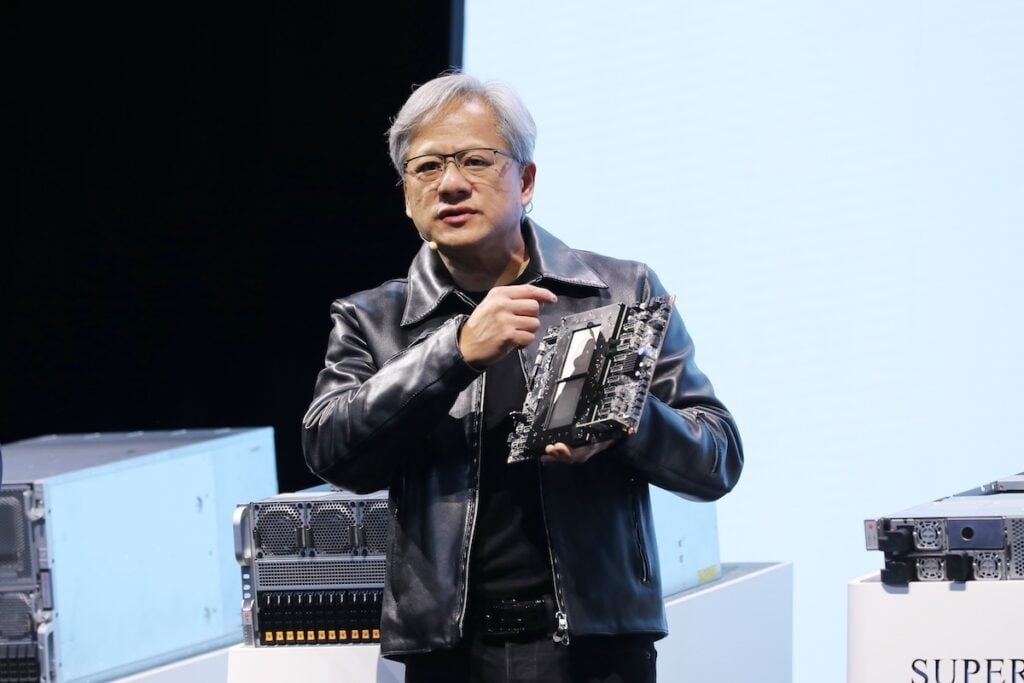

Over the weekend, Nvidia Corp (NASDAQ:NVDA) CEO Jensen Huang pushed back against growing market speculation that custom AI chips from cloud providers could overtake Nvidia’s GPUs, calling the idea fundamentally flawed.

On Saturday, while speaking with reporters in Taipei, Huang dismissed reports suggesting that custom silicon, or application-specific integrated circuits or ASICs, could eventually surpass Nvidia’s AI GPU shipments, reported DigiTimes Asia.

“I don’t think so. And it doesn’t make sense,” Huang said, arguing that such claims underestimate the scale and complexity required to compete with Nvidia.

Don’t Miss:

While Huang acknowledged that ASICs will continue to coexist with Nvidia’s products, he said they are unlikely to pose a serious threat. “There’s a place for ASIC all the time,” he said, adding that it is “ok” for companies to experiment with custom chips.

Huang pointed to Nvidia’s vast engineering and research investments as a key barrier.

The company employs about 45,000 people focused on AI and computing and spends roughly $20 billion annually on R&D. That figure, Huang said, could grow to $30 billion and eventually $45 billion in the coming years.

To build something better, companies would need an engineering budget like Nvidia, Huang said, calling that level of commitment “very rare.”

Huang also highlighted the increasing difficulty of chip design, describing Nvidia’s Hopper architecture as manageable, Blackwell as “so hard” and the upcoming Rubin platform as effectively out of reach for competitors trying to keep pace.

Unlike ASICs, which are often designed for narrow tasks, Nvidia builds an entire AI computing stack, spanning GPUs, CPUs, networking hardware, switches and software. Huang said this holistic approach delivers greater flexibility and lower total cost of ownership.

Jensen Huang is basically saying custom chips from $GOOGL, $AMZN, $AMZN, $MSFT & $META struggle to compete with $NVDA because Nvidia is singularly focused on AI acceleration at a scale no one else matches.

CUDA is the default language developers build on, NVLink is still ahead… pic.twitter.com/KQYQT8CWYO

See Also: Wall Street’s $12B Real Estate Manager Is Opening Its Doors to Individual Investors — Without the Crowdfunding Middlemen

Earlier in the week, Morris Chang, the 94-year-old founder of Taiwan Semiconductor Manufacturing Co. (NYSE:TSM), resurfaced publicly for the first time in over a year, attending a private dinner with Huang.

At the time, Huang told reporters that Chang is still mentally sharp and in high spirits, noting that their discussion was as perceptive and engaging as ever.

After landing in Taiwan, Huang also said that the company works closely with all major high-bandwidth memory suppliers, including SK Hynix, Samsung Electronics (OTC:SSNLF) and Micron Technology Inc. (NASDAQ:MU) and depends on those partnerships to help meet surging demand this year.

Nvidia earns high marks on Benzinga’s Edge Stock Rankings for Quality, backed by strong price trend across short, medium and long-term timeframes.

Read Next: Americans With a Financial Plan Can 4X Their Wealth — Get Your Personalized Plan from a CFP Pro

Photo Courtesy: glen photo on Shutterstock.com

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga:

This article Jensen Huang Has No Fear Of Custom Chips From Tech Giants Eclipsing GPUs: ‘Doesn’t Make Sense’ originally appeared on Benzinga.com