Bitcoin miners are sitting on some of the most powerful data centers in the world, built during years of heavy investment in high-end servers and energy-intensive infrastructure. Yet, as mining becomes tougher and less lucrative, those same facilities are proving far more valuable for something else. AI, high-performance computing, and cloud workloads thrive on exactly the kind of hardware miners already operate at scale.

Grand View Research estimates that the global market for AI-driven high-performance computing reached $2.6 billion in 2023 and could climb to $4.8 billion by 2030, reflecting a 9.4% CAGR. Growing demand for advanced compute capabilities across industries is fueling that expansion, and drawing bitcoin miners toward a business model with more dependable revenue potential.

Citizens JMP analyst Greg Miller has been watching this dynamic take shape, and he describes it in clear prose, explaining the way it can bring opportunities for investors.

“Given surging demand for data center space and a shortage of supply in the market today, the buildout of new powered data center space can create significant value… Several companies are in the unique position to supply capacity to AI hyperscalers which provides shareholders a far better alternative to bitcoin mining… We believe the universe of former bitcoin miners can supply ~15 GW, with scaled power companies accounting for another ~15GW… Even with the near – meteoritic rise in valuation, we believe the stocks have room to run as hyperscale deployments around the country accelerate from here,” Miller opined.

Against this backdrop, Miller has highlighted three former bitcoin miners now leaning into the AI boom. We ran the trio through the TipRanks database to see how the rest of Wall Street views their prospects. Let’s dive in.

Cipher Mining (CIFR)

We’ll get started with Cipher Mining, a tech firm operating in Texas – where it has five industrial-scale data centers online with another five in the construction and development pipeline. The company’s data centers are currently in a state of transition, shifting from a bitcoin mining focus to high performance computing – with the goal being that Cipher Mining will be able to allocate resources toward both applications as opportunity and business call.

Currently, Cipher Mining has five active data centers, all located in the northwest of Texas. The largest facility, Barber Lake, is expanding, and its Phase II, expected online in 2029, will add another 500 megawatts to its existing 300-megawatt capacity. Overall, Cipher Mining has 3.2 gigawatts of new capacity in its development pipeline.

These existing sites and development projects were supplemented in the company’s November 3 announcement that it will be developing a 1-gigawatt site in West Texas. The new site, dubbed Colchis, will be majority financed by Cipher and will focus on high-performance computing.

While Cipher’s current activities – and revenues – center on bitcoin mining, the company is moving quickly to bring its HPC business to the fore. In recent months, Cipher has executed pivotal transactions with Fluidstack and Google to provide HPC-capable computing, building its credibility as a provider. More importantly, the company has announced, also on November 3, a 15-year lease agreement plan with AWS. The plan sees Cipher providing ‘turnkey space and power for AI workloads,’ as well as 300 megawatts of power capacity next year. The deal is valued at approximately $5.5 billion, and rent will commence in August of next year.

For now, as noted, Cipher’s revenue is still derived from its bitcoin activities. In the last quarter, 3Q25, the company generated a top line of $71.7 million, nearly triple the 3Q24 figure – although it was also $4.8 million below expectations. The company’s non-GAAP third-quarter EPS, at $0.10 missed the forecast by $0.01.

In his coverage for Citizens JMP, analyst Greg Miller notes the potential inherent in Cipher’s planned strategic shift, writing of the company, “With likely 3.8 GW of capacity to bring to bear in the HPC market, entirely in Texas, we expect Cipher’s HPC inventory will rival that of some of the major projects in the market like Stargate with 3 GWs planned… Despite the ~146 % rise in the share price of CIFR over the past three months, we continue to believe the stock remains attractive as full -scale hyperscale leasing accelerates… If Cipher successfully executes on its planned capacity build-out, the stock could exceed $90 per share assuming it leases all of its 3.8 GW in its pipeline.”

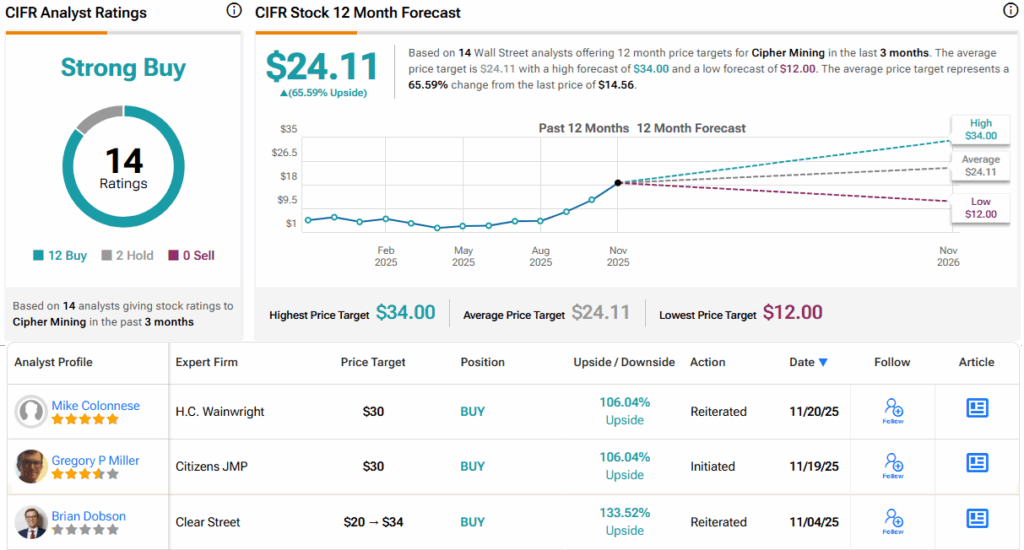

Miller puts an Outperform (i.e., Buy) rating on Cipher, along with a $30 price target that indicates room for an upside of 106% by this time next year. (To watch Miller’s track record, click here)

The stock has 14 recent analyst reviews on file, and the 12-to-2 split in favor of Buy over Hold gives it a Strong Buy consensus rating. Shares in Cipher are priced at $14.56 and their $24.11 average price target implies that a one-year gain of 65.5% is in the offing. (See CIFR stock forecast)

Riot Platforms (RIOT)

Next on our list is Riot Platforms, a Colorado-based bitcoin miner with data center facilities in Texas and Kentucky, and electrical switchgear engineering and manufacturing ops located in its home city of Denver. The company has well over 1 gigawatt of data center capacity already up and running, with another 600 megawatts under development in the ongoing expansions of its Corsicana facility in Texas. The first 112 megawatts of new capacity there are already under construction. We should note that Riot’s Rockdale facility, by developed capacity, is currently the largest bitcoin mining data center in North America.

In addition to its extensive data center ops, Riot is also the full owner of ESS Metron, a subsidiary company with a strong position in the global market for power distribution centers and other advanced electrical equipment. Owning this subsidiary allows Riot to keep much of its ancillary hardware systems, necessary for maintaining the data centers, ‘in-house,’ a key advantage in a capital-intensive field.

Riot has not switched to selling HPC access – yet. But the company’s large expansion of its already large data center footprint is aimed in that direction. Like many of its peers, Riot is relying on bitcoin mining proceeds as a permanent income driver, and the company saw record revenue in its last reported quarter, 3Q25.

In that quarter, the company’s top line came to $180.2 million, up 112% year-over-year and some $7.9 million better than had been expected. Riot’s net income for the quarter, of $104.5 million, translated to a diluted EPS of 26 cents, 13 cents per share better than the forecast. These gains came on the heels of a large production jump – in Q3, Riot produced 1,406 bitcoin, a year-over-year increase of 302.

Miller, in his coverage for Citizens, points out Riot’s large active capacity, and notes how it is pre-adapted for the HPC market. Summing up the company’s prospects, the analyst writes, “With 1.7GW of power capacity in key markets, RIOT is uniquely positioned to monetize its asset base in a manner far superior to that of bitcoin mining. We expect the pivot in strategy, to sell capacity into the HPC market, will produce significant returns for shareholders once the company signs its first contract. Currently, we value only the 1.7GW of approved power but expect the pipeline will grow as rapidly as others that could produce a doubling of this pipeline in the next six months.”

Quantifying his stance, Miller sets an Outperform (i.e., Buy) rating on RIOT, with a $25 price target that implies a robust one-year share price gain of 87%.

Riot’s Strong Buy consensus rating on the Street is unanimous, based as it is on 17 positive analyst reviews. The stock has a trading price of $12.78 and its average target price, $27.35, points toward a 114% appreciation over the next 12 months. (See RIOT stock forecast)

IREN, Ltd. (IREN)

Last on our list is IREN, a bitcoin miner that has seen the wider applicability of its next-generation data centers. IREN keeps its administrative offices in Sydney, Australia, and Vancouver, British Columbia, and operates four data center facilities – three of these are in BC, and the fourth is in Texas. The company boasts that its data centers run on 100% renewable power sources; in British Columbia, that means the facilities are plugged into the province’s hydroelectric power network. The facilities have a combined power rating of 160 megawatts. In Texas, the company’s large Childress facility is currently operating at 350 megawatts capacity, with another 400 megawatts under construction, based on wind and solar power.

Just as important as the power rating, IREN’s data center facilities are connected to global online networks using dedicated fiber optic cable pathways, able to maintain high levels of data transmission. While originally planned as part of the bitcoin mining operations, these connections have proven capable of supporting the company’s shift toward AI data center operations.

IREN no longer describes itself as a bitcoin miner; rather, the company bills itself as an AI Cloud Service provider – and it is making large strides toward expanding that new role. Just this month, IREN announced that it had scored an important win – a multi-year GPU cloud service contract with Microsoft. Microsoft is a major provider of cloud subscription services, and IREN will now give the software giant access to late-model NVIDIA GB300 GPUs. The contract will run over a five-year term and is valued at $9.7 billion.

Along with the Microsoft deal, IREN will work with Dell to buy the GPUs and other necessary gear in a purchase deal valued at $5.8 billion. The new hardware will be installed at IREN’s Texas facility in phases throughout next year. All of this is part of IREN’s plan to expand its annualized run-rate revenue (ARR) to $3.4 billion by year’s end 2026.

In the meantime, the company’s fiscal 1Q26 report (September quarter) showed a record-level top line of $240.3 million. This figure was up an impressive 355% from fiscal 1Q25. In addition, the company’s net income turned from a $51.7 million net loss in fiscal 1Q25 to a 1Q26 profit of $384.6 million – which was also a record level for the company.

We should note two salient points about IREN’s share price. First, that year-to-date, IREN shares are up by 366%, with most of that gain coming since August. And second, that the stock fell sharply in November, when a pullback in AI stocks sparked worries about whether the AI boom can maintain its fast pace.

Analyst Miller has noted IREN’s strategic move to providing AI-capable cloud services, and the company’s success; checking in with him one last time, we find that he is not worried about the persistence of the AI boom. Miller writes, “IREN is attempting to become a vertically integrated GPUaaS provider with direct ownership of the underlying data center assets. The strategy should better protect the company from escalating real estate costs with declining ASPs. With faster revenue growth and payback, GPUaaS should produce very strong financial metrics in the near-term, allowing the company to produce more than $3.4b in revenue for this new segment by the end of 2026. Valued in blocks of GPUaaS contracts, it could be worth of $280+ per share over an extended period or time.”

These comments back up Miller’s Outperform (Buy) rating, while his $80 price target implies a one-year upside potential of 84%.

This stock’s Moderate Buy consensus rating is based on 13 recent analyst reviews that include 9 to Buy and 2 each to Hold and Sell. The shares are priced at $43.47, and their $83.45 average price target suggests a gain of 92% for the next 12 months. (See IREN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.