This article first appeared in The Edge Malaysia Weekly on January 12, 2026 – January 18, 2026

THE richer millionaire members of the Employees Provident Fund (EPF) below age 55 are probably unfazed by the increase in the excess savings withdrawal threshold from RM1 million to RM1.1 million starting Jan 1 this year, even though withdrawals under this facility reached their highest level in more than two decades in 2024.

The change, announced in December 2024, raises the minimum balance that EPF members must retain before making excess savings withdrawals, that is, only amounts above RM1.1 million can now be withdrawn. In practical terms, members must keep a higher minimum balance in their EPF accounts before accessing any excess savings. Under the same policy, the threshold will be progressively increased to RM1.2 million in 2027 and RM1.3 million in 2028.

The change also affects eligibility thresholds for withdrawals under EPF’s Members’ Investment Scheme (MIS), owing to adjustments to the amount that EPF deems as basic savings (RM390,000), adequate savings (RM650,000) and enhanced savings (RM1.3 million). EPF says the three-tiered savings adequacy levels are aligned with its Retirement Income Adequacy (RIA) Framework, which aims to guide members towards a more comfortable retirement by balancing flexible access with the long-term protection of savings, in line with current living costs.

EPF did not say how many of its members would be affected by the threshold change.

There was a notable increase in EPF withdrawals involving savings above RM1 million, rising to 87,605 in 2024 from 63,273 in 2023 — both significant figures relative to the number of EPF millionaires in those years. It is not immediately clear whether the EPF reports the number of withdrawals or the number of members making withdrawals.

Withdrawal data for 2025 is not yet available but should provide more insight, especially since EPF’s decision to raise the excess withdrawal threshold was announced in December 2024.

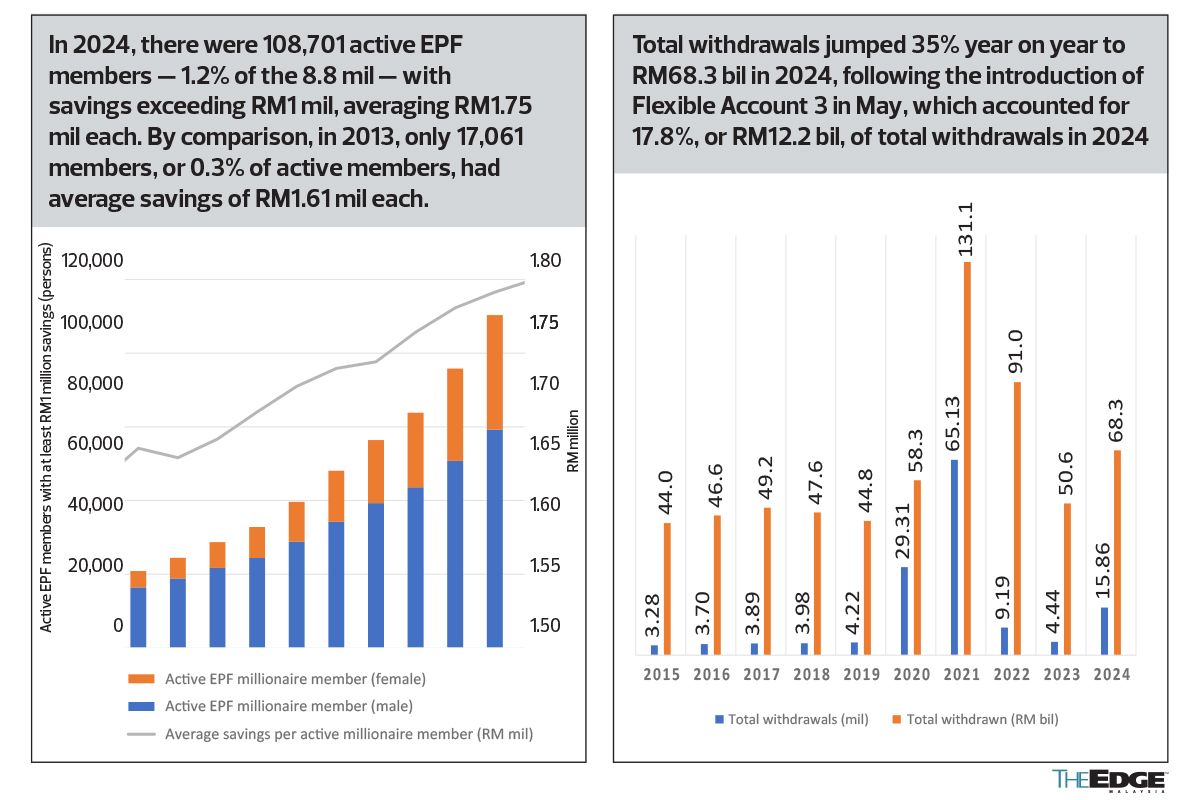

EPF data shows that there were 108,701 active members with savings of at least RM1 million as at Dec 31, 2024. Women accounted for 39,358, or 36.2%, of these EPF millionaires at end-2024.

These 108,701 members represent 1.2% of EPF’s 8.78 million active members as at end-2024, yet collectively hold RM190.05 billion, or 19.7%, of the RM962.4 billion in total savings belonging to all active members.

On average, this works out to about RM1.75 million per EPF millionaire, although there is no data on median balances or how much the wealthiest members hold.

It is also unclear how many of EPF’s 7.44 million inactive members have savings exceeding RM1 million, though the number is probably small, given that members are currently free to withdraw all their savings from age 55.

EPF data shows that its 115,284 active members aged 54 as at end-2024 had average savings of RM168,172, with collective savings of RM34.2 billion.

By comparison, the 156,183 inactive EPF members aged 54 had average savings of just RM12,157, with total savings of RM9.12 billion.

According to EPF’s annual report, the fund had 16.22 million active and inactive members with total investment assets of RM1.25 trillion as at end-2024. Of this, just over RM962.4 billion, or 76.83%, belonged to its 8.78 million active members, translating into a simple average of RM109,578 per member. The remaining RM290.25 billion in assets was held by 7.44 million inactive members as at end-2024, implying a much lower simple average of RM39,012 per member.

Withdrawals above RM1 mil hit new high

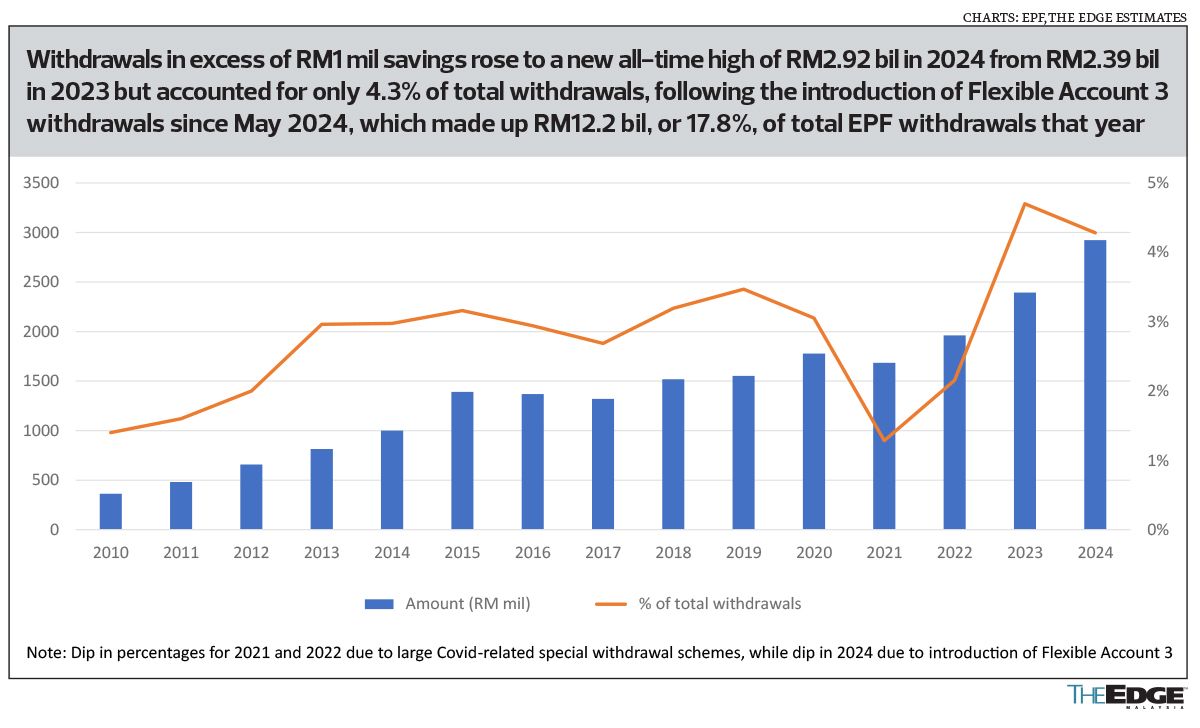

In 2024, a total of 87,605 members collectively withdrew RM2.92 billion under the RM1 million withdrawals facility, accounting for 4.3% of the RM68.3 billion in total withdrawals by members that year.

This marks a new all-time high for the facility, surpassing 64,373 members who withdrew RM2.4 billion in 2023; 44,647 members who withdrew RM1.96 billion in 2022; 33,076 members who withdrew RM1.68 billion in 2021; and 24,372 members who withdrew RM1.78 billion in 2020, according to The Edge’s compilation of EPF data.

It is worth noting that EPF allowed special Covid-19-related withdrawals totalling more than RM86.2 billion in 2021 and RM145 billion in 2022.

Withdrawals of savings in excess of RM1 million accounted for between 1.38% and 4.7% of total EPF withdrawals between 2010 and 2014, according to The Edge’s compilation of data, with 4.7% recorded in 2023.

In 2024, the percentage fell to 4.3% even though the absolute amount rose to RM2.92 billion. This decline was due to the introduction of Flexible Account 3 withdrawals in May 2024, which alone accounted for RM12.17 billion, or 17.8% of total withdrawals that year, EPF data shows.

Sizeable withdrawals from Flexible Account 3

It is not yet clear whether the 2024 figures represent a one-off spike or a shift in EPF withdrawal trends.

On Aug 13, 2025, the Ministry of Finance informed parliament that a total of RM14.79 billion had been withdrawn from Flexible Account 3 by 4.63 million members, or 35.14% of EPF’s 13.2 million members aged below 55, in just over a year since its introduction. This implies that only RM2.62 billion may have been withdrawn from Flexible Account 3 between January and mid-August 2025, since EPF data shows that RM12.17 billion was withdrawn by 11.03 million members between May and December 2024.

It is worth monitoring whether withdrawal trends have indeed slowed, given that Flexible Account 3 was the second-largest withdrawal type in 2024, behind only the RM20.24 billion, or 29.6%, withdrawn under the 55-year facility. Members aged above 60 collectively withdrew RM9.98 billion, accounting for 14.6% of total withdrawals in 2024.

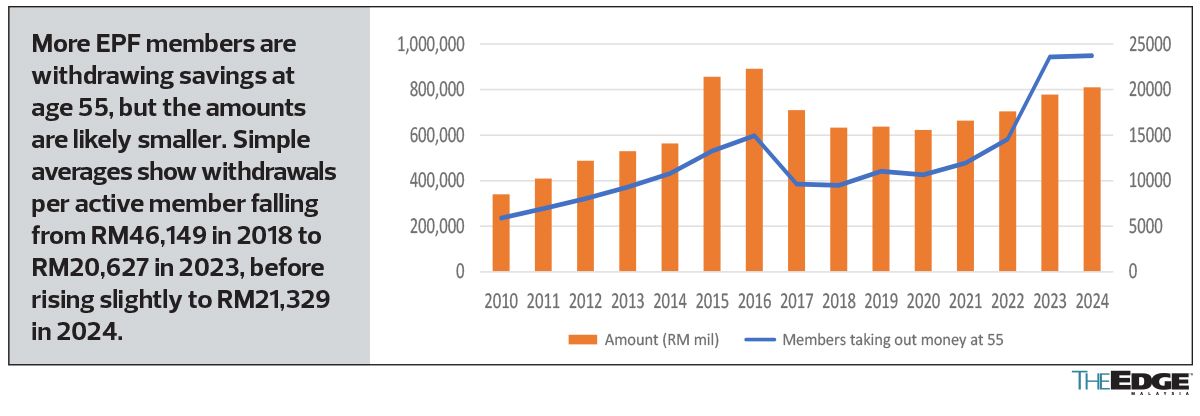

As for averages, it is worth noting that the average savings among active EPF members fell year on year from RM94,978 (among 7.59 million active members) in 2020 to RM93,179 (among 7.69 million) in 2021 and RM92,351 (among 8.39 million) in 2022, following the large Covid-19-related withdrawals. Since then, the simple average has risen, reaching RM101,730 (among 8.52 million active members) in 2023 and RM109,578 (among 8.78 million) in 2024.

Even so, this is still far from EPF’s old basic recommended savings of RM240,000 at age 55, based on the previous minimum public pension of RM1,000 a month for 20 years. With the minimum wage now at RM1,700, the same calculation raises the benchmark to RM408,000 — slightly above EPF’s new basic savings target of RM390,000 at age 60. Policymakers are aware that a significant gap remains to be closed to ensure most Malaysians can enjoy a dignified retirement.

Save by subscribing to us for

your print and/or

digital copy.

P/S: The Edge is also available on

Apple’s App Store and

Android’s Google Play.