By Davide Barbuscia

U.S. Treasury yields declined slightly on Friday after new surveys indicated deteriorating consumer sentiment, partly due to the U.S. government shutdown, and as investors weighed debt supply concerns against worries over an economic slowdown.

The Labor Department did not release a closely watched October jobs report as scheduled on Friday because of the shutdown, leaving investors to rely on consumer surveys to assess economic conditions.

The University of Michigan’s preliminary consumer sentiment index for November showed sentiment fell to 50.3, the lowest level since June 2022, on worries about the economic impact of the government shutdown. The decline was driven mainly by a sharp deterioration in respondents’ views of current conditions, which tumbled to the lowest level on record.

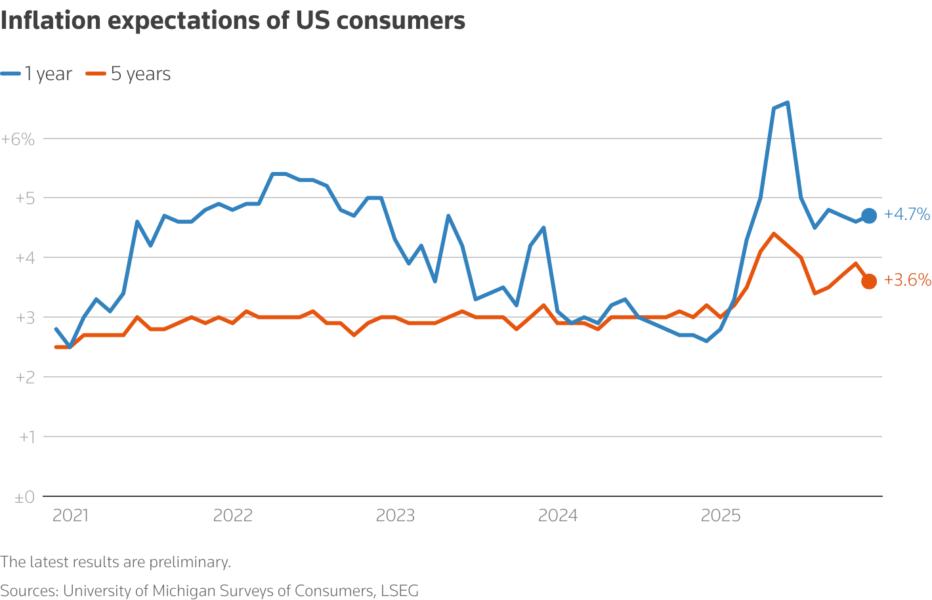

Year-ahead inflation expectations inched up to 4.7% this month from 4.6% last month, the data showed.

Meanwhile, a survey of consumer expectations by the Federal Reserve Bank of New York showed Americans last month expected moderating near-term inflation pressures but continued to worry about the outlook for the job market.

Thomson ReutersInflation expectations of US consumers

Thomson ReutersInflation expectations of US consumers

Treasury yields, which move inversely to prices, inched lower after the releases, extending Thursday’s bond rally that was triggered by private labor indicators that pointed to a weakening economy.

“People are still concerned about the jobs market,” said Stan Shipley, fixed income strategist at Evercore ISI.

Benchmark 10-year yields US10Y were last at 4.085%, about one basis point down from Thursday, while two-year yields (US2YT=RR) shed about two basis points to 3.547%, hitting their lowest in over a week. Further out the yield curve, 30-year yields were marginally higher at 4.698%.

Rates futures traders were assigning a 70% probability to an additional 25-basis-point interest rate cut by the Federal Reserve at its next policy meeting in December, roughly unchanged from Thursday, CME Group data showed.

The closely watched part of the yield curve that compares two and 10-year yields (US2US10=TWEB) steepened further to 53.8 basis points, the steepest since mid-October. A steepening 2/10 curve, when caused by shorter-dated securities performing better than long-dated ones, tends to indicate stronger market expectations of interest rate cuts over the near term.

The bond moves reflected broader market caution, with stocks continuing their decline on Friday.

“Risk-off winds dominated Wall Street as participants remained concerned about decelerating employment conditions, lofty valuations, margin compression, and reports of cost-cutting on earnings calls amid political gridlock in Washington,” José Torres, senior economist at Interactive Brokers, said in a note.

SUPPLY NEXT WEEK

The Treasury next week will issue debt with maturities of three, 10, and 30 years, for a total of $125 billion.

Shipley at Evercore ISI said he expected that, to attract demand, yields could rise ahead of the auctions, given their current low levels, but they should stabilise after that.

The U.S. fiscal picture this week returned to prominence among investors because of the potential impact of a U.S. Supreme Court decision against President Donald Trump’s sweeping tariffs, which could lead to wider government budget deficits and more Treasury debt supply hitting the markets if the tariffs are revoked.

“Most of the weakness (in bonds) is related to the Supreme Court tariff issue … the Treasury is going to have to pretty significantly change their issuance schedule if and when that decision comes out,” said Mark Hackett, chief market strategist for Nationwide’s Investment Management Group.