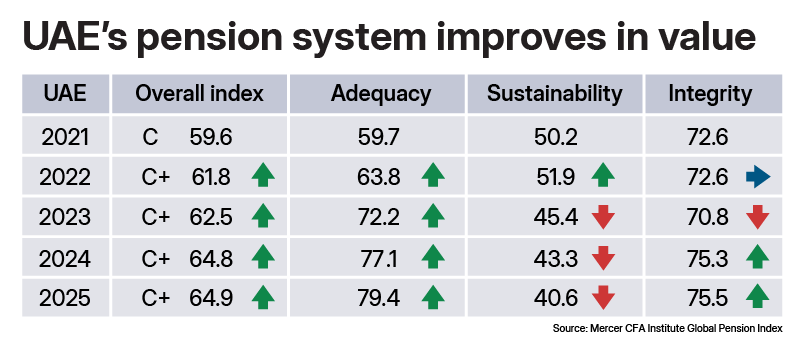

The UAE’s retirement income system improved its score for the fifth year in a row on Mercer’s global index backed by its reforms in the sector.

The Emirates’ overall index score increased slightly to 64.9 in 2025 from 64.8 in 2024 on the Mercer CFA Institute Global Pension Index, primarily due to a refinement in approach for measuring pension coverage, according to the survey.

The index covers 52 countries with long-standing pension systems such as the US, Singapore and France, that account for 65 per cent of the world’s population. It uses a weighted average of factors such as adequacy, sustainability and integrity.

Globally, the Netherlands took the top spot, followed by Iceland, Denmark, Singapore and Israel. India was ranked last.

“Evidence of the UAE’s forward-thinking strategy to enhance long-term financial security is the Dubai International Financial Centre’s employee workplace savings plan for expatriate employees – the Employee Workplace Savings Plan (DEWS) that was launched over five years ago, which has now surpassed $1 billion in assets under administration,” Claudia Maldonado, head of savings and pensions, Mercer Middle East, said.

“While DEWS is not included in the UAE’s national pension system, it is testament to the UAE’s adaptability to the changing economic landscape and its focus on building a strong foundation for meaningful retirement outcomes for all.”

The UAE’s retirement income system comprises a minimum means-tested state pension and an earnings-related national employment-based scheme. Within the UAE, the pensions of Emiratis are administered by different agencies such as the Abu Dhabi Pension Fund, Sharjah Social Security Fund and the General Pensions and Social Security Authority.

Emiratis working in the government and private sectors are eligible for pensions and other retirement benefits after reaching the retirement age of 49 or after having served a minimum of 20 years, according to the UAE government.

Employee monthly contributions for new Emirati workers in the public and private sectors increased to 11 per cent in 2023 from 5 per cent earlier. Public sector employer contributions remain at 15 per cent but for private sector employers, it has been increased to 15 per cent from 12.5 per cent.

Non-Emirati employees have their end-of-service entitlements covered by the UAE’s gratuity programme. Gratuities are lump-sum payments to which all employed residents are entitled after completing at least one year of service. They are covered by the UAE labour law and the sum depends on an employee’s length of service and basic salary.

In 2023, the UAE introduced an optional savings retirement plan that allows employees in private and free zone sectors to invest their end-of-service benefits to build long-term wealth. In 2022, Dubai also launched a savings retirement initiative for non-Emirati employees working in the emirate’s government and public sector.

The UAE’s pension system scored highly, compared with global peers, in the areas of adequacy and integrity, Mercer said on Wednesday. The country had the highest score, 79.4, in adequacy due to generous retirement benefits, according to Mercer. It scored 40.6 in sustainability (or long-term viability) and 75.5 in integrity, owing to the strong management structure around the pension system.

“The overall index value for the UAE’s pension system could be increased by increasing the coverage of employees in occupational pension schemes, increasing the state pension age as life expectancies rise, and reducing household debt levels,” the Mercer report said.

Saudi Arabia’s retirement income system also improved its overall score to 67.6 in 2025 from 60.5 in 2024 primarily due to improved data provided on the minimum pension, the index found.

Countries recognising Palestine

France, UK, Canada, Australia, Portugal, Belgium, Malta, Luxembourg, San Marino and Andorra

Sting & Shaggy

44/876

(Interscope)

The Vile

Starring: Bdoor Mohammad, Jasem Alkharraz, Iman Tarik, Sarah Taibah

Director: Majid Al Ansari

Rating: 4/5