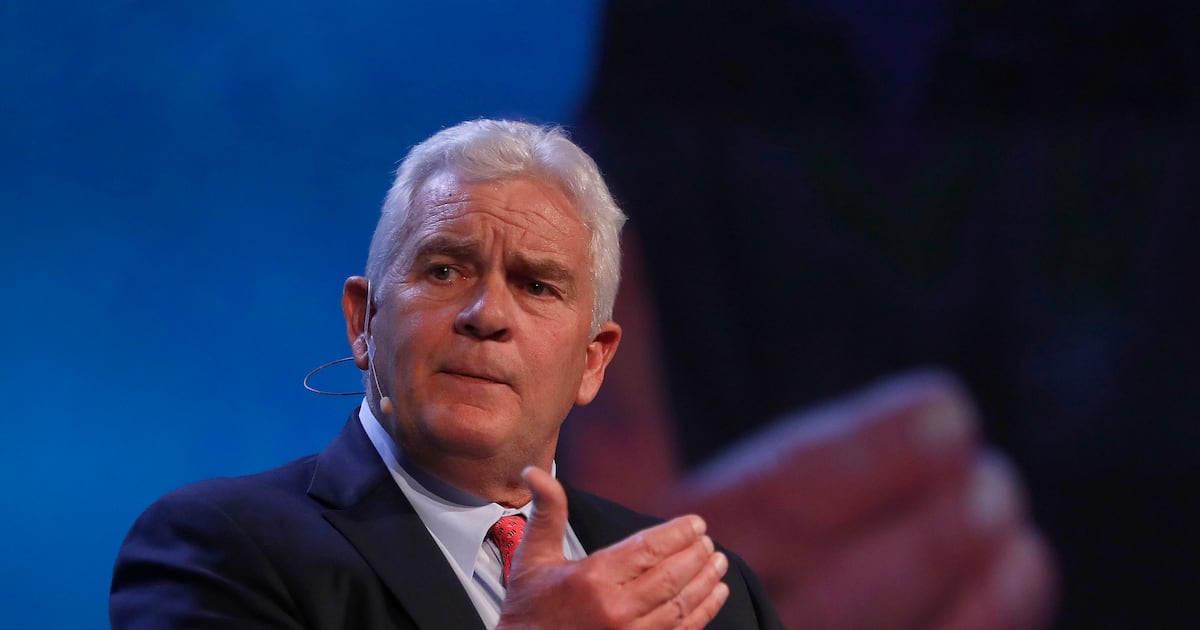

Texan oil billionaire Kelcy Warren is behind a €30 million investment into Waterford Airport, according to sources with knowledge of the deal.

Waterford City and County Council approved the private investment in October following a long-running bid for public funding to lengthen the airport’s runway to allow it attract commercial airlines.

Local councillors were not informed of the identity of the investor in advance of a vote to approve the investment, which involved the council selling €2.3 million worth of public land to a then unnamed US businessman for just €50,000.

Mr Warren is the chief executive and chairman of Energy Transfer, one of the largest oil and gas pipeline companies in the US. It had turnover of $82.7 billion (€70.7 billion) in 2024. The company owns the Dakota Access Pipeline and other US oil infrastructure.

Mr Warren has a net worth of $7.1 billion according to Forbes, ranking him just outside the richest 500 people in the world. He is a long-time funder of Republican Party candidates, including Donald Trump.

A runway extension would allow jet aircraft to operate from Waterford Airport. Photograph: Waterford Airport/twitter

A runway extension would allow jet aircraft to operate from Waterford Airport. Photograph: Waterford Airport/twitter

It is understood the investment deal is now near completion.

Mr Warren also owns the Georgian Palladian mansion, Castletown Cox in Co Kilkenny through a company Rosebrack Limited, and is in the process of developing a whiskey distillery at the property. A Rosebrack subsidiary, The Willy Good Distillery Limited, was incorporated in March 2025.

The identity of the bidder has not been officially named due to a non-disclosure agreement binding key shareholders and stakeholders. As Mr Warren is a non-EU resident, the deal has been subject to inward investment screening by the Department of Enterprise.

Another huge corporate tax take to AI’s next phase: What’s in store for 2026?

Another huge corporate tax take to AI’s next phase: What’s in store for 2026?

For this week’s episode, host Ciarán Hancock Is joined by an expert panel to look forward to 2026. After another record-breaking year for corporate tax receipts, is there now a real threat of concentration risk in the Irish economy?A huge amount of money has been raised and spent on AI, but where is it at in terms of its development? When will investors start looking for a tangible return?And will Donald Trump turn his attention back to economic matters after moves to end the conflicts in Gaza and Ukraine? Could more tariffs be on the way in 2026?The panel comprises CEO of the Sherry Fitzgerald Group, Marian Finnegan, tech entrepreneur and columnist at the Irish Times, Chris Horn, and Irish Times Economics Correspondent, Eoin Burke-Kennedy.Produced by John Casey with JJ Vernon on sound.

Mr Warren’s legal advisers, Mason Hayes and Curran, have been contacted for comment.

Waterford council has helped to fund shortfalls at the airport since 2016 and will be forgiving a loan of €670,000 to enable the investment. The council also owns a small minority stake in the company. It will waive its shareholding and will dispose of an 84-hectare landholding to enable the development.

The land, which was valued at €2.295 million by independent estate agent Avison Young, will be sold for €50,000. The sale conditions include a number of so-called anti-embarrassment clauses, such as restrictions on changing the use of the land and future sales.

The chief executive of the council, Sean McKeown, recommended councillors take the deal in light of the “absence of any viable alternative investment proposal, the imminent financial risk to the airport and the clear and measurable economic and social benefits” of the investment.

The agreement includes a clause that the sale of the land will only take effect once the full development works at the airport have been completed.

The airport’s single largest shareholder, the Bolster Group, had been in negotiations with the Department of Transport for public funding for a number of years, securing an “expression of support” for a public-private funding agreement in 2019.

William Bolster of the Bolster Group described the approval as “fantastic news” at the time. He refused to comment on the identity of the investor.