Peracetic Acid Market Size and Share Forecast Outlook 2025 to 2035

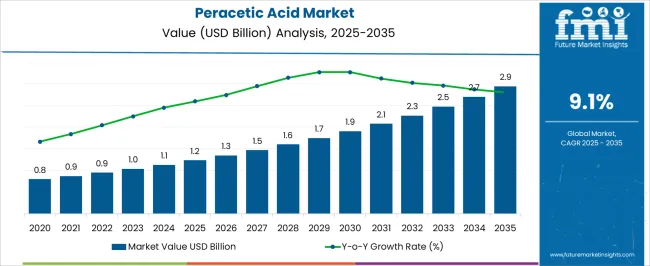

The peracetic acid market is estimated to be valued at USD 1.2 billion in 2025 and is projected to reach USD 2.9 billion by 2035, registering a compound annual growth rate (CAGR) of 9.1% over the forecast period.

A detailed breakpoint analysis provides insights into the incremental growth over successive periods, highlighting the dynamics shaping market expansion. In the first block, 2025 to 2027, the market is expected to grow from USD 1.2 billion to USD 1.3 billion, passing through intermediate values of USD 1.2 billion, 1.3 billion, and 1.5 billion. This initial growth phase is primarily driven by rising demand for eco-friendly disinfectants and sterilization chemicals in food processing, healthcare, and water treatment sectors, along with increasing regulatory focus on hygiene and pathogen control. The second block, 2028 to 2032, illustrates the market’s advancement from USD 1.5 billion to USD 2.1 billion, with intermediate projections of USD 1.6 billion, 1.7 billion, 1.9 billion, and 2.1 billion.

During this phase, technological improvements in peracetic acid formulations, enhanced supply chain efficiency, and expansion into emerging markets contribute significantly to value creation. Finally, from 2033 to 2035, the market accelerates from USD 2.3 billion to USD 2.9 billion, passing through USD 2.5 billion, 2.7 billion, and ultimately 2.9 billion. Growth in this period is supported by large-scale adoption in industrial cleaning, wastewater management, and agriculture, combined with global emphasis on sustainable and low-residue chemical solutions. The breakpoint analysis underscores how consistent adoption trends, regulatory drivers, and industrial applications collectively sustain long-term market growth over the 2025–2035 horizon.

Quick Stats for Peracetic Acid Market

Peracetic Acid Market Value (2025): USD 1.2 billion

Peracetic Acid Market Forecast Value (2035): USD 2.9 billion

Peracetic Acid Market Forecast CAGR: 9.1%

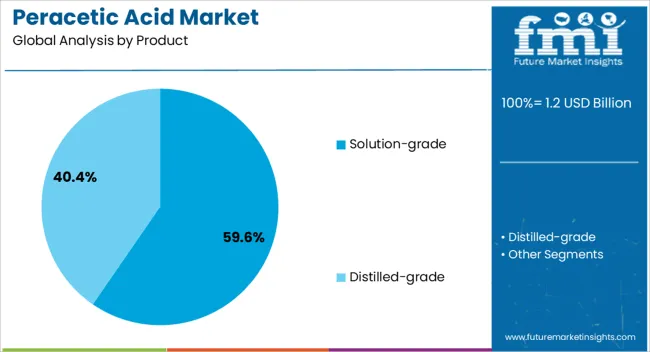

Leading Segment in Peracetic Acid Market in 2025: Solution-grade (59.6%)

Key Growth Regions in Peracetic Acid Market: North America, Asia-Pacific, Europe

Key Players in Peracetic Acid Market: Evonik Industries, Kemira Oyj, Mitsubishi Gas Chemicals Inc, Solvay S.A, SEITZ GmbH, Ecolab Inc

Peracetic Acid Market Key Takeaways

The peracetic acid market is influenced by a range of interrelated end-use sectors that collectively drive demand, adoption, and technological advancement in disinfection and sterilization solutions. The healthcare and medical sector holds the largest share at 35%, as peracetic acid is extensively used for sterilizing surgical instruments, medical devices, and hospital environments, ensuring compliance with stringent hygiene and infection control standards.

The food and beverage processing market contributes 30%, driven by its application in sanitizing processing equipment, packaging lines, and surfaces to prevent microbial contamination and enhance shelf life. The water treatment and municipal sanitation segment accounts for 20%, as peracetic acid offers an effective alternative to chlorine-based treatments, ensuring safe drinking water and wastewater management while minimizing harmful byproducts.

The agricultural and horticultural sector holds a 10% share, where peracetic acid is used for crop protection, seed treatment, and post-harvest sanitization, supporting sustainable practices and reducing chemical residues. Lastly, the chemical manufacturing and industrial cleaning market contributes 5%, leveraging peracetic acid for eco-friendly bleaching, surface treatment, and cleaning applications in various production processes.

Combined, the healthcare and food & beverage sectors represent 65% of the total market, emphasizing that safety, hygiene, and contamination control are the primary drivers of peracetic acid demand across industries, supported by rising regulatory frameworks, sustainability mandates, and technological improvements in formulation and delivery.

Metric

Value

Peracetic Acid Market Estimated Value in (2025 E)

USD 1.2 billion

Peracetic Acid Market Forecast Value in (2035 F)

USD 2.9 billion

Forecast CAGR (2025 to 2035)

9.1%

Why is the Peracetic Acid Market Growing?

The peracetic acid market is experiencing robust growth, supported by its broad-spectrum antimicrobial properties, versatility across applications, and increasing alignment with stringent environmental and safety regulations. Current market momentum is being driven by its adoption as an effective disinfectant and oxidizing agent in industries ranging from water treatment to food processing. Regulatory agencies are encouraging reduced reliance on chlorine-based disinfectants, positioning peracetic acid as a preferred alternative due to its rapid degradation into non-toxic byproducts.

Supply stability has been enhanced by capacity expansions and improved manufacturing processes, ensuring consistent quality and concentration levels. Price competitiveness and operational efficiency have been strengthened by technological advancements in formulation and dosing systems.

Over the forecast period, demand is anticipated to be reinforced by tightening water quality standards, heightened public health awareness, and expanding use in emerging industrial sectors These factors, coupled with sustainability-driven procurement policies, are expected to sustain market penetration and revenue growth across diverse geographies.

Segmental Analysis

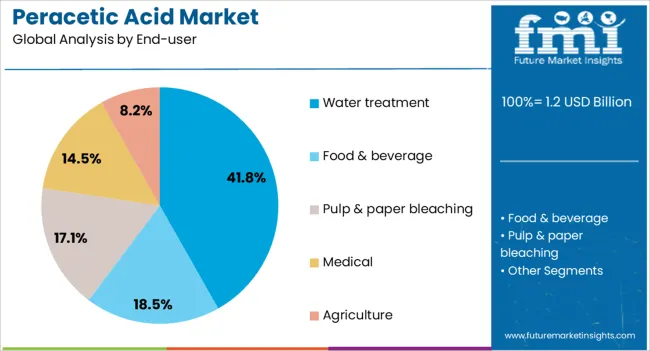

The peracetic acid market is segmented by product, end-user, and geographic regions. By product, peracetic acid market is divided into Solution-grade and Distilled-grade. In terms of end-user, peracetic acid market is classified into water treatment, food & beverage, pulp & paper bleaching, medical, and agriculture. Regionally, the peracetic acid industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Insights into the Product Segment

The solution-grade segment, holding 59.60% of the product category, has retained market leadership due to its high versatility and ease of integration into industrial and municipal operations. Its dominance is attributed to the consistent demand from sectors requiring ready-to-use formulations that minimize on-site handling risks and ensure precise concentration control. The segment has benefited from advancements in storage stability and packaging, enabling extended shelf life and simplified logistics.

Widespread adoption in water treatment, food sanitation, and healthcare sterilization has reinforced its market share, as these applications require consistent potency and regulatory compliance. Manufacturers have focused on refining production efficiency to reduce cost per unit while maintaining purity levels, further supporting competitive positioning.

Additionally, strategic partnerships with distributors and service providers have enhanced availability across both developed and emerging markets This combination of operational practicality, regulatory approval, and broad application range is expected to continue driving the segment’s dominance in the forecast period.

Insights into the End-user Segment

The water treatment segment, accounting for 41.80% of the end-user category, has sustained its leading position due to increasing emphasis on water quality management across municipal, industrial, and recreational systems. Growth has been reinforced by the compound’s efficacy in eliminating a wide spectrum of microorganisms without generating harmful residuals, aligning with environmental safety mandates.

Rising investments in wastewater treatment infrastructure, particularly in developing economies, have expanded the demand base for peracetic acid solutions. Regulatory bodies’ shift towards sustainable disinfection methods has further boosted adoption, as operators seek to comply with evolving quality benchmarks while minimizing ecological impact.

Enhanced dosing technologies and automated monitoring systems have improved treatment efficiency and reduced operational costs, strengthening the segment’s appeal The role of water treatment in safeguarding public health and supporting industrial processes ensures that this application will remain a major demand driver, with long-term growth potential supported by global urbanization and tightening environmental regulations.

What are the Drivers, Restraints, and Key Trends of the Peracetic Acid Market?

Peracetic acid market growth is primarily driven by healthcare sterilization, food safety compliance, and water treatment adoption. Agriculture and industrial cleaning provide additional steady demand, reinforcing market expansion.

Rising Healthcare Sterilization Requirements Drive Market

The healthcare sector is a significant growth driver for the peracetic acid market. Hospitals, clinics, and surgical centers increasingly depend on effective sterilization agents to prevent healthcare-associated infections (HAIs). Peracetic acid is preferred for its broad-spectrum antimicrobial efficacy, rapid action, and minimal residue, making it ideal for sterilizing medical instruments, endoscopes, and laboratory equipment. Regulatory mandates on infection control, coupled with growing awareness of hospital hygiene, are pushing demand upward. The expansion of healthcare infrastructure in emerging regions is contributing to incremental growth. The market benefits from both recurring consumable demand in sterilization cycles and increasing adoption of advanced disinfection protocols, which cumulatively reinforce the sector’s dominance in overall peracetic acid consumption.

Food And Beverage Processing Drives Adoption Growth

The food and beverage industry represents a critical application area, driving significant peracetic acid consumption. It is extensively used for sanitizing equipment, conveyors, packaging lines, and storage tanks to prevent microbial contamination and extend product shelf life. Stringent food safety regulations globally, including HACCP compliance and FDA guidelines, necessitate the adoption of effective disinfectants, enhancing market demand. Increasing consumer preference for hygienically processed food, coupled with rising production capacities, further fuels usage. Manufacturers benefit from repeat purchases due to recurring cleaning cycles, making the sector a consistent revenue contributor. The growth is also supported by rising investments in ready-to-eat foods and beverages, which require high sanitation standards across processing and packaging operations.

Water Treatment Sector Expands Disinfection Applications

Municipal and industrial water treatment systems are increasingly incorporating peracetic acid as a chlorine alternative. Its effectiveness in treating drinking water, wastewater, and effluents while producing minimal harmful byproducts drives market adoption. The chemical is used in controlling biofilms, eliminating pathogens, and maintaining water quality for municipal utilities and industrial plants. Rising urban water demand, coupled with stringent regulatory standards on wastewater discharge and water safety, encourages broader application. Peracetic acid supports environmentally friendly treatment protocols, which are favored in industrial and municipal sectors. This segment’s adoption grows steadily, reflecting its essential role in ensuring safe water supply and effective wastewater management, thereby contributing significantly to market expansion.

Agriculture And Industrial Cleaning Boost Market Demand

Peracetic acid finds niche applications in agriculture and industrial cleaning, supporting market growth. In agriculture, it is applied for crop protection, seed treatment, and post-harvest sanitization, preventing microbial spoilage and enhancing yield quality. The industrial cleaning sector uses it for bleaching, surface treatment, and equipment sanitation in chemical, pharmaceutical, and food processing plants. These applications offer high-value opportunities due to recurring cleaning cycles and regulatory compliance requirements. Growing emphasis on safe, residue-free chemical treatment in crops and industrial facilities enhances adoption. Collectively, these segments, though smaller than healthcare and food processing, provide stable incremental demand and help diversify market reliance across multiple end-use sectors, ensuring long-term growth resilience.

Analysis of Peracetic Acid Market By Key Countries

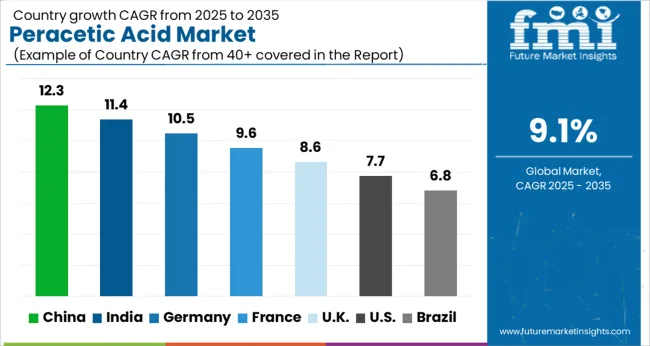

Country

CAGR

China

12.3%

India

11.4%

Germany

10.5%

France

9.6%

UK

8.6%

USA

7.7%

Brazil

6.8%

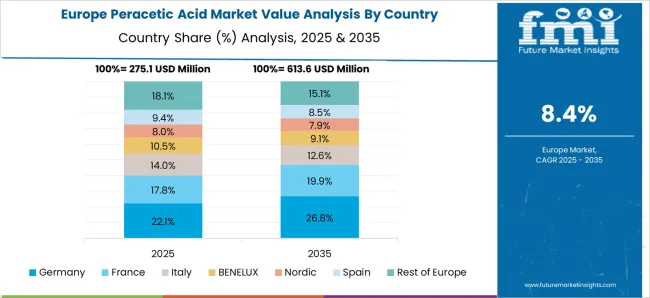

The global peracetic acid market is projected to grow at a CAGR of 9.1% from 2025 to 2035. China leads with 12.3%, followed by India at 11.4%, Germany at 10.5%, the UK at 8.6%, and the USA at 7.7%. Growth is driven by rising demand in healthcare sterilization, food and beverage processing, water treatment, and industrial cleaning applications.

China and India are witnessing rapid expansion due to large-scale industrial and healthcare infrastructure development, while Germany, the UK, and the USA focus on regulatory compliance, high hygiene standards, and adoption of eco-friendly disinfectants. High utilization of peracetic acid in hospitals, processing plants, and municipal water systems is further boosting dollar sales and market share. The analysis spans over 30+ countries, with the leading markets shown below.

Growth Analysis of Peracetic Acid Market in China

The peracetic acid market in China is projected to grow at a CAGR of 12.3% from 2025 to 2035, driven by increasing demand for disinfectants, water treatment, and food processing applications. Rising concerns over hygiene and industrial effluent management are encouraging adoption across chemical, pharmaceutical, and food sectors.

Government initiatives for clean water and sustainable sanitation further support market expansion. Domestic manufacturers are scaling production capacity while introducing stabilized formulations to enhance shelf life and safety. Adoption of automated dosing systems in industrial processes is increasing efficiency and reducing operational risks.

Use in water treatment and sanitation driving demand

Food processing and pharmaceutical applications expanding market

Innovation in stabilized formulations improving safety and efficacy

Demand Forecast for Peracetic Acid in India

The peracetic acid market in India is expected to grow at a CAGR of 11.4% from 2025 to 2035, supported by rising industrialization, hygiene awareness, and expansion of water treatment facilities. Food processing, beverage production, and pharmaceutical sectors are adopting peracetic acid for disinfection and microbial control.

Government programs promoting clean water, sanitation, and safe food supply chains boost market penetration. Industrial clusters in Maharashtra, Gujarat, and Tamil Nadu are driving distribution and faster deployment of solutions. Growing focus on sustainability and regulatory compliance enhances the preference for peracetic acid over traditional chlorine-based agents.

Food and beverage sector adoption increasing

Government sanitation programs supporting market growth

Preference for eco-friendly disinfection solutions rising

Growth Analysis of Peracetic Acid Market in Germany

The peracetic acid market in Germany is projected to grow at a CAGR of 10.5% from 2025 to 2035, fueled by stringent environmental regulations, demand for sustainable disinfectants, and expansion of industrial and pharmaceutical sectors. Water treatment plants, food processing units, and healthcare facilities are major adopters.

Focus on reducing chlorinated by-products encourages the switch to peracetic acid. Manufacturers are introducing concentrated and stabilized solutions to meet industrial safety standards. Automation in dosing systems enhances operational efficiency in wastewater treatment and sanitation.

Regulatory compliance driving adoption

Industrial and healthcare applications expanding

Concentrated solutions improving safety and efficiency

Demand Forecast for Peracetic Acid in the UK

The peracetic acid market in the UK is expected to grow at a CAGR of 8.6% from 2025 to 2035, driven by increased focus on water treatment, hygiene, and food safety. Adoption in hospitals, food processing plants, and beverage industries is rising due to its eco-friendly profile and effectiveness against pathogens.

Stringent environmental and safety regulations encourage industries to transition from traditional disinfectants to peracetic acid. Local manufacturers are enhancing distribution networks and developing customized solutions for industrial and municipal applications.

Water and wastewater treatment adoption increasing

Food and beverage sector requiring safe disinfectants

Regulatory compliance driving preference for eco-friendly agents

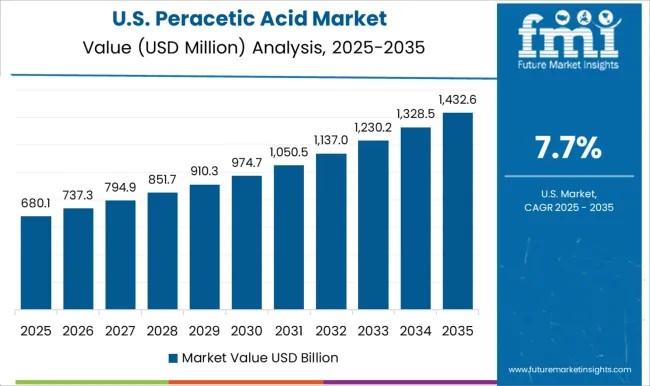

Growth Analysis of Peracetic Acid Market in the USA

The peracetic acid market in the USA is projected to grow at a CAGR of 7.7% from 2025 to 2035, supported by expanding healthcare, pharmaceutical, and food processing industries. Increased awareness of water hygiene, microbial control, and sustainable disinfection solutions is boosting adoption.

Manufacturers are focusing on concentrated, stabilized, and easy-to-apply formulations for industrial and municipal applications. Investments in automated dosing systems and monitoring solutions enhance operational efficiency and safety. Growing demand in hospitals and large-scale food processing plants ensures steady market expansion.

Healthcare and food processing applications driving demand

Automated dosing systems improving efficiency

Shift towards sustainable and safer disinfection methods

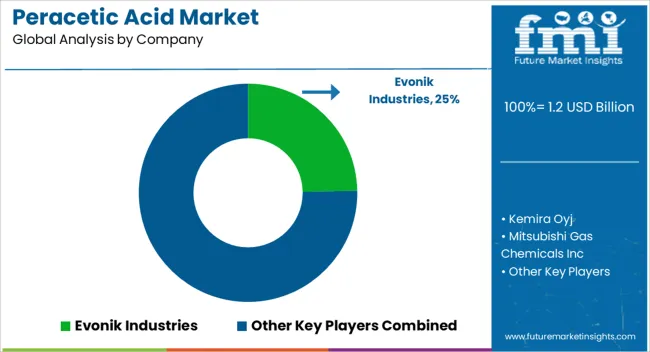

Competitive Landscape of Peracetic Acid Market

Competition in the peracetic acid market is primarily driven by factors such as product purity, regulatory compliance, sustainability, and the versatility of applications across various industries. Leading players like Evonik Industries and Kemira Oyj dominate the market with high-quality peracetic acid formulations tailored for water treatment, disinfectants, and industrial cleaning applications.

These companies emphasize extensive global distribution networks, technical support, and consistent product performance to maintain a strong market presence. Mitsubishi Gas Chemicals Inc focuses on specialty grades of peracetic acid designed for electronics, healthcare, and food processing industries, highlighting customized solutions, strict quality control, and adherence to international safety standards. Solvay S.A provides peracetic acid for applications such as biocides, sanitation, and textile processing, with an emphasis on eco-friendly production methods and compliance with environmental and safety regulations.

SEITZ GmbH specializes in niche segments, including pulp and paper processing and medical sterilization, offering tailored solutions supported by strong regional service networks. Ecolab Inc integrates peracetic acid into comprehensive cleaning and disinfection systems, leveraging expertise in operational efficiency, hygiene management, and regulatory compliance. Other market participants differentiate themselves through specialty grades, regional focus, and sustainable formulations.

Key industry strategies include strict adherence to REACH and EPA regulations, lifecycle service support, and ongoing innovation in stabilized, high-concentration peracetic acid solutions. Products are marketed with detailed concentration levels, application guidelines, safety certifications, and storage/handling instructions, reflecting a market strongly focused on efficacy, operational safety, regulatory compliance, and sustainable practices.

Key Players in the Peracetic Acid Market

Evonik Industries

Kemira Oyj

Mitsubishi Gas Chemicals Inc

Solvay S.A

SEITZ GmbH

Ecolab Inc

Scope of the Report

Item

Value

Quantitative Units

USD 1.2 billion

Product

Solution-grade and Distilled-grade

End-user

Water treatment, Food & beverage, Pulp & paper bleaching, Medical, and Agriculture

Regions Covered

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa

Country Covered

United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa

Key Companies Profiled

Evonik Industries, Kemira Oyj, Mitsubishi Gas Chemicals Inc, Solvay S.A, SEITZ GmbH, and Ecolab Inc

Additional Attributes

Dollar sales, key applications, regulatory compliance, competitive players, product grades, regional demand, technological innovations, pricing strategies, market share, CAGR, and end-use adoption patterns.