It’s time to up the ante. After the first round of offers for Warner Bros. Discovery arrived, the David Zaslav-run studio giant has set the next deadline for the sweetened bids from suitors.

That next round of multibillion-dollar offers is expected by December 1, a source confirms. That’s only 11 days removed from the initial offers that were submitted by November 20. While the David Ellison-owned Paramount has pursued a full takeover of the Warner Bros. Discovery assets, both the Brian Roberts-run Comcast and the Greg Peters and Ted Sarandos-led Netflix have submitted bids.

The latter two suitors are expected to be more interested in the studios and streaming businesses, rather than the linear TV properties. Bloomberg earlier reported the deadline for the second round of offers.

The next bid marks the latest turn in a process that accelerated beginning in June when Warners formally unveiled a plan to split its studio business (Warner Bros. Television, Warner Bros. Motion Picture Group, DC Studios, HBO and HBO Max) from its global networks unit (CNN, TNT Sports, Discovery and streamer Discovery+) that’s been diminished as cord-cutting eroded the Pay TV landscape.

After word of Ellison’s overtures leaked, the company formally put up a “For Sale” sign on Oct. 21, saying it received “unsolicited bids” from “multiple parties,” although the conventional wisdom has suggested that the son of Oracle owner Larry Ellison (current net worth: $257 billion) has the inside track. The younger Ellison only months ago in August closed an $8 billion merger for his Skydance Media to effectively take over the owner of Paramount Pictures, CBS and MTV and Paramount+. Adding Warner Bros.’ to New Paramount’s stable of assets would create a formidable studio empire that also would remove another major player from the mix of buyers for film and TV projects. Creatives have been circumspect as the prospect of a Warner Bros. sale has moved ahead.

At the time it was formally put up for sale, Warners itself indicated that it’d like to see its separation of its assets move forward, believing that the two companies would provide more value for shareholders when they’re eventually sold in pieces. Samuel A. Di Piazza, Jr., chair of the Warner Bros. Discovery board of directors, noted at the time, “We continue to believe that our planned separation to create two distinct, leading media companies will create compelling value. That said, we determined taking these actions to broaden our scope is in the best interest of shareholders.”

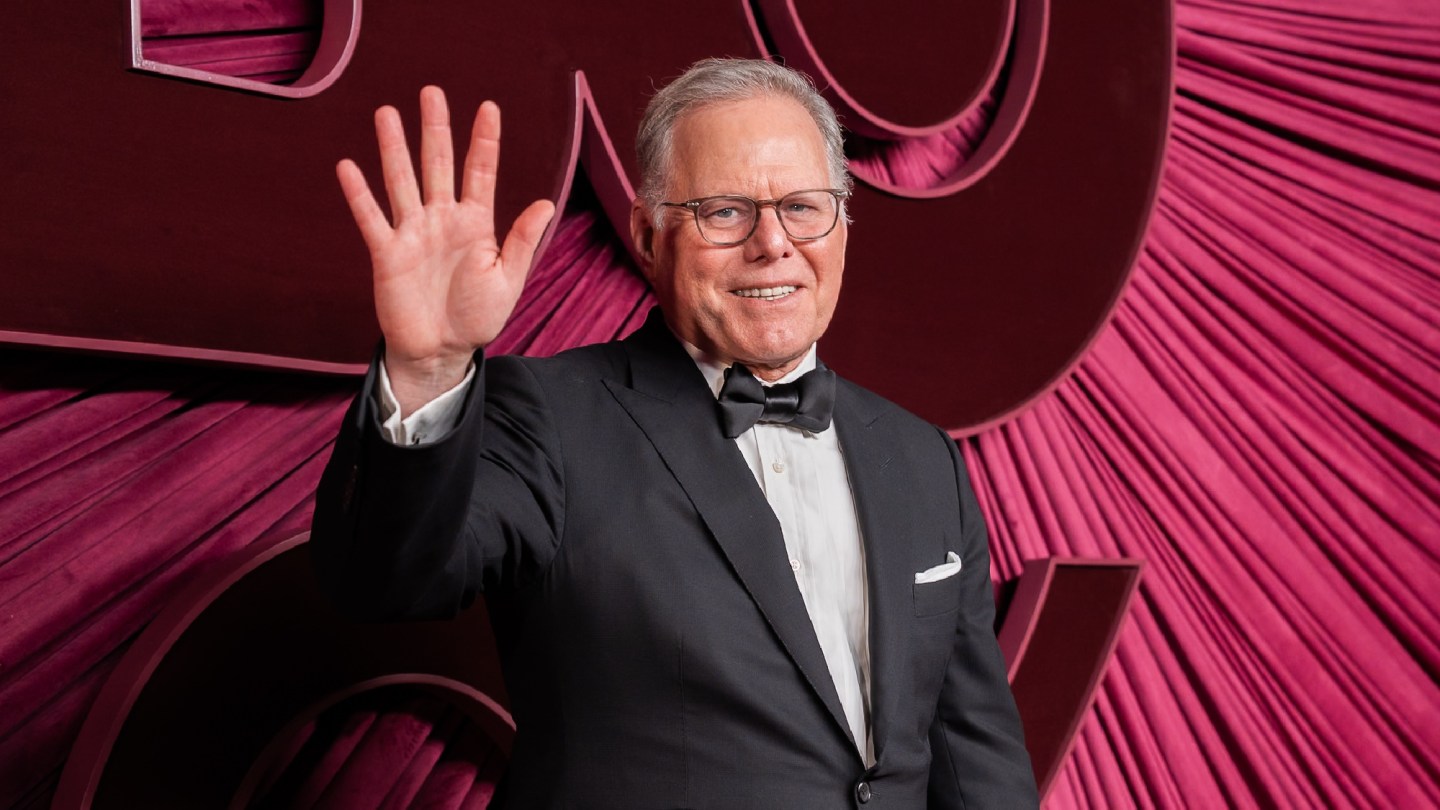

As of Warners’ Nov. 6 earnings, Zaslav had declared the sale an “active process” but didn’t name suitors, as the WBD board will evaluate its options as the process moves ahead. He added, “When you look at our films like Superman, Weapons and One Battle After Another, the global reach of HBO Max and the diversity of our networks offerings, we’ve managed to bring the best, most treasured traditions of Warner Bros. forward into a new era of entertainment and new media landscape.”