A sharp drop in international tourists paired with declining F-1 student arrivals from India and China is squeezing America’s biggest education and travel hubs, triggering billions in lost spending and new economic risks for campuses and cities alike.

Amid tightening immigration rules and rapidly shifting visa policies, the United States is seeing an unprecedented drop in arrivals from around the world — a decline now hurting not just tourism but also U.S. campuses and local economies.

A new analysis by The Kaplan Group, titled “Which U.S. Cities Are Hurting Most from the Tourism Crash,” finds that the slowdown in international travel is increasingly intersecting with falling F-1 student numbers, for long, a critical source of revenue for universities, housing markets, and local businesses.

The report shows the U.S. saw 624,404 fewer international visitors in July, an 8.9% year-over-year decline, translating into an estimated $2.62 billion in lost tourism spending. Expectedly, the steepest losses hit major gateway states such as California and New York.

“The tourism decline we’re seeing isn’t isolated to the hospitality sector, it’s affecting entire local economies, particularly in education hubs,” said Dean Kaplan, president of The Kaplan Group, a U.S. commercial debt-collection firm specializing in large B2B recoveries and corporate consulting.

The analysis estimates that the drop in overseas visitors alone cost $444 million in spending for July, using an industry benchmark of $4,200 per visitor.

READ: F-1 visa: Students to face stricter rules on transfers and post-study stay in US (August 28, 2025)

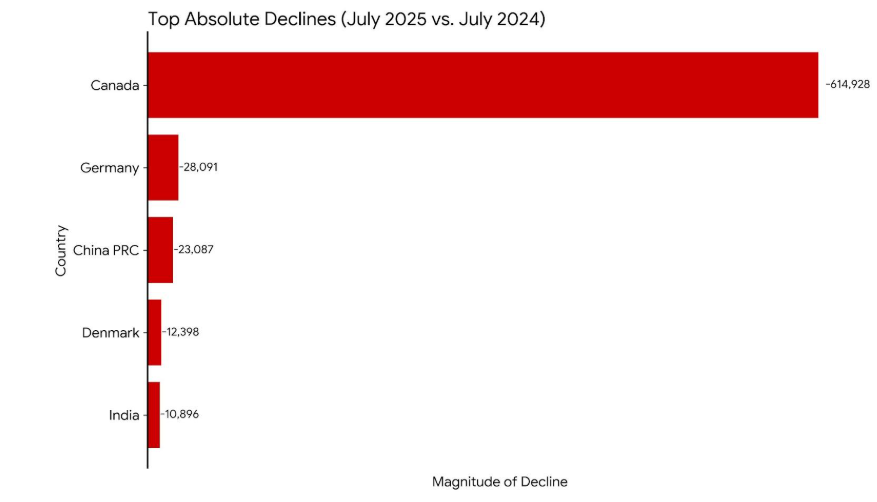

While big coastal cities absorbed the first wave of losses, some of the sharpest declines came from unexpected places. Canada accounted for most of the short-term shock, sending 614,928 fewer travelers, a staggering 31.1% decline from last year. Drops from Germany and China signal deeper medium-term concerns because both are significant student-sending markets.

The impact is most visible in education and travel hubs like New York, Los Angeles, San Francisco, and Boston, cities that historically rank among the highest for tourism-linked foreclosure risk.

“International student declines are running parallel to tourism losses,” Kaplan said. “Cities like New York, San Francisco, and Boston face a double squeeze: fewer tourists spending at hotels and restaurants, and fewer international students paying tuition and supporting off-campus housing.”

New F-1 visa data from late 2022 to mid-2025 reinforces the trend. After rebounding to 445,000 visas in 2023, approvals slipped to around 401,000 in 2024, and early indicators suggest 2025 will fall further into the high-300,000 range, drifting back toward pre-COVID levels and far below the 2023 high that was once viewed as a full recovery.

READ: F-1 visa rejection for Indian students surges to highest in a decade (March 27, 2025)

Much of this drop comes from the largest sending countries. India and China have registered significant year-over-year declines, with additional sharp falloffs from South Korea and Chile.

Taken together, the travel downturn and shrinking student numbers indicate that cities heavily reliant on international visitors and campus populations are being hit on multiple economic fronts at once.

For its rankings, the Kaplan analysis combined federal arrival data, city tourism estimates, hotel density, and typical overseas spending to calculate how much money states lost and to identify which U.S. cities now face the highest foreclosure risk based on tourism dependence, visitor decline, state-level revenue losses, and hotel exposure.