1h agoWed 15 Oct 2025 at 1:33amMarket snapshotASX 200: +0.8% to 8,969 points

Australian dollar: +0.2% to 64.9 US centsWall Street: Dow Jones (+0.4%), S&P 500 (-0.2%), Nasdaq (-0.8%)Europe: FTSE (+0.1%), DAX (-0.6%), Stoxx 600 (-0.4%) Spot gold: +1% to $US4,183/ounceOil (Brent crude): -0.1% at $US62.31/barrelIron ore: -0.3% at $US106.10/tonneBitcoin: +0.4% at $US112,547

Prices current at around 12:33pm AEDT

Live updates on the major ASX indices:

3m agoWed 15 Oct 2025 at 3:20amCBA boss to stay in top job until at least 2028

Commonwealth Bank boss Matt Comyn will stay in the top job for at least the next three years, says board chair.

Chair Paul O’Malley told the bank’s annual general meeting in Brisbane the search for the next CEO would begin after his own next three-year term on the board ends.

“We have been pleased with the performance of Matt as CEO,” Mr O’Malley told the meeting.

“Our intention and expectation is that the decision as to the appointment of the next CEO will be made by the board led by my successor as Chair.”

Mr O’Malley was re-elected at the meeting, meaning he will be board chair until the end of 2028.

Matt Comyn has been chief executive for seven years.

-reporting with Reuters

22m agoWed 15 Oct 2025 at 3:02amBHP says Australia must cut red tape to compete

BHP’s head of Australia, Geraldine Slattery, says the country must speed up environmental approvals and boost access to cheap power if it hopes to compete globally for mining investment capital.

The federal government is reaching the final stages in negotiations with the Coalition and Greens to reform its environmental laws.

Ms Slattery says permit timeframes are key to productivity.

“This is not a small matter, it’s a linchpin to make the resources and many other sectors more productive,” Ms Slattery said at a conference in Western Australia.

“Australia’s labour productivity growth is now at a sixty-year low. This is not some isolated economic statistic. It’s a trend that poses challenges, not only for attracting future investment, but also for sustaining the higher standards of living that productivity enables,” she said.

It comes as the United States is bringing in ‘mining-friendly’ policies to spur development of an alternative supply chain to China.

BHP CEO Mike Henry told the Financial Times this week the company was considering reopening old mines in Arizona as a result of the US administration’s ‘breathtaking’ shift to build up the mining industry.

The mining giant has already earmarked more than $840 million for its Olympic Dam copper operations in South Australia.

-reporting with Reuters

38m agoWed 15 Oct 2025 at 2:46am

Will gold prices stay up in the long term?

Yes, thinks UBS analysts.

The price of gold is up around 20% in the past three months, to US$4,126 or A$6,330 an ounce, well ahead of forecasts.

UBS has lifted its long-term gold price by US$450 an ounce to US$3,250 an ounce, saying the investment bank has an ‘even more bullish outlook for gold.’

“Whilst we’re aware of the risks of chasing higher prices and ‘peak cycle’ behaviours, we see limited risk of gold prices reverting to our previously assumed US$2,800 per ounce long -term price,” the analyst note reads.

“We continue to view gold’s rationale as a strategic asset for investors to hold and diversify portfolios against macroeconomic risks and geopolitical uncertainties over the long run.”

The spot gold price is at around US$4,100 an ounce.

52m agoWed 15 Oct 2025 at 2:31amRBA’s Hunter flags hotter-than-expected inflation

I’m back at the desk from the Citi Investment Conference and thought I’d share my impressions of RBA chief economist Sarah Hunter’s speech and Q&A session.

My top takeaway would be — don’t hold your breath for more interest rate cuts.

After yesterday’s RBA meeting minutes, from its September on-hold decision, were taken to be fairly hawkish, Dr Hunter’s speech would have done little to reignite hopes for much further easing.

She spoke about productivity and noted the central bank had downgraded its outlook for productivity growth over the next few years, and that means it’s also lowered the pace of growth it thinks the economy can sustain without generating inflationary pressures.

As a result, Dr Hunter said the 1.8% annual GDP growth recorded in the June quarter, while slow by historical standard, was actually broadly balanced from the RBA’s point of view.

So, economic growth is not ringing alarm bells for the RBA.

And at the same time, Dr Hunter flagged that recent data suggested underlying inflation was likely to be stronger than the RBA had forecast for the September quarter.

“This may suggest that the labour market, and economic conditions more generally, remain a bit tighter than we had assessed — and we’re actively analysing this question ahead of our next set of forecasts which will be released in November,” she said.

So economic growth okay, inflation potentially hotter than expected and the jobs market stable to tighter than forecast — I’d say Dr Hunter’s remarks add to the emerging view that the RBA could have just one more interest rate cut to go or be already done with cutting this cycle.

There’s less than three weeks to go until the next RBA decision and the updated economic forecasts that’ll come with it.

A quick check in on market pricing on LSEG puts the chance of no change in rates in November at 56%, with a 44% chance of a 0.25 percentage point cut.

1h agoWed 15 Oct 2025 at 2:23amBrent oil futures edge lower

Brent oil futures are down, as US-China trade tensions escalate and the International Energy Agency warns of oversupply.

Brent oil futures fell as low as $US61.50 a barrel overnight.

Last week, US President Donald Trump threatened to apply an additional 100% tariff on Chinese imports. China then sanctioned US units of South Korean shipping giant Hanwha Ocean.

CBA commodities analyst Vivek Dhar said these moves could delay any normalisation in US-China trade.

“There are credible concerns that a normalisation in US-China trade, which was widely anticipated by early November when the US-China trade truce was set to expire, may be delayed.”

Meanwhile, the International Energy Agency’s monthly oil market report says it’s only a matter of time before observed global stockpiles rise and pointed at a significant increase in oil stored in tankers in September.

“Another reason why global oil inventories may start rising now is that refining activity typically tapers off from September as refined product demand seasonally weakens,” Mr Dhar said.

1h agoWed 15 Oct 2025 at 2:05am

Fuel prices don’t add up

Petrol prices vary across Australia, but discrepancies of 50 cents per litre are prompting calls for an investigation

This story resonates, I don’t fill up in my locally area of Sutherland each week, I instead travel 10mins to Padstow where the price is 50c cheaper. It doesn’t add up that there is such a price discrepancy between neighboring suburbs.

– Colin

Thanks for your comment Colin.

Don’t forget there are lots of apps for finding the cheapest fuel including ones run by state governments.

These include:

Fuel Check NSW FuelWatch WAMyFuel NTFuelCheck Tas1h agoWed 15 Oct 2025 at 1:44amMarkets at lunchtime

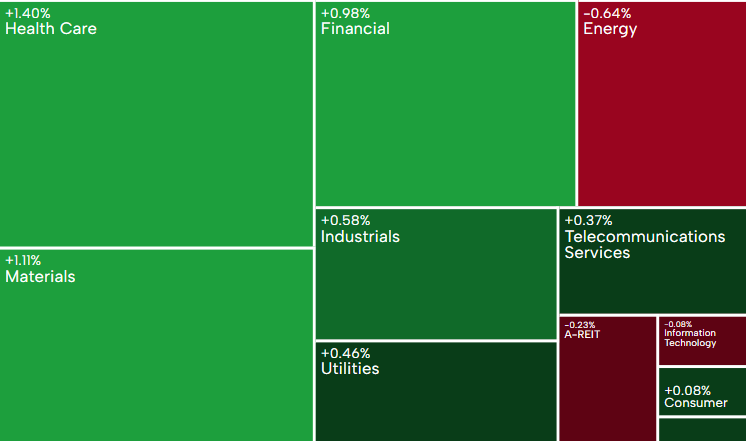

Australian shares are up at lunchtime trade, with the benchmark on track to record its best day in two weeks, if current trends hold.

The ASX200 is up 0.8% to 8,968 points (as at 12.35pm AEDT).

The broader All Ordinaries index is up 0.7% to 9,274 points.

Banks, healthcare and materials are leading the sectors today, while energy is down.

ASX 200 Sectors (ASX)

ASX 200 Sectors (ASX)

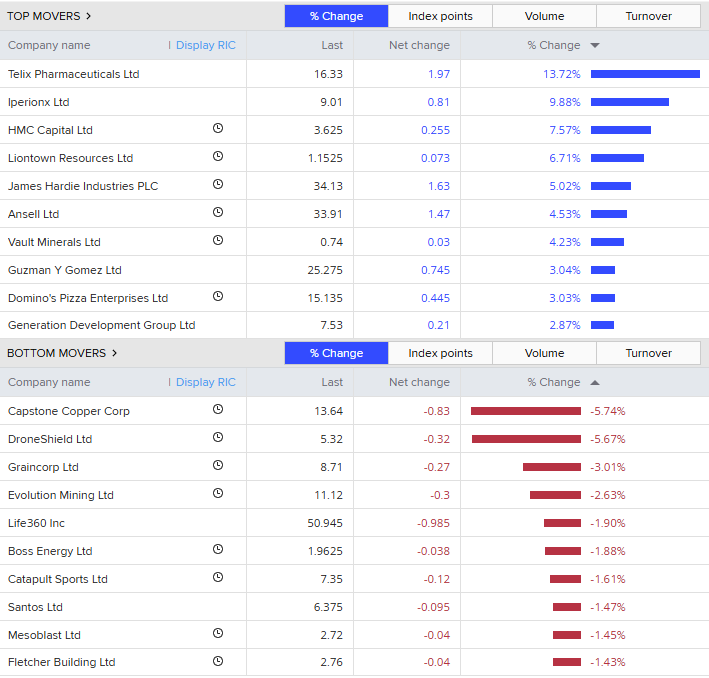

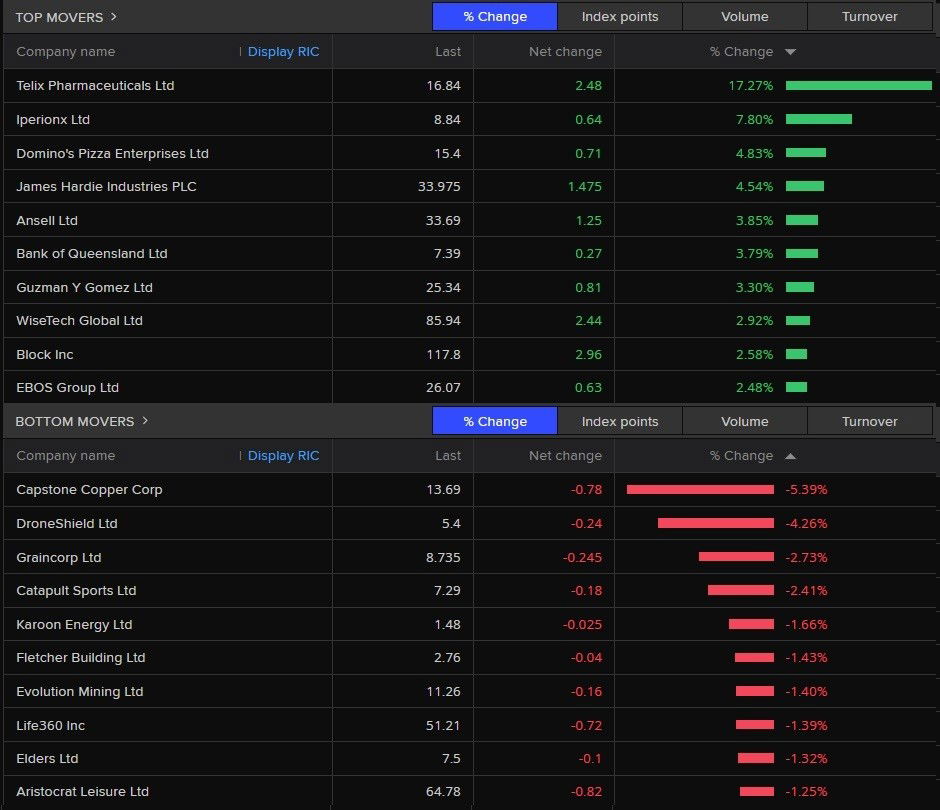

The top performing individual stocks are Telix Pharmaceuticals — up almost 14%, after the healthcare company saw its third-quarter revenue jump.

Titanium metals products company Iperionx is up 10% after filing strong full year results.

Top and bottom movers (Eikon)

Top and bottom movers (Eikon)

Capstone copper is down almost -6%, while DroneShield is down -5.7%.

2h agoWed 15 Oct 2025 at 1:06am

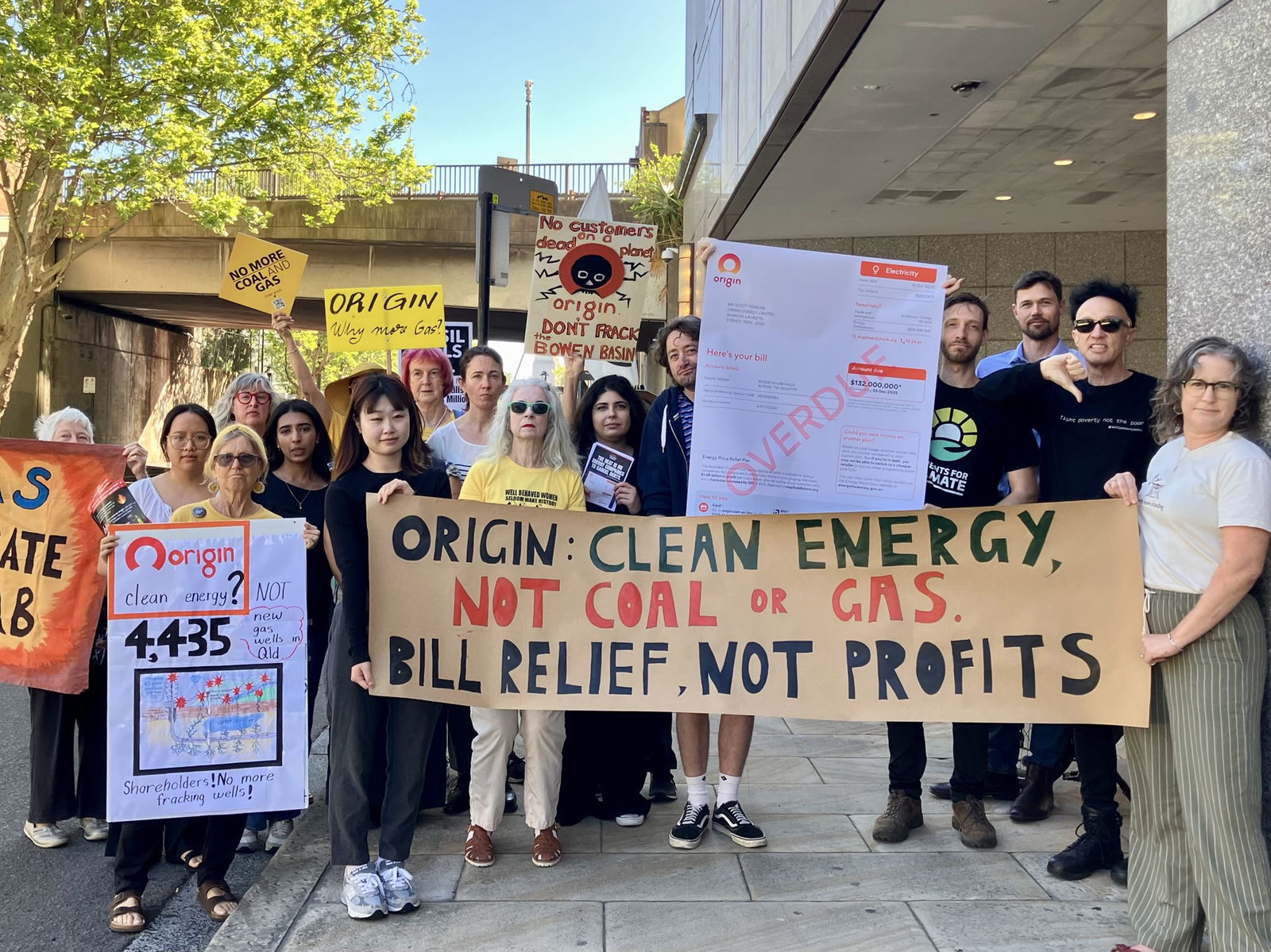

Not all happy at Origin Energy AGM

Hold an annual general meeting (AGM) and the shareholders get to come and have their say.

So too, people unhappy with your business.

Protestors outside Origin Energy’s AGM (Supplied)

Protestors outside Origin Energy’s AGM (Supplied)

Out the front of Origin Energy’s AGM are clean energy campaigners and supporters of the ‘Stop The Bill Shock’ campaign who want shareholders to wipe debt for 89,000 customers who are on hardship plans.

‘Stop the Bill Shock’ campaigners outside Origin Energy’s AGM today (Supplied)

‘Stop the Bill Shock’ campaigners outside Origin Energy’s AGM today (Supplied)

The Australian Energy Regulator found high levels of energy debt in its last market report in December 2024. (It’s a record, depending on if you count proportion of debts or size).

Contrasting with this, Origin Energy reported a +26% lift in profit to more than $1.48 billion in financial year 2024.

The campaign is run by Sweltering Cities, the Antipoverty Centre and Parents for Climate.

Jay Coonan of the Antipoverty Centre says the debts are enormous to those with them, but small to the company.

“Origin could wipe every debt for customers on a hardship plan and still have more than an estimated $1.2 billion in profit leftover in FY25,” they said.

Parents for Climate’s Nic Seton says the company can do better:

“Families are being squeezed while Origin makes billions from expensive and outdated coal and gas. Origin needs to prove it’s part of the solution by using its record profits to wipe household energy debt and invest in cheaper, cleaner power, instead of keeping parents trapped paying for the past.”

The share price of Origin Energy has gone up +19% this year.

It’s currently down -0.3% today, to $12.06 a share.

2h agoWed 15 Oct 2025 at 12:54am

An 1840s birthday?

After an unnamed bank merged some logins, they lost my birthday and I had trouble identifying myself. I asked and was told it wasn’t reset to a default such as 1st January 1900,

Apparently I was born 1st January 1840. Not only am I looking pretty good for my age, but now you can ask me about bread prices even before 1900.

– Bof

Hi Bof,

Wow, you’re officially old.

So what exactly were bread prices back then?

2h agoWed 15 Oct 2025 at 12:40am

US-China tensions make forecasts challenging: RBA

Our very own Stephanie Chalmers asked RBA chief economist Sarah Hunter whether the US-China tensions have made forecasting more challenging.

“It’s certainly an unpredictable situation to be dealing with; we’re still in a phase seemingly where we wake up to start the day and there’s another major announcement come through,” she says.

“I guess my China team and my international team more broadly are getting a real workout at the moment and working pretty hard on this and it is pretty challenging.”

While the team is still working through the latest ‘escalations’, Sarah Hunter says historically uncertainty drags on the outlook.

“It makes it very hard for businesses to make decisions, in particular, around investment. It can be pretty challenging for consumers as well. If you’re concerned you might be at risk of losing your job that can dampen your spending too.

What we’ve seen in the data through to now is I think there’s some of that may be coming through in the US, around the main market data in particular.

We’re seeing less evidence of that here in Australia.”

2h agoWed 15 Oct 2025 at 12:35am

RBA board continually reassessing view: Hunter

Dr Hunter wraps up her prepared remarks with some comments on the outlook for interest rates, although nothing too revealing.

“Given these signs that private demand is recovering, and indications that inflation may be persistent in some areas, while labour market conditions have been stable, the Board decided that it was appropriate to maintain the cash rate at its current level at the September meeting.

“Looking forward, we will monitor outcomes and continually reassess our view on the outlook for the economy, and the Board will adjust policy as appropriate as new information comes to hand.”

After yesterday’s RBA meeting minutes, ANZ senior economist Adelaide Timbrell said she forecast only one more rate cut this cycle, with no cuts more likely than two more, while CBA head of Australian economics Belinda Allen described the tone as “hawkish”.

Dr Hunter is now taking questions and says the RBA wants to keep inflation around roughly where it is now.

RBA’s Sarah Hunter (ABC News: Stephanie Chalmers)

RBA’s Sarah Hunter (ABC News: Stephanie Chalmers)

2h agoWed 15 Oct 2025 at 12:30am

Our August forecasts look pretty good: RBA’s Hunter

RBA chief economist Sarah Hunter is coming to near the end of her speech in Sydney and then should be taking questions.

Dr Hunter says, from “a monetary policy standpoint, our August [statement on monetary policy] forecasts looked pretty good”.

“We expected inflation to stay around the midpoint of the target band over the next two years and for labour market conditions to remain broadly stable, with employment growth tracking underlying population growth.

“But of course – as always – there were material risks on both sides of that central projection, as we set out in the August SMP and as I have discussed in previous speeches. One such set of risks stems from the outlook for productivity,” she says.

2h agoWed 15 Oct 2025 at 12:27am

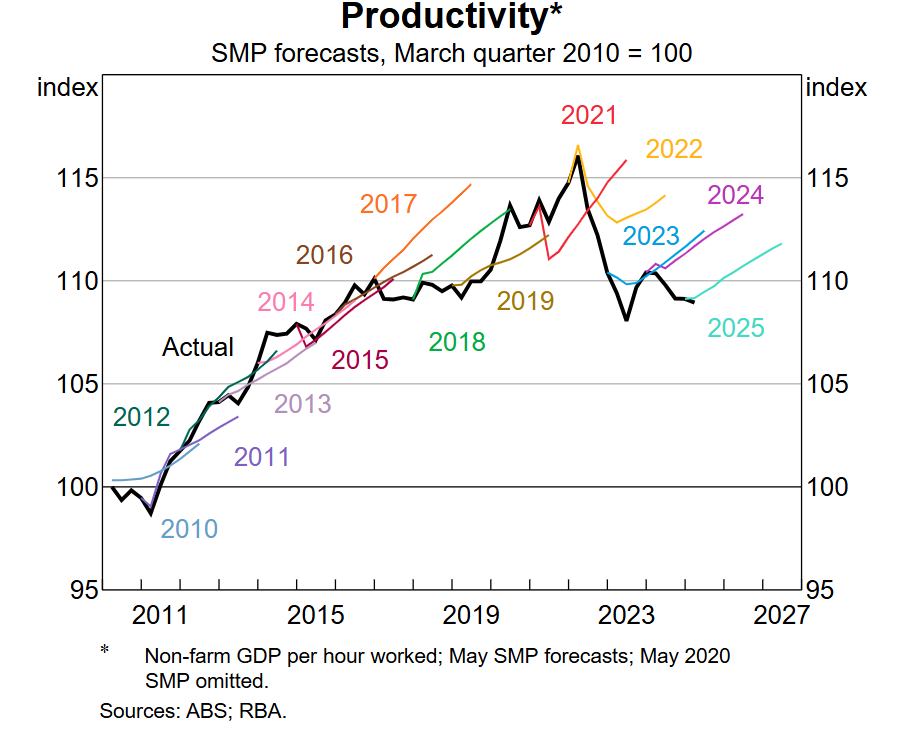

RBA downgrades short-term productivity outlook

Dr Hunter notes that the central bank downgraded its outlook for productivity growth in its August statement on monetary policy.

That’s after repeated forecasts for it to pick up proved incorrect:

(Source: RBA)

(Source: RBA)

“…we downgraded our medium-term trend productivity growth assumption from 1.0 per cent per annum to 0.7 per cent in the August SMP,” she says.

“It’s worth emphasising that this is an assumption about productivity growth for the next two years or so.

“It says nothing about the outlook for productivity growth over the longer term which will be shaped by a broad range of developments, including the pace of diffusion of new technologies like AI.

“And consistent with this shorter time horizon, we will revisit the assumption regularly over time as the outlook for productivity changes.”

3h agoWed 15 Oct 2025 at 12:22am

How long does it take to earn a loaf of bread?

RBA’s Sarah Hunter is outlining why productivity growth is important to the economy and the central bank.

“Most fundamentally, it is a key driver of improvements in our living standards over the medium term. As productivity rises, it becomes cheaper to produce goods and services, and the economic pie grows as we can produce more with the scarce resources we have,” she says.

“In the data that economists track, this improvement shows up as an increase in real incomes, which is a dollar value of the goods and services we can buy per hour worked, after stripping out inflation.”

Dr Hunter gives the example that 1901, it took 18 minutes on average to earn enough to buy a loaf of bread, while today it takes an average of just four minutes.

“When productivity rises, we produce (and so earn) more. This allows all of us to either consume more or work less and spend more time doing what we value most, or potentially both,” she says.

“In fact, Australians have used around one-quarter of the productivity gains since 1980 to work less and have more leisure, with the rest being banked as higher income and consumption.”

If any of our blog readers have experienced having increased leisure time since 1980, drop us a comment! I won’t do a similar call out for people who were buying bread in 1901.

3h agoTue 14 Oct 2025 at 11:59pm

RBA’s assistant governor Sarah Hunter speaking

RBA chief economist and assistant governor Sarah Hunter is now speaking at the Citi Investment Conference.

Her speech is titled ‘Why Productivity Matters for Central Bankers’.

She says as a central banker, her focus on productivity has to be on its impact on economic growth.

3h agoTue 14 Oct 2025 at 11:53pm

RBNZ’s chief economist wraps up

RBNZ’s Conway’s parting words are “monetary policy is working”.

He says the New Zealand economy was on track for a “reasonable recovery” before it was derailed earlier in the year by “uncertainty” (presumably Trump tariff-related).

3h agoTue 14 Oct 2025 at 11:53pmTelix Pharmaceuticals and Bank of Queensland among the best-performing ASX stocks

Around 140 out of 200 stocks are trading higher today (so that’s most of them).

Today’s best performing stock on the ASX 200 is Telix Pharmaceuticals, which saw its share price surge 17.3% (in just the first hour of trade).

That’s after the healthcare company, with a focus on cancer treatments, said its third-quarter revenue jumped 53%. Telix also raised its full-year revenue guidance to a range between $US800 million and $US820 million.

Bank of Queensland shares are also in demand, with its share price up 3.8%.

BoQ increased its dividend (from 18 to 20 cents per share) and reported an improved annual profit.

Its full-year cash profit rose 12% to $383 million, driven by its commercial lending division.

However, its statutory annual profit dropped 53% to $133 million. That was mainly due to a $170 million goodwill impairment as BoQ wrote down the value of its “Retail Bank Cash Generating Unit” to zero because of “industry structural shifts in retail banking”.

BoQ also incurred $43 million in “branch strategy” costs as it converted its owner-managed branch network to corporate branches.

Shares of health care, tech and financial stocks rose sharply. (Refinitiv)

Shares of health care, tech and financial stocks rose sharply. (Refinitiv)

3h agoTue 14 Oct 2025 at 11:49pm

Limited scope for earlier easing: RBNZ chief economist

RBNZ chief economist Paul Conway is now being asked about whether the Kiwi central bank should’ve eased interest rates earlier, after our neighbour’s economy has struggled through recession amid restrictive monetary policy.

Conway notes he wasn’t on the monetary policy committee when some of the decisions were being taken, but he does stand by the timing, arguing the scope for earlier easing was limited, given inflation in New Zealand was still around 3%.

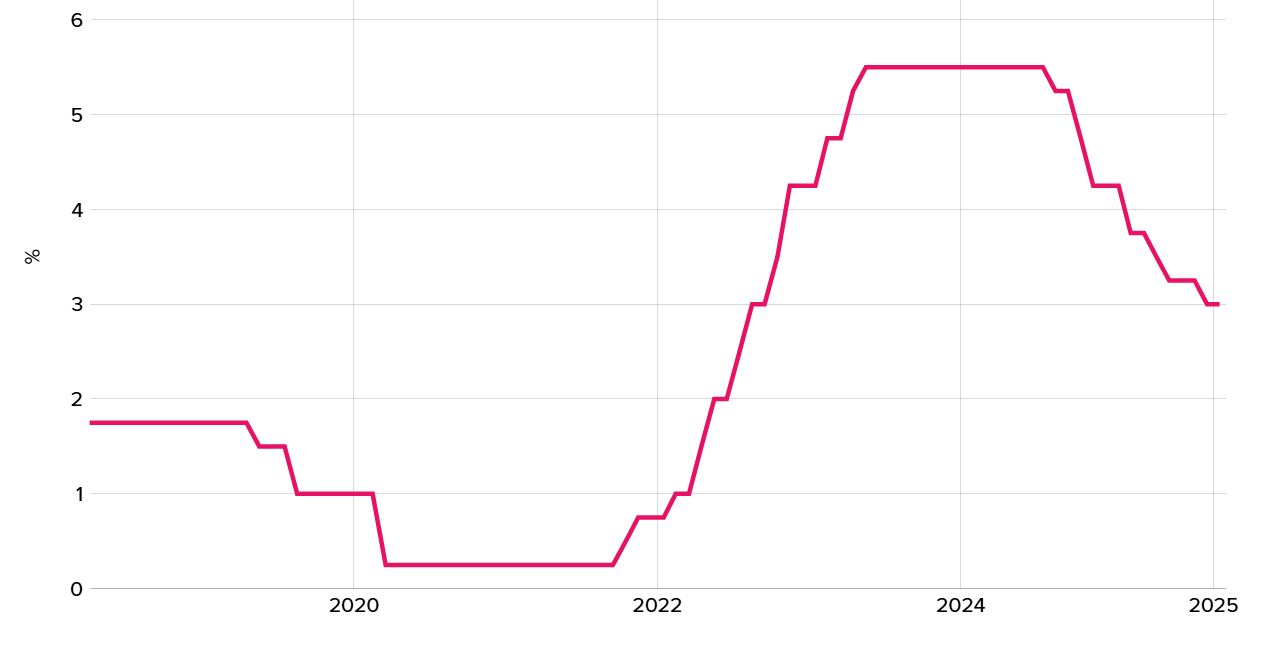

Here’s how NZ’s official cash rate has tracked:

RBNZ official cash rate (Source: RBNZ)

RBNZ official cash rate (Source: RBNZ)

If you want to catch up on how NZ has fared compared to Australia as a result of their divergent rates, The Business interviewed Kiwibank’s chief economist Jarrod Kerr earlier this month:

Loading…

3h agoTue 14 Oct 2025 at 11:35pm

Was the RBNZ’s pandemic monetary policy response worth it?

RBNZ’s Paul Conway is now turning to New Zealand’s monetary policy response to the pandemic, namely, it quantitative easing through Large Scale Asset Purchases (LSAPs).

He says LSAPs clearly kept financial markets functioning smoothly, which is hard to quantify the impact of, but he says it was “critical” to pass through the effects of lower rates to the broader economy.

Conway says LSAPs are a powerful stabilisation tool, but come with costs.

And he did earlier note the central bank did not plan on having to use these tools again anytime soon. But says LSAPs will always remain an important option when interest rates are at their floor.

ASX 200: +0.8% to 8,969 points

ASX 200: +0.8% to 8,969 points