This week: breakouts, good starts, fun with fund flows, animal spirits, shorts, long-term trends, generational changes, market cap movements, and the energy sector in focus

Learnings and conclusions from this week’s charts:

The S&P 500 is getting off to a good start in 2026.

Statistically, that bodes well for the rest of the year.

Rotation out of cash and into stocks is ramping up.

Animal spirits are stirring (seeing rotation into cyclicals).

Energy stocks are unloved, undervalued, and underestimated.

Overall, there are a number of very interesting dynamics playing out in macro and markets as we gear-up into 2026. Trend and momentum are positive overall, traditional cyclicals are picking up, commodities are stirring, and the winds of rotation are gathering…

1. Starting Strong

Reflecting back on the few months of price action, it’s looking a lot like the November drawdown was indeed a “healthy correction”.

Even though the only fell -5%, some of the more speculative parts of the market got a good rinsing e.g. -30%, Semis -15%, tech -10%.

Breadth also went through a multi-week decline into the 20 Nov low — but now, we’re seeing breadth surge to multi-month highs, and a convincing breakout by the index. So the short-term technical outlook is decent (especially set against the backdrop of a rising 200-day moving average: the trend is your friend).

Source: MarketCharts.com

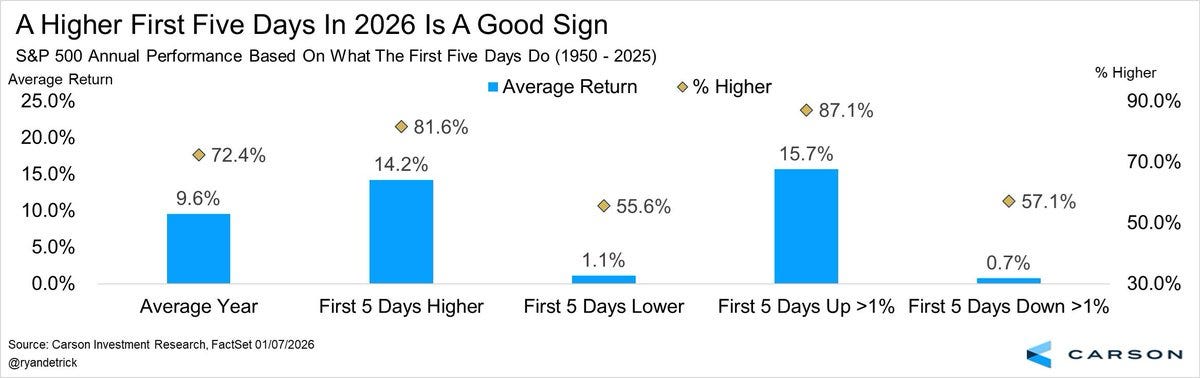

2. Good Start, Good Year

The strong start to 2026 bodes well for the rest of the year, as Ryan Detrick Notes: “The S&P 500 is up more than 1% after the first 5 days of 2026. Historically, when this happens, the full year is positive more than 87% of the time and up nearly 16% on average.”

Thinking it through, the main logic to this statistical boon is probably a combination of momentum effects and the absence of bad macro/fundamental news.

Source: @RyanDetrick

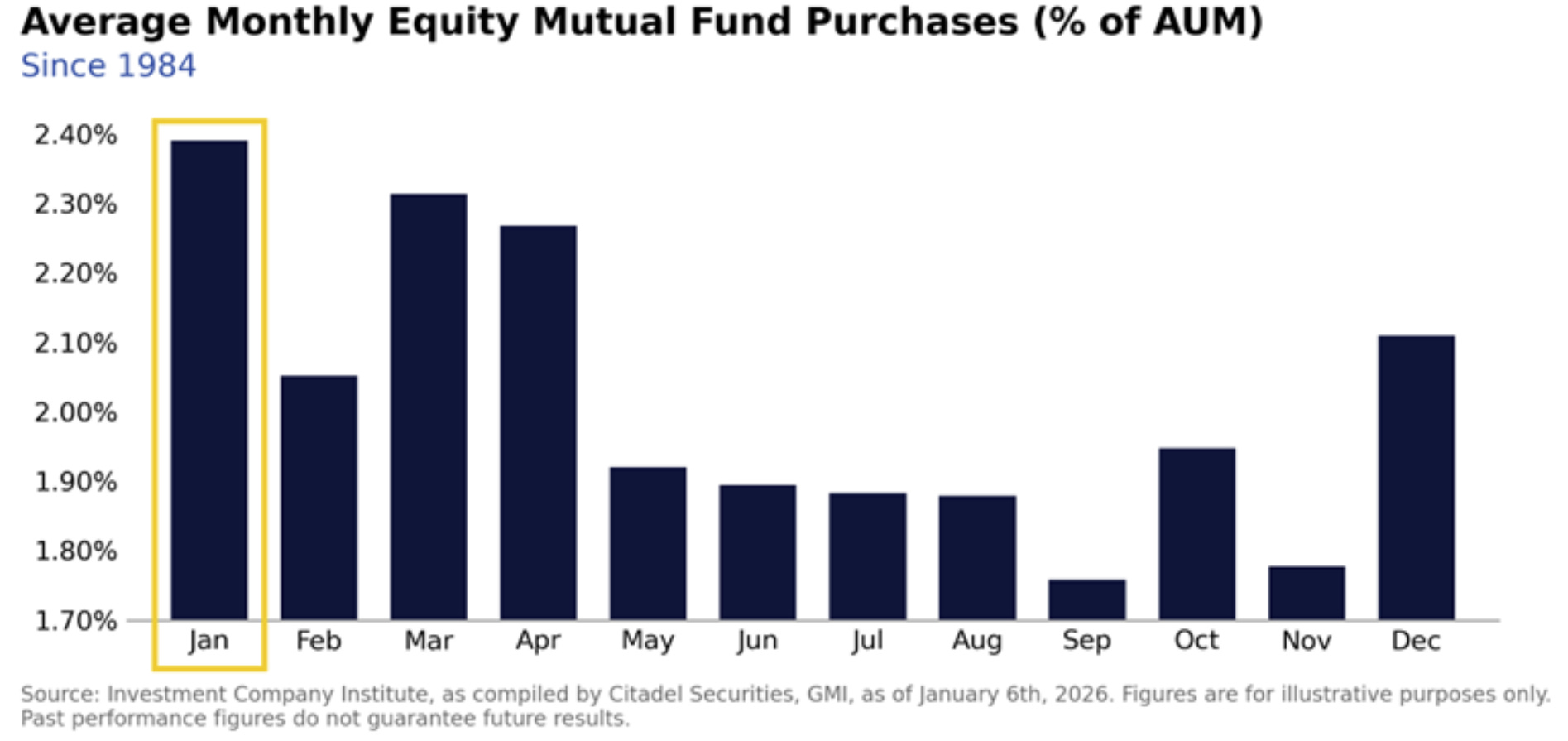

3. Happy New Flows

Helping things along in January has been the seasonal uplift in fund flows, as Scott Rubner of Citadel notes: “As markets reopen after the holiday pause, capital tied to retirement contributions (401k, 529), year-end bonuses, and discretionary PWM mandates moves quickly from cash into passive risk assets. This is particularly true when money market yield levels have declined.”

Source: Citadel Securities

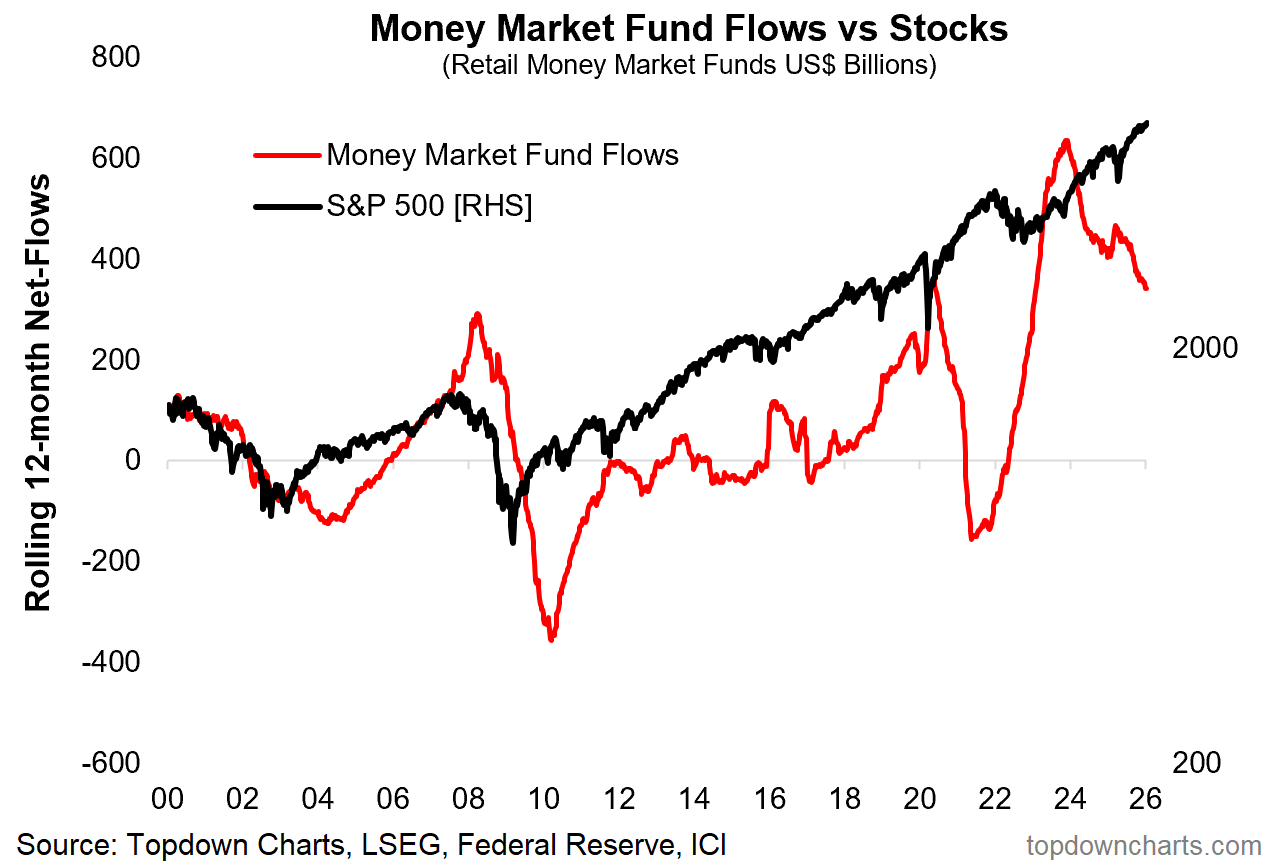

4. On Deployment

Bigger picture, we are seeing a turning point in money market fund flows. There has been a historical pattern of rolling annual money market fund flows rising into market downturns, and declining into new cyclical bull markets. The rise in 2023 was overstated by the impact of the SVB failure triggering rotation out of bank accounts into money market funds, but with and a robust bull market in progress, we may well continue to see flows tailwinds as this chart plays through.

Source: Topdown Charts