Find your next quality investment with Simply Wall St’s easy and powerful screener, trusted by over 7 million individual investors worldwide.

If you are trying to figure out whether NVIDIA’s share price still makes sense, you are not alone. The stock often sits at the center of the debate about what counts as a fair price for growth.

NVIDIA recently closed at US$180.34, with a 4.3% decline over the last 7 days and a 4.5% decline over the last 30 days, while its 1 year return sits at 52.0% and its 3 year return is around 7x.

Recent headlines continue to focus on NVIDIA’s role in semiconductors and graphics processing, especially around high performance chips for data centers and artificial intelligence use cases. These stories help explain why the share price can move sharply as expectations around chip demand and AI related spending shift.

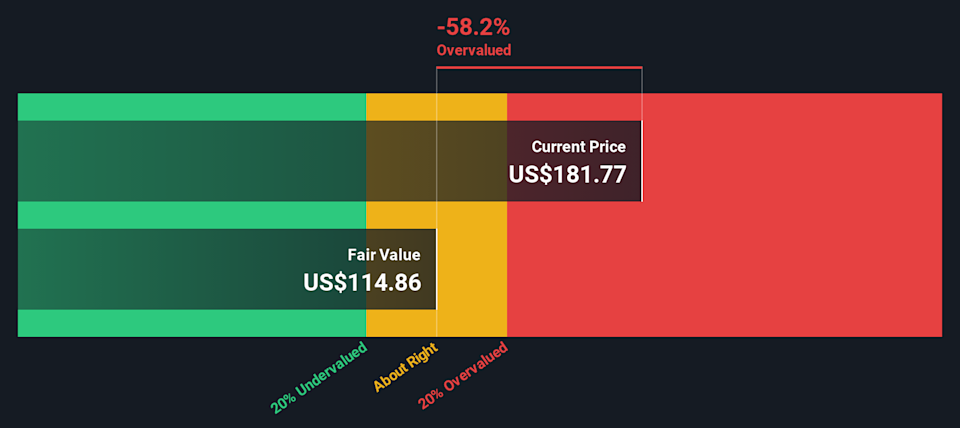

Simply Wall St currently gives NVIDIA a valuation score of 2 out of 6, reflecting that it screens as undervalued on 2 of 6 checks. Next we will compare different valuation methods to see how they stack up, before finishing with a broader way to think about what the stock is really pricing in.

NVIDIA scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

A Discounted Cash Flow, or DCF, model looks at the cash NVIDIA is expected to generate in the future and discounts those cash flows back to today to estimate what the business might be worth now.

For NVIDIA, Simply Wall St uses a 2 Stage Free Cash Flow to Equity model. The latest twelve month free cash flow is about US$77.96b. Analyst and extrapolated projections in this model have free cash flow reaching about US$325.07b in 2031, with ten year forecasts stepping up between 2026 and 2035. All these projected cash flows are then discounted back to today and summed.

On this basis, the model arrives at an estimated intrinsic value of about US$155.09 per share. Compared with the recent share price of US$180.34, the DCF output suggests the stock screens as around 16.3% overvalued using these assumptions and projections.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests NVIDIA may be overvalued by 16.3%. Discover 873 undervalued stocks or create your own screener to find better value opportunities.

NVDA Discounted Cash Flow as at Feb 2026

NVDA Discounted Cash Flow as at Feb 2026

For a profitable company like NVIDIA, the P/E ratio is a useful shorthand for what investors are willing to pay for each dollar of current earnings. It ties the share price directly to actual profits, which many investors find easier to interpret than cash flow models.

Story Continues

What counts as a “normal” or “fair” P/E depends on how the market views a company’s growth prospects and risks. Higher expected growth or lower perceived risk can justify a higher P/E, while slower growth or higher risk usually points to a lower P/E being more reasonable.

NVIDIA is currently trading on a P/E of 44.18x. That sits above the broader Semiconductor industry average of about 42.19x, but below the peer group average of around 64.89x. Simply Wall St also calculates a proprietary Fair Ratio for NVIDIA of 56.54x, which reflects factors such as its earnings growth profile, profit margins, industry, market cap and risk characteristics. This Fair Ratio aims to be more tailored than a simple comparison with industry or peers because it tries to account for NVIDIA’s specific fundamentals rather than broad group averages. Since the current 44.18x P/E is meaningfully below the 56.54x Fair Ratio, this framework points to the stock screening as undervalued on this metric.

Result: UNDERVALUED

NasdaqGS:NVDA P/E Ratio as at Feb 2026

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1426 companies where insiders are betting big on explosive growth.

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of NVIDIA with the numbers behind it.

A Narrative is your story for the company, translated into assumptions like fair value, future revenue, earnings and margins, so you are not just looking at ratios in isolation but at a joined up view of what you think the business could deliver.

On Simply Wall St, Narratives live in the Community page, where millions of investors connect a company’s story to a financial forecast and then to a fair value. They can then compare this directly with the current share price to help decide whether it might be a time to buy, sell or simply watch.

These Narratives update automatically when fresh information such as earnings releases or news is added. With NVIDIA that can mean one investor’s cautious Narrative with a lower fair value and modest growth assumptions sitting right beside another investor’s more optimistic Narrative that uses higher revenue growth, stronger margins and a higher fair value for the same stock.

Do you think there’s more to the story for NVIDIA? Head over to our Community to see what others are saying!

NasdaqGS:NVDA 1-Year Stock Price Chart

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NVDA.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com