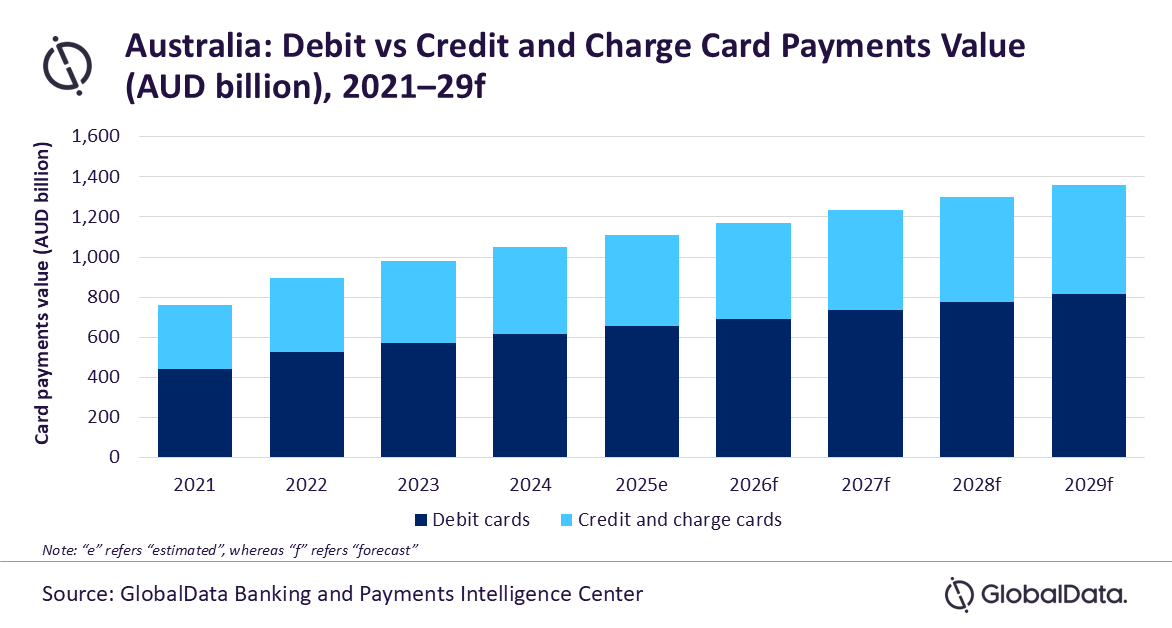

AUSTRALIA | The card payment market in Australia is expected to grow at a CAGR of 5.2 percent between 2025 and 2029 to reach AUD 1.4 trillion in 2029.

Driven primarily by debit cards, this growth is underpinned by a substantial banked population, increasing digital banking adoption, and consumers’ growing preference for contactless transactions, according to GlobalData, a leading data and analytics company.

GlobalData’s Payment Card Analytics revealed that card payments (including payments at POS and those initiated remotely) in Australia registered a strong CAGR of 11.2 percent between 2020 and 2024.

However, the value is expected to register a slower growth of 5.7 percent in 2025 due to the country’s economic slowdown. The country’s GDP growth rate decreased from 4.3 percent in 2022 to 1.4 percent in 2024.

“Australia has achieved significant success in promoting financial inclusion, evidenced by its near-100 percent adult banked population. This success is primarily due to legislation mandating the availability of basic bank accounts,” said Kartik Challa, Banking and Payments Senior Analyst at GlobalData.

“Additionally, low interchange fees on debit cards and a growing preference for contactless payments have further encouraged the use of debit cards. As the country moves toward a highly digitised society, citizens find it increasingly convenient to access online financial services. In this environment, both fintech companies and digital-only banks have gained a substantial foothold in the debit card market.”

The widespread adoption of debit cards is a significant trend, evidenced by the average adoption of nearly two cards per individual, highlighting the extensive market penetration.

The strong banking infrastructure, comprising both traditional banks and fintech companies, has played a crucial role in creating an environment where a substantial segment of the population utilises banking services. The estimated banked adult population in 2025, at 99.6 percent, reflects a society that is not only financially literate but also deeply engaged in the banking ecosystem.

According to the Australian Banking Association (ABA), as of September 2024, there were 96 banks in Australia serving 20.8 million Australian customers. This achievement can be attributed to the easy accessibility of basic bank accounts for vulnerable customers.

Debit cards represent 59 percent of the total card payment transaction value in 2025e. In the face of rising economic uncertainty, Australians are increasingly choosing to spend within their means instead of accruing debt, leading to a higher usage of debit cards.

Additionally, the annual frequency of debit card payments recorded a CAGR of 3.5 percent, increasing from 213.7 transactions per card in 2021 to 245.5 in 2025, ranking among the highest in the world.

Conversely, the credit and charge cards account for 41 percent of total card payment value in 2025, though usage is on the rise. This increase can be attributed to the aggressive marketing strategies of Australian banks to promote their use.

The appeal of incentives such as cashback offers, reward points, and discounts, along with the convenience of instalment payments, has resonated with consumers, leading to their continued use.

“Looking ahead, Australia’s card payments market is poised for continued expansion, with debit cards driving growth. The combination of a high banked population, heightened financial awareness, and the growing adoption of contactless payments will underpin future growth. Overall, the card payments market is expected to grow by 5.7 percent to reach AUD1.1 trillion in 2025.”

More from the c-store here