Welcome to Michael Kramer’s pick of the key market events to look out for in the week beginning Monday 20 October.

The US government remains shut down as of 17 October, meaning that economic data releases are still on hold. However, the Bureau of Labour Statistics is scheduled to release the consumer price index report on Friday (24 October). Meanwhile US earnings season continues, with many investors keeping a close eye on Tesla’s latest earnings, and analysts’ guidance. UK banks, namely Barclays, Lloyds and NatWest, also release quarterly updates this week.

UK consumer price index

Wednesday 22 October

Since bottoming in October 2024, inflation rates have been rising steadily, from a low of 1.7% to 3.8% year-on-year in September 2025. This persistent rise in inflation hasn’t prevented the Bank of England from cutting interest rates, and based on market expectations, the rate-cutting cycle isn’t over yet.

If the inflation trend continues at the current pace, it seems likely that further rate cuts from the Bank of England will be harder for bond market investors to stomach, especially when coupled with the fiscal strains that have recently taken centre stage. While one might assume that a steeper yield curve would be bullish for the pound, the opposite is likely to be true.

For now, GBP/USD appears bullish, with a potential falling wedge pattern, and the relative strength index seems to be breaking out, suggesting it may rise first, potentially even ahead of Wednesday’s CPI report.

Sources: TradingView, Michael Kramer

Sources: TradingView, Michael Kramer

Tesla Q3 earnings

Wednesday 22 October

The NASDAQ-listed company will report earnings after the close of trading on Wednesday. Analysts forecast revenue growth of 3.8% to $26.1bn, while earnings are expected to decline by 26.3% to $0.53 per share, with gross margins slipping to 17.4% from 19.9% a year ago. Total automotive revenue is projected to fall to $19.5bn.

The company doesn’t provide formal guidance, but analysts expect Q4 revenue to decline by 1.3% year-on-year to $25.4bn, and earnings to drop by 35.5% to $0.47 per share, with gross margins of 17.2%. The stock is expected to rise or fall by around 7.4% following the earnings release.

Given the sharp run-up in the stock, options positioning is highly bullish, and implied volatility levels are likely to remain well above 100% for the options expiry on 24 October. This suggests that once the company reports, implied volatility may fall sharply, leading to a decline in call premiums and potentially creating additional stock for sale.

The chart appears to show a topping, diamond-like pattern, suggesting that if the stock falls below support at $410, it could drop towards approximately $370, or even lower to the next major support level at $350. Given the bullish positioning, a very strong outlook or significantly better-than-expected results are likely to be needed to propel the stock higher, towards resistance at $470.

Tesla share price, May-16 October 2025

Sources: TradingView, Michael Kramer

Sources: TradingView, Michael Kramer

US consumer price index

Friday 24 October

Inflation is expected to deliver a hot reading, with headline CPI forecast to rise by 0.4% month-on-month, the same as in August, and increase by 3.1% year-on-year, up from 2.9%. Core CPI is expected to remain unchanged in September, rising by 0.3% month-on-month and 3.1% year-on-year.

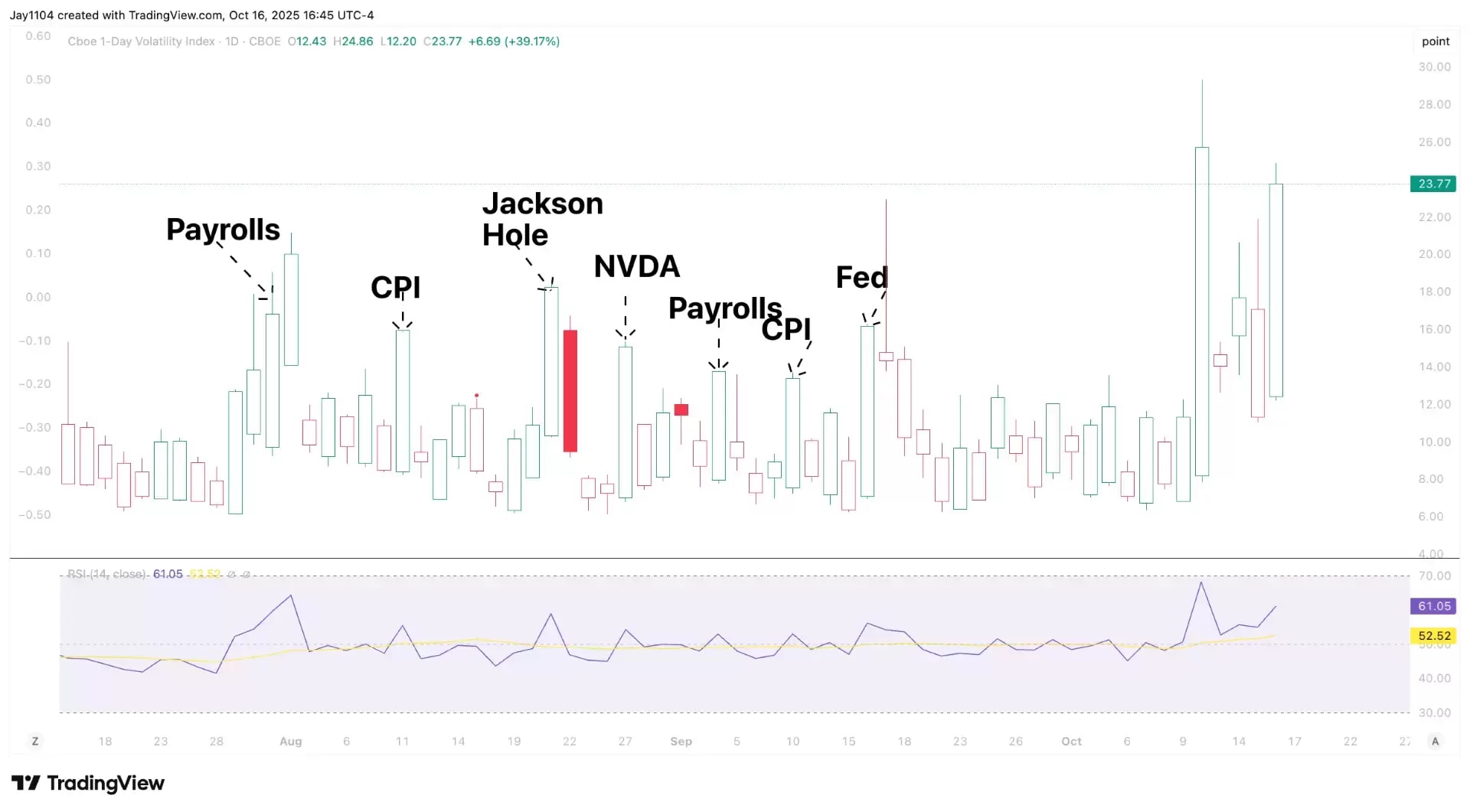

Implied volatility is likely to be elevated heading into the CPI release, similar to what has been seen before previous reports, particularly given the recent lack of economic data. Generally, when the VIX 1-Day rises sharply ahead of key economic data and the figures come in as expected or better, implied volatility tends to fall rapidly, providing a short-term boost to stock indices. This suggests that if the VIX 1-Day remains elevated going into the CPI report on Friday, there is a strong possibility that the stock market could rally – unless the data comes in significantly worse than expected.

Cboe 1-Day Volatility Index, 18 August-16 October 2025

Sources: TradingView, Michael Kramer

Sources: TradingView, Michael Kramer

Economic and company events calendar

Major upcoming economic announcements and scheduled US and UK company reports include:

Monday 20 October

• China: GDP (Q3)

• UK: Rightmove house price index (Oct)

• Results: WR Berkley (Q3)

Tuesday 21 October

• Canada: CPI (Sep)

• UK: Public sector net borrowing (Sep)

• Results: Coca-Cola (Q3), Netflix (Q3), Phillip Morris International (Q3), RTX (Q3), Texas Instruments (Q3)

Wednesday 22 October

• UK: CPI (Sep), producer price index (Sep), retail price index (Sep)

• Results: AT&T (Q3), Barclays (Q3), GE Vernova (Q3), International Business Machines (Q3), Lam Research (Q1), Sofcat (FY), Tesla (Q3), Thermo Fisher Scientific (Q3)

Thursday 23 October

• Australia: Manufacturing PMI (Oct); services PMI (Oct)

• Eurozone: Consumer confidence (Oct)

• US: Existing home sales (Sep); new home sales (Sep)

• Results: Blackstone (Q3), Intel (Q3), Lloyds Banking Group (Q3), T-Mobile (Q3)

Friday 24 October

• Eurozone: Manufacturing PMI (Oct); services PMI (Oct)

• UK: Consumer confidence (Oct); retail sales (Sep); manufacturing PMI (Oct); services PMI (Oct)

• US: Consumer price index (Sep); manufacturing PMI (Oct); services PMI (Oct); Michigan consumer sentiment index (Oct)

• Results: NatWest Group (Q3), Procter & Gamble (Q1)

Note: While we check all dates carefully to ensure that they are correct at the time of writing, the above announcements are subject to change.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.