There will be a new set of tariffs from 26 October – Germany is Vodafone’s biggest market but in recent years has been a drag on the group’s performance

Vodafone is launching new offers to encourage the switch from DSL to faster broadband, which the country’s Digital Ministry is prioritising. Recently, Vodafone dropped the cost of its Giga CableMax offer to under €50 a month, and from 26 October will reduce tariffs for fibre broadband, or increase the capacity for the same price.

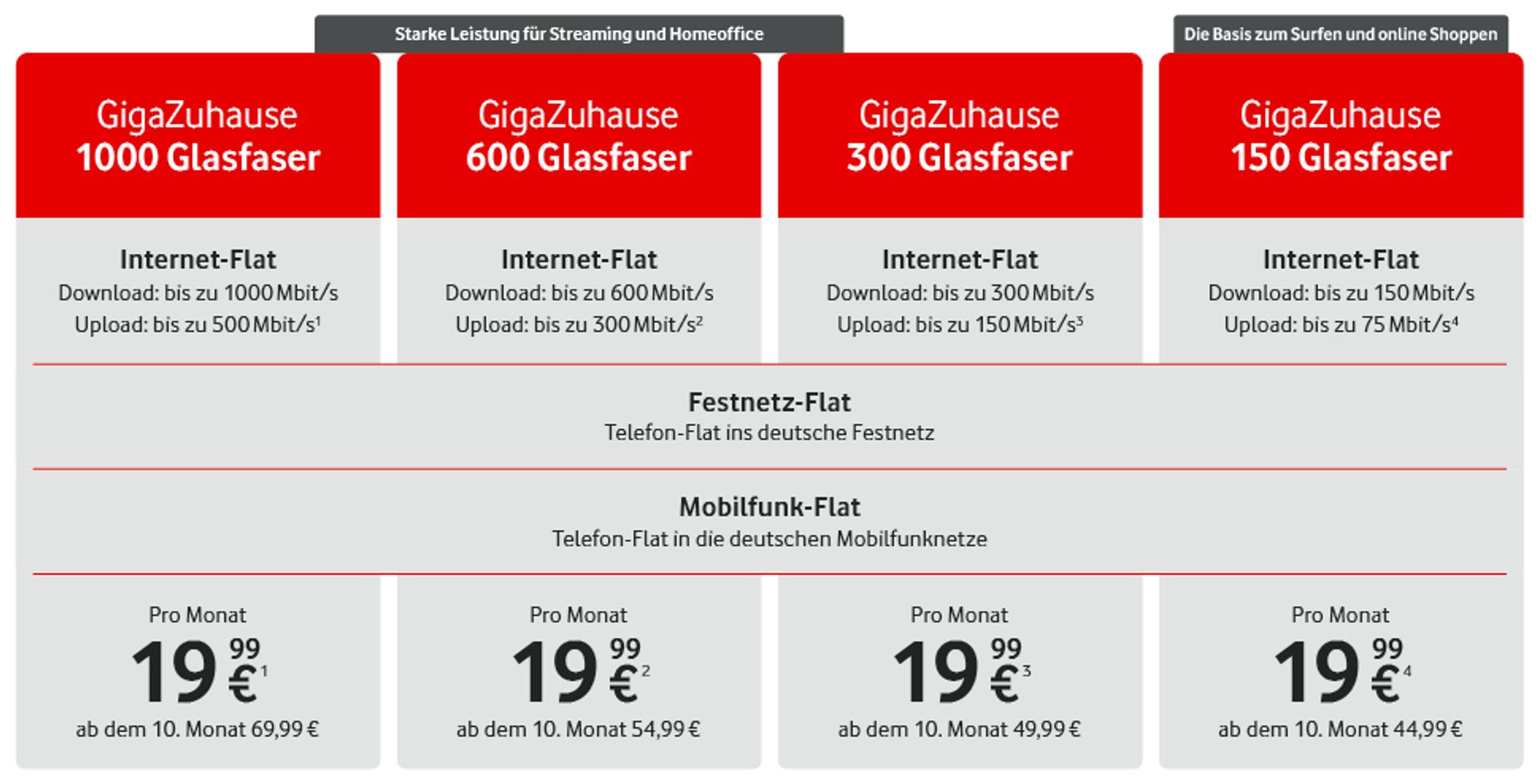

More than 10 million households in Germany can book new fibere offers from Vodafone. New download bandwidths are 150Mbps (instead of 100 previously), 300Mbps (instead of 250 previously) and 600Mbps (instead of 500 previously) and up to three times higher upload speeds – see table below.

Vodafone is lowering the prices for the fastest gigabit tariff, GigaZuhause 1000 fiber optics, by €10 and recommends this deal for applications like home office, content streaming and gaming. Hoewever, customers can downgrade the link if they find they don’t need the high transmission rates after six months without penalty

From the 26th There are new fiber optic offerings from Vodafone in October. Faster download bandwidths and up to three times higher upload speeds make the new portfolio much more powerful compared to the previous tariffs. © Vodafone

From the 26th There are new fiber optic offerings from Vodafone in October. Faster download bandwidths and up to three times higher upload speeds make the new portfolio much more powerful compared to the previous tariffs. © Vodafone

In recent years Germany, which is Vodafone Group’s largest market, has been a drag on financial performance. It will be interesting to see is this move boosts take up of its fixed internet after churn caused by a change in regulation which meant tenant in multi-tenant dwellings have the right to chose their broadband provider rather than having to accept the provider chosen by the landlord.

Through its €18.4 billion acquisition of Liberty Global’s cable operations in Germany and the Czech Republic, Hungary, and Romania in 2019, Vodafone was the incumbent in many multi-tenant dwellings buildings. It has also scored badly in customer satisfaction in the country according to the regulator, BNetzA.

In May, when Vodafone published its earnings for the financial year 2024–2025, it insisted it had hit the nadir regarding the German market and now the only way is up. However, it noted in its Q1 earnings report for the current year that, “Slowing growth in Germany’s fixed broadband market may affect overall performance”.

In fact, Germany declined by 3.2% in Q1 (Q4: -6.0%), “due to the impact of the TV law change”. Excluding this, service revenue was broadly stable at -0.3% in Q1 (Q4: -2.7%), as mobile market competitive intensity was offset by Wholesale growth.

Its EBITDA growth of 2.2% in Q1 was driven by strength in the UK, Africa and Turkey.