Report Overview

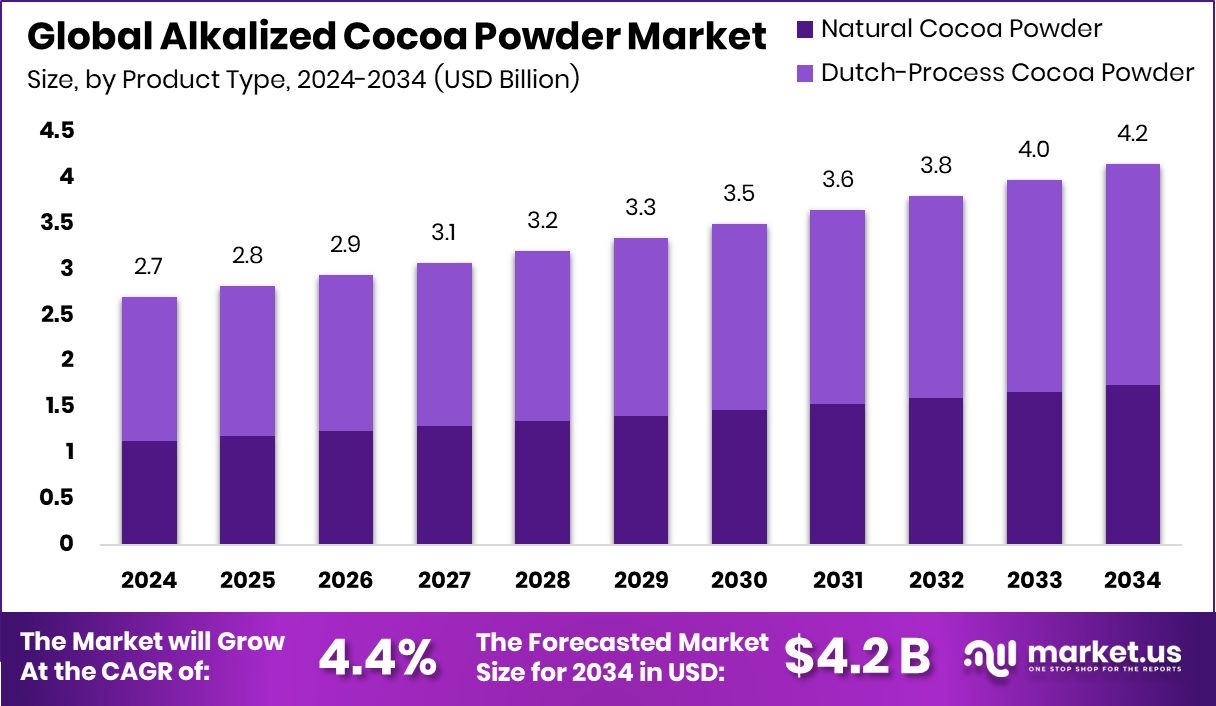

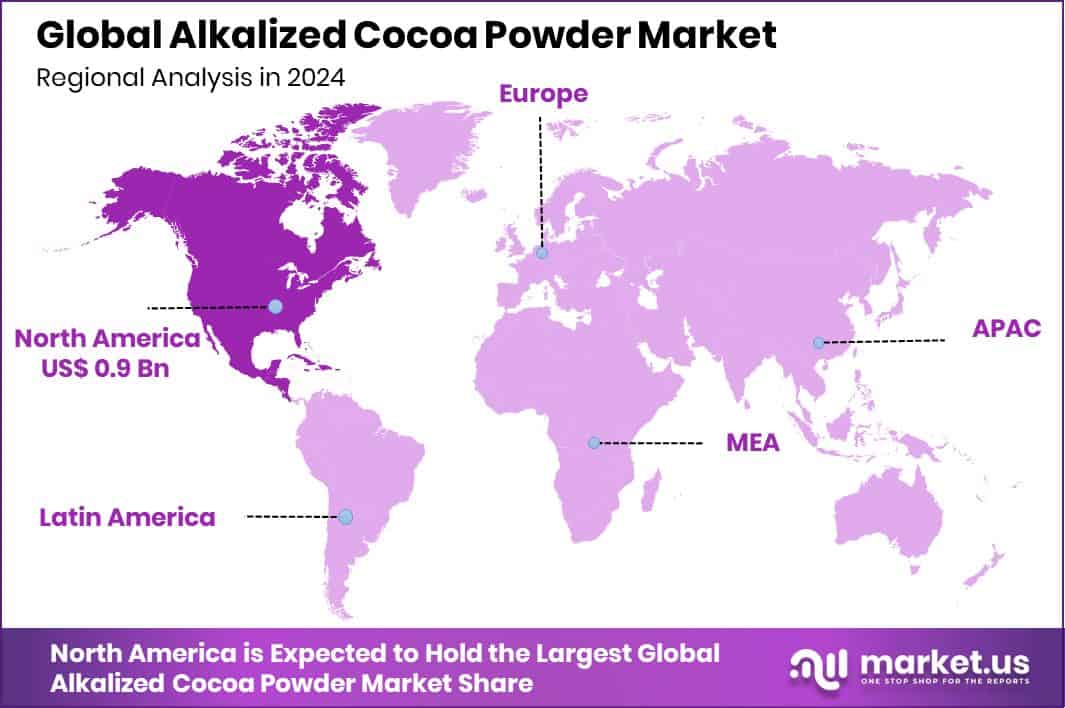

The Global Alkalized Cocoa Powder Market is expected to be worth around USD 4.2 billion by 2034, up from USD 2.7 billion in 2024, and is projected to grow at a CAGR of 4.4% from 2025 to 2034. With a 34.90% share, North America’s USD 0.9 Bn market thrives on confectionery and beverage consumption.

Alkalized cocoa powder, also called Dutch-processed cocoa, is a type of cocoa that has been treated with an alkaline solution to reduce its acidity. This process makes the cocoa darker in color, smoother in flavor, and more soluble, which enhances its use in beverages, desserts, and baked goods. Compared to natural cocoa, alkalized cocoa powder has a more mellow and less bitter taste, making it a popular choice for recipes that require a rich chocolate profile.

The alkalized cocoa powder market refers to the global trade and demand for this specialized cocoa product. It is driven by its wide use in chocolates, bakery products, confectionery, dairy-based beverages, and even health supplements. The market also benefits from the growing consumer preference for premium and indulgent chocolate flavors, as well as its functional applications in processed foods.

One major growth factor is the increasing consumption of bakery and confectionery items worldwide. Rising urbanization and busy lifestyles have boosted demand for ready-to-eat snacks and desserts, which in turn fuels the use of alkalized cocoa as a key ingredient.

The demand for alkalized cocoa powder is also supported by changing dietary patterns. With consumers seeking richer taste experiences and better-quality cocoa, food producers increasingly prefer alkalized cocoa over natural cocoa, further strengthening its market presence. According to an industry report, Ghana’s Niche Confectionery has secured a €8 million loan from a Dutch investment bank.

An opportunity lies in the rising interest in clean-label and premium food products. As people look for authentic chocolate flavors in beverages and snacks, alkalized cocoa provides both taste and functionality, offering manufacturers a chance to innovate in the growing premium food segment. According to an industry report, Parag Milk Foods has raised ₹161 crore, strengthening its position with the support of a key investor.

Key Takeaways

The Global Alkalized Cocoa Powder Market is expected to be worth around USD 4.2 billion by 2034, up from USD 2.7 billion in 2024, and is projected to grow at a CAGR of 4.4% from 2025 to 2034.

In 2024, Dutch-process alkalized cocoa powder captured 58.9%.

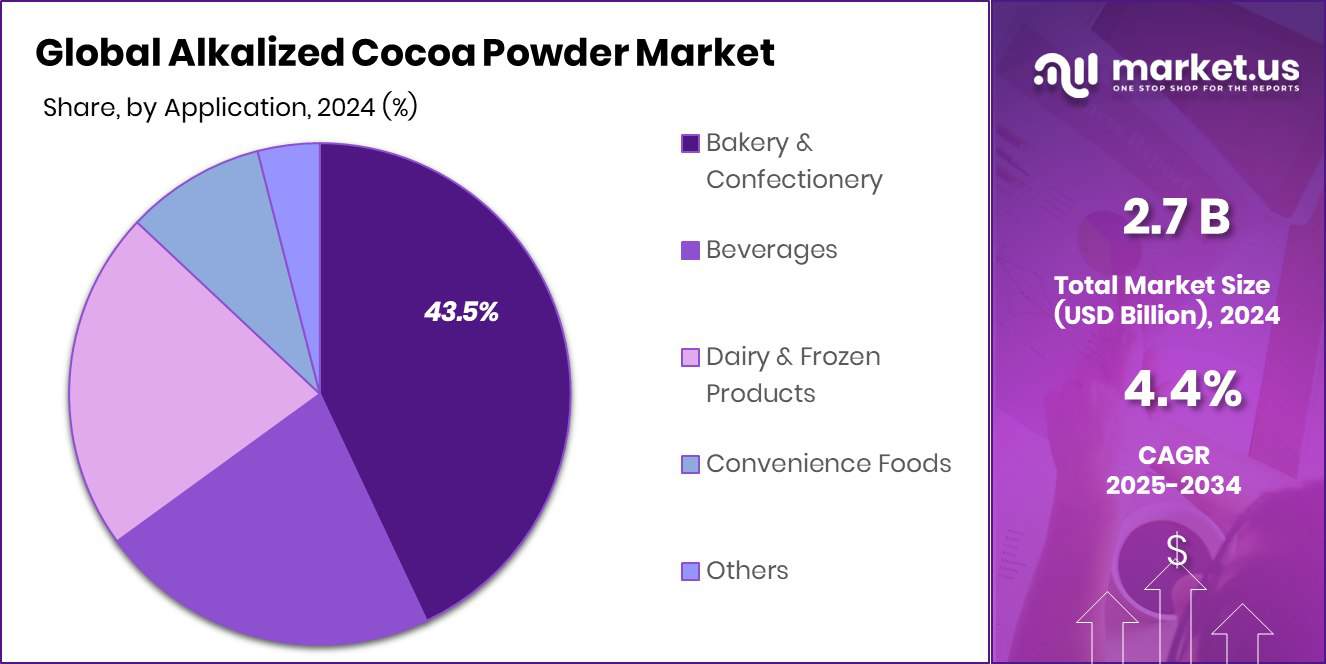

Bakeries and confectioneries dominated the alkalized cocoa powder market with a 43.5% share.

Supermarkets and hypermarkets held 44.8% of the alkalized cocoa powder market.

The North America market, valued at USD 0.9 Bn, captured a 34.90% share through strong bakery demand.

By Product Type Analysis

By Product Type, Dutch-process cocoa powder dominated the Alkalized Cocoa Powder Market, holding a 58.9% share.

In 2024, Dutch-Process Cocoa Powder held a dominant market position in the product type segment of the Alkalized Cocoa Powder Market, with a 58.9% share. This leadership highlights the growing preference among food manufacturers and consumers for cocoa products that deliver a smooth, mellow flavor and enhanced solubility compared to natural cocoa.

The alkalization process not only reduces acidity but also gives the powder a darker and richer appearance, making it highly suitable for bakery, confectionery, and beverage applications where consistent flavor and color are important.

The strong demand for Dutch-Process Cocoa Powder can be linked to its widespread adoption in bakery items such as cakes, brownies, and cookies, where its balanced taste profile elevates product quality.

It is also increasingly favored in premium chocolates and instant drink mixes, as it dissolves easily and provides a luxurious mouthfeel. This versatility across food categories makes it the first choice for large-scale manufacturers aiming to meet evolving consumer tastes.

By Application Analysis

By Application, bakery and confectionery led the Alkalized Cocoa Powder Market, capturing nearly 43.5% overall share.

In 2024, Bakery and Confectionery held a dominant market position in the By Application segment of the Alkalized Cocoa Powder Market, with a 43.5% share. This dominance is driven by the widespread use of alkalized cocoa in baked goods, chocolates, and sweet treats, where its rich flavor, dark color, and smooth texture provide both functional and sensory benefits.

The product’s ability to blend easily into doughs, batters, and fillings makes it a preferred choice for large-scale bakeries and confectionery manufacturers aiming to deliver consistent quality and appealing taste.

The segment’s strength is further supported by growing consumer demand for indulgent and premium bakery products such as brownies, cakes, cookies, and pastries, which rely heavily on alkalized cocoa powder for their distinct chocolate profiles. Similarly, in the confectionery space, the ingredient enhances the richness and mouthfeel of chocolates, truffles, and cocoa-based sweets, aligning well with the rising global consumption of chocolate-based snacks.

Holding 43.5% of the application market share reflects the segment’s central role in driving overall growth. With evolving consumer preferences leaning toward high-quality, flavorful products, the bakery and confectionery sector continues to anchor demand, ensuring alkalized cocoa powder remains a critical ingredient for innovation and expansion in the food industry.

By Distribution Channel Analysis

By Distribution Channel, supermarkets and hypermarkets were strongest in the Alkalized Cocoa Powder Market, reaching 44.8% share.

In 2024, Supermarkets and Hypermarkets held a dominant market position in the By Distribution Channel segment of the Alkalized Cocoa Powder Market, with a 44.8% share. This strong presence highlights the growing importance of organized retail in making cocoa-based products more accessible to a broad consumer base.

Large retail chains provide an extensive variety of product choices, attractive packaging, and promotional offers, which strongly influence consumer buying behavior. The availability of alkalized cocoa powder in different pack sizes and quality grades within these outlets has significantly contributed to higher sales volumes.

The dominance of supermarkets and hypermarkets is also supported by their ability to cater to both household consumers and small-scale bakeries or foodservice buyers who prefer bulk purchasing. The structured shelf displays, in-store sampling, and premium product placement enhance visibility and encourage impulse purchases, strengthening demand further.

Consumers also trust these outlets for authentic and standardized quality, which adds to the credibility of alkalized cocoa powder as a staple ingredient for baking and confectionery needs.

Key Market Segments

By Product Type

Natural Cocoa Powder

Dutch-Process Cocoa Powder

By Application

Bakery and Confectionery

Beverages

Dairy and Frozen Products

Convenience Foods

Others

By Distribution Channel

Supermarkets and Hypermarkets

Conventional Store

E-commerce websites

Others

Driving Factors

Rising Demand for Bakery and Confectionery Products

One of the strongest driving factors for the alkalized cocoa powder market is the rising demand from bakery and confectionery products. Consumers today are looking for indulgent and premium chocolate-based goods such as cakes, brownies, cookies, and chocolates, where alkalized cocoa powder plays a key role in delivering rich flavor, darker color, and smooth texture.

The global bakery sector is expanding quickly, supported by urban lifestyles and growing interest in ready-to-eat desserts. Confectionery products, particularly chocolates and truffles, also rely on alkalized cocoa for its enhanced solubility and balanced taste.

This growing appetite for indulgence directly pushes food manufacturers to use more alkalized cocoa, making bakery and confectionery demand the single biggest growth driver of the market.

Restraining Factors

Health Concerns Over Processed Cocoa Consumption

A key restraining factor for the Alkalized Cocoa Powder Market is the rising health concerns linked to processed cocoa consumption. The alkalization process, while improving flavor and color, reduces some of the natural antioxidants present in raw cocoa.

With consumers becoming more health-conscious and seeking nutrient-rich foods, this reduction in beneficial compounds can limit preference for alkalized cocoa in certain groups. Additionally, products made with cocoa powder are often linked to high sugar and fat levels, which raises concerns about obesity and lifestyle-related diseases.

Growing awareness around healthier alternatives, such as minimally processed cocoa or natural powders, may slow down the market’s momentum, especially among health-focused consumers who prioritize nutrition over indulgence.

Growth Opportunity

Expanding Use in Premium Beverages and Desserts

A major growth opportunity for the Alkalized Cocoa Powder Market lies in its expanding use in premium beverages and desserts. Consumers are increasingly drawn toward indulgent drinks like hot chocolate, flavored lattes, cocoa shakes, and smoothies, where alkalized cocoa powder offers a rich taste and smooth solubility.

Similarly, the premium dessert segment, including mousses, puddings, and gourmet ice creams, is gaining popularity worldwide as people seek unique and luxurious flavor experiences. With rising disposable incomes and a strong demand for café-style products at home, this trend creates new opportunities for manufacturers to innovate with alkalized cocoa.

By positioning it as a high-quality ingredient for premium offerings, the market can tap into the fast-growing indulgence-driven consumer base.

Latest Trends

Growing Preference for Clean-Label Cocoa Products

One of the latest trends in the Alkalized Cocoa Powder Market is the growing preference for clean-label cocoa products. Consumers are becoming more conscious about what goes into their food and are seeking transparency in ingredients.

This has led to higher demand for alkalized cocoa powders that are produced without artificial additives, preservatives, or chemical residues. Clean-label products not only attract health-focused buyers but also align with the global shift toward sustainable and natural food choices.

Food brands are responding by offering cocoa powders with clear labeling, minimal processing, and certifications that highlight quality and safety. This trend is shaping product innovation and creating stronger trust between consumers and manufacturers in the cocoa powder market.

Regional Analysis

In 2024, North America held a 34.90% share of the Alkalized Cocoa Powder Market, worth USD 0.9 Bn.

In 2024, North America emerged as the leading region in the Alkalized Cocoa Powder Market, accounting for 34.90% of the market share with a market value of USD 0.9 billion. This dominance is largely driven by the region’s mature bakery and confectionery sector, where demand for high-quality cocoa ingredients continues to rise.

Consumers in North America show strong preferences for indulgent products such as chocolates, cakes, cookies, and premium beverages, all of which heavily rely on alkalized cocoa powder for its smooth flavor, rich color, and easy solubility. The growing trend of at-home consumption of café-style drinks and desserts has further accelerated demand.

Moreover, the presence of advanced food processing facilities and organized retail channels enhances availability and distribution across the region. While Europe, Asia Pacific, the Middle East & Africa, and Latin America also contribute significantly to the global market, North America’s consistent appetite for premium chocolate-based products ensures its leadership.

With a 34.90% share valued at USD 0.9 billion, the region stands out as the dominating hub, reflecting both strong consumer demand and a supportive industry ecosystem that continues to strengthen its position in the global alkalized cocoa powder market.

Key Regions and Countries

North America

Europe

Germany

France

The UK

Spain

Italy

Rest of Europe

Asia Pacific

China

Japan

South Korea

India

Australia

Rest of APAC

Latin America

Brazil

Mexico

Rest of Latin America

Middle East & Africa

GCC

South Africa

Rest of MEA

Key Players Analysis

Barry Callebaut stands as a global leader in cocoa and chocolate solutions, with a strong emphasis on sustainability and product innovation. Its large-scale operations ensure a consistent supply of high-quality alkalized cocoa powder, while its investments in sustainable sourcing enhance credibility among manufacturers and consumers alike. The company’s reach across multiple continents supports its influence in both mature and emerging markets.

Olam Group brings strength through its integrated supply chain and wide sourcing network, which ensures traceability and consistent quality of cocoa. Its focus on sustainability and farmer support programs not only secures raw material availability but also aligns with the growing demand for ethically sourced cocoa products. Olam’s efficiency in procurement and distribution makes it a critical supplier to global food manufacturers.

Indcre, S.A., though smaller in scale compared to the other two, provides specialized cocoa products with a strong focus on meeting the needs of regional and niche markets. Its contribution lies in flexibility and responsiveness to customer-specific requirements, which positions it as a competitive player in select markets.

Top Key Players in the Market

Barry Callebaut

Olam Group

Indcre, S.A.

Bloomer Chocolate Company

JB Cocoa

Carlyle Cocoa

Cargill, Incorporated

Recent Developments

In June 2024, Barry Callebaut secured a substantial funding package—partly through a €700 million investment and a CHF 600 million bond—to bolster financial flexibility. This move was specifically aimed at offsetting heightened cocoa bean costs, enabling the company to better sustain its sourcing operations under volatile market conditions.

In December 2024, in collaboration with LOTTE, Fuji Oil, and MC Agri Alliance, ofi launched its first pilot cocoa biochar project in Dankwa County, Ghana, for the 2024/25 crop season. The project converts leftover cocoa pod husks into biochar—a carbon-locking soil amendment that enhances soil health while reducing emissions. It complements ofi’s existing biomass boiler installations at its global cocoa facilities and reflects its circular-agriculture and climate-action efforts under the “Cocoa Compass” framework.

Report Scope