Kenya’s fixed broadband market has posted impressive growth, with subscriptions surging 42.9% to 2.14 million by June 2025, according to new data from the Communications Authority (CA).

The surge reflects rising demand for high-speed internet, aggressive competition among Internet Service Providers (ISPs), and the ongoing rollout of national fiber infrastructure.

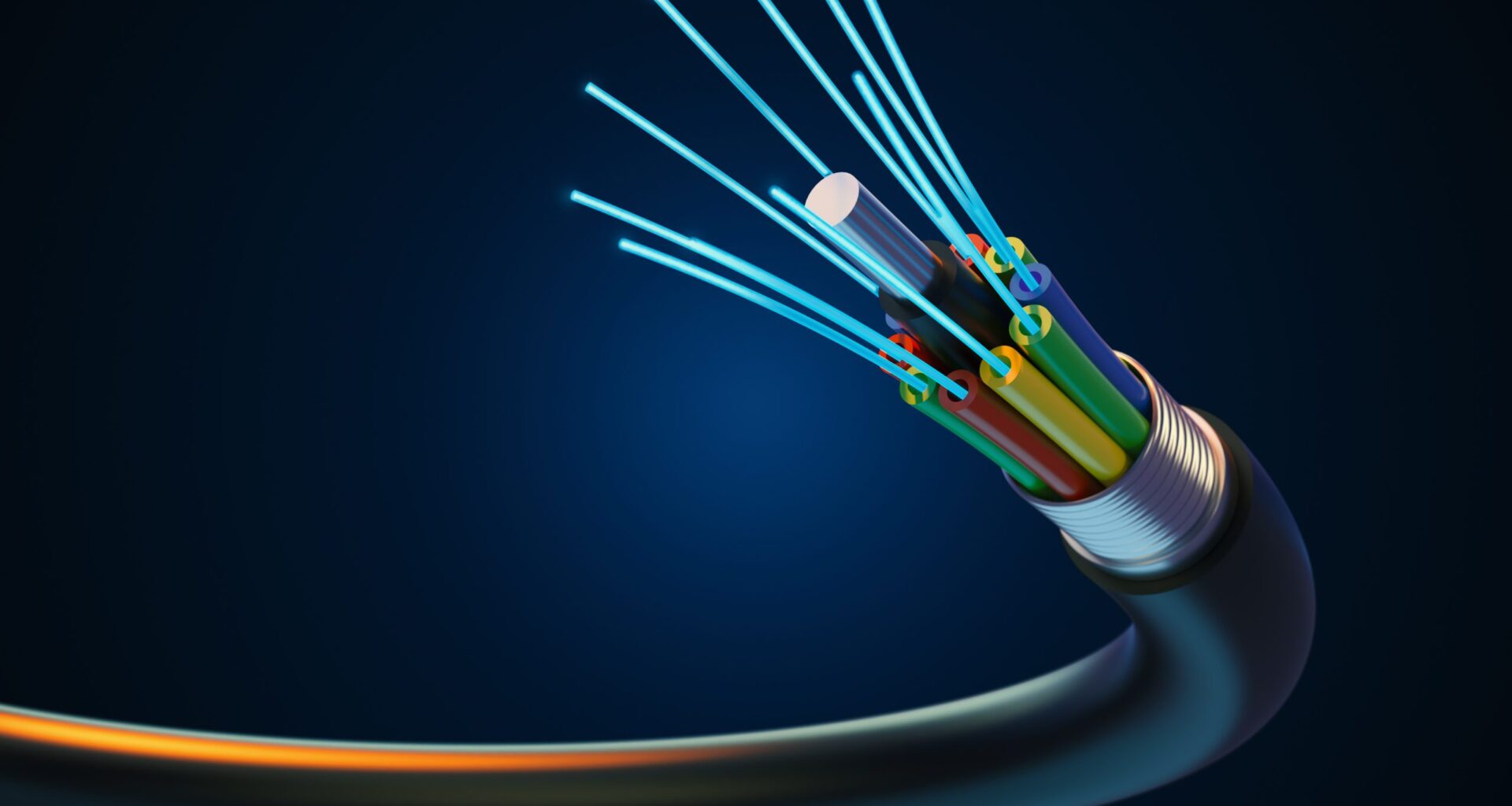

Fiber and Wireless Lead Growth

The report shows that fiber-to-the-home (FTTH) and fixed wireless continue to dominate the market. FTTH accounts for over 1.1 million subscriptions, while fixed wireless follows closely with 721,000 connections.

Fiber-based enterprise services (FTTO) also grew steadily, hitting 101,677 subscriptions, indicating the shift by businesses to dedicated high-capacity internet.

READ: Airtel Is Preparing to Launch Home Fiber Internet in Kenya

When it comes to speed, most Kenyans are connecting through mid-tier packages. Over 870,000 subscriptions fall within the 10-30 Mbps range, followed by more than 717,000 in the 2–10 Mbps bracket.

In fact, ultra-high-speed plans above 1 Gbps remain niche, mostly adopted by offices on fiber networks.

Safaricom Still Dominating

The competition among ISPs is heating up. Safaricom still leads the market with 735,749 subscriptions, translating to a 34.3% share.

However, Jamii Telecommunications (Faiba) has grown to 20.6%, consolidating its position as Safaricom’s main challenger.

Zuku (Wananchi Group) holds 12.7%, but it is facing pressure from newer players like Poa Internet (12.5%) and Ahadi Wireless (7.5%), both of which have grown by aggressively targeting estates and peri-urban markets.

Smaller players such as Vilcom (4.1%), Mawingu (3.6%), and satellite newcomer Starlink (0.8%) add to the increasingly diverse ISP ecosystem.

The growth is partly attributed to the government’s ongoing National Optic Fiber Backbone Initiative (NOFBI) and county-level connectivity programs, which are lowering barriers for ISPs and improving reach to underserved regions.

Given the importance of internet adoption for e-commerce, education, and remote work, Kenya’s fixed broadband market is poised to continue being one of the fastest-growing segments in the ICT sector.