Ireland Draught Beer Market Summary

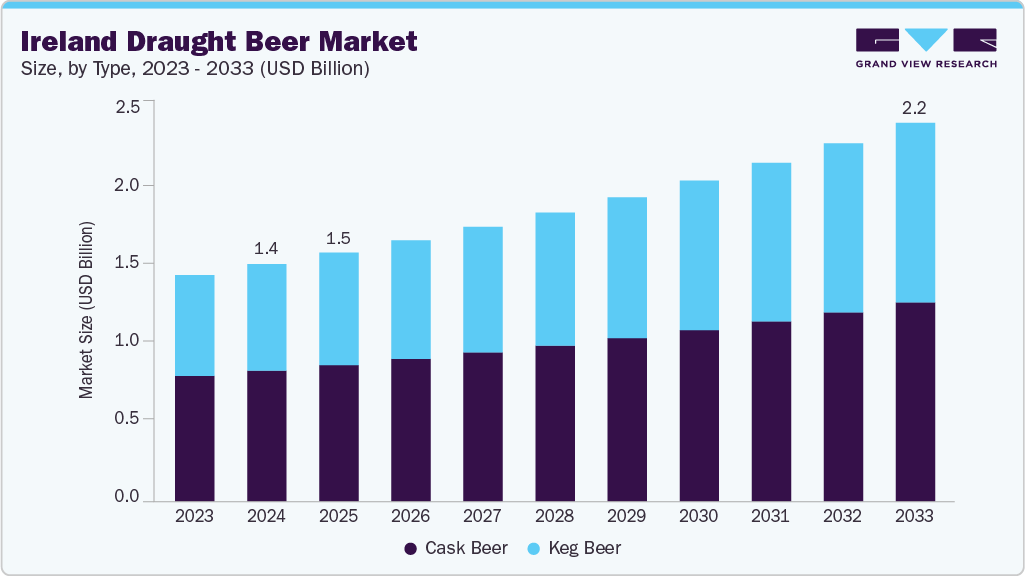

The Ireland draught beer market size was estimated at USD 1.40 billion in 2024 and is projected to reach USD 2.24 billion by 2033, growing at a CAGR of 5.4% from 2025 to 2033. The market is growing due to rising interest in premium and craft options, and increased health awareness, driving low-alcohol and no-alcohol choices.

Key Market Trends & Insights

By type, the cask beer segment held the largest market share of 55.1% in 2024.

By category, the premium segment held the highest market share of 49.3% in 2024.

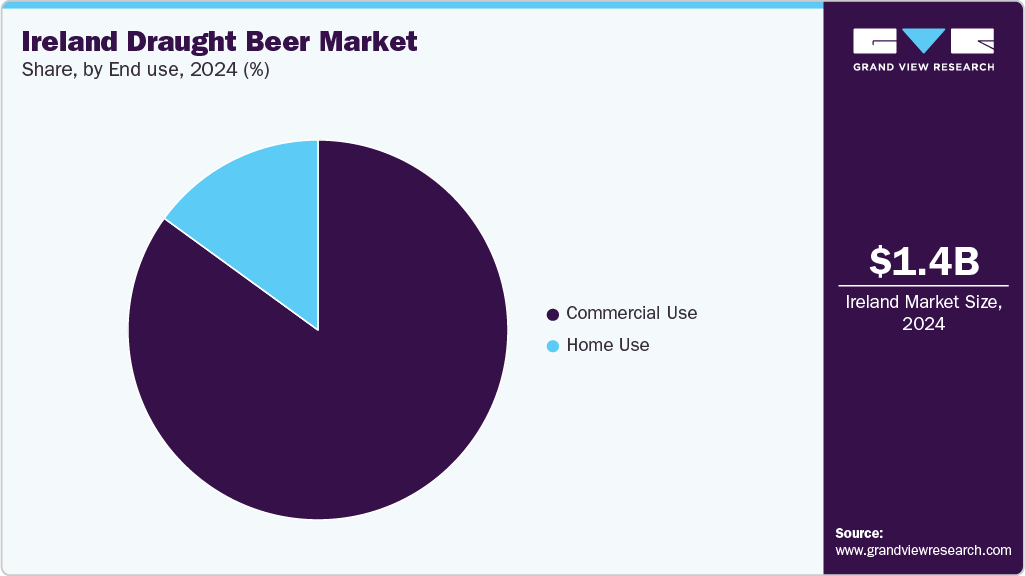

By end use, the commercial use segment accounted for the highest market share of 85.0% in 2024.

By production type, the macro breweries segment accounted for the largest market share of 89.0% in 2024.

Market Size & Forecast

2024 Market Size: USD 1.40 Billion

2033 Projected Market Size: USD 2.24 Billion

CAGR (2025-2033): 5.4%

The growth in tourism, expansion of urban Irish breweries, innovation in home-use draught systems, and consumer focus on sustainability and local sourcing are other factors driving the market growth. Consumer preferences in the Ireland draught beer market are increasingly shifting toward premium, craft, and locally brewed offerings, driven by a desire for authenticity, flavor diversity, and sustainability. This trend has led to a rise in microbreweries and urban taprooms, particularly in key cities such as Dublin, Cork, and Galway, which serve as hubs for innovation and experimentation in draught beer production.

In response to this evolving demand, many companies adopt sustainable brewing practices, prioritize local ingredient sourcing, and enhance ingredient traceability. In addition, the growing appeal of at-home consumption is reshaping traditional distribution models.

Consumer Insights

The Ireland draught beer market is witnessing a dynamic shift in consumer behavior, driven by evolving lifestyle preferences and demographics. An increasing number of health-conscious and younger consumers are opting for reduced alcohol consumption, yet they continue to seek flavorful options that support social engagement. Urban millennials and Gen Z consumers increasingly favor premium, craft, and locally brewed draft offerings that align with sustainability and authenticity. These evolving preferences are prompting brewers to diversify their portfolios and innovate with new formats and formulations to cater to the emerging demand.

Digital engagement and social media significantly influence purchasing decisions, particularly among younger demographics. Consumers are increasingly influenced by peer reviews, influencer endorsements, and online content highlighting sustainability, innovation, and craftsmanship. The evolving consumer landscape encourages market players and local microbreweries in Ireland to customize their offerings, invest in targeted marketing, and deliver more personalized, authentic experiences to strengthen market presence and brand loyalty.

Type Insights

The cask beer segment dominated the market with a revenue share of 55.1% in 2024. This segment is driven by evolving consumer preferences toward authenticity, craft production, and sustainability. Consumers are increasingly interested in beverages with lower carbonation and richer flavor profiles. This trend is further supported by local breweries and pubs reintroducing or expanding cask beer offerings. Moreover, seasonal and limited-edition cask launches enhance consumer engagement and drive pub footfall. In June 2025, CAMRA launched a regional cask beer list across Britain and Northern Ireland to celebrate Beer Day. The initiative supported Boundary Brewing’s cask IPA in Northern Ireland, encouraging the revival of cask culture regionally.

The keg beer segment is expected to register the fastest CAGR of 6.0% from 2025 to 2033. The segment is driven by shifting consumer preferences and operational advantages for the on-trade sector. Keg beer offers enhanced consistency, longer shelf life, and superior carbonation, aligning well with the expectations of younger consumers who prefer chilled, fizzy, and easy-to-drink beer styles. In November 2023, Diageo expanded the draught availability of Guinness 0.0 to 1,000 pubs across Ireland, following a successful keg-format trial, to meet rising demand for high-quality, non-alcoholic beer without compromising taste or experience.

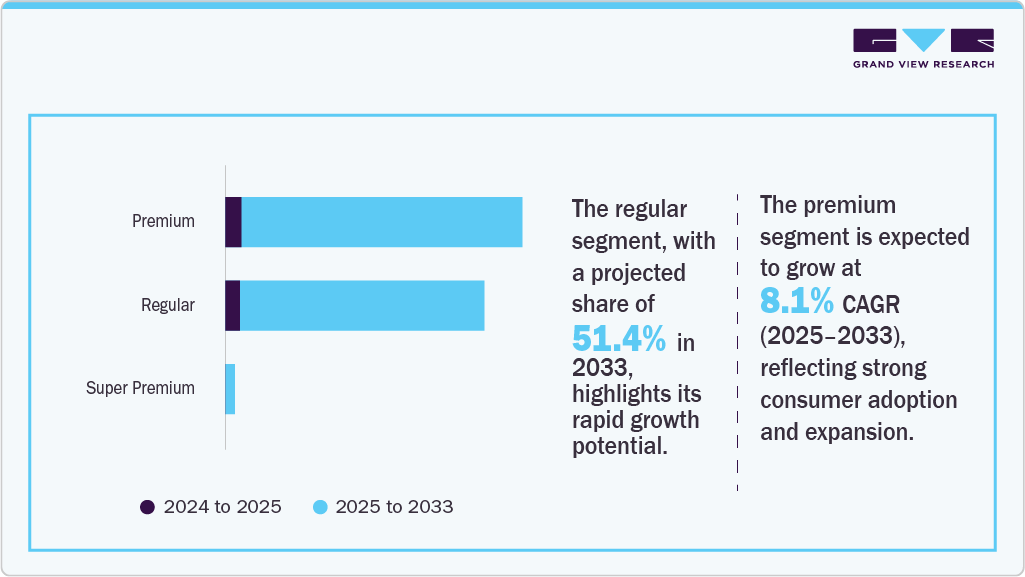

Category Insights

The premium segment dominated the market with a revenue share in 2024. The market is driven by consumers’ demand for high quality, flavor, and experience over volume. This trend aligns with increasing innovation from craft and established breweries and the hospitality sector’s focus on premium offerings. Urban consumers are seeking unique, locally crafted beers with strong brand stories.

The super-premium segment is anticipated to register the fastest CAGR from 2025 to 2033. The market is driven by rising demand and growing consumer preference for authenticity, craftsmanship, and exclusivity. Higher disposable incomes and a “drink less, drink better” mindset encourage the purchase of artisanal, small-batch brews with unique flavor profiles. In addition, younger urban consumers are increasingly interested in limited-edition and seasonal releases, positioning super-premium beers as a lifestyle product.

Production Insights

The macro breweries segment accounted for the largest revenue share in 2024, driven by strong brand recognition, consistent product quality, and extensive distribution networks. Established players such as Diageo and Heineken benefit from extensive networks across pubs and hospitality venues, ensuring high visibility and availability. Their large-scale infrastructure enables cost-efficient production and dependable supply, particularly during peak demand periods such as Christmas and other events. In December 2024, Heineken expanded its draught 0.0 beer across 3,000 venues in Ireland, following a USD 31.2 million investment since 2018. This captured a 48% market share in the Republic’s non-alcoholic beer segment.

The microbreweries segment is anticipated to register the fastest CAGR from 2025 to 2033. The market is driven by shifting consumer preferences toward authenticity, flavor variety, and local craftsmanship. Consumers, especially younger demographics, are increasingly drawn to small-batch, innovative brews that offer unique taste experiences and sustainable practices.

End Use Insights

The commercial use segment accounted for the largest revenue share in 2024. The market is driven by strong pub culture, rising tourism, and premiumization trends. Breweries support on-trade growth through exclusive draught offerings, promotional investments, and technical support. In addition, consumer demand for authentic social drinking experiences and the availability of unique products in bars continue to fuel the market.

The home use segment is anticipated to register the fastest CAGR from 2025 to 2033. The market is driven by evolving consumer lifestyles and increased preference for at-home socializing. The availability of compact and user-friendly home draught systems has enhanced the appeal of premium, pub-quality experiences in domestic settings. Cost efficiency over time and the influence of home entertainment and social media trends are further expected to support this shift.

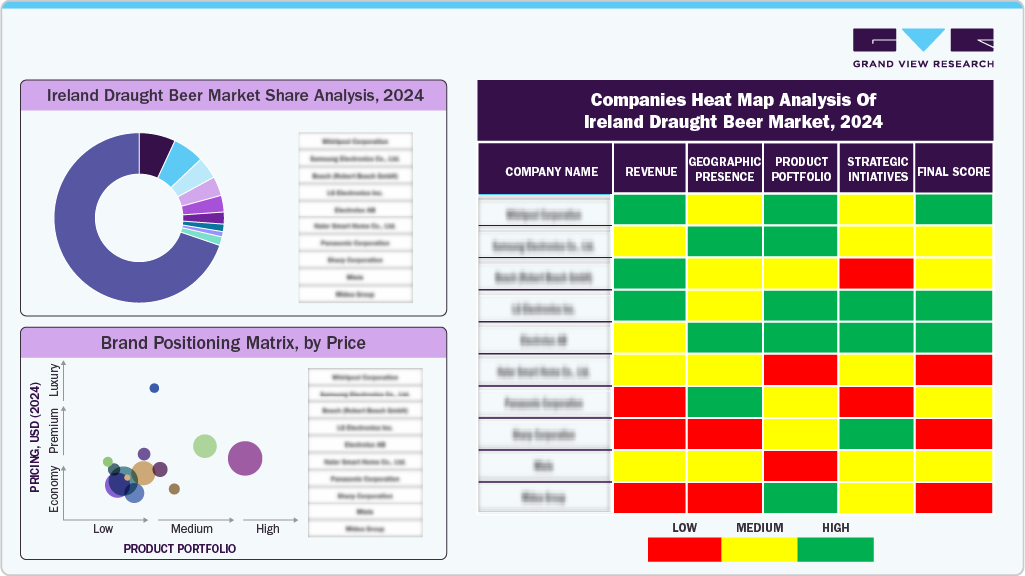

Key Ireland Draught Beer Company Insights

Some key players in the Irish draught beer market include Heineken Ireland, Anheuser-Busch InBev, and Diageo.

Key Ireland Draught Beer Companies:

Heineken Ireland

Anheuser-Busch InBev.

Molson Coors Beverage Company

Carlsberg

Diageo

Guinness & Co

Ireland Draught Beer Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.47 billion

Revenue forecast in 2033

USD 2.24 billion

Growth rate

CAGR of 5.4% from 2025 to 2033

Actuals

2021 – 2024

Forecast period

2025 – 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, category, production type, end use

Key companies profiled

Heineken Ireland; Anheuser-Busch InBev.; Molson Coors Beverage Company; Carlsberg; Diageo

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Ireland Draught Beer Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Ireland draught beer market report based on type, category, production type, and end use:

Type Outlook (Revenue, USD Million, 2021 – 2033)

Category Outlook (Revenue, USD Million, 2021 – 2033)

Super Premium

Premium

Regular

Production Type Outlook (Revenue, USD Million, 2021 – 2033)

Macro Breweries

Microbreweries

End Use Outlook (Revenue, USD Million, 2021 – 2033)