The market researchers at Gartner have extended their forecast out to 2027 and dropped 2024 from the view since it is now more than a year past. And rather than providing the very detailed forecast that it did in its September forecast, which we covered here, Gartner has decided to provide less granularity in its data, which as you might imagine we never like.

We always like keeping you appraised of the latest market data because money and units matter, and running it through the neural network and context engine that we carry behind our eyes and between our ears.

So, let’s get to it.

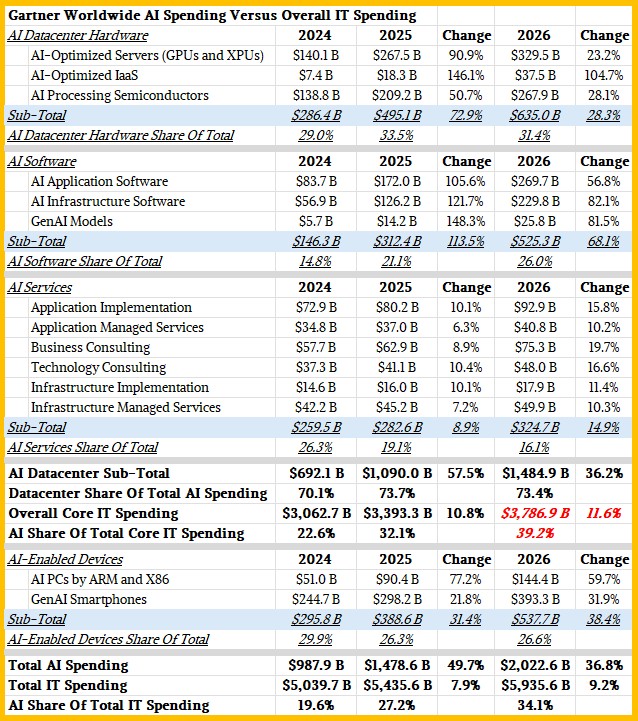

Back in September, when this first detailed AI spending forecast came out, we got a bunch of supplemental information from Gartner and fleshed out the spending breakdown for AI services. We compared the numbers to the core IT datacenter spending and overall IT spending forecasts put together by Gartner to give a sense of how AI was penetrating the IT market at large. Our analysis for the September 2025 forecast is here, and we are embedding the chart from that story as a compare-contrast with the latest dicing and slicing of AI spending by Gartner.

Take a gander:

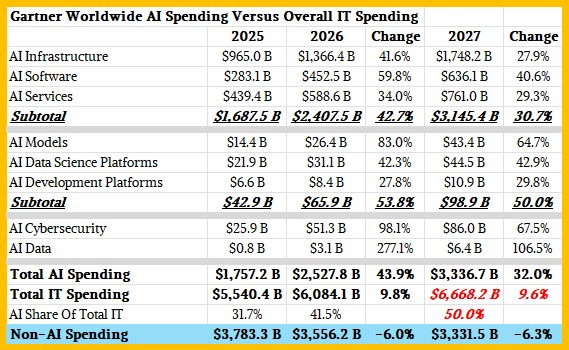

I was mixing and matching data from IDC and Gartner by necessity in that table, but in October 2025 Gartner put out a revised forecast for overall IT spending worldwide, and now we can compare and contrast these within the same organization and, presumably, get a much more accurate sense of how AI spending is driving IT consumption overall. Take a look:

With this dataset, we cannot separate out datacenter infrastructure spending from client infrastructure (PCs, tablets, and smartphones) spending, which is a shame. Over the long haul, all client devices will very likely have tensor processors that assist with AI functions – they already have vector units that can do it – and AI servers with GPU and XPU accelerators already account for half of revenues, give or take. That share will only continue to grow as AI adoption increases, but it may be increasingly hard to figure out how much inference is being done on CPUs versus GPUs versus XPUs in the datacenter and at the edge and on the client. It will be a mix, for sure.

This latest AI spending table from Gartner just lumps them all together, and as you can see, the growth rate for AI infrastructure spending growth will slow in 2027 from the rate expected in 2026. Still, the spending will almost double in two years, which is a Moore’s Law kind of rate. AI software, as you can see, is also growing at this rate and will also nearly double in two years – mostly through the addition of AI functions into existing systems software, middleware, database, and application stacks. As more things get AI functions, they get counted in the AI bucket even if the amount of the AI function is not necessarily that great. The server virtualization and cloud markets “grew” in this manner in the past as well. When a technology becomes normal, as AI will eventually be, it is just “IT spending” as we now do it.

All distinctions and characterizations are transitory even if they are not ephemeral.

As you can see, sales of AI infrastructure and services is growing fast, bit not as fast as growth in the sale of AI models, data science tools, and various development tools. Tools for securing AI systems (and often using AI to do this) as well as AI data management tools are growing even faster, albeit from much smaller sales levels in the forecast from 2025 through 2027 from Gartner.

What you can also see at the bottom of the chart is that AI spending represented 31.7 percent of all IT spending in 2025, according to Gartner, and it expects AI to account for 41.5 percent of the pie in 2026. Gartner has not put out a forecast for overall IT spending in 2027 as yet, but we put a good guess in there and when we do, that means AI will drive half of all IT spending in 2027. (We did not force this 50 percent rate. We took a reasonable guess of how overall IT budgets will increase next year.)

As you can see, the IT sector is going to grow reasonably, mainly because AI spending will still be growing years hence while non-AI spending will shrink a bit every year.

It’s a tale of two datacenters – the best of times, and the worst of times.

Featuring highlights, analysis, and stories from the week directly from us to your inbox with nothing in between.

Subscribe now

Related Articles