Fears over an AI bubble bursting, a potential banking crisis brewing, and renewed trade jitters between the US and China have served to put investors on the edge of their seat in recent weeks.

We’ve seen several sessions where financial markets have experienced a sharp jolt, but they’ve subsequently resumed an upwards trajectory.

While no-one knows exactly when or even if a correction is coming, it does feel as if we’re in the classic ‘climbing the wall of worry’ stage in financial markets. This is a term to describe the market moving higher despite ongoing negative news.

Markets can continue to melt up for months or years. The key is to understand what could go right or wrong, and to work out if you’re comfortable with the risks you’re currently taking.

The list of concerns hanging over the market is lengthy, but equally there are numerous reasons why markets could continue to strengthen.

The question on everyone’s lips is what would it take to trigger a proper market correction? We can see three scenarios that would cause distress if they happened. We also detail reasons why markets might continue to move higher.

Three scenarios that could trouble the market if they happened1. There is evidence that AI adoption is slower than expected

Vast sums of money are being invested on the infrastructure to support AI. Gigantic data centres, state of the art servers, computer chips capable of processing significant amounts of information quickly, the list goes on.

Money is being ploughed into the AI space at an incredible pace. But is anyone using it on a large scale? There are growing fears in some circles that companies are spending big, yet staff are not using the technology either because they don’t trust it or don’t know how to get the best from it.

Google boss Sundar Pichai calls AI a ‘once in a lifetime technology’ and ‘the most profound shift of our lifetimes’. He might be right, but will the journey be a smooth one for investors? It’s feasible the take-up is erratic, at least to begin with.

A lot of people are worried about a small group of big companies becoming intertwined, such as Nvidia taking a stake in OpenAI, and OpenAI using some of that money to buy products from Nvidia. There are other similar examples where deals are dressed up as an investment but are simply vendor financing. There are flashbacks to the dotcom era, and that didn’t end well.

Alcatel, Lucent and Nortel financed telecom equipment purchased by dotcom start-ups in the late 90s, with customers then discovering they either ordered too much, didn’t need it or didn’t have revenues to pay for it. Cue bad debts and equipment the telecom companies couldn’t shift. For a period, these telecom stocks looked like they were in a happy place, but the story turned into a nightmare as the dotcom bubble burst.

People were right to say the internet would change the world, what they got wrong was the pace at which it would happen. The same might apply with AI.

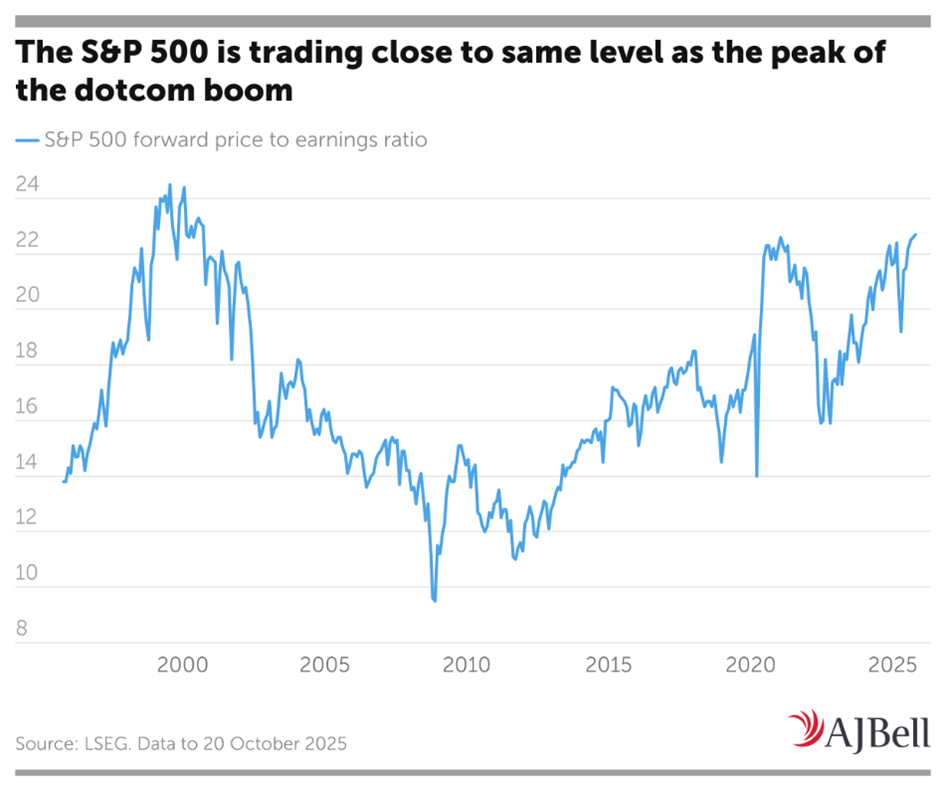

The US stock market, as measured by the S&P 500 index, is currently trading on 22.6 times forward earnings. At the peak of the dotcom boom, it hit 24.5-times earnings. The market is being driven by companies at the heart of the AI story, so any disappointment could pull the market lower, potentially exacerbated by a de-rating in all things tech.

2. There is a new banking (or liquidity) crisis

Last week’s stock market shock was a reminder that other factors beyond Trump policies and AI setbacks have the potential to trouble investors.

We’ve just had a reminder of how markets are ultra-sensitive to potential issues in the banking sector.

Markets wobbled in 2023 as negative issues at Silicon Valley Bank, Signature Bank and First Republic played out. They did the same last week when various trouble spots emerged at a handful of US banks, raising concerns around poor risk management and loose lending standards in the private credit market.

While investors appear to have calmed down in recent days, it’s impossible to say with any certainty that all the problems have gone away. JPMorgan chief executive Jamie Dimon warned, ‘when you see one cockroach, there’s probably more’. Banks are going to be grilled hard over the coming weeks during results season, and investors will want reassurance that there are no skeletons in the closet.

Last week’s market wobble was also a red flag regarding liquidity issues in the US. There are fears the Federal Reserve has drained liquidity from the financial system through its quantitative tightening programme, which involved letting bonds and mortgage securities mature without buying replacements.

There are growing expectations for the Fed to end this programme next month, but failure to do so could trouble the market.

3. The US goes into recession

While US GDP has been more resilient than some might have expected in the face of tariffs, there are worrying signals from various data points. The US going into recession could wipe out market optimism globally.

The NFIB Small Business Optimism Index fell for the first time in three months in September. Weak small business confidence can be a leading indicator for recession.

The Conference Board Expectations index measures consumers’ short-term outlook for income, business and labour market conditions, and fell by 1.3 points to 73.4 in September. Historically, a reading below 80 has signalled a recession, and the index has sat below this level since February this year.

The knock-on effect of a recession would be severe pressure on the US government. Tax income would fall, welfare spending would rise, and the budget deficit would be even bigger than it already is.

That could trouble bond investors and lead them to demand a higher return for the risk of holding US government bonds – i.e., we could see a bond market sell-off and Treasury yields would rise. That in turn could weigh on the high valuations of US tech stocks which populate so many investor portfolios around the world.

Reasons why financial markets could keep moving higher

Despite three potential catalysts that could put markets into reverse, it’s important to note that equities continue to move higher. That suggests certain investors are happy with the risks they are taking and see reasons to stay positive.

It’s easy to see why they are optimistic, and even the most cynical person should take time to consider why markets are moving higher.

Even though US shares are trading on rich valuations, consensus forecasts expect the S&P 500 to deliver 12.2% earnings growth in 2026. If accurate, it would imply that corporate America is in full swing.

The US economy could feasibly slow towards the end of the year and stay sluggish in early 2026, but optimists might argue there is enough resilience to avoid a recession. Trump might find new tricks up his sleeve to avoid the economy limping along. The Fed has already indicated that interest rates are coming down, which might give a glimmer of hope for consumers and businesses.

Hopes are rising for a Middle East peace deal. Furthermore, Donald Trump will travel to Asia this week. That could pave the way for a more rational conversation with China’s President Xi Jinping. Any sign the two sides are getting along would be a huge relief for markets.

The challenge is finding companies doing well that are trading at low valuations. The lower the valuation you pay, the more downside protection you have if markets go into retreat.

What to consider with your investment portfolio if you’re worried about a crash

We do not see a reason for investors to panic and dump their holdings now. There is always some noise, and many people are happy to tune it out, preferring to focus on the long-term.

The uncertain backdrop is a good reminder to spread your risks through diversification. Having exposure to multiple sectors, geographies and asset classes means there should be elements that support a portfolio if certain parts go through a difficult patch.

Even if we get a correction, history suggests that time in the market is better than timing the market. Quite often people will sell after a crash and then miss the rebound, which can happen fast and hard. Staying put might take a bit of nerve, but it puts you in the right place to ride any recovery.

Anyone putting a set amount of money into their investment account each month would be able to buy more shares or fund units if markets are down, and less if markets go up. Get into this routine and you could reap the rewards down the line for keeping an investment plan intact.

Ways to lower risk in your investment portfolio

If you’re still worried and want to dial down some of the risk in your portfolio, there are various options. One is to look at areas that have done well for you and potentially lock in some profits. Strong areas of the market in recent years include defence stocks, banks and tech firms.

Money market funds are one option if you’re looking to park money for a short period. These are lower-risk investments that aim to offer a slightly better return than cash.

Gold is often popular during uncertain times, yet the metal has already enjoyed a strong run.

Other options include funds with a defensive slant, namely investing in companies whose products and services are in demand no matter what’s happening in the world, or funds whose primary goal is to preserve investors’ capital. There is a chance these types of funds lag a rising market, but they should come into their own during times of stress.