January 24, 2026 — 4:01am

Save

You have reached your maximum number of saved items.

Remove items from your saved list to add more.

Save this article for later

Add articles to your saved list and come back to them anytime.

Got it

AAA

Where to start fixing your finances? At this time of year, that’s the often paralysing dilemma.

You probably know you’re paying over the odds on some of your financial and other products, but there’s a daunting number of them.

Got some subscriptions that need cancelling? Now’s the time to do it.Aresna Villanueva

Got some subscriptions that need cancelling? Now’s the time to do it.Aresna Villanueva

It’s possibly, post-Christmas, time to rein in the spending, but you’re on a delightful/destructive roll. And that stepped-up savings plan is likely to be just that, still a plan.

Well, this is your 2026 life audit list – starting with my fast number fix.

This is the length of time that binding death nominations last. It is an all-important form that means if you prematurely fall off the perch, your super will land in the right place. Yes, it’s binding for only three years.

So, start your life auditing by jumping on your super portal and re-doing this if needed (bear in mind, though, there will be large tax if you leave it to non-financial dependents).

While you’re at it, update or make a will. You are bestowing a nightmare of delays and discussions if you don’t.

38 per cent

This is the proportion of the population that fails to cancel subscriptions before auto-renewal. A Westpac survey also suggests almost one in three of us (32 per cent) have paid for subscriptions we’ve forgotten and another 31 per cent have difficulty cancelling a subscription.

We’re apparently spending almost 20 per cent more on average on subscriptions – often duplicate services and apps – than we realise. How many times might you have forgotten? And what are you hanging onto that you don’t need?

26 times

That’s probably the number of payslips you will get this year, with perhaps 24 left. Plan your holidays – you will never get to where you want to go if you don’t decide where that is.

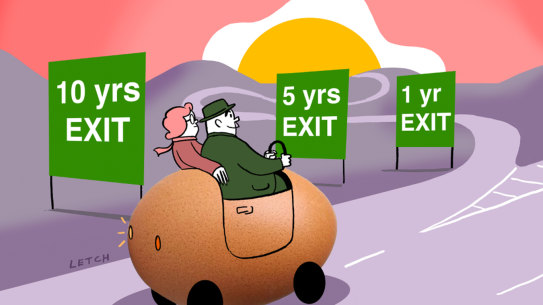

And, vitally, that applies to your bigger picture life goals as well. Now is the perfect time to set targets so sweet you can almost taste them – for this year, the next few years and your long-term enjoyment.

Key, though, is to cost and then what I call calendar them. Determine when you want to hit each happy reward. Working backwards from that, doing so requires taking the cost and dividing it by the number of pays between now and your target date – it’s that simple but it is also perhaps difficult to find this money.

You want your super fund to have outperformed in at least three years of the past five.

5.2 per cent

This is your benchmark for what you should be paying on your home loan.

Sure, you could overhaul a bunch of other financial products too, but at least do this one as the saving you stand to make is huge. If you have the standard $694,000 home loan and switch it from the average 6.13 per cent rate to the best 5.2 per cent, you will put $388 back in your pocket a month.

This is what the median balanced super fund is forecast to have returned last year. That’s for funds that hold between 60 and 76 per cent in growth assets, like shares. Does your fund make the grade?

If it has turned in below the median just this once, that’s probably OK. But if it has come up short in more than two of the past five years, it’s probably time to kick it to the kerb.

For previous years, the numbers you need to know are 11.1 per cent for 2024, 9.6 per cent for 2023, negative 4.8 per cent for 2022 (the only loss in the past five years) and a huge gain of 13.4 per cent, post-pandemic in 2021. The 2020 pandemic year was a gain of 3.3 per cent.

You want your fund to have outperformed in at least three years of the past five. You can also check how it compares with alternatives on the ATO’s Your Super tool.

(The rule of) 72

This is the number to get you focused on that saving/investing plan – beyond super – to secure for yourself a brighter future.

The rule of 72 is a neat back-of-the-envelope trick that shows the magic of compound investment returns – specifically, how long it would take at a given return to double your money.

What you do is divide 72 by your expected investment return. So, for a fairly average sharemarket return of 7 per cent, it’s 72 ÷ 7 = 10.3. Therefore, at 7 per cent, you can expect to double your money in just over 10 years.

And that would be an outstanding outcome of a little life audit.

Nicole Pedersen-McKinnon is the author of How to Get Mortgage-Free Like Me, available at www.nicolessmartmoney.com. Follow Nicole on Facebook, X and Instagram.

Advice given in this article is general in nature and is not intended to influence readers’ decisions about investing or financial products. They should always seek their own professional advice that takes into account their own personal circumstances before making any financial decisions.

Expert tips on how to save, invest and make the most of your money delivered to your inbox every Sunday. Sign up for our Real Money newsletter.

Save

You have reached your maximum number of saved items.

Remove items from your saved list to add more.

From our partners