The drop in profits at Irving Oil Whitegate Holdings Ltd followed revenues decreasing by 18pc from $3.27bn to $2.68bn.

The directors say refining margins in Europe were strong in the first half of the year but declined in the second half.

They say “evolving international trade policies, political instability and other global events continue to drive volatility in commodity markets”.

The group’s cost of sales reduced from $3.09bn to $2.67bn.

Numbers employed increased from 235 to 262 in 2024 as staff costs rose from $36.4m to $39.34m.

The group recorded a gross income of $19.39m in 2024 which was down 89pc on the gross income of $176.7m in 2023.

Non-cash depreciation and amortisation costs of $19.66m further reduced the group’s profits.

The firm recorded an operating profit of $599,000 and finance income of $9.9m to result in the pre-tax profit of $10.52m.

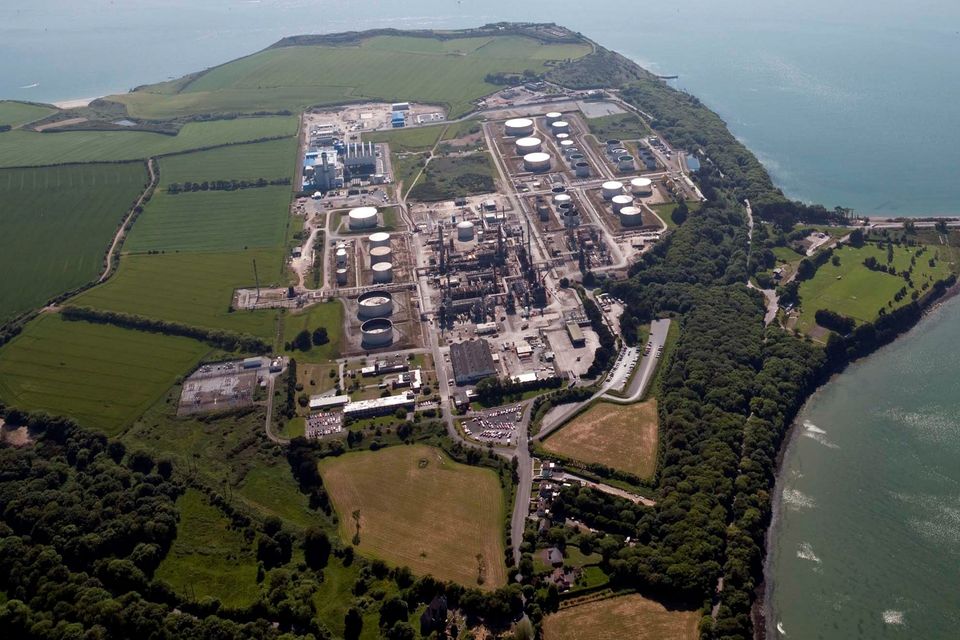

Whitegate, which opened in 1959, can process up to 75,000 barrels of oil a day and plays a critical role in the country’s energy infrastructure, supplying 40pc of the petroleum needs of the country.

In a note concerning a gas oil leak, the directors state on January 22, 2024, a leak was discovered on the gasoline line at the refinery, resulting from a damaged gasket.

The note says: “The vast majority of the released product has been recovered.

“Any unrecovered product is located onsite at the refinery… the impact on the surrounding environment is minimal and there is not a significant financial impact.”

Whitegate Oil Refinery in Cork

Today’s News in 90 – Tuesday, December 2

Key management personnel received $2.98m while directors shared $653,000, made up of pay of $466,000, long-term incentive scheme payments of $111,000 and pension contributions of $76,000.

The firm’s accumulated profits totalled $286.6m while shareholder funds totalled $321.67m.

Irving Oil also operates the separate Tedcastle group of companies it acquired in 2019.

Separate consolidated accounts for that business, Hillingdon Investment Co, show that pre-tax profits declined by 14pc to $8.22m.

The profits take account of a revaluation loss of $7.5m.

The drop in profits follows revenues dipping only marginally from $1.91bn to $1.9bn. Numbers employed declined by 30 to 436.