At the end of September, outstanding short-term foreign loans stood at $9.61 billion, up from $9.54 billion in August.

TBS Report

04 November, 2025, 10:05 pm

Last modified: 05 November, 2025, 12:36 am

Photo: Freepik

“>

Photo: Freepik

The country’s private sector short-term foreign borrowing increased marginally in September, rising by just $68 million from the previous month, according to Bangladesh Bank data released today (4 November).

At the end of September, outstanding short-term foreign loans stood at $9.61 billion, up from $9.54 billion in August.

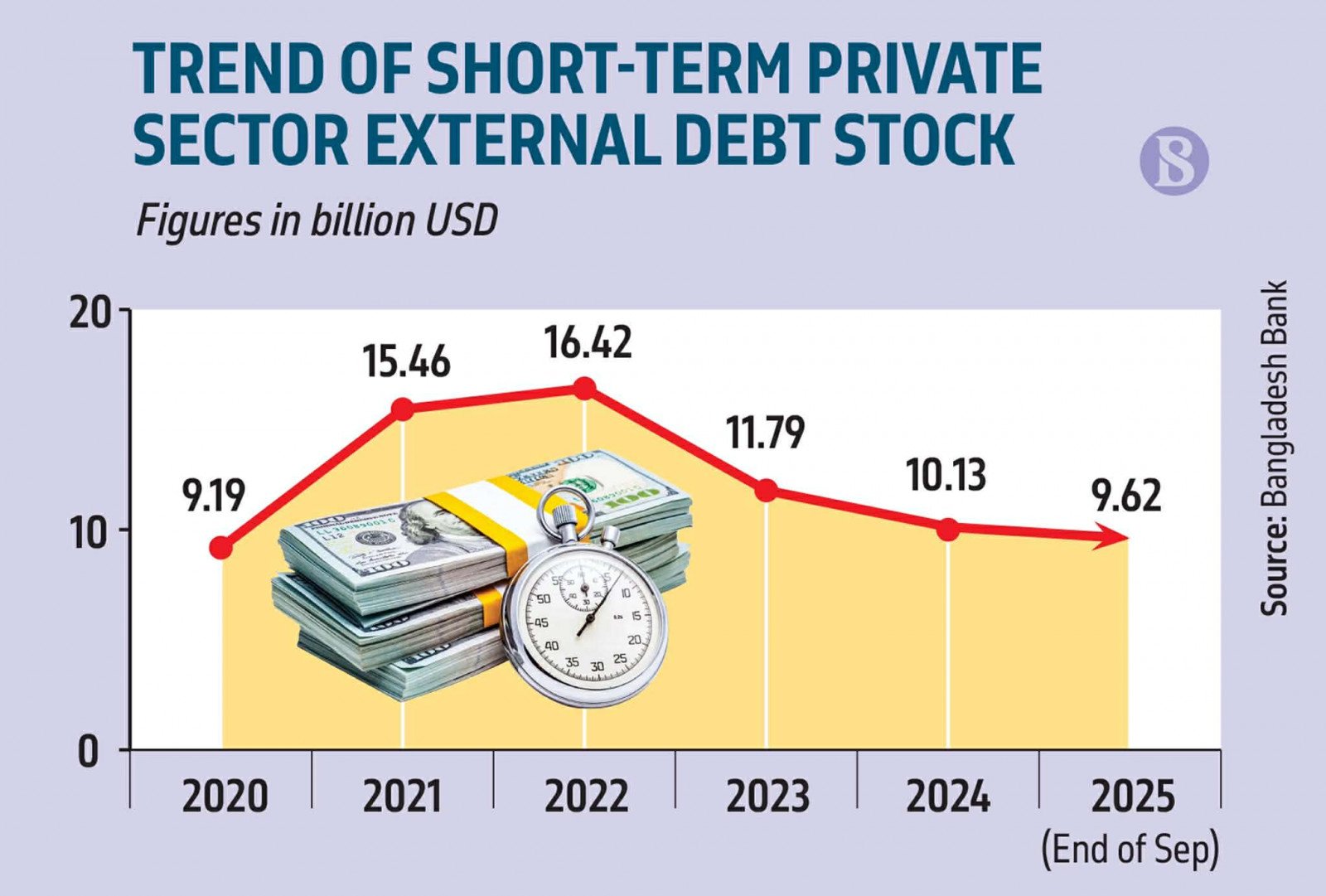

Although the figure shows a slight uptick, central bank senior officials, bankers and economists said the growth is minimal compared to the total outstanding volume, which now exceeds $9.5 billion. The amount was once above $16 billion.

Keep updated, follow The Business Standard’s Google news channel

Speaking to The Business Standard today, a senior Bangladesh Bank official noted that most of the short-term foreign loan inflow was offset by repayments of earlier loans.

Infograph: TBS

“>

Infograph: TBS

“Repayments of previously taken foreign loans are now due as their maturity periods have ended, and there is a set schedule for monthly payments,” the official said.

“Compared to those repayments, new short-term borrowing by the private sector has been relatively low – meaning that repayments of earlier loans have exceeded fresh borrowing,” he added.

A managing director of a private bank said the decline in credit lines has also led to a drop in short-term foreign loans to the private sector. “Due to reduced credit facilities and weaker confidence, foreign banks are less interested in offering short-term loans now,” he said.

Another senior central bank official told TBS that the decline in business activity and new investment has also contributed to the lower inflow of short-term foreign loans.

“Since 5 August, many people have fled the country, and operations of several large business groups have been disrupted. As a result, imports of capital machinery have declined, leading to a fall in buyers’ credit,” the official said.

He added that this trend is likely to continue until the upcoming national election, after which short-term foreign borrowing may rise again with new investments and higher demand for capital machinery.

Central bank data show that Bangladesh’s short-term foreign debt stood at $16.42 billion at the end of 2022, which fell to $11.80 billion in 2023 and further to $10.13 billion by the end of 2024.

Bangladesh Bank also reported that imports of capital machinery dropped by around 12% in the first two months of the current fiscal year, reflecting reduced investment appetite in the private sector.