, the EU, the US, Uruguay, Argentina and Brazil – we’re expecting milk supply growth of 2% YOY for the second half of 2025 before slowing to 0.44% YOY in 2026,” she said. “Most European and Oceania farmgate milk prices are near record highs. At the same time, purchased feed prices are expected to be favourable into 2026, as ample supplies keep prices in check.”

Moving forward, the report says, global dairy markets are still expected to face headwinds on the demand side, particularly among low and middle income earners.

“Ongoing sluggishness in demand is evident across many food service channels, and a boost in consumer confidence will be needed to lift discretionary spending,” Ms Higgins said.

“China is still battling a consumption slump, and recovery signals in Southeast Asia are mixed. In the US, concerns around the labour market and the impact of tariffs are contributing to soft consumer sentiment.”

Despite the changing supply and demand fundamentals, Ms Higgins said, RaboResearch still anticipates a New Zealand farmgate milk price of $10.00/kgMS is possible for the 2025/26 season. “Although a gradual recovery in demand should help absorb the additional volume, nearterm price softness is likely,” she said.

“One of the key risks to maintaining a $10.00/kgMS forecast is the potential for increased milk production out of New Zealand. With broadly favourable weather conditions, strong cashflows, and the sun emerging, the 2025/26 season could see a robust spring flush, adding further supply-side pressure to global markets.”

“These dynamics suggest that while $10.00/kgMS is still possible, it will require a delicate balance between supply growth and demand recovery.”

What to watch

The report says trade developments shape as a key watch factor over the months ahead. “As of late August, the US-China trade deal remains in a holding pattern, with both sides extending the trade truce for 90 days until November 10, and until then reciprocal tariffs are capped at 10%,” Ms Higgins said.

“We’ve also recently seen the US reach a trade deal with the EU, resulting in tariffs set at 15%. In addition the European Commission has proposed introducing tariff rate quotas for numerous agricultural and food products including some US dairy products.

“While the proposed trade volumes pale in comparison to the over 100,000 metric tons of EU cheese and 50,000 metric tons of butter exports to the US, they still represent a significant step toward increased market access for the US.”

Ms Higgins said plans by milk-importing countries to boost local milk production, and the next phase of China’s economic cycle are further watch factors for the global sector over the remainder of the year.

New Zealand update

The report says New Zealand dairy export volumes for the three months to July 2025 were down 5% year-on-year, despite a 3.7% YOY surge in milk flows in quarter two.

“Shipments to China held steady over the three-month period, but exports to Indonesia, Algeria, Malaysia, Australia, and Thailand all fell by double-digit percentages,” Ms Higgins said.

“Increased demand from Saudi Arabia and UAE helped offset part of the short fall.”

“Some inventory overhang from the end of the previous selling season may be lingering as the new production year begins. Looking ahead export volumes are expected to remain stable through the second half of 2025 and into 2026.”

The report says New Zealand dairy farmer revenues remain strong. “Fonterra has maintained its milk price forecast of $10.00/kgMS for the 2025/26 season and raised its forecast for 2024/25 to $10.15/kgMS,” Ms Higgins said.

“Strong beef prices are also supporting farm incomes, with additional revenue from cull cows providing the income boost. Yet, slaughter data suggests more cows are being retained, with kill rates down over 5% for the 2025/26 season to date (ending 30 September).

“At the time of writing, bobby calf slaughter is down 14.5% YOY over the same period, potentially indicating up to 110,000 additional calves being reared.”

While revenues are up, Ms Higgins said, so too are costs. “Feed prices are rising across most inputs, but they remain affordable, and strong early season milk flows point to a bumper production season.

“If conditions continue to align, New Zealand dairy farmers could be on track to set a new production record – building on a strong 2024/25 season, which ended 2.6% YOY higher in tonnage and 3.3% YOY higher in milk solids.”