If Vanke experiences a major crisis, it will create another landmark event that drags down the corporate credit of the entire real – estate industry, which is something that the vast majority of real – estate professionals are reluctant to see.

However, Vanke is indeed on the verge of debt restructuring.

01

This week, a piece of news has been circulating in the industry: “The central government has issued preliminary instructions to the Shenzhen municipal government to consider handling Vanke’s debt in a’market – oriented’ manner.”

At present, the authenticity of this news cannot be verified, but it has triggered significant fluctuations in Vanke’s bonds in the market. Many bonds such as “22 Vanke 02”, “21 Vanke 04”, “23 Vanke 01”, and “21 Vanke 06” were temporarily suspended from trading due to large declines.

Source: Eastmoney.com

Moreover, shortly after this news spread, Vanke issued an announcement on the Shanghai Clearing House, stating that it would hold a creditors’ meeting to discuss the extension of “22 Vanke MTN004” and initiate the extension of its first 2 – billion – yuan bond.

Currently, Vanke has not announced the scale of the debt involved in the extension, nor has it entered the stage of comprehensive debt restructuring. However, the market is already worried that this extension is just the beginning, and in the future, it will indeed be handled in accordance with the “market – oriented” principle.

Extending the maturity of bonds is equivalent to a “quasi – restructuring”. Referring to the debt – handling paths of large – scale real – estate enterprises that have encountered problems previously, the end of the extension is debt restructuring.

02

Before this, the attitude of the major shareholder, Shenzhen Metro Group, also showed subtle changes.

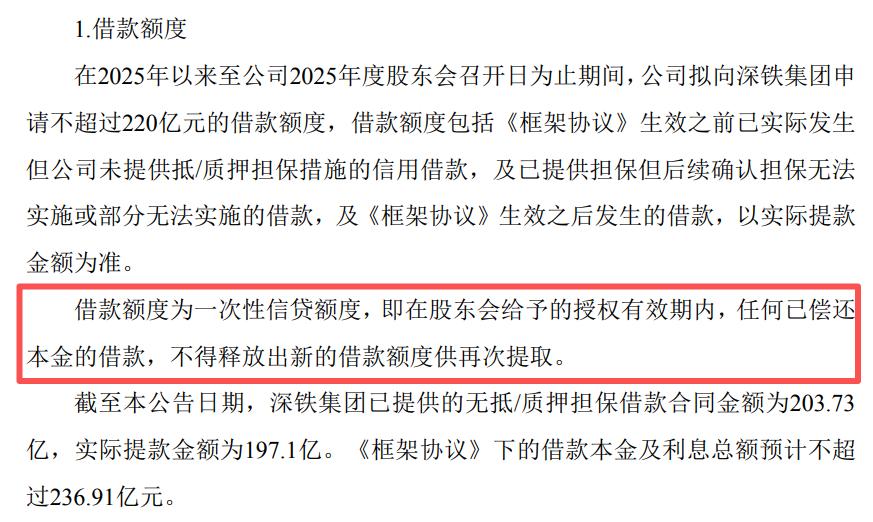

On the evening of November 2nd, Vanke issued an announcement titled “Announcement on Shenzhen Metro Group Providing Shareholder Loans to the Company and the Company Providing Guarantees and Related Daily Transactions”.

The announcement mentioned that “China Vanke Co., Ltd. signed a ‘Framework Agreement on Shareholder Loans and Asset Guarantees’ with its largest shareholder, Shenzhen Metro Group Co., Ltd., on November 2, 2025.” There are two core points in this agreement:

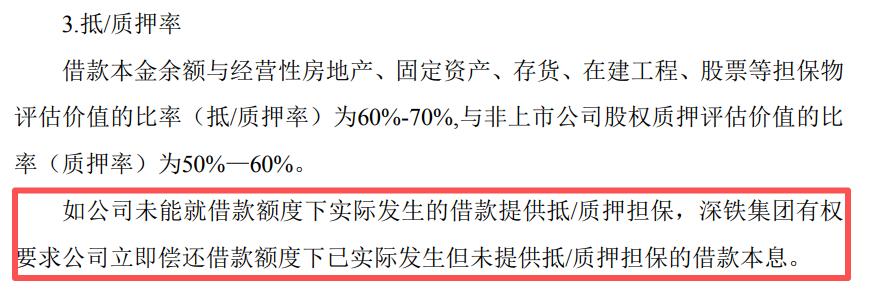

Firstly, it stipulates the maximum borrowing limit for Vanke from the major shareholder, Shenzhen Metro Group, as well as the borrowing and repayment rules; secondly, it raises the requirements for mortgage and pledge guarantees for Vanke’s borrowing.

In other words, Shenzhen Metro Group will no longer provide “unlimited support” to Vanke, and from now on, everything will be handled in accordance with the regulations. This is a very obvious and significant change.

Source: “Framework Agreement on Shareholder Loans and Asset Guarantees”

Source: “Framework Agreement on Shareholder Loans and Asset Guarantees”

Before this, Shenzhen Metro Group had already provided about 20 billion yuan in loans to Vanke. In addition, Shenzhen Metro Group, backed by its own credit, helped Vanke obtain loans from banks and other channels.

At Vanke’s first extraordinary general meeting of shareholders on November 20th, someone asked: Where did the hundreds of billions of yuan that Shenzhen Metro lent to Vanke come from? Was it from banks and other institutions or from the Shenzhen State – owned Assets Supervision and Administration Commission?

Vanke Group’s executive vice – president and chief financial officer said that part of Shenzhen Metro’s funds came from banks, and part came from the State – owned Assets Supervision and Administration Commission.

Previously, the market had always questioned that investing in Vanke and providing unlimited assistance to it had dragged down Shenzhen Metro Group. Now, there is an answer to this question. The money that Shenzhen Metro lent to Vanke is not all its own funds. A considerable part of it was injected into Shenzhen Metro by the State – owned Assets Supervision and Administration Commission, and Shenzhen Metro borrowed from banks and then lent it to Vanke.

This is also the reason why Shenzhen Metro Group cannot provide “unlimited support”. Once banks and other institutions or departments put forward higher mortgage and pledge requirements for Shenzhen Metro Group’s loans, Shenzhen Metro Group, with limited cash on hand, must also put forward corresponding requirements to Vanke.

Risk isolation is the basic principle of the modern corporate system and also the bottom line that Shenzhen Metro Group has to consider. Even with the support of the State – owned Assets Supervision and Administration Commission, it cannot bear off – balance – sheet risks indefinitely. The increase in mortgage and pledge requirements this time is a clear signal that the risk isolation mechanism has been activated.

Then, there is one last question: Vanke’s repayment ability?

According to the data publicly released by Vanke in August, in the first half of 2025, Vanke achieved sales of 69.11 billion yuan, with a collection rate of over 100%; it achieved a signed amount of 6.43 billion yuan in large – scale transactions; and it achieved a total of 5.75 billion yuan in recovered funds from asset revitalization.

Comparing with the data in 2024: The annual sales reached 246 billion yuan, with a collection rate of over 100%; the signed amount in large – scale transactions was 25.9 billion yuan; and the recovered funds from asset revitalization were 10.4 billion yuan.

The sales in the first half of the year were about 28% of the whole – year sales last year; the signed amount in large – scale transactions in the first half of the year was about 24.8% of the whole – year amount last year; and the recovered funds from asset revitalization in the first half of the year were about 55.3% of the whole – year amount last year.

This means that Vanke’s self – generating ability is still declining.

However, as of the end of the third quarter of 2025, Vanke’s total interest – bearing debt was 362.93 billion yuan, which did not decrease compared with last year.

Therefore, Vanke needs more external financing to ease its debt pressure.

However, in the first half of this year, the new financing and refinancing within Vanke’s consolidated statements totaled 24.9 billion yuan, compared with 94.8 billion yuan for the whole of last year.

This shows that Vanke’s financing ability is also declining, so the major shareholder, Shenzhen Metro Group, has to step in.

From the end of last year to the end of June this year, Shenzhen Metro Group provided nearly 24 billion yuan in shareholder loans to Vanke in total. Coupled with Vanke’s own 24.9 billion yuan in financing and refinancing, the total was about 48.9 billion yuan, which successfully eased Vanke’s financing pressure.

If Shenzhen Metro Group stops providing support, Vanke will be in a very precarious situation.

03

Although Vanke has initiated the extension work for “22 Vanke MTN004”, there is still one last line of defense before real comprehensive debt restructuring.

Next, it is highly likely that Vanke will first conduct partial debt restructuring. It will give priority to extending the maturity and reducing the interest rate of bonds and non – standard debts with high due – date pressure, and at the same time continue to seek the sale of some assets to delay the situation as much as possible.

Currently, Vanke still has some important assets in hand, including shares in Wumuyun, GLP Logistics, and Huishang Bank. Among them, Wumuyun is not for sale.

In addition, some assets can obtain a certain amount of cash flow through asset securitization. However, the drawback of this method at this stage is that the realization of cash is too slow, and Vanke may not have enough time to wait.

Once upon a time, real – estate enterprises desperately raced against time and developed the “high – leverage, high – turnover, high – debt” model, which planted a time bomb for the industry’s development. Now, real – estate enterprises are still desperately racing against time, this time to “survive”.

Regardless of the result, whether it was the “uphill” ten years ago or the “downhill” now, they have all run very hard.

This article is from the WeChat official account “Future Habitat”. Author: Xiaowu Sees Dawu. Republished by 36Kr with permission.