The S&P 500 (SPY) gained 14.3% over the past year as stocks dramatically outperformed bonds over the past decade.

Retirees with 30-year horizons should maintain S&P 500 exposure rather than abandoning equities due to market timing fear.

Financial planners recommend holding 3-5 years of living expenses in cash while keeping the remainder invested in stocks.

Investors rethink ‘hands off’ investing and decide to start making real money

Market timing anxiety intensifies as investors approach retirement, especially when headlines scream about economic uncertainty. The impulse to abandon a winning strategy at the finish line can be overwhelming.

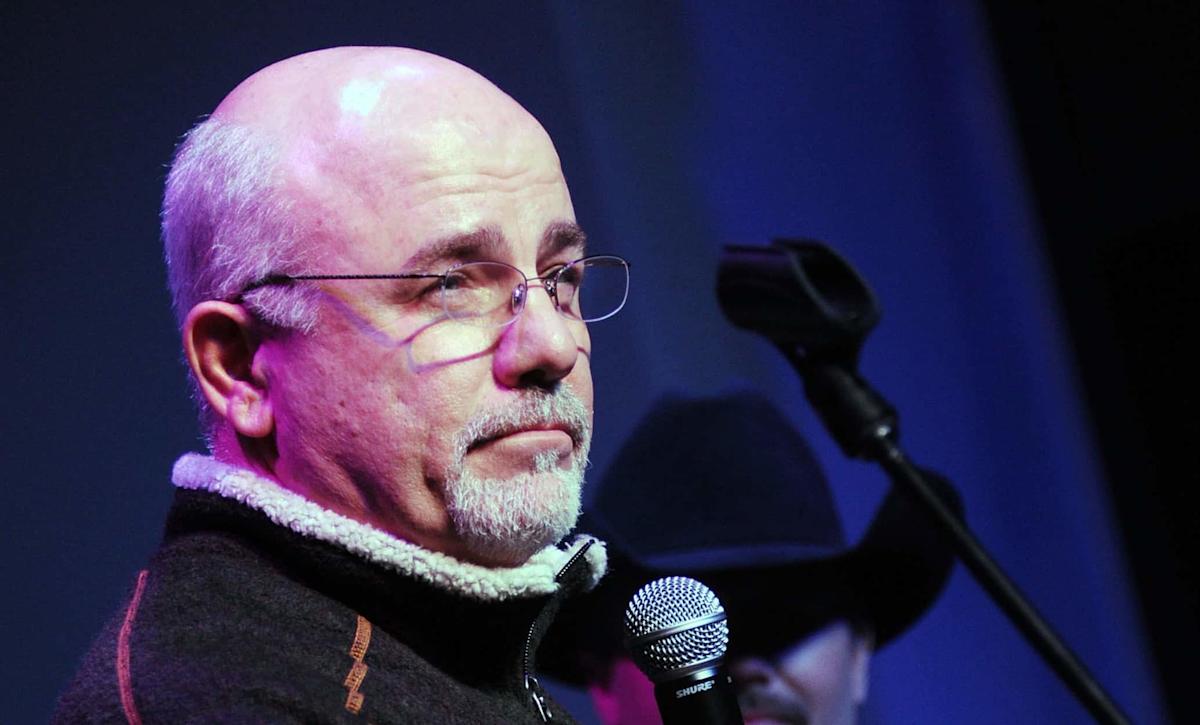

On a January 2026 episode of The Dave Ramsey Show, a caller named Robert from Nashville shared his dilemma. At 70 years old and planning to retire by year’s end, Robert and his wife have built a $400,000 nest egg in their 401k and Roth accounts, plus $100,000 in high-yield savings. His portfolio has returned 10.89% annually over 23 years with 93% in stocks. With gold prices high and economic uncertainty, Robert wondered if he should move part of his retirement into a money market fund.

“Way to go. That’s exactly what we tell people you should be,” the host responded about Robert’s returns. The advice was clear: don’t abandon equities based on fear. “You could live another 30 years,” the host reminded Robert, noting his wife plans to live to 100. “You are missing out on a whole lot of returns” by shifting to bonds out of panic.

Ramsey’s core insight is mathematically sound. A 70-year-old with a spouse planning to live to 100 faces a potential 30-year investment horizon. The historical evidence supports maintaining equity exposure: stocks have dramatically outperformed bonds over the past decade, with the performance gap illustrating why abandoning equities at retirement could cost Robert hundreds of thousands in growth over three decades.

The opportunity cost of moving to bonds becomes clear when you consider purchasing power erosion. Shifting his nest egg into bonds would generate modest annual income, but inflation would steadily erode that income’s real value over a multi-decade retirement. The seemingly safe choice actually guarantees a declining standard of living as the cost of goods and services rises faster than bond yields.

Ramsey’s guidance assumes Robert can emotionally withstand a 30-40% portfolio decline without panicking. The S&P 500 has gained 14.3% over the past year, but maintaining 93% equity exposure means accepting significant short-term volatility. A retiree drawing income during a market crash faces sequence-of-returns risk: selling stocks when they’re down locks in losses permanently.

Financial planners commonly recommend that retirees hold 3-5 years of living expenses in cash or short-term bonds while keeping the remainder invested. This approach lets retirees weather downturns without forced selling.

Financial advisors often suggest that investors evaluate their ability to avoid portfolio withdrawals during market downturns. Those who can weather volatility may benefit from equity exposure, while those who cannot might consider larger cash reserves. The 30-year horizon is real, but only if panic-selling during inevitable downturns can be avoided.

For more than a decade, the investing advice aimed at everyday Americans followed a familiar script: automate everything, keep costs low, and don’t touch a thing. And increasingly, investors are realizing that being completely hands-off also means being completely disengaged.

That realization hits like a lightning bolt when you realize not just how much better your returns could be, but that there are amazing offers like one app where new self-directed investing accounts funded with as little as $50 can receive stock worth up to $1,000.

Take back your investing and start earning real returns, your way.