The latest CNBC Supply Chain survey provides new data on how the global trade war has influenced this year’s holiday shopping season, and one more signal that consumer spending is holding up reasonably well amid concerns about affordability across the U.S. economy. But the survey data also suggests that the freight market remains in a vulnerable position headed into 2026, despite the Dow Jones Transportation Average recently hitting a 52-week high.

Overall, close to half (44%) of respondents said more holiday items are leaving warehouses and distribution centers compared to last year. One-third of respondents said fewer items were leaving the warehouses. The majority of respondents who said they were moving more freight said the level of increase was 5-10% in volumes.

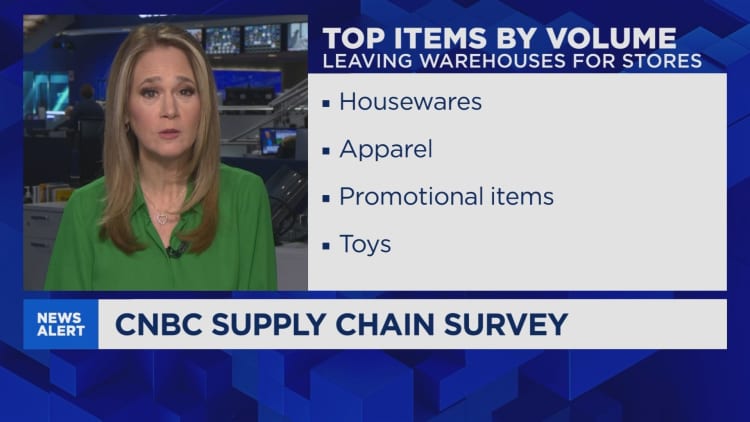

The volume of products leaving warehouses to stores or customers also revealed what product categories are emerging as winners and losers this holiday shopping season. Housewares, apparel, and promotion items top the list, with luxury (both aspirational and traditional) and furniture (both high-end and low-end), having a softer outlook.

The majority of respondents said inventory levels in warehouses are running at two to three months, with one-third of respondents saying they have several weeks of product being stored.

Companies and organizations representing, logistics providers, freight shippers and retailers participated in the survey, which was conducted Dec. 4-Dec. 11.

Despite the trade war and tariff volatility, “retailers and brands successfully overcame obstacles, captured customer demand during peak, and achieved volumes comparable to last year,” said Kraig Foreman, president of e-commerce for DHL Supply Chain North America.

E-commerce holiday volumes, in particular, are up even more, according to the survey, with 53% of respondents reporting an increase year over year. Only 18% of respondents reported lower volumes of e-commerce goods, with the rest saying volumes were flat.

In e-commerce, the same product category strengths and weaknesses are evident. The survey respondents said promotional items, housewares and, apparel were the most-ordered by consumers. Furniture and luxury were again the laggards.

The survey results show that after the U.S. and China announced a trade truce in late October negotiated between President Donald Trump and Chinese President Xi Jinping, the reaction inside the U.S. supply chain and freight business was muted. The pause in the trade hostilities and escalating tariffs between the two nations did not result in another surge of orders for holiday replenishment, according to survey. Retailers were comfortable with the level of inventory already frontloaded, starting in June and July, after initial tariffs levels set in April were lowered for China, as well as for many other countries.

Supply chain volatility to persist in 2026

Supply chain volatility is expected to persist amid challenging economic conditions. Even as consumers continue to spend and inflation has remained lower than many economists expected in relation to tariffs, the freight volume outlook is mixed, and the pricing outlook in retail remains in flux.

“After a year marked by instability, sourcing and logistics managers are treading carefully as we enter 2026,” said Stephen Lamar, president of the American Apparel and Footwear Association. “Persistent tariffs and uncertainty will continue to complicate the ability of fashion supply chains to avoid high costs that are ultimately passed along to American consumers as higher prices,” Lamar said.

The recent category winners can expect to experience a decline in orders given the inventory levels. “In the U.S., we observe a softer demand pattern, especially for home goods and apparel, as some businesses were reducing their inventory levels due to uncertainties. However at some point, they will restock, and the industry will have to be ready to handle this,” said Michael Aldwell, executive vice president of sea logistics at Kuehne+Nagel.

There has been a steady pullback in overall U.S. imports in recent months. Data from freight intelligence firm Sonar tracking global container volumes to the U.S. shows an 18% decrease year over year as inventory replenishment has become more costly. Inventory management has a direct impact on freight volumes and the freight business outlook, as logistics companies generate their revenue based on the amount of freight they move.

Forty-two percent of survey respondents said freight volumes for Q4 are flat, with nearly one-quarter (24%) saying volumes were down quarter over quarter, and another 34% saying there has been some level of increase. But the picture is mixed for the beginning of the new year, with almost equal percentages of respondents saying they expect freight volumes to be up (52%), or flat to down (48% combined).

“In 2026, we expect the market will continue to be volatile due to trade tensions, geopolitical uncertainties, and oversupply as new container vessels will be deployed in the coming two years at a time when overall demand is slowing,” Aldwell said.

Though not the majority, a significant percentage of survey respondents, 43%, describe the freight market as being in a recession or likely to enter one in 2025.

“We are forecasting an increase in continued trucking company exits because of the lower freight volumes,” said Paul Brashier, vice president of global supply chain at ITS Logistics.

An up-and-down freight picture has been the story in 2025.

“Throughout 2025, we experienced periods of reduced year-over-year volumes,” Foreman said. “How this peak season will shape the year ahead remains to be seen, as we are still in the midst of peak activity. However, the insights and lessons gained in 2025 will be invaluable as retailers and brands refine strategies for the coming year,” he added.

“Forecasting for 2026 presents considerable challenges due to various uncertainties, including tariff levels, AI impacts, and numerous possible global economic changes,” said Brian Kobza, chief commercial officer for IMC Logistics. “According to our customers, the U.S. consumer remains resilient, and inventory levels have not increased. These factors collectively give us optimism for a successful 2026,” Kobza said.

Use of AI in logistics

All respondents said they will use artificial intelligence more in their business. Predictive analytics tops the list in AI use case deployments, followed by inventory management, route optimization, warehouse automation, dynamic pricing and AI-powered robots.

“Visibility is a make-or-break factor, and planning must include both the physical and digital infrastructure as deployment of technology and AI ensures structured data that can be embedded in your decision-making, and it automates complex workflows,” Aldwell said, who added retailers often still lack coordinated visibility across store and warehouses.

Respondents were split on AI replacing jobs, with a slight majority (53%) saying no.

At a broader level of freight planning, according to Noah Hoffman, vice president of North American surface transportation with C.H. Robinson, shippers are reassessing their inventory strategies. “They’re moving from ‘just-in-case’ pandemic-era models to hybrid approaches that limit carrying costs and position goods closer to customers. That means evaluating trade-offs in sourcing locations, inventory placement, and transportation.”

AI is playing a role in that shift, with C.H. Robinson seeing an increase in customers using its agentic supply chain.

“We’ve built a fleet of more than 30 AI agents that are performing millions of shipping tasks on our customers’ behalf, from price quotes to tracking,” Hoffman said. “Artificial intelligence maximizes value and minimizes waste. Price quotes are delivered in 32 seconds. An order that used to take up to four hours for a person to get to is now processed in 90 seconds. … Time is money at every step … Our research with MIT shows that shippers delayed in getting to the market can pay 23-35% more,” Hoffman added.

Amanda Rasmussen, chief commercial officer at DHL Global Forwarding, said data is key for competitiveness and productivity. “Digital visibility, data-driven forecasting, and collaborative planning across modes are becoming essential elements of resilience,” she said. “We are also beginning to see sustainability considerations beginning to influence network design as customers seek lower carbon routes and smarter consolidation options.”

Global supply chain shifts

As tariffs evolve and supply chains undergo longer-term structural realignments, new “trade hotspots around the world” are being created, Rasmussen said. “Markets like Mexico and Turkey are gaining momentum through nearshoring. South East Asian markets such as Vietnam and Malaysia are benefiting from diversification away from China. Markets such as China, India and Saudi Arabia continue to draw strong domestic and foreign investment,” she said.

Over 90% of respondents to the CNBC survey said supply chain sourcing continues to shift, with Southeast Asian nations including Vietnam, Malaysia, Cambodia and Thailand cited, as well India, and several Latin American nations — Mexico, Brazil and Colombia.

The acceleration of the dual sourcing strategies is helping U.S. companies with their freight visibility and planning. “We expect strong demand in ocean freight as we move toward the Chinese New Year,” Rasmussen said. “Sectors such as data center logistics, life sciences, and healthcare remain important growth engines for air freight,” she added.

The reshoring to the U.S. specifically is also expected to continue, with just over half of respondents (53%) saying there will be more of the activity as a result of tariffs.