Mier Wang’s first job in high school was at a wealth manager’s office in Kalamazoo, Mich..

If the rest of his path to launching a modern, acquisitive registered investment advisor seems like it would be obvious—join a firm, work a decade as an RIA, launch your own—think again.

Wang graduated, went on to study finance at The Wharton School, then took on a series of jobs in investment banking and hedge funds, with stints at Barclays, JPMorgan Chase and the direct middle-market lender Silver Point Finance.

In 2018, he followed a long-held interest in the restaurant and hospitality business and started AYS Hospitality Group in New York. He opened “niche Japanese” restaurants in New York. Today, they include The Office of Mr. Moto in the East Village and The Resident of Mr. Moto in Brooklyn.

So why, in 2023, did he return to his wealth management roots by launching an RIA aggregator with ambitious plans to compete amid private-equity-backed aggregators?

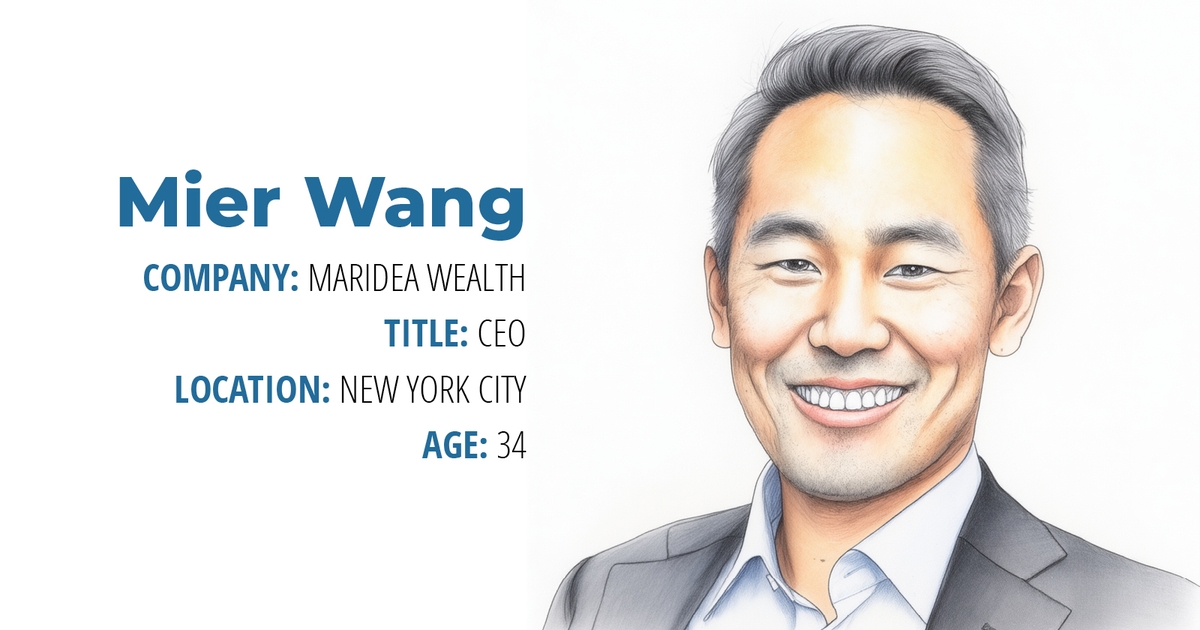

“In an industry that now manages over $20 trillion in assets, with RIAs rapidly accelerating their share to roughly a third of the market, I believed we could make a meaningful dent,” Wang said of his firm, Maridea Wealth, headquartered in Brooklyn. “With around 20,000 advisors in the independent RIA space, my conviction was that we could find both advisors and clients to join us in building something different—a platform defined by its culture and by its obsession with the client experience.”

Client experience, Wang said, serves as the common thread that ties his interests across finance, restaurants and the wealth management sector. With any hospitality field, he said, if the client isn’t happy, the business can’t thrive.

“Whether I’m serving a financial plan or curating a dinner experience, I’ve always been driven by perfecting the client experience,” Wang said. “Wealth management is where those two passions meet—the rigor of financial services and the heart of hospitality.”

Wang was conscious that his work in banking and investing didn’t directly translate to the RIA space. To get there, he obtained his license, earned the CPWA designation and then went prospecting. In a few weeks, he had gathered a few million in assets under management.

“That was the turning point where I gained the confidence to say, ‘Alright, I have something here. I can do this,’” he said.

The methodical entrepreneur then brought experienced partners on board and launched the platform with Hightower co-founders Larry Koehler and Daniel Lidawar. He secured guidance and funding from Alex Binderow of Pelican Capital, whom Mier calls “a personal mentor.”

It wasn’t all smooth sailing. Some advisors who had planned to join the firm backed out because they weren’t comfortable being at a startup, he said.

The team persevered, gathering both advisors and clients at a relatively fast clip. In May, Maridea sold a private equity stake to Binderow’s Pelican and 119th Street Capital to fund more acquisitions and partnerships.

That helped Maridea grow to nearly $1 billion in assets under management with over 40 advisors across the United States. Mier remains bullish on his thesis regarding the sector and the firm’s continued growth in 2026.

“The opportunity ahead of us is enormous,” he said. “There is still a vast white space in wealth management, with countless clients yet to be served. I believe that everyone should have a wealth manager in the same way they have a dentist or a family doctor.”