Report Overview

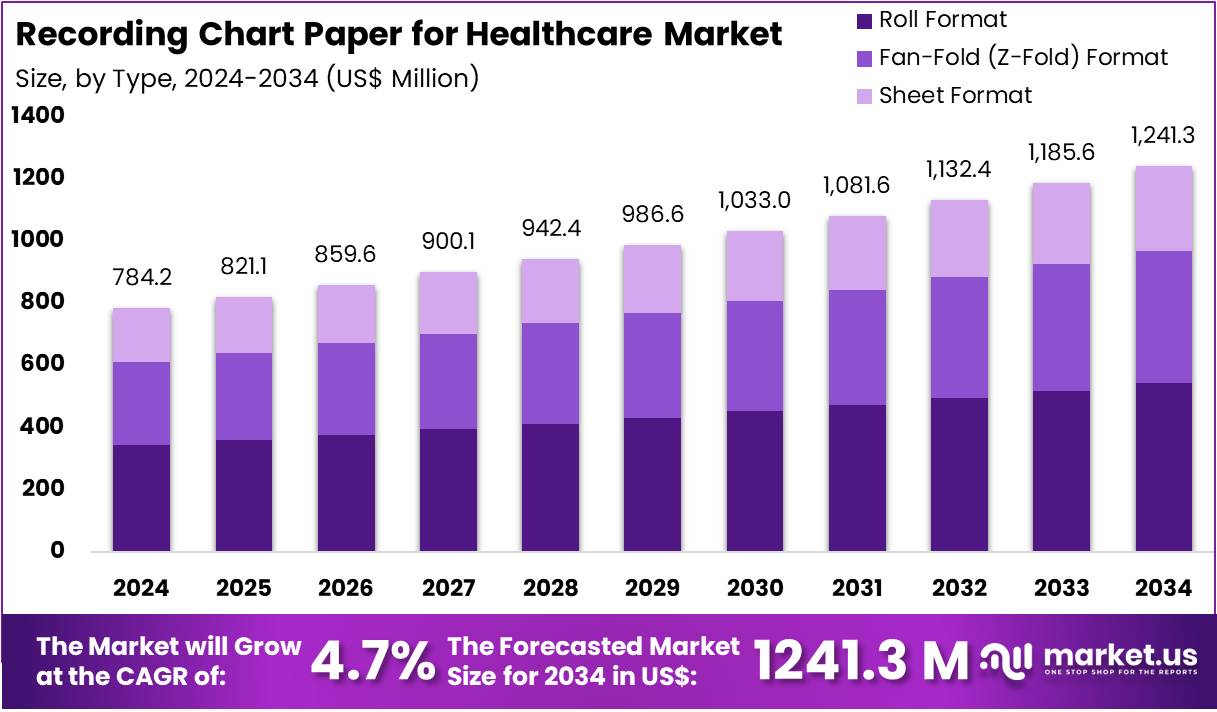

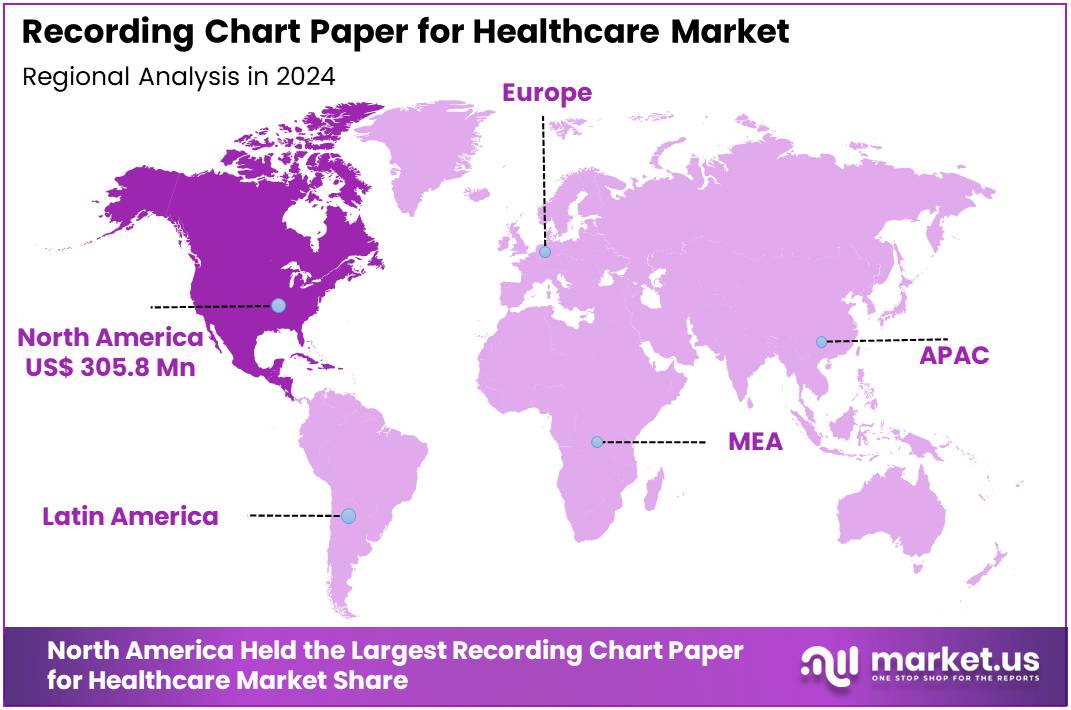

The Global Recording Chart Paper for Healthcare Market size is expected to be worth around US$ 1241.3 Million by 2034, from US$ 784.2 Million in 2024, growing at a CAGR of 4.7% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 39% share and holds US$ 305.8 Million market value for the year.

Recording chart paper is a specialized medium used in medical equipment for capturing patient data such as heart rate, blood pressure, respiratory patterns, and fetal activity. It is widely applied in electrocardiographs (ECG), electroencephalographs (EEG), and patient monitoring systems. According to healthcare practices, the precision and durability of this paper are vital as they directly affect the readability and interpretation of diagnostic results. Hospitals, clinics, and diagnostic laboratories remain the primary end users, sustaining consistent demand worldwide.

The global market is driven by the rising burden of chronic diseases, particularly cardiovascular disorders. The World Health Organization (WHO) reported that 19.8 million people died from cardiovascular diseases in 2022, representing 32% of global deaths. For instance, ECG remains a frontline diagnostic tool in stroke and heart attack management, where printed tracings support bedside decisions. This reliance ensures continuous demand for ECG chart paper in healthcare facilities, especially in emergency and inpatient settings.

Population ageing further boosts market demand. The United Nations estimates that by 2050, one in six people will be aged 65 years or older. Older populations require frequent cardiac and neurological monitoring, often using legacy devices that still generate paper outputs. For example, many hospitals operate in hybrid digital–paper environments, where printed results remain integral to diagnostics. This trend strengthens the role of recording chart paper as a reliable component of routine patient care.

Hospital activities also contribute to consumption levels. According to OECD data, there were about 130 hospital discharges per 1,000 population in 2021. Each hospital admission is associated with monitoring events in peri-operative and inpatient care, which often produce paper-based results. Maternity monitoring represents another strong driver. Study guidelines from the UK’s National Institute for Health and Care Excellence recommend continuous fetal monitoring for certain labor cases. Cardiotocography (CTG) in such settings still produces printed strips for real-time assessment and long-term storage.

Record-retention regulations across health systems reinforce the need for durable chart papers. For example, the NHS Records Management Code requires maternity records to be stored for over 20 years. Similarly, US federal guidance mandates long-term retention of fetal monitoring, EEG, and ECG strips. Regulatory oversight from agencies such as the US FDA, which has historically reviewed ECG recording paper as an accessory, supports standardized product cycles. These compliance obligations ensure ongoing replacement demand in both public and private sectors.

Infrastructure realities in emerging economies also sustain usage. The World Bank reported in 2023 that about 92% of the global population had access to electricity, leaving 660 million people without reliable supply. In such areas, paper-based recording provides a practical and low-cost solution. According to WHO’s Global Health Expenditure Database, healthcare spending continues to rise worldwide, with higher GDP allocations toward hospital and primary care. This expansion supports procurement of consumables, including recording chart paper, to meet diagnostic needs in both developed and developing regions.

Key Takeaways

The global recording chart paper market in healthcare is projected to reach US$ 1241.3 million by 2034, growing steadily at 4.7% CAGR.

In 2024, the Roll Format segment held dominance within the type category, capturing 43.8% market share, reflecting widespread usage across healthcare applications.

Cardiology Monitoring emerged as the leading medical specialty application in 2024, commanding a 38.1% share, indicating its strong reliance on recording chart paper.

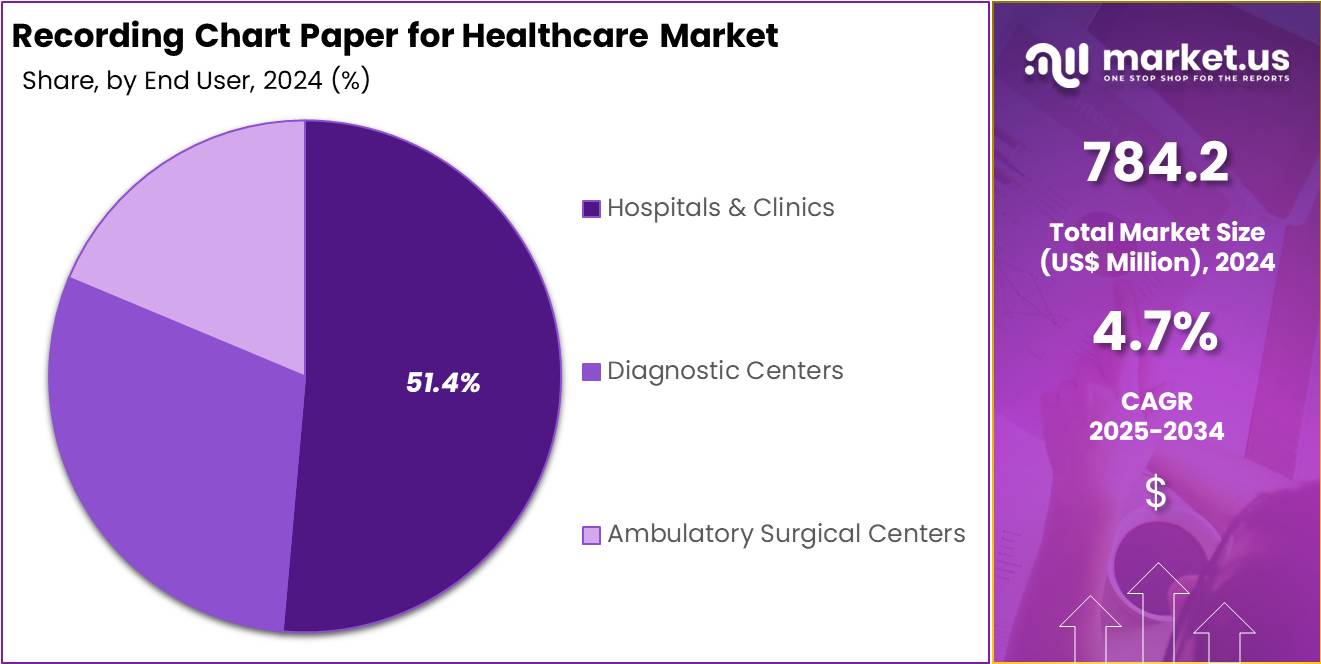

Hospitals and Clinics represented the largest end-user group in 2024, securing 51.4% market share, highlighting their critical dependence on recording chart paper usage.

Within distribution channels, Direct Sales dominated in 2024, accounting for 48.5% of the market, underscoring preference for direct procurement over intermediaries.

North America led the global market with a 39% share in 2024, recording a market value of approximately US$ 305.8 million.

Type Analysis

In 2024, the Roll Format held a dominant market position in the Type Segment of Recording Chart Paper for Healthcare Market, and captured more than a 43.8% share. This position was achieved due to its wide use in patient monitoring and diagnostic systems. The roll format is easy to handle and offers longer recording capacity. It also supports compatibility with many medical devices. These features make it a preferred choice for hospitals and healthcare centers worldwide.

The Fan-Fold (Z-Fold) format secured a notable share in the type segment. It is widely used for its structured design and simple record management. The format supports quick access to records and lowers the risk of paper jams. Healthcare providers prefer it for organized storage and sequential documentation. Its consistent demand is driven by the need for reliable recording formats. This makes the fan-fold option a strong segment with stable growth prospects.

The Sheet Format contributed a smaller share within the segment. This format is mainly applied where short-term recording is required. It is often used in specific diagnostic setups where ease of replacement is critical. While its demand is lower compared to roll and fan-fold formats, it continues to serve niche applications. Its role in supporting certain clinical processes ensures steady demand. The sheet format therefore remains a supporting segment in the overall recording chart paper market.

Medical Specialty Analysis

In 2024, the Cardiology Monitoring held a dominant market position in the Medical Specialty Segment of Recording Chart Paper for Healthcare Market, and captured more than a 38.1% share. This dominance was explained by the rising number of cardiovascular diseases worldwide. Cardiac rhythm documentation was considered essential for long-term monitoring and patient safety. Increasing hospital admissions, coupled with the clinical demand for accurate ECG tracking, further reinforced the strong share of cardiology monitoring within this market segment.

The Fetal Monitoring segment was observed to contribute significantly to overall demand. The segment’s growth was linked to an increasing focus on prenatal healthcare and continuous fetal heart rate tracking. Recording chart paper was considered crucial for providing reliable documentation during high-risk pregnancies. Neurology (EEG) also emerged as a steady contributor, supported by rising cases of epilepsy, sleep disorders, and other neurological conditions. EEG chart paper was found to be important for capturing brain wave patterns accurately.

The Obstetrics & Gynecology (OBGYN) segment displayed consistent adoption, supported by the need to monitor maternal health and hormonal activity. Reliable documentation was required during labor and other gynecological procedures, which encouraged demand for recording chart paper. Emergency Medical Services (EMS), although smaller in scale, was noted to grow at a faster pace. Rising reliance on point-of-care testing and mobile medical units supported this trend. EMS chart paper played a vital role in documenting vital signs immediately during pre-hospital emergency care.

End User Analysis

In 2024, the Hospitals & Clinics held a dominant market position in the End User Segment of the Recording Chart Paper for Healthcare Market, and captured more than a 51.4% share. This position was linked to the large volume of patient admissions. Frequent use of recording devices in emergency units and surgical wards supported this dominance. Hospitals and clinics depend heavily on accurate chart documentation to ensure compliance and reliability in patient monitoring, diagnosis, and treatment processes.

Diagnostic Centers represented another key segment of the market. Their adoption of recording chart paper was driven by the rising number of diagnostic tests. These tests include electrocardiograms, stress tests, and similar evaluations that require reliable documentation. Increased awareness of preventive healthcare also supported demand in this segment. The expansion of diagnostic services in both urban and semi-urban areas further boosted usage. Diagnostic centers are expected to continue playing a vital role in market growth.

Ambulatory Surgical Centers contributed a smaller but growing share of the market. Their demand was supported by the rising number of outpatient procedures. Many centers focus on same-day surgeries and minimally invasive techniques. These facilities rely on cost-effective chart paper solutions to record patient data during treatment. Growth in ambulatory services has been supported by patient preference for lower costs and shorter stays. This segment is anticipated to expand steadily as healthcare systems adopt outpatient care models globally.

Distribution Channel Analysis

In 2024, the Direct Sales held a dominant market position in the Distribution Channel Segment of the Recording Chart Paper for Healthcare Market, and captured more than a 48.5% share. This leading position was supported by strong supply agreements between manufacturers and hospitals. Direct procurement ensured steady product availability and consistent quality. Healthcare providers preferred this channel because of its reliability. Long-term collaborations also built trust. Direct sales became the most dependable option for critical medical settings.

The Distributors and Wholesalers segment followed with a considerable share of the market. This channel extended the manufacturers’ reach to smaller hospitals, diagnostic centers, and laboratories. It also provided flexibility and wide-scale availability of products. Competitive pricing and bulk supplies made this option attractive to medium-sized buyers. Many healthcare facilities used distributors to manage stock efficiently. The role of intermediaries helped in maintaining access to diverse customer groups across various healthcare service providers.

The E-Commerce Platforms segment recorded fast growth in recent years. Digital procurement trends drove this expansion. Online platforms gave healthcare organizations easy product visibility, transparent comparisons, and faster purchase processes. Smaller clinics and independent providers showed strong interest in this channel. The Others segment, including regional suppliers and niche retailers, held a smaller share. Yet, it met local and customized requirements. These channels provided specialized services when needed. E-commerce is expected to become the fastest-growing option in the coming years.

Key Market Segments

By Type

Roll Format

Fan-Fold (Z-Fold) Format

Sheet Format

By Medical Specialty

Cardiology Monitoring

Fetal Monitoring

Neurology (EEG)

Obstetrics & Gynecology (OBGYN)

Emergency Medical Services (EMS)

By End User

Hospitals & Clinics

Diagnostic Centers

Ambulatory Surgical Centers

By Distribution Channel

Direct Sales

Distributors and Wholesalers

E-Commerce Platforms

Others

Drivers

Rising Demand for Accurate Patient Monitoring and Documentation

The demand for recording chart paper in healthcare is rising due to its vital role in accurate patient monitoring and diagnostic documentation. According to studies, hospitals and clinics continue to depend on chart paper for applications such as electrocardiograms (ECG), electroencephalograms (EEG), and fetal monitoring. This medium ensures reliable physiological data capture, supporting effective diagnosis and treatment planning. For example, in cardiology, printed ECG outputs remain a standard requirement, highlighting the enduring relevance of chart paper in modern clinical practice.

Compliance with healthcare regulations is another strong driver for this market. Recording chart paper provides transparent, traceable, and physical records that meet medico-legal requirements. According to regulatory guidelines, institutions are required to maintain precise medical documentation for verification and auditing purposes. Chart paper offers a tangible record, minimizing risks linked to system errors or interoperability issues. For instance, medico-legal disputes often require hardcopy evidence, where physical documentation serves as an additional layer of assurance for compliance and accountability.

Procurement activities reinforce this demand. A study by NHS revealed a national framework for “Medical Chart Paper & Ultrasound Film” running from October 2023 to October 2027, with a framework value of £4.95 million. This framework covers modalities such as CTG and ECG paper, confirming the institutional purchasing trend. Such structured procurement programs emphasize the ongoing requirement for physical chart paper in healthcare systems, ensuring market stability. For example, multi-year NHS procurement contracts directly validate the sustained use of chart paper in patient monitoring.

High utilization of monitoring systems further sustains demand. For instance, electronic fetal monitoring (EFM/CTG) is used in approximately 90% of labors, multiplied by around 3.6 million births in the U.S. during 2023. This translates into significant volumes of paper strip usage in sites archiving on paper. According to equipment specifications from GE and Philips, cardiographs still require thermal chart paper as standard. These specifications, combined with high procedure volumes, demonstrate how recording chart paper remains embedded in healthcare workflows through 2025 despite the growth of digital systems.

Restraints

Digital Transformation and Declining Demand for Paper-Based Recording in Healthcare

The recording chart paper market in healthcare is facing significant restraints due to the transition toward digitalization. According to a study by OECD (2023), primary care providers across member nations are increasingly adopting electronic medical records (EMRs) and electronic health records (EHRs). For instance, U.S. hospitals reported that 70% were engaged across all interoperability domains in 2023. This transformation reduces reliance on paper-based methods for clinical documentation, which in turn minimizes the demand for recording chart paper within healthcare operations.

The integration of digitized patient management systems is contributing to the long-term decline in paper use. Study by NHS England (2023) indicated that 90% of NHS trusts had adopted EPRs, with projections rising to 94% in 2025. For example, this wide-scale deployment allows hospitals to store, access, and share patient information digitally, thereby discouraging manual charting solutions. Digitized systems also improve efficiency and reduce errors, making physical chart paper less attractive for modern healthcare providers.

Technological advancements in monitoring devices and data management platforms further accelerate this decline. According to U.S. statistics (2024), e-prescribing is supported in nearly all pharmacies with 92% prescriber capability, demonstrating a shift toward digital-first solutions. For instance, modern patient monitors now include optional recorder modules where chart paper use is not a default requirement. This design trend allows facilities to operate entirely digitally, reducing purchases of chart paper. Remote monitoring and cloud-based data sharing also provide benefits unmatched by traditional paper recording.

The overall impact on the recording chart paper market is structural and long term. For example, England’s NHS reported that by May 2025, 94% of acute trusts were using live EPR systems, leaving only 6% reliant on paper-based methods. According to NHS England board reports (2025), digital foundations remain a strategic priority, further reinforcing this substitution effect. With interoperability, centralized databases, and seamless information flows becoming the standard, the adoption of advanced digital alternatives directly limits the market potential of chart paper in healthcare.

Opportunities

Sustainable and Cost-Effective Opportunities in Recording Chart Paper for Healthcare

The demand for eco-friendly recording chart papers in healthcare is growing as sustainability concerns rise. Hospitals, diagnostic centers, and other healthcare institutions are increasingly implementing green procurement policies. According to a study, this trend creates opportunities for manufacturers to develop biodegradable, recyclable, and environmentally safe chart papers. As healthcare facilities aim to meet global sustainability goals, this shift towards eco-friendly alternatives opens up new avenues for manufacturers to innovate and capture market share in a rapidly changing industry.

Affordability remains a key factor in emerging economies, where healthcare budgets are constrained. For instance, in countries like India, cost-effective options for recording chart paper are essential for maintaining affordable healthcare services. According to price data, a 80mm × 20m ECG roll costs between ₹121–₹142, making it a high-volume product. Manufacturers who focus on producing durable and low-cost chart papers can tap into this market segment, offering eco-friendly solutions without sacrificing affordability.

Regulatory bodies are playing a crucial role in shaping the future of recording chart papers in healthcare. For example, the European Union banned BPA in thermal paper under REACH regulations, and a broader restriction on bisphenols is expected in the coming years. According to ongoing studies, this trend towards phenol-free products, including chart paper, aligns with the global push for sustainable procurement. Healthcare tenders are increasingly favoring eco-friendly and compliant products, strengthening the opportunity for manufacturers to meet both environmental and regulatory standards.

The growing need for decarbonization in healthcare also presents an opportunity for innovation. Healthcare is responsible for around 5% of global emissions, with consumables like chart paper under scrutiny for their environmental impact. According to recent reports, the paper recovery system in the U.S. recycles about 60–64% of paper, highlighting a gap in full recyclability. As healthcare facilities work toward carbon neutrality, manufacturers can innovate by offering recyclable, phenol-free chart papers to meet these sustainability targets, increasing their appeal in the market.

Trends

Continued Use of Recording Chart Paper in Healthcare Amid Digital Transformation

The trend of using recording chart paper in healthcare continues, particularly in regions with developing infrastructure. While digital solutions are becoming more widespread, chart paper remains a critical tool. Many healthcare facilities still rely on it as a backup, ensuring continuity of care in the event of system failures. This hybrid approach allows for immediate documentation, especially when digital infrastructure is unreliable. The presence of chart paper ensures healthcare workers can continue their work without interruption during digital system outages.

In addition to its role as a backup, recording chart paper serves as a method for data validation and verification. Healthcare professionals use it to cross-check digital entries, which helps to minimize errors and maintain data accuracy. This dual-checking system ensures that patient information remains reliable, providing an extra layer of security in patient care. As a result, chart paper continues to play an essential role in confirming the integrity of digital records.

Regulatory requirements also contribute to the continued use of chart paper in healthcare. Some jurisdictions mandate physical documentation for specific procedures, necessitating the use of recording chart paper. These regulations ensure compliance with healthcare standards and protocols, reinforcing the importance of hybrid documentation systems. In these areas, chart paper is not only a tool for validation but also a necessary component for meeting legal and procedural requirements.

The cost factor plays a significant role in the ongoing demand for chart paper. In areas where digital tools are expensive or underdeveloped, paper-based systems remain a more affordable option. Healthcare facilities, particularly in resource-constrained settings, continue to use chart paper as they gradually transition toward digital solutions. This cost-effective approach ensures that healthcare operations remain functional while healthcare providers work toward enhancing their digital infrastructure in the future.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 39% share and holding a market value of US$ 305.8 million. The region maintained its leadership due to advanced healthcare infrastructure and rising demand for accurate patient monitoring. Hospitals and diagnostic centers in the United States and Canada widely used recording chart paper in cardiology, neurology, and critical care. The strong presence of healthcare providers and regulatory support has further accelerated market penetration across this region.

Although electronic monitoring systems are gaining popularity, recording chart paper remains highly relevant in North America. Hospitals still prefer chart paper for its dependability, simplicity, and ability to provide physical records. Compliance, audit requirements, and medico-legal documentation have further sustained its use. Rural and semi-urban facilities with limited digital access continue to depend on chart paper. This ongoing preference ensures that the product holds its place even as digitalization expands in major cities.

The prevalence of chronic diseases, particularly cardiovascular and respiratory disorders, has created steady demand for monitoring equipment that requires chart paper. The United States has emerged as the largest contributor, driven by high patient admissions and routine health screenings. Strict clinical data recording standards have reinforced the market. Regular monitoring practices and the increasing focus on accurate medical documentation are expected to maintain product demand across multiple healthcare segments in the country.

The presence of leading medical device manufacturers and continuous investment in healthcare technology give North America a competitive advantage. Insurance claim requirements and medico-legal needs emphasize the importance of reliable record-keeping systems. Hybrid solutions that combine digital monitoring with chart paper have gained attention, addressing both technological and regulatory requirements. This approach strengthens the position of recording chart paper and supports its adoption alongside advanced healthcare practices.

Asia Pacific also accounted for a significant share of the global market in 2024 and is projected to expand at the fastest rate. Growth in this region is supported by healthcare infrastructure development, modernization programs, and rising patient admissions. China, India, and Japan are leading contributors due to increasing chronic disease cases and expanding hospital networks. While digital solutions are growing, chart paper continues to be widely used in hospitals, clinics, and laboratories, especially in rural and semi-urban areas where digital access remains limited.

Key Regions and Countries

North America

Europe

Germany

France

The UK

Spain

Italy

Russia

Netherland

Rest of Europe

Asia Pacific

China

Japan

South Korea

India

New Zealand

Singapore

Thailand

Vietnam

Rest of APAC

Latin America

Brazil

Mexico

Rest of Latin America

Middle East & Africa

South Africa

Saudi Arabia

UAE

Rest of MEA

Key Players Analysis

The market for recording chart paper in healthcare is shaped by both global leaders and regional suppliers. Tele-Paper (Sonomed) has gained strength through broad product compatibility and reliable performance, especially in export markets. Nissha Medical Technologies remains a premium player with strong materials science expertise and regulatory compliance. ISD Meditech (SKYMED) is focused on emerging markets with competitive pricing and flexibility. Cardinal Health, through its Kendall line, leverages wide distribution networks and contracting power. Each competitor pursues different strategies to secure market presence.

Tele-Paper demonstrates strong catalog depth and cross-device compatibility, which helps hospitals reduce supply risks. Its export orientation and adoption of low-BPA coatings position it well in cost-sensitive tenders. Nissha, in contrast, emphasizes coating innovation, image quality, and batch traceability. This quality orientation secures loyalty from acute-care hospitals, although pricing limits adoption in budget-driven facilities. ISD Meditech continues to grow by targeting flexible supply needs, yet it still faces hurdles in brand recognition and uneven country-level registrations.

Cardinal Health benefits from entrenched access to GPOs and IDNs in North America. Its Kendall line maintains strong formulary stickiness and trust in supply assurance. However, it lacks the SKU depth of specialist producers. Precision Charts Inc. competes as a niche specialist, offering customization and rapid turnaround for cardiology and neurology departments. Smaller regional converters also participate with private-label programs. While competitive on price, these suppliers often face challenges in regulatory compliance, consistency, and batch reliability compared to established global brands.

Overall, the market remains moderately consolidated at the top, with premium players sustaining influence through regulatory rigor and product quality. Value suppliers continue to win opportunities in decentralized and price-sensitive care environments. Procurement trends show growing focus on traceability, device compatibility, and phenol-free coatings. Hospitals are increasingly advised to pursue dual sourcing, balancing premium anchors with agile, cost-effective partners. This approach secures supply resilience, while also leveraging competitive pricing opportunities. Future growth will likely be shaped by regulatory tightening and shifts in thermal coating chemistry.

Market Key Players

Tele-Paper (Sonomed)

Nissha Medical Technologies

ISD Meditech (SKYMED)

Cardinal Health (Kendall)

Precision Charts Inc.

Harmac Medical

Tianjin Grand Paper Industry Co. Ltd.

Precision Charts Inc.

Thomas Scientific

GlobalSpec

Merck KGaA

Kokusai Chart Co.

Recorders Charts & Pens

Recent Developments

In February 2025: Tele-Paper announced that its Sonomed medical chart paper (encompassing ECG, CTG, EEG papers) had been registered with the UK Medicines and Healthcare products Regulatory Agency (MHRA). A UK Responsible Person was appointed to facilitate this registration. As a result, importers into the UK are able to bypass significant regulatory burdens, thereby saving over £5,000 in fees and reducing import time by up to six months.

In May 2024: NMT secured another asset acquisition, this time acquiring the medical chart paper and industrial ticket business from Print Media, Inc. and Amtec Sales, Inc. This acquisition further broadens NMT’s product offering in medical chart paper, enhances digital imaging capabilities, and strengthens its presence in the U.S. through consolidated operations in Buffalo, New York, with the aim of improved operational efficiency and profitability.

In November 2023: ISD Meditech initiated the production of its SKYMED Medical Chart Recording Paper (used for ECG, CTG, etc.) and SKYMED Ultrasound Paper. This launch represented a strategic expansion of their product portfolio, aimed at fulfilling a critical requirement in medical documentation and diagnostic imaging.

Report Scope