This article is part of Bain’s 2026 Global Healthcare Private Equity Report.

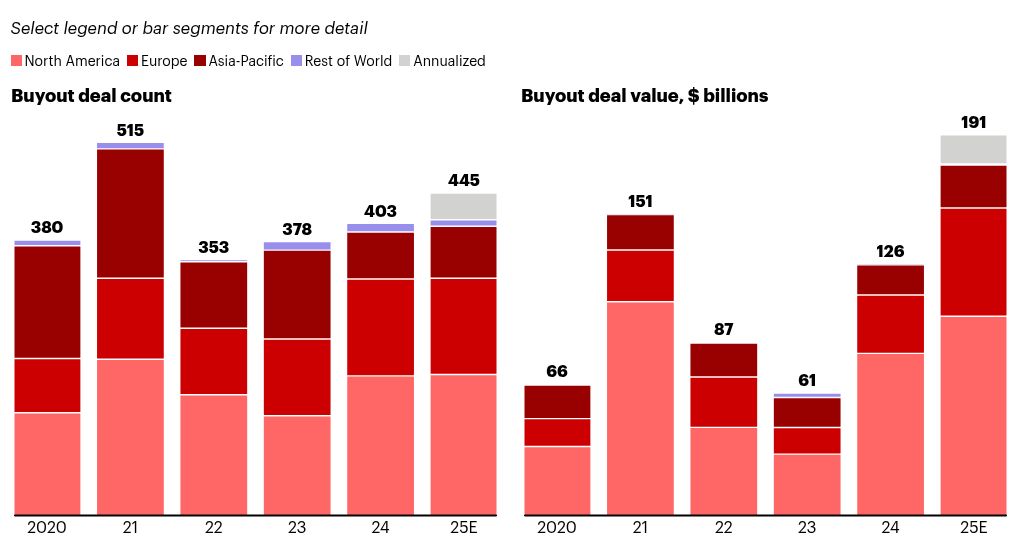

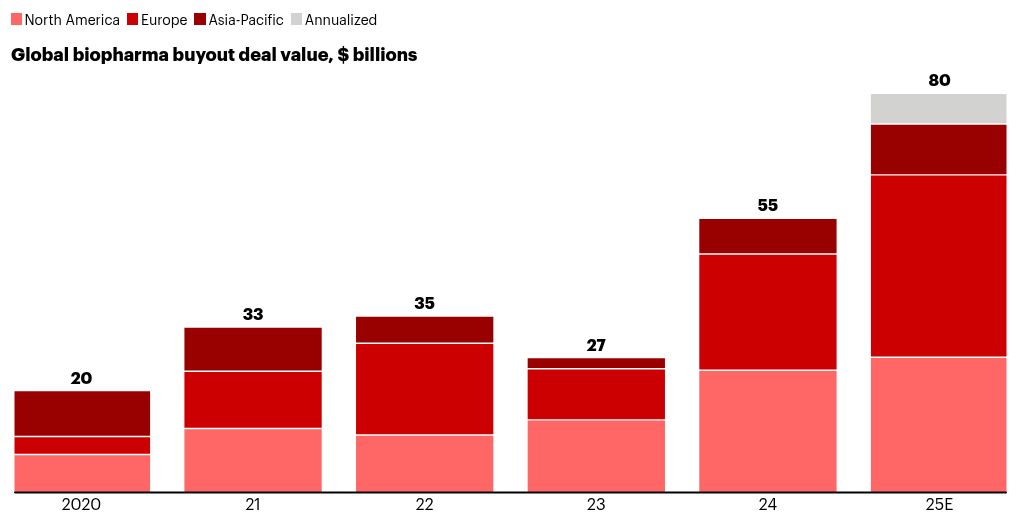

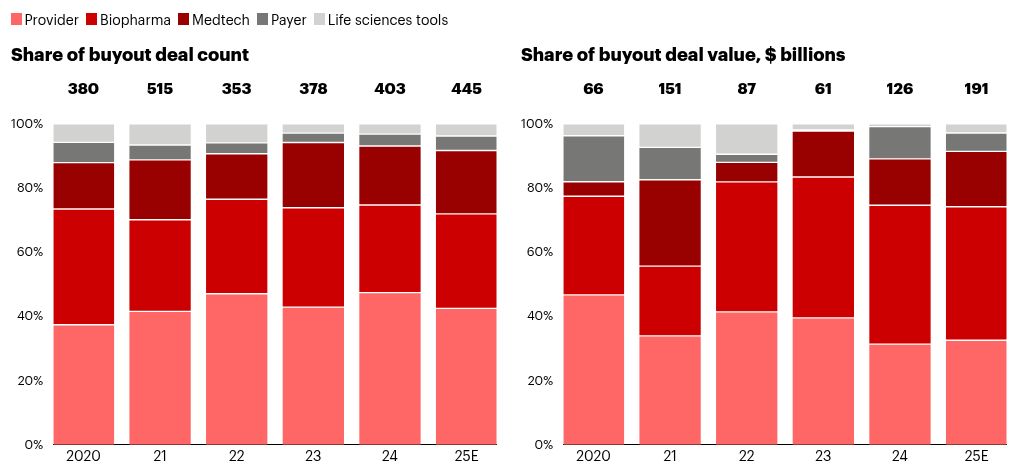

Healthcare private equity (PE) delivered a record performance in 2025, with disclosed deal value exceeding an estimated $191 billion, surpassing the previous high in 2021. Deal activity was similarly robust: Investors announced an estimated 445 buyouts, marking the second-highest annual total on record behind 2021 (see Figure 1).

Healthcare deal activity posted another strong year in 2025

Notes: Based on announcement date; includes announced deals that are completed or pending, with data subject to change; deal count and deal value exclude add-on deals below $250 million; 2025E represents actual data through November 30, 2025, annualized for the rest of the year; some deals show as $0B due to rounding; bar totals may not equal sum of segments due to rounding

Sources: Dealogic; AVCJ; Bain analysis

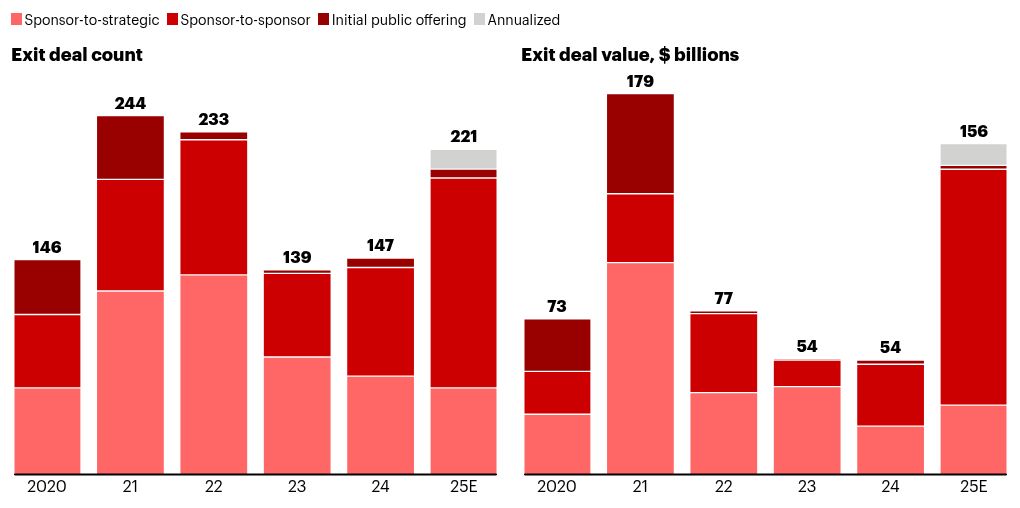

The year also saw a rebound in exits. Exit value reached its second-highest year ever, while exit volume ranked third all-time (see Figure 2). The leap in exit value—from $54 billion in 2024 to an expected $156 billion for 2025—was similarly propelled by a sharp increase in large deals. In 2024, only 16 exits exceeded $1 billion in disclosed value; in 2025, more than 40 deals have cleared this hurdle.

Exit count and value rose sharply

Notes: Based on announcement date; includes announced deals that are completed or pending, with data subject to change; deal count and deal value exclude add-on deals below $250 million; 2025E represents actual data through November 30, 2025, annualized for the rest of the year; bar totals may not equal sum of segments due to rounding; 2025 annualization does not include $6 billion-plus Medline IPO at a valuation of more than $50 billion

Sources: Dealogic; AVCJ; Bain analysis

Strong activity reflects two key themes within PE: high levels of dry powder to deploy and a growing cohort of sponsor-owned assets reaching the end of their fund lives. These trends signal continued tailwinds for the industry and set the stage for an active 2026.

Resurgent performance overcame a second-quarter pullback

Global growth was propelled by Europe’s sustained activity and an inflection after the second quarter in North America and Asia-Pacific.

The year started on a hot streak, with first-quarter deal volume up around 21% relative to the first quarter of 2024. Momentum in North America and Asia-Pacific slowed in the second quarter amid policy shifts, trade tensions, and tariff uncertainty, while activity in Europe remained strong throughout, in part due to limited exposure to these shocks (see Figure 3). Despite the midyear turbulence, the market regained its footing in the second half of the year. Deal activity rebounded, with volume rising 39% between the second and third quarters, and the second half finishing an estimated 7% higher than the first half, as momentum in Europe continued and deal activity rebounded in North America and Asia-Pacific.

Deal trajectories played out differently in each region

Notes: Based on announcement date; includes announced deals that are completed or pending, with data subject to change; deal count and deal value exclude add-on deals below $250 million; 2025E represents actual data through November 30, 2025, annualized for the rest of the year

Sources: Dealogic; AVCJ; Bain analysis

Europe was fueled by biopharma and provider deals

Dealmaking in Europe rose sharply in 2025, with deal value doubling to an estimated $59 billion. Biopharma continued to lead buyout activity, making up the top five deals that accounted for 65% of total deal value in Europe. Some 15 deals exceeding $1 billion in 2025 reflect a reemergence of large-cap activity compared with just 3 and 4 deals topping $1 billion in 2023 and 2024, respectively. Deal count similarly grew, outpacing 2024’s high-water mark and continuing an upward trend begun in 2022. Exit activity also rose substantially, to an estimated $53 billion, after a steep drop in 2024. These were led by large sponsor-to-sponsor transactions such as the announced sale by Bain Capital and Cinven of a majority stake in STADA Arzneimittel AG, a Germany-based global pharmaceutical company, to a group led by CapVest Partners.

Large transactions propelled North America

Macroeconomic and policy uncertainties in the second quarter drove a major pullback in North America, with deal count and value down 19% and 37%, respectively, from the first quarter. Despite the temporary retreat, North America delivered a healthy 2025, bolstered by an uptick in deals exceeding $1 billion; 26 transactions surpassed this threshold through November 2025, compared with 14 in full-year 2024. Of these deals, more than 70% were sponsor-to-sponsor sales. Total North American deal volumes were slightly up vs. 2024 but remain below the previous high set in 2021. Exit activity in 2025 rose to an expected $90 billion, well above 2024’s $35 billion.

Asia-Pacific showed broad strength across markets

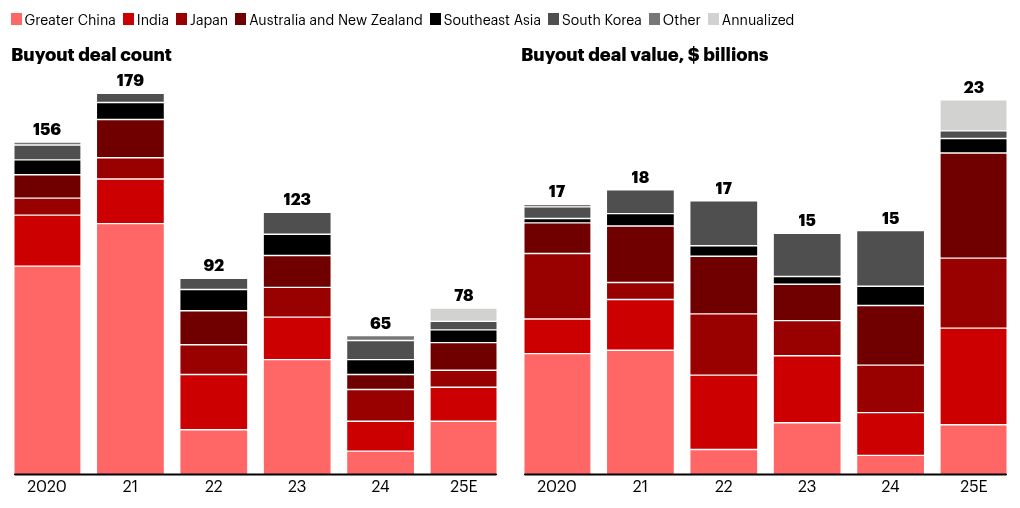

In Asia-Pacific, deal value set a record for the year, exceeding 2021’s high by more than 30% despite a second-quarter slowdown. Investment spanned a greater breadth and depth across countries and sectors: Biopharma and provider continue to drive most of the healthcare PE market, but we also saw growth in medtech and healthcare IT. Provider and hospital deals remain a persistent theme, with deal value expected to double from $5 billion in 2024 to more than $10 billion expected for full-year 2025. The region’s exit value also rose more than 20%, with volume increasing by around 6%.

Japan, India, and Australia and New Zealand saw notable growth since 2024, and activity in Greater China more than doubled its 2024 performance in terms of both volume and value (see Figure 4). China’s rebound was driven by biopharma and medtech, although overall activity is still below recent historical highs.

Most countries in Asia-Pacific saw deal values pick up

Notes: Based on announcement date; includes announced deals that are completed or pending, with data subject to change; Greater China includes China, Hong Kong, and Taiwan; deal count and deal value exclude add-on deals below $250 million; 2025E represents actual data through November 30, 2025, annualized for the rest of the year; some deals show as $0B due to rounding; bar totals may not equal sum of segments due to rounding

Sources: Dealogic; AVCJ; Bain analysis

Turning to sectors, the year 2025 underscored both the durability and evolution of healthcare PE, with biopharma and provider anchoring activity and medtech gaining momentum as a new growth engine.

Biopharma commanding a large share of deal value

Biopharma deal value rose to an estimated $80 billion from 2024’s $55 billion, and volume is expected to increase nearly 20% to more than 130 deals. This sector continued to be a major focus for investors, accounting for about 30% of overall deal volume and at least 22% of deal value each year since 2020. Europe drove much of this momentum, with a nearly 40% increase in deal volume and a 70% increase in deal value since 2024 (see Figure 5). Exit activity was similarly robust, especially within pharma IT: One large, notable corporate exit was Nordic Capital and Astorg’s sale of Clario, a tech-driven contract research organization (CRO), to Thermo Fisher Scientific for nearly $9 billion; another is Insight Partners’ sale of Dotmatics, a provider of cloud software for pharmaceutical R&D, to Siemens for more than $5 billion.

Growth in North America was more mixed in 2025, with value up 20% and volume flat relative to 2024. Across biopharma globally, investors continue to pursue familiar themes such as contract development and manufacturing organizations (CDMOs) while scaling earlier-stage opportunities like site management organizations (SMOs), with growing activity, especially in Europe, in segments less exposed to payer pressures and policy uncertainty, including generics, consumer health, and animal health.

Europe’s share of biopharma activity has steadily increased since 2023

Notes: Based on announcement date; includes announced deals that are completed or pending, with data subject to change; deal value outside of these regions totaled less than $200 million for each year and is excluded from chart presentation; deal value excludes add-on deals below $250 million; 2025E represents actual data through November 30, 2025, annualized for the rest of the year; bar totals may not equal sum of segments due to rounding

Sources: Dealogic; AVCJ; Bain analysis

Provider deals spurred by services and IT

Provider and related services deal value jumped 57% over last year, to an estimated $62 billion in 2025. Volume remained flat from the prior year, reflecting more high-value deals. Provider IT and services drove 2025’s growth, while pure provider investment did not see the same acceleration. In 2025, investors sharpened their focus on technology-enabled assets, such as analytics, workforce optimization, and platform solutions. Healthcare IT deal value within the provider segment doubled in 2025, to an estimated $32 billion. This was led by Warburg Pincus’s sale of its majority interest in ModMed, a provider IT company, to Clearlake Capital, which valued the asset at more than $5 billion. Broader provider dealmaking trends included continued site-of-care migration, retail healthcare M&A (such as dental and veterinary), lab and diagnostic platforms, and workforce and staffing solutions.

Medtech leads the pack in post-Covid growth

Medtech, meanwhile, is gaining momentum as investors see opportunities to deploy proven value-creation playbooks: focusing on revenue growth, margin expansion, and multiple expansion, while managing downside risk. This is especially true in large-scale assets that have origins in public markets, whether as take-privates or carve-outs. A notable example is Carlyle Group’s acquisition of Vantive, a global renal care business carved out from Baxter, which closed in early 2025. Medtech deal value nearly doubled over the prior year to an estimated $33 billion, and volume increased nearly 20% to an estimated 88 deals (see Figure 6). Blackstone and TPG’s acquisition of Hologic in an $18.3 billion take-private deal accounted for more than half of projected medtech buyout activity for the year.

At the time of writing, Medline had just raised more than $6 billion in an IPO at a valuation of more than $50 billion, which is not included in our exit statistics given announcement timing. Medline was acquired in 2021 for approximately $34 billion by a consortium led by Blackstone, the Carlyle Group, and Hellman & Friedman.

The biopharma and provider segments still dominate deals, but medtech expanded

Notes: Based on announcement date; includes announced deals that are completed or pending, with data subject to change; deal count and deal value exclude add-on deals below $250 million; 2025E represents actual data through November 30, 2025, annualized for the rest of the year; some deals show as $0B due to rounding; bar totals may not equal sum of segments due to rounding

Sources: Dealogic; AVCJ; Bain analysis

Chris Toth, the CEO of Vantive, discusses full potential value realization through carve-outs/take-private deals and the value-creation bets needed to achieve these goals with Nirad Jain, coleader of Bain’s Healthcare Private Equity team.

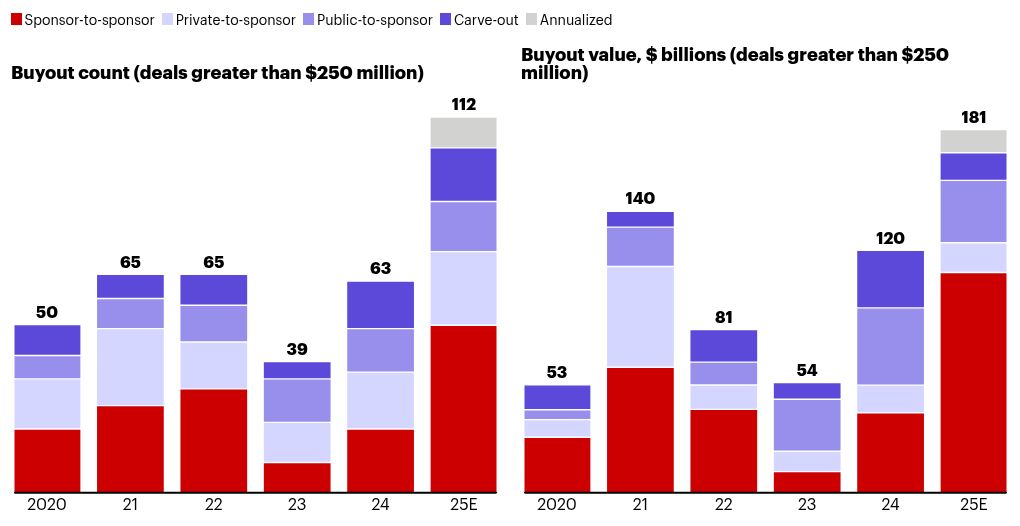

Sponsor-to-sponsor deals surged; public markets rising as an opportunity

After a slowdown in 2023 and 2024, sponsor-to-sponsor deals continue to surge as a buyout deal type. Both volume and value hit record highs in 2025, with more than 150 sponsor-to-sponsor deals expected and more than $120 billion in estimated value. The overall uptick in sponsor-to-sponsor activity signals the healthcare PE market’s strength. We see higher average deal value as well, with more than 30 sponsor-to-sponsor deals exceeding $1 billion for 2025, a sharp rise from the eight sponsor-to-sponsor deals greater than $1 billion in 2024. In addition, public-to-private deals and carve-outs continue to present alternative paths forward for investors; both have grown on an absolute basis since 2023 (see Figure 7).

Sponsor-to-sponsor deals soared

Notes: Based on announcement date; includes announced deals that are completed or pending, with data subject to change; deal count and deal value exclude add-on deals below $250 million; 2025E represents actual data through November 30, 2025, annualized for the rest of the year; bar totals may not equal sum of segments due to rounding

Sources: Dealogic; AVCJ; Bain analysis

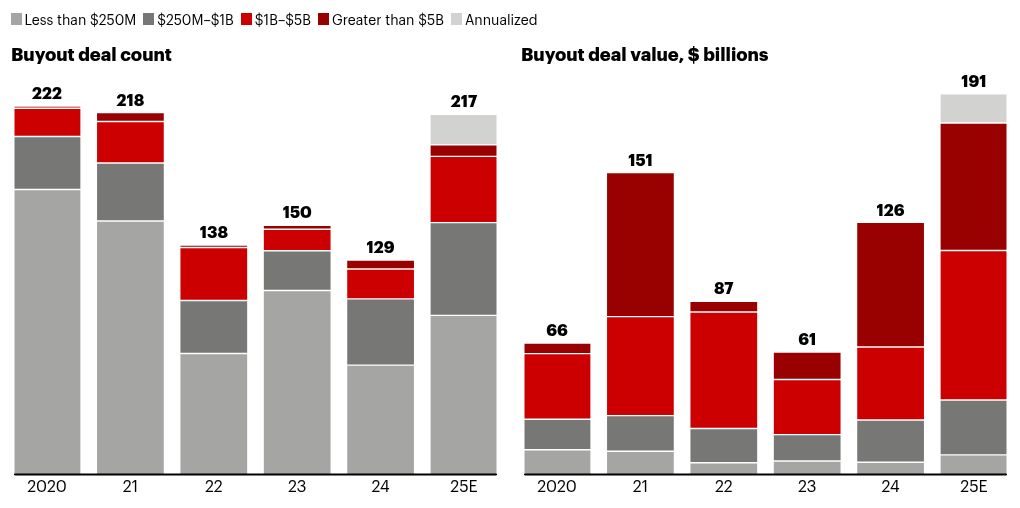

High-value deal activity fuels outsized average deal size growth

Deal value saw a significant boost compared with volume, largely driven by growth in deals exceeding $1 billion (see Figure 8). The growth in large-cap activity reflects interest in high-valued segments such as medtech and healthcare IT. For deals less than $1 billion, volume rose 56% for the year, albeit still well below the previous high-water mark in 2021.

Deal volumes grew, with value spiking in large caps

Notes: Based on announcement date; includes announced deals that are completed or pending, with data subject to change; deal count and deal value exclude add-on deals below $250 million; 2025E represents actual data through November 30, 2025, annualized for the rest of the year; bar totals may not equal sum of segments due to rounding

Sources: Dealogic; AVCJ; Bain analysis

October brought the announcement of the largest deal within healthcare PE: Blackstone and TPG will acquire all outstanding shares of Hologic, a women’s health medtech. At around $18 billion, this deal represents about 9% of total healthcare PE deal value in 2025.

Sycamore Partners’ take-private acquisition of Walgreens Boots Alliance also represents a significant deal value at around $24 billion, although it is primarily classified as a retail deal and is therefore excluded from these totals.

Healthcare PE trends in 2025

Three major trends emerged over the past year:

Healthcare IT is ripe for opportunistic value creation. Buyout deal volume and value in this segment have remained on an upward trend since 2023, indicating continued investor interest. Investors who stay focused on a few targeted value-creation levers—such as developing a comprehensive pricing-and-packaging strategy or pursuing large-scale M&A to build synergistic platforms—are best positioned to distinguish their bids and ultimately deliver superior exit outcomes amidst consistently high valuations and competitive deal dynamics.

Reshaping the pharma services investment landscape. While pharma services has long been a sizable and attractive space, recent headwinds have pushed some investors to the sidelines. But others have leaned in by deploying a more selective approach, prioritizing premium and high-potential assets that have room for operational improvement, as well as business models insulated from broader instability.

Physician groups innovate on traditional models. While activity remains below its peak of a few years ago, interest in physician groups persists among US investors, with leading platforms distinguishing themselves via moves beyond traditional buy-and-build models and toward integrated, clinician-centric approaches that elevate care quality. Those investing in next-generation models built around attractive themes such as pharma exposure or value-based care will find attractive opportunities.

Key questions to shape the future

Many facets of the healthcare PE market suggest a cautiously optimistic outlook for 2026. Despite a slow second quarter, global dealmaking reached record levels in 2025, underscoring investor confidence in the fundamentals. Continued growth in public-to-private and carve-out transactions, along with the return of sponsor-to-sponsor activity, also points to robust activity. As portfolios mature and exit pipelines build, the stage is set for an active 2026. Investors can benefit by addressing a few key questions:

Will Europe sustain its recent momentum? As macroeconomic and political landscapes evolve, will investors continue to find near-term opportunity in Europe while riding out the ebbs and flows of policy changes in the US?

What is the next act for healthcare IT? Will pharma IT activity accelerate? Will combinatory M&A continue to be a value-creation play as platforms become scarcer in the healthcare IT market? Will the use of generative AI tools driving efficiency and data-enabled care delivery continue to grow?

With macro pressures easing, will biopharma activity open up? What impact will that have on the global biopharma ecosystem? Will pharma services see amplified strategic demand if funding conditions return to previous levels?

How will investors hone their value-creation playbooks to deliver outsized returns in this next chapter of private equity? Will there be shifts in focus areas, from sectors to business models and asset types?

Will the dam break in 2026 with extended deal and exit momentum, given the increasing weighted age of PE portfolios and investors’ push for distribution? After two years of strong activity overcoming macroeconomic and policy headwinds, will 2026 mark a year of sustained performance across all four quarters?

Read our 2026 Global Healthcare Private Equity Report

More from the report