Japan is in a bad place. Gross government debt is 240 percent of GDP, which forces the Bank of Japan (BoJ) to cap long-term yields for fear that a sharp rise could spark a debt crisis. But this means yields are kept artificially low, which is what’s sent the Yen into a depreciation spiral in recent years. This just underscores that yield caps aren’t any kind of solution to a debt overhang. They merely transform what would have been a bond market crisis into a currency crisis.

The standard policy prescription for countries with too much debt is to cut spending and raise taxes. Japan has a third option, which is for the government to sell some of the financial assets it holds and use the proceeds to retire debt. These asset holdings are very substantial, which is why Japan’s net government debt is so much lower than its gross debt.

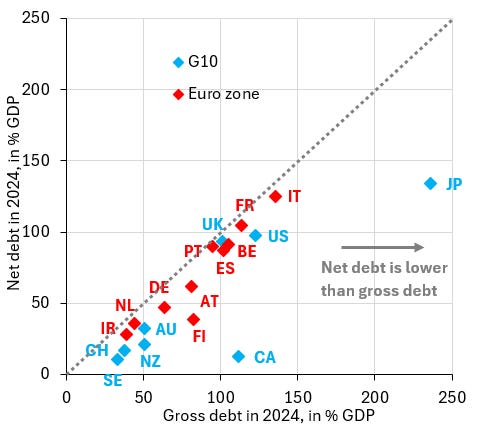

The chart above plots IMF data on gross (horizontal axis) and net (vertical axis) government debt across the world’s key advanced economies in 2024. Japan’s gross debt is a staggering 240 percent of GDP, but its net debt is far lower at 130 percent. The difference is financial assets, at least some of which can be sold in fairly short order, with the proceeds used to retire some of Japan’s debt overhang. Such a step would reduce the need for BoJ yield caps, stabilize the Yen and – most importantly – signal that Japan is finally getting serious about confronting its debt burden.

The reason this hasn’t been done yet is that there’s vested interests that want to keep managing the various financial assets Japan’s government owns. The sooner these vested interests are cut down to size, the sooner Japan can exit its debt trap. Given how politically difficult tax hikes and spending cuts are at the current juncture, this is the best way forward for Japan.