How much someone needs to enjoy a comfortable retirement is a highly personal thing. We don’t all have the same retirement goals or financial commitments, and so there’s no single answer to the question of how much is needed to save in an investment product like an Individual Savings Account (ISA) or a pension.

That said, it’s still a good idea for savers and investors to have a rough idea. According to Pensions UK, the average one-person household will need to have a nest egg of £540,000 to £800,000 for a comfortable retirement.

That’s assuming an individual purchases an annuity policy to achieve an income for life. For a two-person household, the amount each individual needs sits between £330,000 and £490,000.

That may seem like a lot of money at first glance, but with a patient approach to investing and saving it’s more than possible.

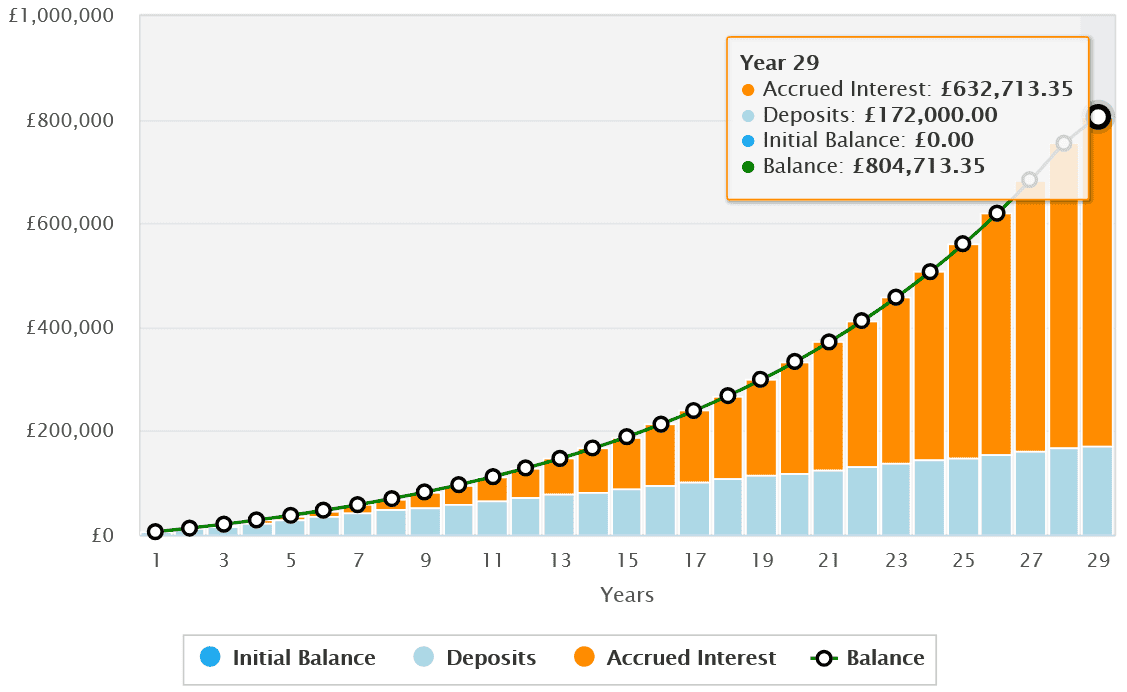

Let’s say someone’s aiming for the top amount of £800k. If they could invest £500 a month in a diversified portfolio of global share they could — based on an average annual return of 9% — reach their target in less than 29 years (28 years and eight months, to be precise).

Source: thecalculatorsite.com

That 9% is bang in the middle of the 8-10% return that long-term stock investors enjoy. And the £500’s roughly in line with the £514 that Shepherds Friendly says the average Briton invests each month.

But let’s forget about Pensions UK’s idea of buying an annuity for a moment. On the one hand, this provides the security of a guaranteed income for life. However, investors can try to achieve a higher retirement income by purchasing high-yield dividend shares. This will depend on factors like interest rates and life expectancy that impact annuity payments.

Targeting a passive income with shares is a riskier option as dividends are never guaranteed. But as I say, this strategy can yield a higher passive income. And it also leaves scope for further portfolio growth over time.

Holding just one or two dividend shares is a highly risky option. But with a large number of diversified holdings — say 20-25 spanning different industries and regions — the danger of income shocks can be substantially reduced.

A portfolio with an average 7% dividend yield would provide an annual income of £37,800 on a £540,000 ISA fund. That figure rises to £56,000 on an £800,000 nest egg. I think Phoenix Group (LSE:PHNX) could be a great share to consider to target this sort of return.

As you can see, the dividend yield chart below has beaten the FTSE 100 long-term average of 3-4%. And I’m confident it can continue offering market-leading dividends.

Story Continues

Source: dividenddata.co.uk

Phoenix is a major player in the life insurance and retirement solutions market, with significant brand power and terrific scale. I’m expecting profits to grow strongly in the years ahead as ageing populations and rising engagement in financial planning drive product demand.

The company’s also highly cash generative, giving it the ammunition to furnish shareholders with large and bulky dividends. This drove its Solvency II capital ratio an enormous 175% as of June.

Competitive pressures and regulatory changes may pose future threats. But as part of a diversified portfolio, I think it could be an excellent wealth generator to think about.

The post Here’s how ISA investors could target a comfortable retirement with dividend shares appeared first on The Motley Fool UK.

More reading

Royston Wild has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

Motley Fool UK 2025