Rollers and Idlers Market Overview

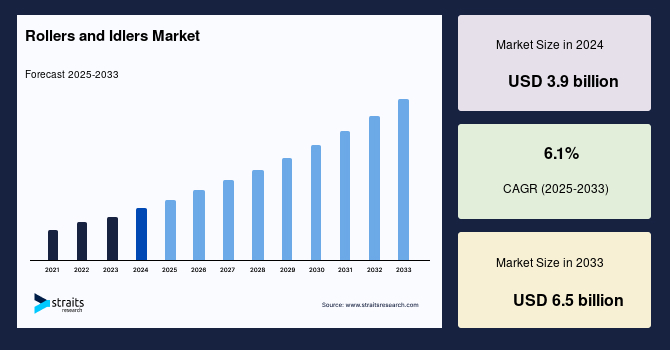

The global rollers and idlers market size was valued at USD 3.9 billion in 2024 and is projected to reach from USD 4.14 billion in 2025 to USD 6.5 billion by 2033, growing at a CAGR of 6.1% during the forecast period (2025-2033). The growth of the market is attributed to growing mining and construction activities, automation in warehousing and logistics and replacement cycles and aftermarket demand.

Key Market Indicators

Asia-Pacific dominated the rollers and idlers market with a market share of over 38% in 2024.

Steel, the material segment, is the dominant material type in the global market with a 64% share in 2024.

Mining & Quarrying dominated the end-use industry segment in 2024, accounting for 36% of revenues.

Aftermarket / Replacement led the sales channel segment in 2024 with a 47% share of total revenues.

Market Size & Forecast

2024 Market Size: USD 3.9 Billion

2033 Projected Market Size: USD 6.5 Billion

CAGR (2025–2033): 6.1%

Asia-Pacific: Largest market in 2024

India: Fastest-growing region

Rollers and idlers are integral components of conveyor systems, which serve as the backbone of industries ranging from mining, cement, and steel to logistics, food processing, and power generation. They are responsible for supporting and guiding conveyor belts, ensuring efficient bulk material handling, reducing operational downtime, and enhancing safety and productivity. Over the past decade, global demand for bulk handling equipment has grown significantly in response to rising industrial output, surging raw material consumption, and the expansion of large-scale infrastructure projects.

Conveyor systems equipped with efficient rollers and idlers have become indispensable in handling higher tonnage and longer distances, particularly in mining, ports, and cement manufacturing. The market has also seen a surge in demand for low-maintenance, energy-efficient, and lightweight rollers, particularly those made from high-density polyethylene (HDPE) and composite materials, offering a viable alternative to traditional steel.

A two-tone co-extruded tube with a green inner layer serves as a visual wear indicator, allowing maintenance and reducing downtime. The non-metallic, belt-friendly construction minimizes conveyor belt damage and lowers operational costs. It is a reliable product across mining applications such as iron ore and coal, the HDPE Slim Shaft Roller supports both carry and return idlers, reflecting the industry’s shift toward lightweight, low-maintenance, high-performance composite rollers.

The growth trajectory of this market also is closely aligned with the economic activities of end-use sectors, such as manufacturing and production, logistics and mining. These components are vital in material handling and conveyor systems that support production and transportation processes in these industries.

For example, the mining sector relies heavily on conveyor systems which are essential to carry raw material such as ores and aggregates. Rollers and idlers make up a significant portion of the conveyor systems as they help in easy transportation from source to the construction site and vice versa.

High-capacity idlers, such as the Continental SDX-2200 series, can support loads up to 2,200 lbs and accommodate belt widths from 36 to 96 inches, with roll diameters of 152–178 mm and troughing angles of 35° and 45°. These idlers enhance belt alignment, reduce maintenance, and support heavy-duty operations. Their robust design makes them ideal for underground mining and high tonnage conveying, enabling mining operations to improve efficiency and maintain continuous material flow.

As industries push for sustainability, companies are adopting lightweight rollers that reduce power consumption and low-noise idlers for compliance with worker safety standards.

A notable example is the the Rollaway 2.0″ Diameter x 16 Gauge Light-Duty Aluminum Gravity Roller Conveyor which is manufactured by Conveyors & Drives, Inc., which is based in Atlanta, Georgia. It is designed to convey lightweight packages, cartons, or totes, making it ideal for applications requiring quick setup and teardown, such as loading and unloading trucks.

These evolving requirements ensure that the market will continue to expand beyond its traditional mining and heavy industry base, spreading into food, automotive, and high-speed logistics applications.

Key Market Drivers

Growing Mining and Construction Activities

Mining continues to be the largest end-use sector, accounting for over 35% of global rollers and idlers demand in 2024. The demand for minerals, coal, and aggregates is rising in both developed and emerging markets, driving the installation of new conveyor systems. Similarly, cement and infrastructure projects in Asia and the Middle East are accelerating demand for heavy-duty rollers that can withstand harsh environments.

Automation in Warehousing and Logistics

The rise of e-commerce has resulted in a surge in automated warehousing, where conveyor systems are used to handle thousands of packages per hour. Amazon’s Robbinsville Fulfillment Center in New Jersey demonstrates how conveyor automation has transformed e-commerce warehousing. The facility integrates 14 miles of conveyor belts with robotic arms to sort and package items efficiently. By processing up to 1,000 packages per hour and working alongside human associates, the system has increased throughput, reduced manual errors, and accelerated orders. This automation has been made possible through the adoption of advanced robotics and coordinated conveyor systems, enabling faster delivery times and higher operational efficiency.

Global e-commerce sales reached USD 6.3 trillion in 2024, and warehouse automation spending exceeded USD 47 billion, much of which is allocated to conveyor solutions. Lightweight rollers designed for high-speed and quiet operation are increasingly in demand, particularly in the U.S., Europe, and Japan.

Replacement Cycles and Aftermarket Demand

Rollers and idlers are subject to wear and tear, typically requiring replacement every 3–5 years depending on load and environmental conditions. The aftermarket segment alone accounts for nearly 45% of total market revenues in 2024. Replacement demand provides suppliers with recurring revenue streams and creates opportunities for companies to offer value-added services such as predictive maintenance, extended warranties, and reconditioning programs.

Key Market Restraints

Volatility in Raw Material Prices

Steel accounts for nearly 60–65% of the total cost of traditional rollers and idlers. Fluctuating global steel prices directly impact manufacturing margins and limit pricing flexibility. This creates challenges for smaller suppliers, particularly in price-sensitive markets like India and Southeast Asia.

High Initial Investment in Conveyor Infrastructure

While rollers and idlers themselves are relatively low-cost components, they are part of large conveyor systems that require significant upfront capital investment. This high initial cost slows adoption in small and medium-sized enterprises and makes large projects dependent on government funding or long-term commodity price stability.

Opportunities in the Rollers and Idlers Market

Despite being a mature segment of material handling equipment, the rollers and idlers market presents significant growth opportunities over the next decade. Key opportunities include:

Technology Integration and Smart Monitoring

One of the largest opportunities lies in digitization of conveyor systems, where smart rollers and idlers are equipped with sensors that monitor wear, vibration, and temperature. Predictive maintenance using IoT-enabled rollers is expected to reduce downtime by up to 30% in mining and heavy industries.

For instance, Tata Steel implemented a digital twin-based conveyor maintenance system across its extensive 93 km conveyor network to achieve its target of being a leader in digital making by 2025. This system leverages IoT sensors installed on rollers, idlers, and other conveyor components to monitor parameters such as vibration, temperature, and alignment. The data collected in real time is fed into a virtual replica of the physical conveyor system, which enables automated inspections and optimized maintenance scheduling. By simulating potential failures and analyzing equipment performance, the system allows maintenance teams to proactively address issues.

As a result, Tata Steel has significantly reduced manual inspection errors, improved operational efficiency, and extended the life of its conveyor assets. This deployment highlights the potential of digitalization in heavy industries, demonstrating how smart technologies can drive cost savings, enhance reliability, and improve safety.

With the rising cost of unscheduled breakdowns estimated at USD 180,000 per hour for mining conveyors smart monitoring solutions present an attractive value proposition. Companies that can integrate advanced monitoring systems into rollers and idlers stand to capture a significant share of future demand.

Expansion of Mining and Bulk Handling in Emerging Economies

Asia-Pacific and parts of Africa continue to expand their mining and quarrying sectors. For example, India’s coal production reached 997 million metric tons in 2024, while China remains the world’s largest consumer of bulk handling systems.

Conveyor infrastructure expansion in these regions creates a large aftermarket demand for rollers and idlers. Emerging economies are also investing in new ports and power plants, each requiring extensive conveyor systems. Countries like China have a massive $12 trillion investment planned in power generation and infrastructure thereby leading in global emerging market infrastructure development and focusing heavily on renewable energy and transportation networks These developments ensure a multi-decade growth cycle for rollers and idlers in developing markets.

Shift Toward Sustainable Materials and Lightweight Design

Traditional steel rollers are being replaced by HDPE and composite idlers due to their corrosion resistance, reduced weight (up to 40% lighter), and energy efficiency. Conveyor systems using lightweight rollers can reduce overall energy consumption by 5-7%, aligning with corporate sustainability targets.

For instance, in 2025 The PROK HDPE Slim Shaft Roller, was launched offering a lightweight, durable, and energy-efficient alternative to traditional steel rollers. Its slim shaft design reduces roller weight by up to 40%, improving handling, installation, and energy consumption. Constructed from high-density polyethylene (HDPE), it provides superior wear and corrosion resistance, while the friction-welded bearing housing enhances durability.

With the increasing emphasis on carbon footprint reduction, particularly in Europe and North America, this shift toward advanced materials offers suppliers an opportunity to differentiate their product portfolio and command higher margins.

📊 Preview Report Scope and Structure – Gain immediate visibility into key topics, market segments, and data frameworks covered.

📥 Evaluate Strategic Insights – Access selected charts, statistics, and analyst-driven commentary derived from the final report deliverables.

Regional Analysis

Asia-Pacific

Asia-Pacific dominated the rollers and idlers market with a market share of over 38% in 2024. China alone accounts for 19% of global demand in 2024, supported by large-scale mining, steel, and power generation industries. Countries like India and Southeast Asian nations are investing heavily in infrastructure projects including roads, ports, and industrial facilities creating a steady need for conveyor systems and replacement components. Coal and mineral mining being prominent in China and India are also driving this market. Continuous mining operations require robust conveyor systems, and regular maintenance creates significant replacement demand. India is the fastest-growing country market, with a forecast CAGR of 5%, driven by coal production and government infrastructure initiatives.

North America

North America accounts for 23% of the market share in 2024, with the U.S. dominating due to strong warehousing, e-commerce, cement, mining, and bulk material handling industries. The U.S. is a global leader in automated warehouses and e-commerce logistics, with companies like Amazon deploying large-scale conveyor networks. Such facilities require high-performance rollers and idlers to handle high throughput efficiently.

Nearly 50% comes from replacement and maintenance. Conveyor systems in the U.S. are widespread and heavily utilized, creating a steady demand for replacement idlers and rollers to maintain operational efficiency.

Europe

Germany, the U.K., and France lead in conveyor technology adoption, particularly in logistics and food industries. The region is witnessing steady growth in HDPE rollers due to stringent EU sustainability regulations such as the Ecodesign for Sustainable Products Regulation (ESPR) which was put into force on July 18 2024.

This regulation aims to improve the sustainability of products placed on the EU market by enhancing their circularity, energy performance, recyclability, and durability. It extends the scope of the previous Ecodesign Directive to cover virtually all physical products, reinforcing requirements for product durability.

The Packaging and Packaging Waste Regulation (PPWR) which was adopted in April 2024 is another regulation enforced by the EU. The PPWR sets ambitious recycling targets and mandates that all packaging placed on the EU market is recyclable. It also introduces requirements for packaging minimization, minimum recycled content in plastic packaging, and bans certain packaging formats

Middle East & Africa

Countries like Saudi Arabia and the United Arab Emirates are investing heavily in infrastructure projects, including transportation networks, ports, and industrial facilities. For instance, DHL Group plans to invest over $545million in the Middle East by 2030 to bolster logistics infrastructure and improve regional connectivity. Strict regulations similar to Europe are also being implemented with environment protection being paramount.

The UAE Net Zero 2050 Charter is a landmark initiative that reflects the country’s commitment to climate action. By setting a target to achieve net-zero greenhouse gas emissions by 2050, it directly influences industrial operations such as manufacturing and material handling sectors. For the rollers and idlers market, this means companies are increasingly incentivized to adopt energy-efficient designs, eco-friendly materials like HDPE or recycled polymers, and smart technologies to monitor energy consumption and reduce emissions.

Latin America

Brazil dominates the Latin American market, largely due to being one of the world’s leading exporters of iron ore, bauxite, and other minerals. The country’s extensive mining operations rely heavily on conveyor systems for bulk material handling, which drives demand for high-quality rollers and idlers. In addition to Brazil, Chile plays a significant role in the region’s market through its copper mining sector.

Type Insights

Carrying rollers dominate the market, accounting for 42% of total demand in 2024. Their critical role in supporting the loaded side of conveyor belts across mining, cement, and power industries ensures their leadership. Demand is particularly strong in Asia-Pacific, where bulk material handling accounts for over half of installed conveyor systems.

Idler Frame Insights

Troughing idlers hold nearly 38% of market share, as they are essential in stabilizing and guiding belts during heavy load operations. Their dominance is linked to the widespread use of bulk material conveyors in mining and aggregate sectors.

Material Insights

Despite growing adoption of composites, steel rollers still represent 64% of the global market in 2024, driven by their durability and suitability for heavy-duty operations. However, HDPE is growing at the fastest CAGR of 2% (2025–2033), signaling a structural shift in material preferences.

Sales Channel Insights

Aftermarket sales contributed nearly 47% of total market revenue in 2024, underscoring the recurring nature of demand in this industry.

End-User Insights

The end-use landscape of rollers and idlers highlights the reliance of heavy industries on efficient bulk handling. Mining and quarrying represent the largest consumer base, with conveyor systems installed across open-pit and underground mines. Cement and aggregate industries also contribute strongly, supported by government infrastructure projects worldwide.

Mining and quarrying remain the largest end-use industry, accounting for 36% of global market revenues. This is followed by cement & aggregates (19%) and logistics & warehousing (14%). The mining sector’s cyclic replacement cycles and continuous expansion in emerging economies drive this leadership.

Meanwhile, logistics and warehousing is the fastest-growing end-use sector, expanding at a CAGR of 8.5% (2025–2033), fueled by e-commerce growth and rising automation. The global warehousing market itself is valued at over USD 340 billion in 2024, ensuring long-term demand for rollers designed for light-duty, high-speed operations.

Export-driven demand is also prominent, particularly in regions like Latin America and Africa, where mining exports generate steady replacement requirements for rollers and idlers. As global commodity trade continues to expand, the aftermarket demand from these regions will remain resilient.

Investment & CapEx Trends

Global investment trends strongly support demand for rollers and idlers. Public spending on infrastructure reached USD 3.4 trillion in 2024, with major allocations toward highways, power plants, and industrial corridors. Private industrial CapEx in mining and steel is also growing, particularly in Asia-Pacific, where new greenfield projects demand fresh conveyor installations. Government programs such as “Made in China 2025” and “Make in India” are fostering local manufacturing of conveyor components, creating opportunities for both global and regional suppliers.

Competitive Intensity, Pricing, and Technological Adoption

The global rollers and idlers market is moderately fragmented, with the top 5 players accounting for 28–30% of the global market share in 2024. Pricing competition is intense in Asia and Africa, while in Europe and North America, differentiation is driven by sustainability and smart monitoring technologies.

List of key players in Rollers and Idlers Market

Sandvik AB

Metso Outotec Oyj

Rulmeca Holding GmbH

Rexnord Corporation

Fenner Group Holdings Plc

Continental AG

Precision Pulley & Idler, Inc.

Titan Conveyors (Parent group)

Hebei Juxin / Hebei Joyroll Conveyor Machinery Co., Ltd.

FLSmidth

Recent Developments

July 2025: FLSmidth’s innovative Rail Running Conveyor (RRC) system is being commissioned at First Quantum Minerals’ (FQM) Sentinel copper operations in Zambia. This new system is designed to replace traditional conveyor belts with idlers and is expected to use 50-70% less power. The installation is engineered to carry 5,000 tons per hour of copper ore over a 3.25 km run and is a significant step forward for energy-efficient conveying in the mining industry.

July 2025: Metso has completed the acquisition of TL Solution’s recycling operations and induction heating technology development capabilities. This acquisition is part of Metso’s strategy to expand its portfolio and strengthen its position in the market. While not directly a roller or idler product, this M&A activity is a development within a key player that has a significant impact on the company’s overall business and future product offerings.

Rollers and Idlers Market Segmentations

By Type (2021-2033)

Carrying Rollers

Impact Rollers

Return Rollers

Guide/Tracking Rollers

Rubber-Coated Rollers

Self-Aligning Rollers

By Idler Frame Design (2021-2033)

Troughing Idlers

Flat Idlers

Transition Idlers

Offset Idlers

V-Return Idlers

By Material (2021-2033)

Steel

HDPE (High-Density Polyethylene)

Composite Materials

Rubber-Coated / Hybrid

By Conveyor Belt Speed/Load (2021-2033)

Light-Duty (up to 1 m/s)

Medium-Duty (1–3 m/s)

Heavy-Duty (above 3 m/s)

By End-Use Industry (2021-2033)

Mining & Quarrying

Cement & Aggregates

Power Generation (Coal, Biomass)

Steel & Metal Processing

Food & Beverages

Logistics & Warehousing

Automotive & Manufacturing

Ports & Airports (Bulk Handling)

By Sales Channel (2021-2033)

OEMs (Original Equipment Manufacturers)

Aftermarket / Replacement

By Region (2021-2033)

North America

U.S.

Canada

Europe

U.K.

Germany

France

Spain

Italy

Russia

Nordic

Benelux

Rest of Europe

APAC

China

Korea

Japan

India

Australia

Taiwan

South East Asia

Rest of Asia-Pacific

Middle East and Africa

UAE

Turkey

Saudi Arabia

South Africa

Egypt

Nigeria

Rest of MEA

LATAM

Brazil

Mexico

Argentina

Chile

Colombia

Rest of LATAM

Frequently Asked Questions (FAQs)

The global rollers and idlers market size was valued at USD 3.9 billion in 2024 and is projected to reach from USD 4.14 billion in 2025 to USD 6.5 billion by 2033.

The growth of the market is attributed to growing mining and construction activities, automation in warehousing and logistics and replacement cycles and aftermarket demand.

Top players present globally are Sandvik AB, Metso Outotec Oyj, Rulmeca Holding GmbH, Rexnord Corporation, Fenner Group Holdings Plc, Continental AG, Precision Pulley & Idler Inc., Titan Conveyors (Parent Group), Hebei Juxin / Hebei Joyroll Conveyor Machinery Co. Ltd., and FLSmidth.

Asia-Pacific dominated the rollers and idlers market with a market share of over 38% in 2024.

Certain segments lead the global market in 2024