2h agoWed 1 Oct 2025 at 2:22amMarket snapshot at middayASX 200: -0.4% to 8,812 pointsAustralian dollar: -0.2% to 66.0 US centsNikkei: -1.1% to 44,430 pointsS&P 500: +0.4% to 6,688 pointsNasdaq: +0.3% to 22,660 pointsFTSE: +0.5% to 9,350 pointsEuroStoxx: +0.5% to 558 pointsSpot gold: +0.2% to $US3,866/ounceBrent crude: +0.1% to $US66.18/barrelIron ore: +0.1% to $US103.85/tonne

Bitcoin: -0.2% to $US114,463

Prices current around 12:22pm AEST.

Live updates on the major ASX indices:

4m agoWed 1 Oct 2025 at 5:01amBHP to boost copper production

BHP has announced it will spend $840 million on its Olympic Dam copper operations in South Australia.

The investment will fund key initiatives including an underground access tunnel, a new backfill system, expanded ore pass capacity and a new oxygen plant to enhance smelter efficiency.

The Olympic Dam project holds one of the world’s largest deposits of copper, uranium and gold.

It has produced more than 300,000 metric tonnes of copper annually for the past 3 years.

“BHP is the largest producer of copper in the world, and we expect to grow our copper base from 1.7 million tonnes to around 2.5 million tonnes per annum,” said BHP COO Edgar Basto in a statement.

“Achieving that scale requires significant copper growth, and we are fortunate to have a world-class copper province right here in South Australia to do just that.”

Copper demand is projected to grow 70% by 2050 due to population growth, rising living standards and the energy transition.

15m agoWed 1 Oct 2025 at 4:50am

Would you drink out of an aluminium wine bottle?

A winery has released Australia’s first aluminium wine bottle, in a bid to cut emissions.

Victoria’s Brown Brothers is selling wine in aluminium bottles to reduce its carbon footprint.

It says while there is no impact on taste, there has been some pushback from consumers.

You can read more on this story here:

29m agoWed 1 Oct 2025 at 4:36am

US dollar on the defensive

The US dollar has hovered near a one-week low versus major peers as the US enters a government shutdown.

The dollar index gauges the currency against six counterparts including the euro and yen, stood at 97.81 near the deadline at 2pm (AEST).

The length of any shutdown may be key for markets as the Federal Reserve’s next policy decision is on October 29.

“The USD will resume its fall today if the political discourse suggests an extended shutdown,” said Joseph Capurso, head of foreign exchange at the Commonwealth Bank.

“More weak US economic data can add to the weight of the USD.”

Reporting with Reuters

51m agoWed 1 Oct 2025 at 4:14amGold at record as US government shuts down

Markets are reacting to the US government’s shutdown.

US stock market futures are lower, with S&P emini futures down 0.5%, while Australian stocks were little moved, with the ASX 200 remaining off by 0.4%.

Meanwhile, gold has hit a fresh record for the third day in a row, hitting $US3,875 an ounce.

Bullion is up more than 47% so far this year, meaning it’s on track for the biggest annual increase since 1979.

It’s been supported by global economic concerns, central-bank buying and rising holdings in gold-backed exchange-traded funds.

Reporting with Reuters

1h agoWed 1 Oct 2025 at 4:05amUS government shutdown begins

Wall Street futures are off 0.4% and gold has struck a record high as the US government shuts down for the first time in nearly 7 years.

A vote to extend a spending bill past a midnight (2pm AEST) deadline failed in the US Senate.

Millions of federal workers will be temporarily laid off or expected to work without pay.

Some government services will face disruptions.

It comes as President Donald Trump has threatened to extend his purge of the federal workforce with ‘irreversible’ firings.

The shutdown is expected to delay the release of crucial jobs data and could muddy the waters around interest rate forecasts.

1h agoWed 1 Oct 2025 at 3:55amMarkets down ahead of US government shutdown

Australian share markets are down ahead of a likely US government shutdown at 2pm (AEST).

The ASX200 is -0.4% and the All Ordinaries is down -0.3% as at 1:54pm (AEST).

Past US government shutdowns have had a limited impact on the economy and the stock market and many investors expect something similar this time around.

1h agoWed 1 Oct 2025 at 3:35am

Aussie dollar near three-year high against Kiwi

The Australian dollar is hovering around a three-year high against the New Zealand dollar, after yesterday’s Reserve Bank meeting saw forecasts for interest rates on either side of the Tasman diverge.

One Australian dollar buys about $NZ1.14. Here’s the climb over the past month:

AUDNZD (LSEG Refinitiv)

AUDNZD (LSEG Refinitiv)

While market pricing for an RBA rate cut in November has pulled back, the Reserve Bank of NZ is considered certain to cut its rates by 0.25 percentage points at its meeting next week, with markets implying a 35% chance of an outsized 0.5 percentage point cut, according to Reuters.

Capital Economics are among those forecasting a jumbo RBNZ cut.

“When the RBNZ cut its Official Cash Rate by 25 [basis points] in August, it made its dovish bias abundantly clear,” senior economist Abhijit Surya wrote.

“We believe that the Committee will end up cutting rates even more aggressively than it has signalled.

“For one thing, the decision came down to a vote between a 25bp cut and a 50bp cut, with the former winning out with four votes against two.

“For another, the Bank revised down its terminal rate forecast, from 2.85% to 2.55%, in an acknowledgement that a more expansionary stance is needed.

“We expect it to slash the OCR by 50bp at its meeting next week and follow that up with another 25bp cut in November.”

Earlier this week, TD Securities rates strategist Prashant Newnaha wrote that “the prudent course of action” would be for the RBNZ to cut by 0.25 percentage points in October and November as has been flagged.

The RBNZ decision is a 2pm local time next Wednesday.

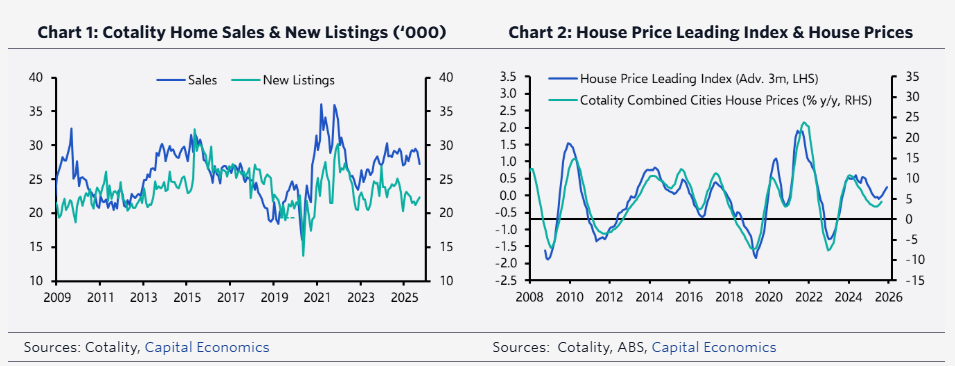

1h agoWed 1 Oct 2025 at 3:20amAustralia’s house price growth could reach 7%

House price growth across the eight capital cities was up by another 0.8 % in September.

“That lifted the annual rate of house price growth to 4.3%, the strongest it has been since January,” said Marcel Thieliant, Head of Asia-Pacific, Capital Economics in an analyst note.

Home sales remain strong, but new listings are weak by historical standards, he says.

“As a result, our sales to new listing ratio was about as high in July as it was in 2021, when house price growth peaked at 24%.”

He says it’s unlikely the current house price rally will be ‘anywhere near that strong’, with affordability still stretched.

While auction clearance rates have picked up in recent months, growth in housing finance commitments is still weak.

House price charts (Capital Economics, Cotality)

House price charts (Capital Economics, Cotality)

The number of days houses remain on sale is low by historical standards, but has barely shortened all year.

While the RBA has cut rates 3 times this year, lower mortgage rates are unlikely to unleash a huge rally in house prices.

“Our forecast is that annual house price growth will peak at around 7% by early next year,” he said.

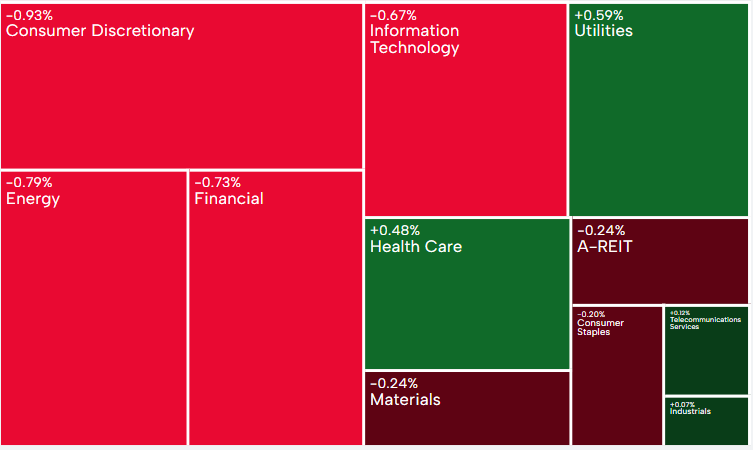

2h agoWed 1 Oct 2025 at 2:50amMidday market update

The local share market is still slightly down in the middle of the trading day.

The ASX200 is down -0.3% to 8,820 points, while the broader All Ordinaries index is down -0.27% to 9,111 points (as at 12:43pm AEST).

7 of the 11 sectors are lower today, with utilities currently the top performing sector, rebounding from its recent decline.

Consumer discretionary, energy, and financials are dragging the market down today.

Sector map (ASX)

Sector map (ASX)

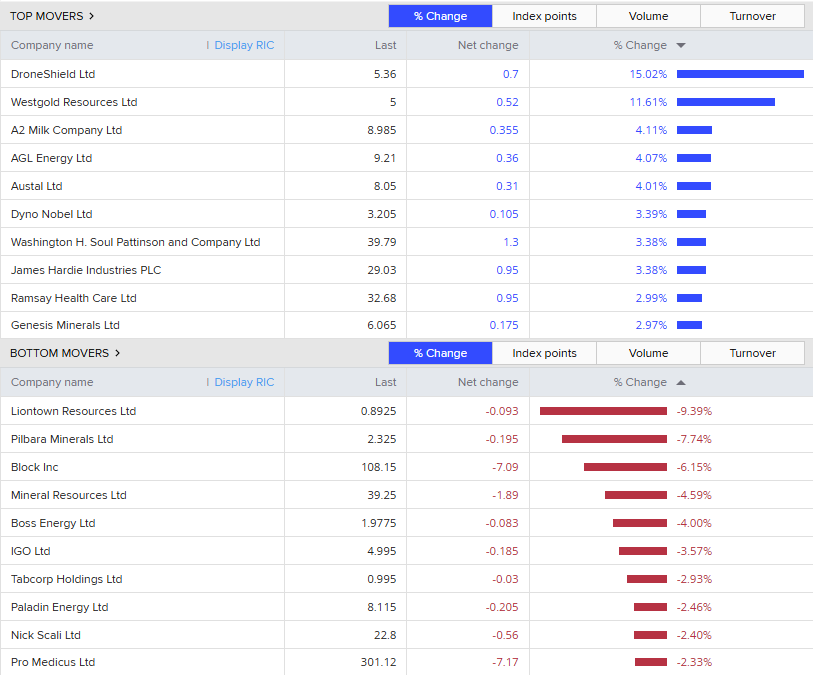

DroneShield continues its winning streak this week, up 15%.

Followed by Westgold Resources, up 11.6%.

The worst performing stocks are Liontown Resources (-9%) and Pilbara minerals (-7.7%).

Top and bottom movers (Eikon)

Top and bottom movers (Eikon)

The Australian dollar is also lower, buying 65.95 US cents.

2h agoWed 1 Oct 2025 at 2:41amGas supply outlook eases in 2026

Gas supply on Australia’s east coast is expected to ease in the first quarter of 2026, according to the latest gas inquiry report by the ACCC.

It’s an improvement from the June outlook, which predicted a shortfall in gas by the end of this year.

A gas supply surplus of between 2 -24 petajoules is expected for the east coast.

However, the outlook still depends on how much uncontracted gas LNG producers decide to export.

The total amount of gas secured under long-term supply contracts remains below pre- 2022 levels.

The Australian government is currently conducting a Gas Market Review which will examine current regulations.

2h agoWed 1 Oct 2025 at 2:25am

Beijing is exerting control over private companies

Beijing has been trying to exert more power on the way iron ore is managed, says Director of Iron Ore Research Philip Kirchlechner.

He says it’s led to increased tension between private companies and Beijing in recent months,

“Since Xi Jinping came to power, he would like to increase the power the central government has over the economy and in particular its industries. Whether these industries are private or not, he likes to exert control.

“But people need to realise that doing deals with countries that have a very restrictive political system, there’s always a risk.”

He said it isn’t just BHP that is affected by threats.

“It’s clear that tensions have risen, but in the end, China needs the iron ore.”

“No other country is even near China in the size of its steel industry and its requirement for iron ore.

It’s currently a national holiday in China, and he said most of the purchases were done before the steel mills go on break.

But Mr Kirchlechner expects the “cat and mouse game” to resume after the holidays.

2h agoWed 1 Oct 2025 at 2:15am

When it comes to business, size does matter

Governments should focus their support on new businesses, regardless of their size, rather than subsidising small businesses, a new report finds.

The research, released by the e61 Institute, has said that young firms — operating for five years or less — have been Australia’s dominant positive economic contributors over the past 15 years.

New firms in their first year of business activity generate 22% of new jobs, with just over 5% of employment.

My colleague Yiying Li has more on this story.

3h agoWed 1 Oct 2025 at 2:00am

A reminder of who’s in control: analyst

After slumping at the open of trade, shares in BHP Group have stabilised a little.

At 11:30 AEST the stock is still down 1.4% though.

Henry Jennings is a senior portfolio manager with Marcus Today.

He’s told the business blog the markets decided this is a negotiating tactic and nothing more.

“This is temporary and clearly a negotiating tactic.”

“China just want to remind them who drives the price,” he said.

3h agoWed 1 Oct 2025 at 1:46amAustralia’s first free trade agreement with the Middle East

Australia’s free trade agreement with the United Arab Emirates has come into effect today.

It’s the first free trade agreement Australia has signed in the Middle East.

“The UAE represents an important trading destination for our exporters and importers as it rates in the top 20 of our trading partners,” said the Australian Chamber of Commerce and Industry’s CEO Andrew McKellar.

“It is an important regional and global hub for transport and logistics, the services sector and goods trade.”

Mr McKellar says it creates new opportunities for Australian business to expand trade and investment linkages.

3h agoWed 1 Oct 2025 at 1:34am

Cup Day cash rate cut a drifting favourite?

Bendigo Bank has joined the chorus of economists who are questioning the timing of the next interest rate cut.

It follows the Reserve Bank’s decision to keep interest rates on hold yesterday at 3.6%.

“Our forecasts are unchanged for a ‘shallow’ RBA easing cycle back to a more neutral rate around 3.25%, but the timing of the next cut is under question,” said chief economist David Robertson.

The monthly August inflation figures plus sharp rises in other key categories has sent mixed signals, meaning a cup Day cut on November 4 remains a popular but drifting favourite, he says.

“The full quarterly CPI numbers out on October 29 will the key event to verify this timing,” he said.

“So barring a significant jump in core inflation, the easing cycle should continue. But it’s a complex environment.”

3h agoWed 1 Oct 2025 at 1:21amRio Tinto’s Gladstone power station to retire early

Mining giant Rio Tinto will close Queensland’s largest and oldest coal-fired power station six years earlier than expected.

The Gladstone Power Station was set to close in 2035, but now could close as early as 2029.

Workers at the station were notified this morning.

The announcement is drawing mixed reactions from industry, politicians and the community.

Rio Tinto shares are up slightly by +0.3% in early trade.

4h agoWed 1 Oct 2025 at 12:59am

Live blog

ABC proof reading is diabolically bad these days, i.e.:

BHP shares dripped in London overnight

– Nicky

Hi Nicky, thanks for the feedback, we’ll fix that.

But just so you know, this is a live blog, so the posts are not proof read before publication.

If we did that it would be a 15-minute delayed blog, not a live one!

This is a pretty good impression of me this morning trying to cover the markets and BHP news while sitting through editorial meetings.

Loading

4h agoWed 1 Oct 2025 at 12:55am

Market snapshotASX 200: +0.1% to 8,856 pointsAustralian dollar: -0.1% to 66.05 US centsNikkei: -0.7% to 44,636 pointsS&P 500: +0.4% to 6,688 pointsNasdaq: +0.3% to 22,660 pointsFTSE: +0.5% to 9,350 pointsEuroStoxx: +0.5% to 558 pointsSpot gold: +0.1% to $US3,862/ounceBrent crude: -0.1% to $US65.99/barrelIron ore: +0.1% to $US103.85/tonne

Bitcoin: -0.4% to $US114,243

Prices current around 10:55am AEST.

Live updates on the major ASX indices:

4h agoWed 1 Oct 2025 at 12:50am

Australian government appears to confirm some sort of Chinese ban on BHP iron ore

Along with the Prime Minister, Treasurer Jim Chalmers has also weighed into the China-BHP issue, calling the reports of the ban “concerning”.

It would be unusual to see such strong statements from the government if there was absolutely no problem with BHP’s current iron ore contract negotiations with Chinese buyers.

Mr Chalmers said he would set up a conversation with BHP chief executive Mike Henry about the issue.

“Ultimately though, they are about the commercial arrangements between two companies and so in one respect, it’s a matter for the company to work through,” he said.

“I’ll have discussions with Mike Henry about that in due course when we can set that up.”

The ABC’s Canberra-based foreign affairs correspondent Stephen Dziedzic has more.

ASX 200: -0.4% to 8,812 pointsAustralian dollar: -0.2% to 66.0 US centsNikkei: -1.1% to 44,430 pointsS&P 500: +0.4% to 6,688 pointsNasdaq: +0.3% to 22,660 pointsFTSE: +0.5% to 9,350 pointsEuroStoxx: +0.5% to 558 pointsSpot gold: +0.2% to $US3,866/ounceBrent crude: +0.1% to $US66.18/barrelIron ore: +0.1% to $US103.85/tonne

ASX 200: -0.4% to 8,812 pointsAustralian dollar: -0.2% to 66.0 US centsNikkei: -1.1% to 44,430 pointsS&P 500: +0.4% to 6,688 pointsNasdaq: +0.3% to 22,660 pointsFTSE: +0.5% to 9,350 pointsEuroStoxx: +0.5% to 558 pointsSpot gold: +0.2% to $US3,866/ounceBrent crude: +0.1% to $US66.18/barrelIron ore: +0.1% to $US103.85/tonne