Every January, we set ambitious financial goals but what derails those goals isn’t motivation. It’s repeating the same costly mistakes.

2026 is a year personal finance expert Anthony O’Neal says he’s excited about.

I absolutely believe that going into 2026 money is tight for a lot of people but I also believe on the positive side that people know money is tight. So what we are seeing is people start to make some adjustments

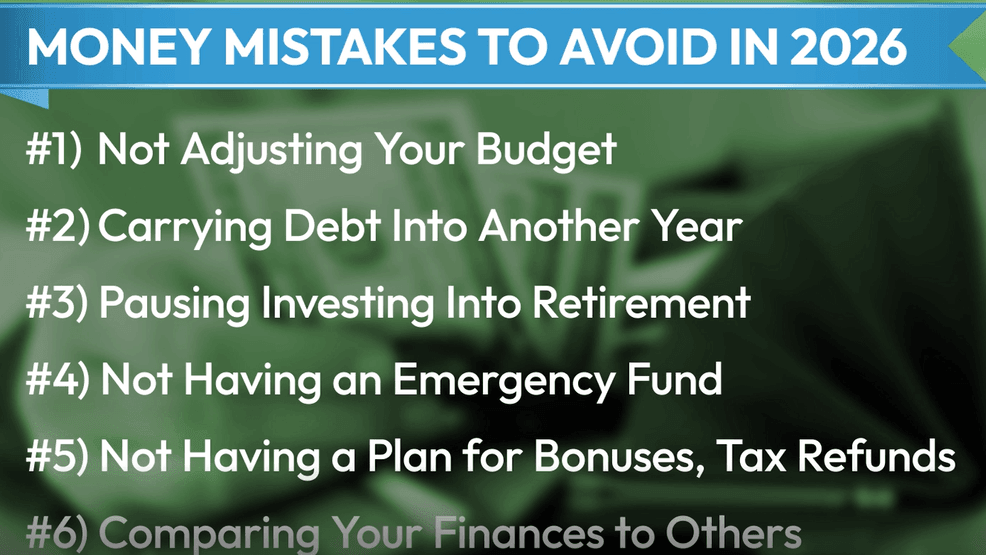

With that in mind, he says there are some common money mistakes we can’t afford to make this year.

MISTAKE #1–Not adjusting your budget for a higher cost of living

The cost of living continues to go up. Overall inflation is up to about 2.7 percent year over year as of November. So what I really want people to do is in the year 2026 is get on a zero based budget and stick to that budget where we list all of our income minus all of our expenses. You got to list that on paper before the month begins.

MISTAKE #2–Carrying high-interest debt into another year

Debt is going to keep you paying for your past instead of focusing on your future

He says to use the debt snowball paying off your smallest debt first.

MISTAKE #3–Putting retirement savings on hold while paying off debt

I believe Personally that pausing retirement contributions specially your 401k contributions while you pay off debt can cost you more money long term than the debt itself.

He says to at least get the company match.

MISTAKE #4–Waiting for an emergency to work on your emergency fund

I believe that people need to have the minimum to start of one month of their average net pay to start before they eliminate the debt. once they become 100 percent debt free move that up to 3 to 6 months of their average net pay not expenses not what you think is good. This then puts you in a position to where if life were to happen, you don’t have to adjust anything.

MISTAKE #5–Not having a plan for bonuses and tax refunds

MISTAKE #6–Comparing your finances to other people

We got to get to a point where we’re not buying things to impress people who won’t even pay the bill. this year anytime you want to buy something just wait. ask yourself for 24 hrs do I really like this or am I being guided by something else that really doesn’t benefit me.Comment with Bubbles

BE THE FIRST TO COMMENT

Also avoid trying to accomplish all of your financial goals at once. Because setting goals to save more, invest more, get out of debt–your goals are competing with each other.