MercadoLibre’s MELI growth remains heavily anchored in Brazil, Mexico and Argentina, which together contribute over 82% of total revenues, a concentration that amplifies exposure to regional volatility. Brazil drives MELI’s core commerce and fintech operations, Mexico has emerged as a fast-growing hub for cross-border e-commerce and Argentina serves as a key fintech engine through Mercado Pago and credit expansion. This geographic skew leaves the company highly sensitive to inflation, currency swings and policy uncertainty across these economies.

In Brazil, persistent inflation and tight monetary policy continue to constrain consumer spending. The Selic rate, the country’s benchmark lending rate, remains elevated at 15%, restricting credit formation and pressuring discretionary demand, both central to MELI’s marketplace and payments growth. Argentina faces renewed political turbulence, with corruption allegations against the ruling administration reigniting uncertainty and driving further peso volatility. Mexico’s environment remains clouded by governance inefficiencies, entrenched corruption and security-linked disruptions that weigh on formal economic activity and slow digital adoption.

The Zacks Consensus Estimate for MELI’s third-quarter 2025 total revenues is pegged at $7.18 billion, indicating 35.08% year-over-year growth. The consensus mark for revenues from Brazil, Argentina and Mexico is pegged at $3.9 billion (up 34.5% year over year), $1.57 billion (up 52.4% year over year) and $1.64 billion (up 43.5% year over year), respectively, suggesting MELI’s overreliance on markets facing persistent macro stress. Elevated borrowing costs, weak consumer sentiment and political instability continue to strain operating leverage and cloud earnings visibility. Without broader diversification or tangible stabilisation in these key economies, this dependence could gradually evolve into a structural constraint, derailing the momentum that once powered MELI’s rise.

Regional Diversification Aids Peers’ Stability

While MELI continues to face challenges from its heavy regional exposure to Latin America, peers like Amazon AMZN and Sea Limited SE benefit from broader geographic diversification. Amazon draws strength from balanced revenue streams across North America, Europe and Asia, while Sea Limited operates across multiple Southeast Asian markets, reducing dependence on any single economy. Both Amazon and Sea Limited leverage scale and regional balance to mitigate macro risks, whereas MELI remains concentrated in Brazil, Mexico and Argentina, leaving performance vulnerable to localized economic and political volatility.

MELI’s Share Price Performance, Valuation and Estimates

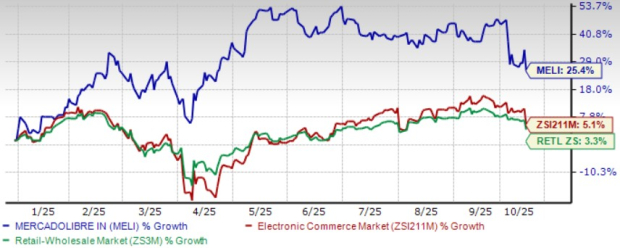

MELI shares have jumped 25.4% in the year-to-date (YTD) period, while the Zacks Internet–Commerce industry and the Zacks Retail-Wholesale sector have increased 5.1% and 3.3%, respectively.

MELI’s YTD Price Performance

Image Source: Zacks Investment Research

From a valuation standpoint, MELI stock is currently trading at a forward 12-month Price/Sales ratio of 3.22X compared with the industry’s 2.23X. MELI has a Value Score of F.

MELI’s Valuation

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for 2025 earnings is pegged at $43.23 per share, down by 43 cents over the past 30 days. The estimate indicates 14.7% year-over-year growth.

MercadoLibre currently carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Radical New Technology Could Hand Investors Huge Gains

Quantum Computing is the next technological revolution, and it could be even more advanced than AI.

While some believed the technology was years away, it is already present and moving fast. Large hyperscalers, such as Microsoft, Google, Amazon, Oracle, and even Meta and Tesla, are scrambling to integrate quantum computing into their infrastructure.

Senior Stock Strategist Kevin Cook reveals 7 carefully selected stocks poised to dominate the quantum computing landscape in his report, Beyond AI: The Quantum Leap in Computing Power.

Kevin was among the early experts who recognized NVIDIA’s enormous potential back in 2016. Now, he has keyed in on what could be “the next big thing” in quantum computing supremacy. Today, you have a rare chance to position your portfolio at the forefront of this opportunity.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Sea Limited Sponsored ADR (SE): Free Stock Analysis Report

MercadoLibre, Inc. (MELI): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).