Peter Thiel’s hedge fund Thiel Macro has sold its entire holdings in Nvidia during the third quarter, a 13F filing shows.

It is the latest technology investor to reduce its stake in the leading maker of artificial intelligence chips. Last week, the Japanese tech investor SoftBank sold its $5.83 billion holding in Nvidia which reports results on Wednesday as it prepares to invest in the ChatGPT maker OpenAI.

Thiel’s fund sold 537,742 shares in Nvidia, which would have been worth about $100 million based on the closing price on September 30. Thiel Macro also reduced its stake in the electric carmaker Tesla during the quarter from 272,613 shares to around 65,000 shares. It still has stakes in Apple and Microsoft.

Ashurst and Perkins Coie merge to create top 20 global law firm

The British law firm Ashurst and the American law firm Perkins Coie have agreed to merge in a deal that would create a top 20 firm globally by revenue with $2.7 billion in revenue.

The firm will be known as Ashurst Perkins Coie and will span 52 offices in 23 countries staffed by 3,000 lawyers. It will be led by Bill Malley, from the US firm, and Paul Jenkins from the British side. The merged firm promises to lead “the industry in harnessing AI to transform the practice of law and help clients implement it effectively”.

Jenkins added: “With Ashurst’s established global presence and sector expertise, and both firms’ reputations for challenging the status quo, I am confident Ashurst Perkins Coie will be a leading advisor across the key industries — technology, energy and infrastructure, and financial services — which are shaping the future of the global economy.”

Arora’s shorter runway plan for Heathrow is big enough to cope, it says

A British Airways aircraft takes off from the runway at Heathrow Airport’s Terminal 5

TOLGA AKMEN/AFP/GETTY IMAGES

The company behind a plan to expand Heathrow airport with a third runway has said its proposals would provide a sufficient capacity boost and avoid disrupting the M4 motorway.

The hotel tycoon Surinder Arora’s company is seeking permission for a 2,800m runway — considerably shorter than the proposed, full-length 3,500m runway put forward by Heathrow’s owners. Unlike the Heathrow owners’ plan, it would not involve diverting the M25 motorway and lowering the M4 spur carriageway.

Arora said the airport’s annual capacity could exceed 756,000 flights, which is 16,000 above the level of the plan backed by the Airports Commission in 2015, while at £23 billion its costs were 30 per cent less than that of the proposals from Heathrow’s owners.

Trafigura’s nickel case begins in London

Trafigura’s close to $600 million case against the Indian businessman Prateek Gupta over alleged fake nickel cargoes began at London’s High Court on Monday.

The Geneva-based commodities traders alleged that Gupta was the mastermind of a fraud it discovered in November 2022, when some containers that were supposed to contain high-grade nickel held carbon steel worth a fraction of the value of nickel. It prompted Trafigura to book a $590 million charge and sue Gupta and his companies in February 2023.

Gupta accepts that purported high-grade nickel cargoes actually contained low-value materials but alleged that Trafigura staff devised the scheme, with the parties essentially trading the differences in the price of cargoes at different times. Trafigura denies there was any such agreement.

EU to grow faster than the UK this year

Sir Keir Starmer at the EU Commission headquarters in Brussels last year

THIERRY MONASSE/GETTY IMAGES

The European Union’s economy is set to outpace the UK this year, as political and economic uncertainty slows Britain’s momentum.

Brussels forecasts GDP growth of 1.4 per cent in 2025 and 2026 for the EU, with the eurozone just behind at 1.3 per cent in 2025 and 1.2 per cent in 2026. By contrast, the Bank of England expects UK growth of 1.2 per cent in 2025 and 1.1 per cent in 2026.

Britain’s strong start to the year has faded amid policy uncertainty and fears of budget tax rises. EU growth was boosted earlier in the year by a surge in exports as companies rushed to beat US tariffs, but Brussels warned that President Trump’s trade policies now threaten momentum. The European Commission said rising global trade barriers and political turmoil are likely to weigh on Europe’s outlook.

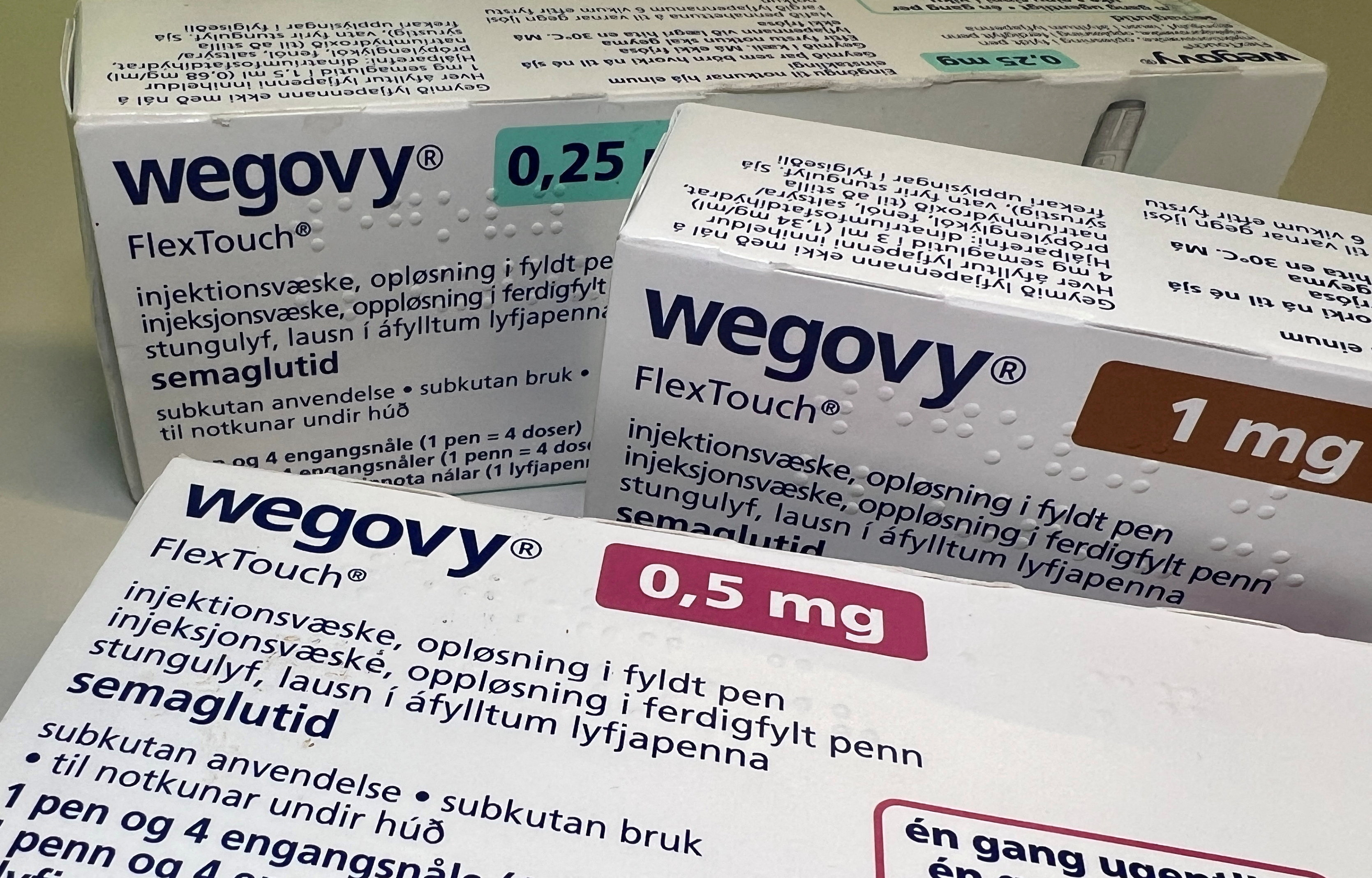

Novo Nordisk ready for ‘aggressive’ launch of weight-loss pill

The boss of Novo Nordisk has said the drug maker has more than enough of its Wegovy weight-loss pills to support an aggressive product launch when the drug wins approval from US regulators.

Mike Doustdar, the chief executive, said the company was intending to avoid a repeat of the supply issues that plagued the drug’s original, injectable version. The pill format is expected to win approval from US regulators by the end of the year.

“We have more than enough pills this time, so we’re going to go all in and really make this happen,” Doustdar said.

Novo Nordisk has seen slowing sales growth for the pioneering weight-loss drug, largely as a result of supply constraints, and this has allowed rivals like Eli Lilly to catch up to the Danish company that became Europe’s most valuable company.

Cirata signs biggest deal with IBM

Cirata, formerly known as WANDisco, has signed its biggest IBM contract, a three-year, $6.7 million deal for a financial services customer.

The announcement is part of the Sheffield-based company’s attempts to cement a turnaround after it nearly collapsed in 2023 when major accounting irregularities were uncovered that led to a trading suspension and leadership overhaul.

Stephen Kelly

TIMES PHOTOGRAPHER RICHARD POHLE

Stephen Kelly, a former boss of Sage, took over as the chief executive shortly after the saga, once the company started trading again on the London Stock Exchange. The company specialises in automating the transfer and integration of large datasets at companies with no downtime.

Cirata’s shares rose 7 per cent to 20½p this morning. The shares have fallen 17 per cent over the past year.

Genuit blames budget for weaker profits

Genuit, formerly Polypipe, has warned that full-year profits will be lower than expected due to economic and political uncertainty created by the budget.

Shares in the provider of sustainable water, climate, and ventilation solutions fell 13 per cent, or 46p, to 309p after it said construction clients had cut back on spending, wary of possible measures in the November 26 fiscal statement.

Underlying operating profit is expected to be between £92 million and £95 million, down from market forecasts of £95 million to £99 million. Underlying operating profits in 2024 were £92.2 million. Revenue in the ten months to October 31 rose 8.4 per cent year on year to £511.1 million, helped by price increases.

Budget rumours have hurt growth, says ex-Bank economist

Andy Haldane, the former Bank of England chief economist

TAYFUN SALCI/ALAMY

Speculation over the upcoming budget has partly driven weaker-than-expected UK growth, as fears over tax rises dampen business investment and consumer spending, the former Bank of England chief economist, Andy Haldane, has said.

Haldane, who served at the Bank until 2021, told Sky’s Mornings With Ridge And Frost that the build-up to November 26 has been a “circus”, urging an overhaul to stop leaks that can harm the economy.

Official data last week showed GDP expanded just 0.1 per cent in the third quarter, below forecasts. The chancellor, Rachel Reeves, blamed the softness to Jaguar Land Rover’s production shutdown after a cyberattack. Haldane said “without any shadow of a doubt” the persistent budget rumours have directly weighed on growth.

UK shares and bonds ‘increasingly attractive’

UK shares and bonds are “increasingly attractive” despite challenges for the economy. Domestic bonds are offering the highest yields among G7 nations and UK shares are trading at a price-earnings ratio of 14, about half that of the United States, according to Morningstar’s 2026 Global Outlook.

The stock market is also diversified, with roughly 80 per cent of the revenues generated by companies in the Morningstar UK Index coming from outside the country, spread relatively evenly across the US, continental Europe, Asia-Pacific, and emerging markets.

Among the G7 countries, Britain has the second-lowest government debt to gross domestic product, behind only Germany and ahead of the United States, Japan, France, Canada, and Italy, the report says.

FTSE 100 edges higher in subdued market

London’s leading share index has edged higher this morning on concerns of the deepening dispute between China and Japan over Taiwan, little corporate news and investors looking ahead to Nvidia results on Wednesday as well as the delayed US jobs report for September on Thursday.

The FTSE 100 rose 5.45 points, or 0.06 per cent, to 9.703.82, after closing down 1.1 per cent on Friday.

The advertising agency WPP was the biggest riser after a report in The Sunday Times that French rival Havas was eyeing out a possible takeover.

Burberry fell in sympathy after Japanese retail shares dropped as Beijing told Chinese tourists not to travel to Japan.

Miners Antofagasta and Anglo American fell after the price of copper eased amid a broad selloff among base metals on concerns that a December interest rate cut in the US may not be on the cards.

Sellers cut prices over budget jitters

Asking prices among new sellers have fallen by £6,589 in the past month

GETTY IMAGES

Sellers are cutting prices by the largest margin in 13 years as buyers hold off ahead of potential tax increases in the budget.

Asking prices for new listings over the past four weeks fell 1.8 per cent, or £6,589, to an average of £364,833, data from Rightmove shows. This is the biggest autumn decline since 2012 and exceeds the 1.1 per cent drop typically seen over the same period in the past decade. New sellers are defined as those listing their homes since October 12.

The slowdown reflects growing market caution amid speculation that the chancellor, Rachel Reeves, may raise property taxes, including a possible “mansion” tax on homes over £2 million, removing capital gains tax exemptions for primary residences, and increasing council tax, prompting many homeowners to adjust their pricing in anticipation.

• Read in full: Sellers cut house prices by most in 13 years over budget fears

Life insurers pass severe market stress test

ALESSIA PIERDOMENICO/REUTERS

The Bank of England’s Prudential Regulation Authority (PRA) said that Britain’s life insurers withstood its latest severe market stress test, indicating the sector was “resilient” to shocks, including falls in interest rates, equities, property, and credit quality.

While the results underscore sector resilience, the PRA emphasises that boards remain responsible for ongoing risk management and forward-looking stress testing to maintain robust solvency and capital planning practices.

The shares of FTSE 100 life insurers, such as Aviva and Legal & General, could be in focus when the stock market opens.

UK infrastructure investment groups to merge

HICL has a stake in London St Pancras Highspeed, the high-speed railway connecting London St Pancras station and the Channel tunnel

ALAMY

HICL Infrastructure and The Renewables Infrastructure Group (TRIG) will merge to form Britain’s largest listed infrastructure investment company with net assets of more than £5.3 billion.

The companies said the increased size would improve share liquidity, broaden the combined companies’ appeal to global institutional investors and index funds, and provide a pathway to potential inclusion in the FTSE 100 index and other global indices.

TRIG’s assets will transfer to HICL via reconstruction and voluntary winding up, with shareholders receiving new HICL shares and the option of up to £250 million in cash. Sun Life will provide £100 million in secondary market support.

Completion is expected in the first quarter of next year, subject to approvals, with existing management teams retained to implement the enhanced investment strategy.

UAE developer takes major stake in Thameside West

Arada, a United Arab Emirates real estate developer backed by Gulf royals, is to acquire a majority stake in London’s Thameside West mixed-use development.

The project, on the north bank of the Thames near Royal Victoria Docks, has a gross development value of £2.5 billion and plans to deliver at least 5,000 homes, Arada said. The first phase, expected to start construction in 2027, will deliver 1,000 homes.

The Arada chairman Sultan bin Ahmed al-Qasimi, a member of Sharjah emirate’s ruling family, said: “Our entry into this market was grounded in our unwavering faith in London and its attractiveness as one of the world’s leading capital cities.”

Japan tourism faces hit from Taiwan row

Chinese tourists visit the Ginza shopping district of Tokyo

GREG BAKER/AFP VIA GETTY IMAGES

Retail, leisure and other tourism-related Japanese shares fell today after China warned its citizens against travel to the island following a widening diplomatic rift over Taiwan.

Isetan Mitsukoshi, a department store operator with substantial sales to Chinese visitors, lost 10.7 per cent, Tokyo Disneyland operator Oriental Land lost 5.9 per cent and Japan Airlines shed 4.4 per cent.

On Friday, Beijing warned Tokyo of a “crushing” military defeat if it used force to intervene over Taiwan and warned Chinese citizens against visiting Japan. This morning Japan’s chief government spokesman, Minoru Kihara, said any move by China to restrict travel would violate an agreement between the nations’ leaders.

A senior Japanese diplomat will travel to China in an attempt to soothe the tensions. Chinese visitors account for roughly 25 per cent of Japan’s inbound traffic, making department stores, luxury retail, and hospitality particularly vulnerable. Fuelled by the weak yen, tourism has become an important part of Japan’s economy.

Bitcoin close to wiping out gains for the year

Bitcoin has stabilised this morning after almost wiping out all its gains for the year.

The cryptocurrency has fallen sharply since topping $125,000 in October as a result of a combination of risk in regards to interest rates and liquidity, geopolitical uncertainty, liquidations, and waning institutional demand.

Bitcoin, which was trading at $94,147 on Friday, is currently at $95,027.42. It ended 2024 at $93,714.