Managing money can be challenging, but it can be even more so as a couple — especially if the two people involved don’t trust each other with money.

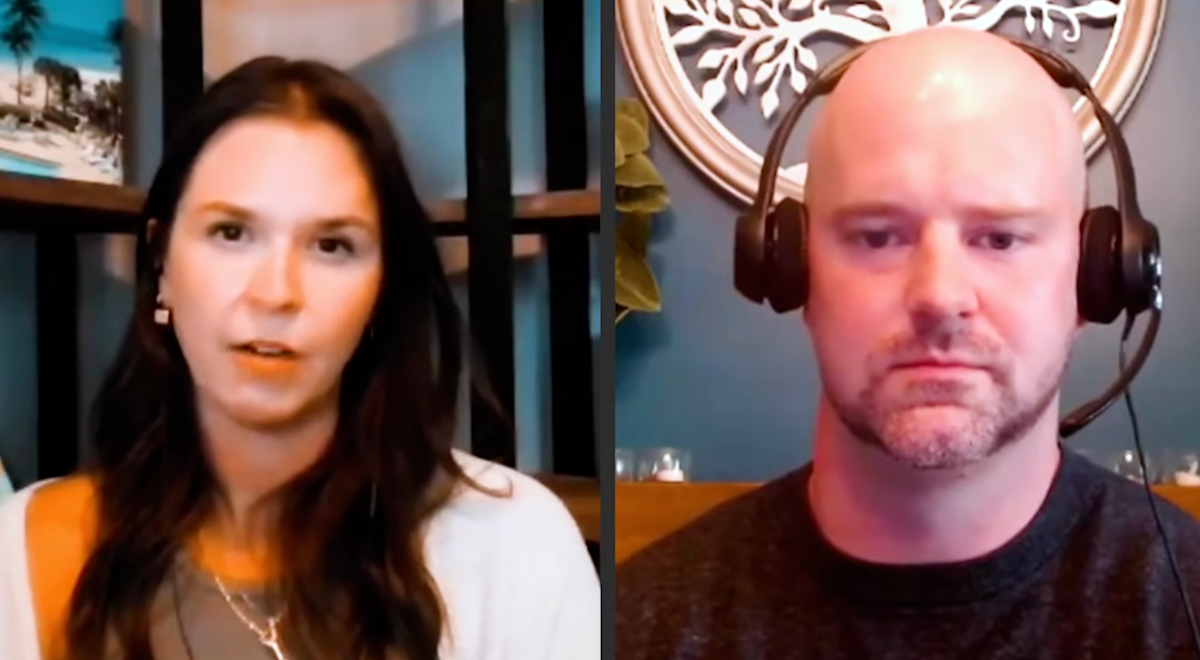

That’s the case for a couple featured on a recent episode of Ramit Sethi’s podcast, I Will Teach You To Be Rich. Jamie, 45, and her husband Ryan, 35, have been married 10 years and have three kids. They live in the Midwest, make about $245,000 per year and have a net worth of $1,033,000 (1).

Still, they feel like they’re struggling financially and tend to run out of money at the end of the month, with no idea where it went.

A major stumbling block? Jamie has lost trust in Ryan after he made a series of major financial decisions without her. The largest of these occurred two years ago when Ryan, unhappy with his lucrative finance job, took what Sethi referred to as the “nuclear of nuclear options.”

Ryan abruptly quit his job and cashed out the 401(k) tied to it without consulting Jamie beforehand or telling her immediately afterward. He compounded this by quitting his next job without first informing her and then borrowing from his IRA to fund a classic car purchase.

Ryan says he “just hit a breaking point.” But now Jamie has a savings account she keeps separate from Ryan to protect their money. She’s resentful that she’s had to pay down his credit card debt, and the couple’s money talks often end in ”arguing, divorce threats and nothing ever changing,” Jamie told Sethi.

The couple wants to get their finances in order — and stop arguing — but to do so, Sethi says they’ll need to stop thinking of each other as individuals, adopt a shared vision and work as a team.

Jamie and Ryan’s situation demonstrates the effects that emotions, burnout and trust can play in derailing the financial plans of even those who are relatively well off. The couple didn’t explicitly state whether Ryan was suffering burnout at work, but he does display some of the behaviors of those who are affected by burnout.

Burnout or depression can lead to impulsive decisions, such as Ryan abruptly quitting his job and making several impulse purchases. It can also cause people to run up their credit cards, which Ryan was doing, and defer making responsible financial decisions, which he was also doing by offloading these responsibilities to Jamie.

Story Continues

As a result, the financial symptoms of burnout can be costly. For instance, Ryan gave up a lucrative job, which could seriously impact his lifetime earnings. He also cashed out his 401(k) early, which will result in higher taxes that year. It will also hurt his retirement savings since the tax-advantaged growth potential is lost for the money he withdrew.

For example, if he withdrew $10,000 that was earning 7%, then in 25 years he’d be missing out on a balance of around $54,000. Using the 4% withdrawal method, this would have provided about an extra $180 per month in retirement.

Most 401(k)s allow you to start making withdrawals without the 10% early withdrawal tax penalty at age 59 ½. Ryan is in his 30s and doesn’t satisfy any of the exemptions for early withdrawal from his 401(k), which means his withdrawal would be taxed as ordinary income in the year it was taken and subjected to a 10% early withdrawal penalty (2).

Read More: The average net worth of Americans is a surprising $620,654. But it almost means nothing. Here’s the number that counts (and how to make it skyrocket)

To get back on track, Jamie and Ryan will need to clearly communicate their needs and expectations to each other.

“When you’re hurt or taken for granted, you have to have patience, but you also have to voice your needs that you have certain expectations moving forward in the relationship,” said psychologist Ramone Ford, PhD, in a Cleveland Clinic blog post (3).

Jamie and Ryan, for example, will need to work together to create new, shared goals and establish boundaries to ensure past trust-breaking behaviors aren’t repeated. As they try to rebuild trust, they’ll also need to start working on their finances — together. Fidelity suggests that couples begin with an honest conversation about money, set shared financial goals and create a joint budget (4).

They can still have individual bank accounts, alongside that joint account, if they choose. “Use the joint account for shared expenses like rent, groceries and bills,” Fidelity recommends. “Individual accounts can be used for personal spending, giving each partner a sense of autonomy.”

Fidelity says this setup “helps prevent conflicts over discretionary spending while ensuring transparency for shared finances,” which could help prevent Jamie and Ryan from playing the blame game with their discretionary spending.

Fidelity also suggests splitting financial responsibilities to keep both partners engaged in their financial affairs, as well as creating a safety net by building and maintaining an emergency fund together. Life happens, so it’s important to have regular check-ins to adjust those plans as needed.

Jamie and Ryan will need to put in the work to rebuild trust and get their finances in order, but they’ve already taken the important first step of asking for help and talking honestly and openly about money. If you need a reset with your partner, consider enlisting the help of a financial advisor or coach to help you get started.

We rely only on vetted sources and credible third-party reporting. For details, see our editorial ethics and guidelines.

I Will Teach You To Be Rich – YouTube (1); IRS (2); Cleveland Clinic (3); Fidelity (4)

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.