For both people and enterprises, rent is frequently the biggest fixed expense, and when it rises, it rapidly reduces discretionary income.

High rents deteriorate living circumstances and increase financial hardship at a time when school fees, taxes, and other yearly obligations are due because they leave families with less money for food, healthcare, education, and transportation.

Steep rental expenses might force people into debt, cramped housing, or informal settlements.

Long commutes from far-off suburbs are becoming more typical, which lowers productivity, raises transportation expenses, and has a detrimental impact on both physical and mental health.

Additionally, high rents increase operational expenses and lower profitability for businesses that rely on operating within a physical space in a world that is rapidly embracing remote work.

When rent is uncontrollable, small and medium-sized businesses, startups, and informal merchants may struggle to remain profitable, resulting in firm closures, reduced employment, or a migration into unregulated markets.

When rent is high, it can reduce consumer spending, which erodes demand throughout the urban economy.

Furthermore, high commercial rents can deter global and domestic investors looking for stable operating conditions.

In a nutshell, high rents exacerbate inflationary pressure at the macro level since housing prices have a significant impact on price indexes and pay demands.

Cities that have consistently high rent indices run the danger of losing investment and talent to more reasonably priced metropolitan areas, which would hurt their long-term economic viability and competitiveness.

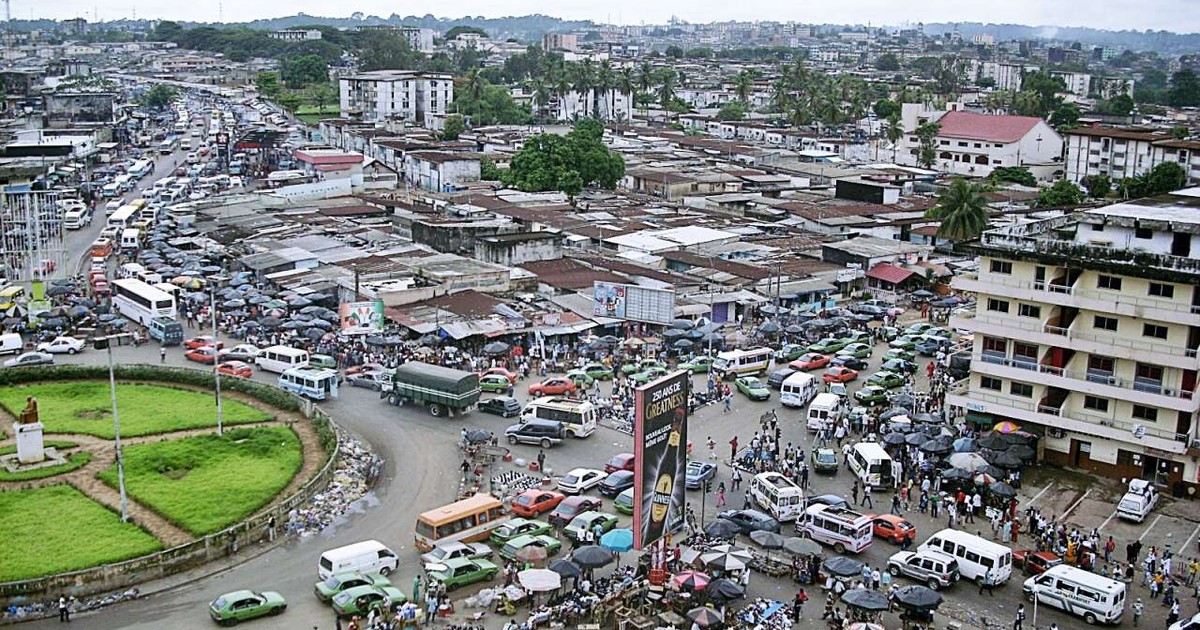

With that said, here are the major African commercial hubs with the highest rent index at the start of 2026, as per data from Numbeo