Ukraine’s international reserves rose by 6.4% in October to $49.5 billion – the highest level in the country’s independent history – according to preliminary data from Ukraine’s central bank, the National Bank of Ukraine (NBU).

The record reserves highlight the impact of Western aid in sustaining Ukraine’s macroeconomic stability amid Russia’s prolonged invasion.

JOIN US ON TELEGRAM

Follow our coverage of the war on the @Kyivpost_official.

The increase was driven by large inflows from international partners, which exceeded both the NBU’s foreign currency sales and the government’s external debt repayments.

The current level of reserves is sufficient to maintain the stability of the foreign exchange market, the central bank wrote in its press release on Oct. 7 2025.

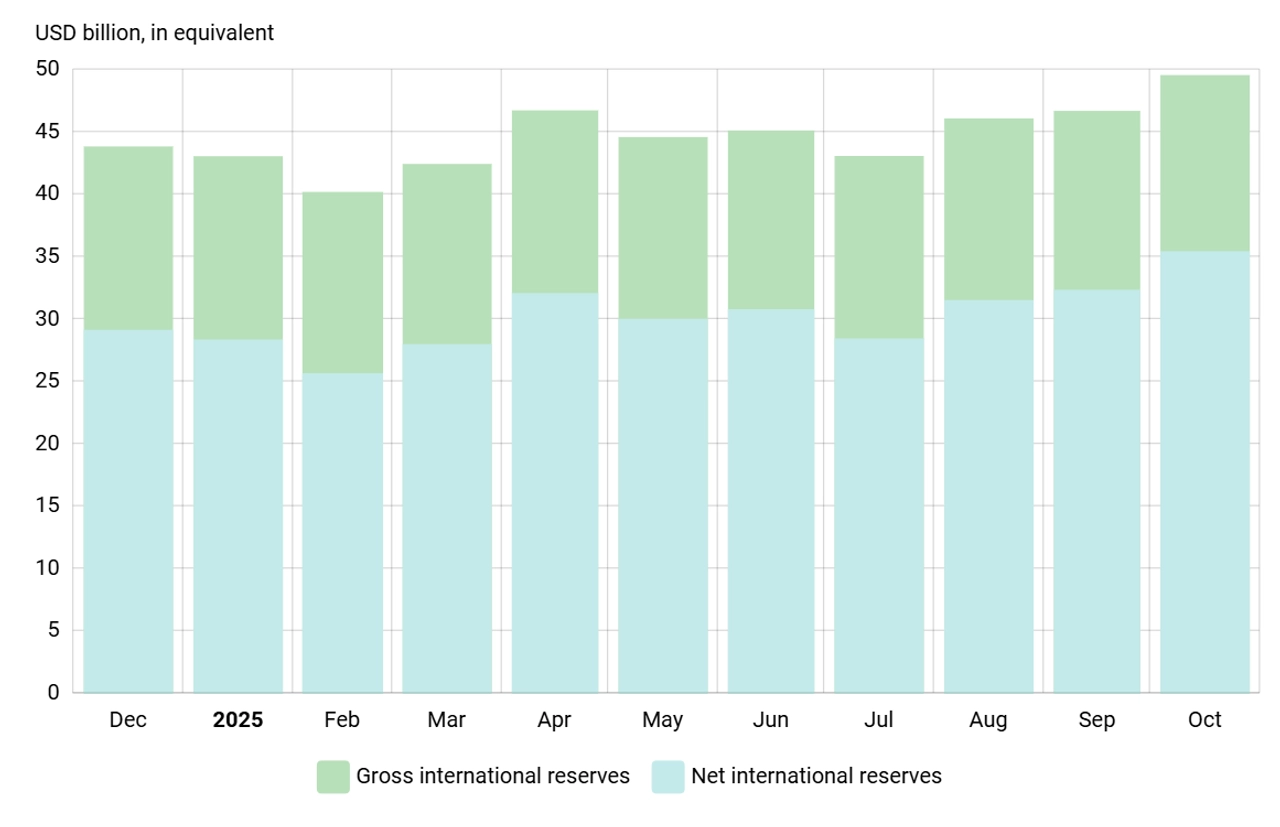

NBU data show that the country’s international reserves rose to a record $49.5 billion in October 2025. The chart illustrates monthly dynamics of Ukraine’s gross and net foreign reserves. Source: NBU website.

NBU data show that the country’s international reserves rose to a record $49.5 billion in October 2025. The chart illustrates monthly dynamics of Ukraine’s gross and net foreign reserves. Source: NBU website.

In October, the government received $6.4 billion in foreign currency inflows to its accounts with the NBU.

These inflows include:

$4.7 billion from the EU under the G7’s Extraordinary Revenue Acceleration for Ukraine (ERA) initiative, also known as the ERA Loan $1.1 billion via World Bank accounts $507.7 million from the placement of domestic government debt securities $117 million from the Council of Europe Development Bank (CEB)

Ukraine’s central bank spent $612 million to service and repay the government’s foreign currency debt, including:

Other Topics of Interest

EU Restricts Visas for Russian Nationals Over Ukraine War

Russian nationals will have to apply for a new visa each time they plan to travel to the EU.

almost $369 million for domestic government debt securities almost $200 million to the World Bank $16.1 million to the European Investment Bank ((EIB) $15 million to the European Bank for Reconstruction and Development (EBRD) $12 million to the EU

Ukraine also repaid $84 million to the International Monetary Fund (IMF), according to the central bank.

On the foreign exchange market, the NBU sold $2.8 billion and bought $0.8 million, resulting in net sales of $2.8 billion in October. “NBU’s net sale of foreign currency in October amounted to $2,834.1 million,” the central bank wrote.

Due to the revaluation of financial instruments – reflecting changes in market value and exchange rates – reserves increased by almost $127 million during the month.

Ukraine’s current reserve level is sufficient to cover just over five months of future imports, the NBU wrote.

Between August and October, Ukraine received about $13 billion in external funding, with another $15 billion expected by the end of 2025, the NBU’s October 2025 Inflation report states.

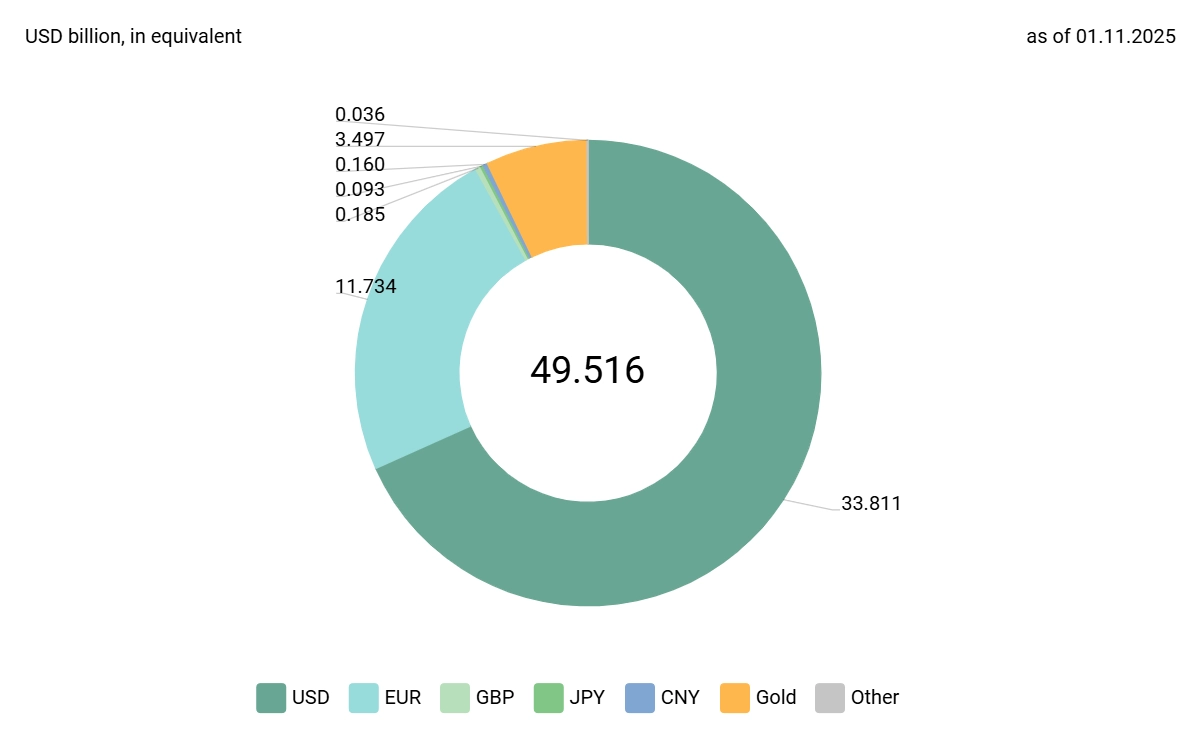

Structure of Ukraine’s international reserves by currency as of Nov. 1, 2025. According to Ukraine’s central bank (NBU), most reserves are held in US dollars, euros and gold. The remainder includes holdings in British pounds, Japanese yen, and Chinese yuan. Source: NBU website

Structure of Ukraine’s international reserves by currency as of Nov. 1, 2025. According to Ukraine’s central bank (NBU), most reserves are held in US dollars, euros and gold. The remainder includes holdings in British pounds, Japanese yen, and Chinese yuan. Source: NBU website

The international reserves of Ukraine’s central bank mostly consist of US dollars ($33.8 billion), while 23.7% are held in euros (equivalent to $11.7 billion), according to NBU data as of Oct. 1, 2025.

Gold accounts for 7.1% of the reserves, or almost $3.5 billion. The remainder is held in British pounds, Japanese yen, and Chinese yuan.