The Government is outlining its annual budget on Tuesday, amid scrutiny of its tax and expenditure priorities.

Follow all the action here from the Irish Examiner political and news teams as Paschal Donohoe and Jack Chambers announced Budget 2026.

Minimum wage to increase by 65c to €14.15; 2% rate band for USC to rise by €1,318 to €28,700;

Renters’ tax credit of €1,000 extended for a further three years to the end of 2028;

New derelict property tax to replace derelict site levy and will be charged at a rate of 7% on the market value of the property; Vat rate for completed apartments cut from 13.5% to 9%;

63,500 jobs expected to be added by the end of the year; inflation expected to remain at around 2% next year;

On excise, a packet of 20 cigarettes will go up by 50c from midnight.

Vat for food and catering businesses, hairdressing services cut from 13.5% to 9% from July 1, 2026

€5,000 VRT relief for electric vehicles extended until the end of 2026; carbon tax increase will be applied to auto fuels from midnight

1.52pm: Public expenditure minister Jack Chambers is now on his feet, delivering his Budget 2026 statement.

Jack Chambers delivering his Budget 2026 statement

Jack Chambers delivering his Budget 2026 statement

A carbon tax increase will be applied to auto fuels from midnight and all other fuels on May 1 next year.

The rate of the tax will go to €71 per tonne of CO2 emitted.

The revenue arising from carbon tax is estimated at €121m next year, and €157m for a full year.

1.48pm: Concluding his speech, Mr Donohoe said the State’s finances are “in good shape”.

“Our employment is at a historically high level. Our schools, our hospitals, our public services are responsible for so much good in our society,” Mr Donohoe said.

“But we must build more homes. We must help those who need our help in a more targeted way.” Mr Donohoe said the Government needed to make choices within the budget and any attempt to do everything would weaken “our ability to be safe in a turbulent world”.

“This is why our tax changes must be of a certain value, and no more.

“Now is the time to steady ourselves on the path for the future.”

1.44pm: Focusing on the film industry, a tax credit to support the visual effects sector in Ireland has been announced.

This will provide a 40% rate of relief for productions with a minimum of €1m of eligible expenditure on visual effects.

The rate will apply up to a maximum of €10m per production.

Another entertainment industry, digital games, will see the digital games tax credit extended for six years until the end of 2031.

To support entrepreneurs the finance minister said he is increasing the lifetime limit on capital gains tax revised entrepreneur relief from one million euros to a million-and-a-half for disposals made from the start of 2026.

1.41pm: The Government is to use €150 million of its tax package for “targeted supports for the most vulnerable.”

Within the €1.3 billion tax package as announced by Paschal Donohoe in the Dáil is a €1,318 increase in the 2% ceiling on the Universal Social Charge (USC) to €28,000.

This is designed to ensure that those who are on the new minimum wage of €14.15 per hour will remain outside the highest rate of USC.

The USC concession for medical card holders will be extended for two years, ensuring those on less than €60,000 receive a reduced rate on the first €12,012 of earnings.

1.35pm: The Government has announced that the rent tax credit of €1,000 per year will be extended for three years and mortgage interest tax relief will be extended to 2027, though the rate will be halved in the second year.

The measure will cost €38 million overall.

On investments, the Budget will decrease the rate of investment undertaking tax, life assurance exit tax, tax on equivalent offshore funds and the rate of tax on some foreign life assurance policies from 41% to 38%.

The VAT rate on gas and electricity will be 9% until the end of 2030 under the Finance Bill and a tax disregard of €20,000 on profits on the manufacture of uilleann pipes will extend to the end of 2028.

Carbon tax will increase €63.50 to €71 per tonne of carbon dioxide emitted. This will add around 2c a litre to petrol, while a VRT relief for electric vehicles will be extended until the end of next year and benefit in kind on EVs will be extended for three years on a tapered basis.

On excise, a packet of 20 cigarettes will go up by 50 cent.

The bank levy will be extended until the end of 2026, but the overall target income of €200 million will remain.

1.25pm: As expected, Mr Donohoe confirmed that the national minimum wage is to increase to €14.15 an hour.

That is a rise of 65c an hour.

The finance minister also confirmed there would be a further extension to mortgage interest relief for two more years, with it set to be reduced for its final year.

Mr Donohoe also confirmed the 9% VAT rate on gas and electricity would be extended until 31 December 2030.

Until now, it had been regularly extended for periods of six months.

“This should go some way to alleviating energy cost pressures across the year for households,” Mr Donohoe said.

1.16pm: In preparing this Budget, Mr Donohoe said that housing has been “at the forefront.”

“We have made significant changes to the design of homes to help them become more affordable.”

He has confirmed there will be a new Derelict Property Tax introduced.

Mr Donohoe said this will be charged at a rate of 7% on the market value of the property, saying this rate will not be lowered.

“Dereliction is a blight on our towns and cities. We need to bring those properties currently lying empty back into use,” Mr Donohoe said.

However, it will require a register of dereliction to be published in 2027, with the tax being implemented “as soon as possible” after this.

It is set to replace the Derelict Site Levy.

In preparing this Budget, Mr Donohoe said that housing has been “at the forefront.

In preparing this Budget, Mr Donohoe said that housing has been “at the forefront.

Mr Donohoe also confirmed there would be a cut to the Vat rate on the sale of apartments, going from 13.5% to 9%.

This will take effect at midnight and run until December 31 2030.

“This reduction will help address the viability gap in apartment construction as part of a social policy to deliver more and higher density apartments,” Mr Donohoe said.

Mr Donohoe also confirmed there would be “substantial changes” to the Living City Initiative, which can assist households to restore residential properties.

This will include allowing people access the tax relief if they redevelop properties built before 1975.

The scheme will also allow the redevelopment of over-the-shop properties.

More regional towns will be added to the scheme, such as: Athone, Drogheda, Dundalk, Letterkenny and Sligo.

Mr Donohoe also confirmed the rollover of income tax deduction for small landlords who retrofit their properties for the next three years.

1.10pm: Inflation is forecast to remain at around 2% next year, Mr Donohoe has said.

He adds: “I and the Government are acutely aware that prices remain high.”

He said the first budget of this coalition Government’s term would deliver for citizens and “tackle the serious challenges of meeting our housing and investment needs”.

The Irish economy is forecast to grow by 3.3% this year and by 2.3% next year.

A further 63,500 jobs are expected to be added by the end of 2025.

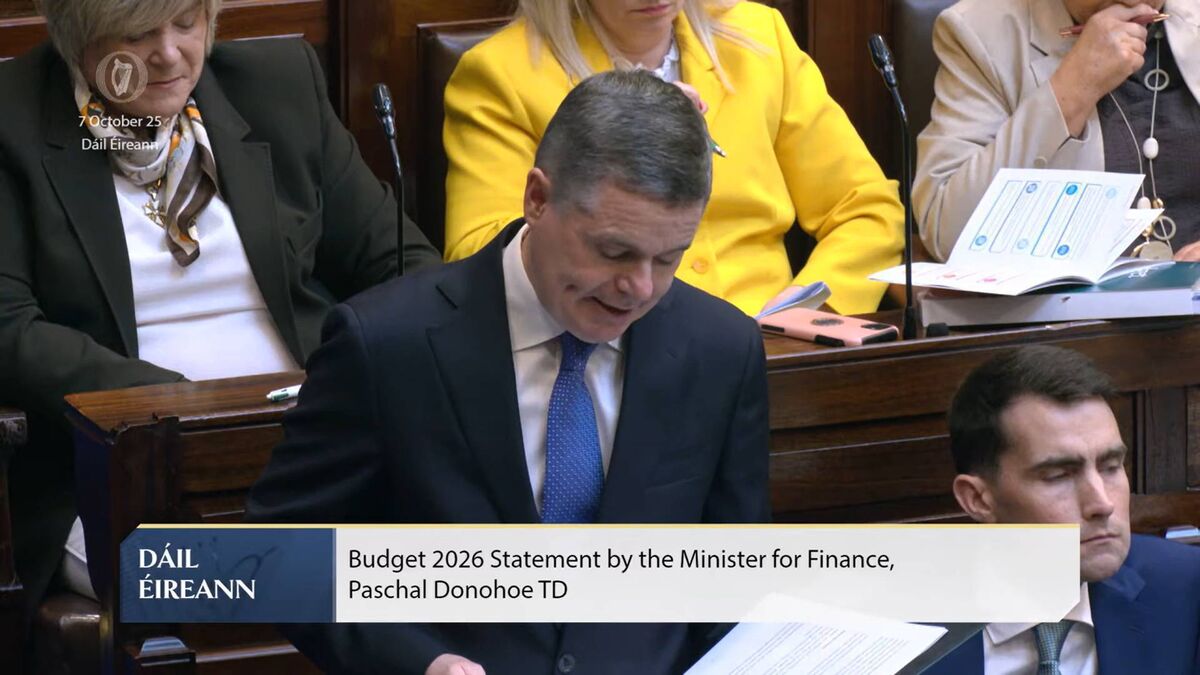

1pm: Paschal Donohoe is on his feet in the Dáil to deliver Budget 2026.

He says: “This Budget builds up our resilience and help us to adapt at a time of historic challenge and change.”

He adds: “We need to achieve more in a world that is dramatically changing.”

He notes that widespread tariffs have been introduced and the world “has been pulling away from its near-universal commitment to free and open trade.”

However, he adds: “Ireland will always be a global voice for co-operation and trade.”

12.52pm: Good afternoon, and welcome to the Irish Examiner’s Budget 2026 live blog.

Stay with us for news and analysis across the day as the Government delivers the final budget before the next general election.

Government sources have indicated there will be a 20% increase in the size of the housing budget, as well as a 20% boost for the disability budget.

For the Department of Justice, funds will be provided to hire 1,000 extra Garda, as well as a further 1,000 teaching posts created.

The 9% Vat rate on energy bills will also be retained.

Social protection minister Dara Calleary has secured an expansion to the fuel allowance as well as an increase to the payment levels.

Core social welfare rates will rise by €10 and rise in the child support payment for children under 12 has been confirmed, increasing by €8. It will increase by €16 for children over the age of 12.

For the Department of Housing, sources said funding has been secured to support the delivery of 10,200 new build social homes.

They added there would be funding for 15,000 so-called “starter homes” through affordability measures and schemes.

Meanwhile, there will also be a measure to exempt profits from homes within cost rental schemes from capital gains tax.

This measure is set to come into effect tomorrow, on October 8.

Oireachtas webcasting is provided by the Houses of the Oireachtas Service, in association with HEAnet, Ireland’s National Educational and Research Network.