American Express (ticker: AXP) joined the Dow Jones Industrial Average (DJIA) on August 30, 1982, replacing Manville Corp. and injecting a prominent financial services player into the 30-stock index of America’s corporate leaders. This addition underscored American Express’s growing influence in the U.S. economy, founded in 1850, now 175 years strong.

Today, Disruption Banking examines American Express’s journey — both before its Dow inclusion and in the decades since — to see how the “charge card” icon has climbed the Dow’s ranks.

Pre-Dow Surge: Amex’s Rise to Prominence

In the decade leading up to its DJIA entry, American Express (Amex or AXP, for short) demonstrated strong momentum, leveraging post-1970s economic recovery and credit card expansion. From 1973 to 1981, AXP’s annual returns averaged around 15–20 percent, with standout performances like 1980’s roughly 43 percent gain as shares rose from an average of $0.74 to $1.06, according to Macrotrends. These figures are adjusted to allow for stock splits that happened as recently as 2005.

The late 1970s saw consistent advances — about +8 percent in 1979, roughly +43 percent in 1980, and about +13 percent in 1981 — fueled by innovations such as the Gold Card launch and global outreach.

This period showcased Amex’s potential, transforming a $1,000 investment from 1972 into over $262,000 by this year with dividends reinvested, that’s 262 times their original investment, per Macrotrends.

Volatility existed, including a roughly 31 percent, 42 percent, 8 percent, and roughly 15 percent dip in 1973, 1974, 1977, and 1978, respectively. But overall trends highlighted Amex’s blue-chip trajectory, outpacing broader market benchmarks.

American Express (AXP) Annual % Change (Pre-Dow Inclusion). Source: Macrotrends

American Express (AXP) Annual % Change (Pre-Dow Inclusion). Source: Macrotrends

Post-Dow Grit: Navigating Market Swings

American Express’ early years post-entry were solid: 1983’s roughly 6 percent return lifted average prices to $2.2, while the 1980s delivered 20+ percent average gains amid booms. The 1990s dot-com era added similar vigor, with shares peaking near equivalents of $107 by 2019.

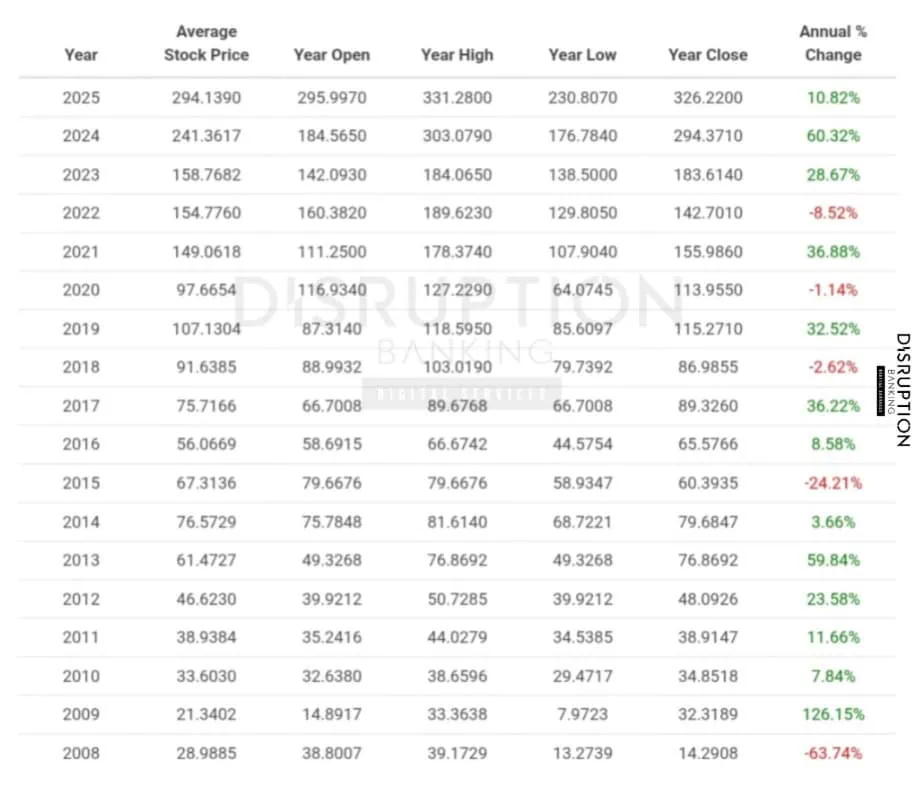

As Macrotrends’ data would show, Amex’s trials forged resilience. Like the 1987 crash, 2008 financial crisis (a 64 percent plunge), and 2020 pandemic low of roughly $98. Yet recoveries were robust, like 2009’s 126 percent surge and 2021’s approximately 37 percent rebound.

More recent peaks include 2024’s 60 percent return to a $294 close, and YTD 2025’s roughly 11 percent through August, hitting an all-time high of $331 amid bets on premium consumer spending, according to Macrotrends. Versus the Dow’s 7-8 percent YTD, AXP’s outperformance endures. Big swings in 2024, and about 9 percent dip in 2022 reflect sensitivity to economic and spending cycles.

American Express (AXP) Annual Annual % Change (Post-Dow). Source: Macrotrends

American Express (AXP) Annual Annual % Change (Post-Dow). Source: Macrotrends

Revenue Boom: Riding Economic Waves

After decades of innovation — including premium card expansions and digital enhancements — American Express faced a 2025 adjustment amid softening consumer trends. The company reported Q2 revenue of $17.9 billion, up 9 percent year-over-year (YoY), driven by premium spending and millennial/Gen Z account growth (over 60 percent of new cards). EPS reached $4.08, surpassing estimates by 5 percent, with billed business up 6 percent in travel and entertainment.

However, rising credit loss provisions on delinquencies prompted caution, leading to reaffirmed full-year guidance of 8-10 percent revenue growth and $15.00-$15.50 EPS.

CEO Stephen J. Squeri says he sees “a long runway for growth” as the company’s “differentiated Membership model and proven product refresh strategy, combined with the expansion of the premium category” takes root.

Yet, insider selling in Q3 — executives trimming stakes by 21-82 percent — has raised eyebrows, signaling possible valuation concerns at current share price.

Dividend Dynasty: Amex’s Payout Power

American Express’s dividend legacy — over 4 consecutive years of increases since resuming in 2019 — point to endurance.

As at the time of writing, AXP’s yield stands at about 1 percent based on an annual dividend of $3.28 per share, modest amid growth priorities that favor buybacks ($6 billion in 2024) and investments.

Dow Heavyweight: Amex’s Elite Status

As a price-weighted Dow component, AXP’s mid-$320s share price yields a 4.4 percent weighting, ranking in the top 7, per Slickcharts — just behind heavyweights like Visa and Sherwin-Williams, as at the time of writing.

Amex’s inclusion enhances the index’s financial sector exposure, offering a lens into upscale consumer and business spending within the blue-chip fold.

Regulatory Ripples: Amex’s Economic Edge

Regulatory scrutiny remains a significant concern for American Express. In January 2025, Amex agreed to pay approximately $230 million to resolve DOJ investigations into deceptive marketing and sales practices.

American Express remains closely tied to economic and consumer spending cycles — particularly in areas like travel and entertainment. “During the early COVID period, Amex paused dividend raises (keeping it at $1.72 annually in 2020 and 2021) to conserve capital, but resumed growth in 2022 once conditions improved,” Kroker Equity Research reported.

Geopolitics and inflation could pressure international revenues (30% of total) via higher provisions, though AXP’s closed-loop network aids fee capture and loyalty.

Why Amex Shines: Investor Insights

American Express’s inclusion in the Dow back in 1982 symbolized a changing of the guard — the beginning of the end of the Dow being only “smokestack” industrials.

After more than 40 years in the Dow, Amex remains an exemplar of durable growth intertwined with cyclical swings. Wall Street rates AXP “Hold,” with a $328 average target — implying modest upside from $326.

The Federal Reserve’s preliminary Stress Capital Buffer (SCB) requirement for American Express is 2.5 percent, effective October 1, 2025, through September 30, 2026. This is the minimum regulatory threshold, indicating Amex’s strong capital standing.

And even if economic cycles introduce some bumps, few companies are as adept at bouncing back as American Express — a trait that should keep it firmly on the Dow’s pedestal for years to come.

Author: Richardson Chinonyerem

See Also:

Goldman Sachs: Dow Jones’ Heaviest Hitter | Disruption Banking