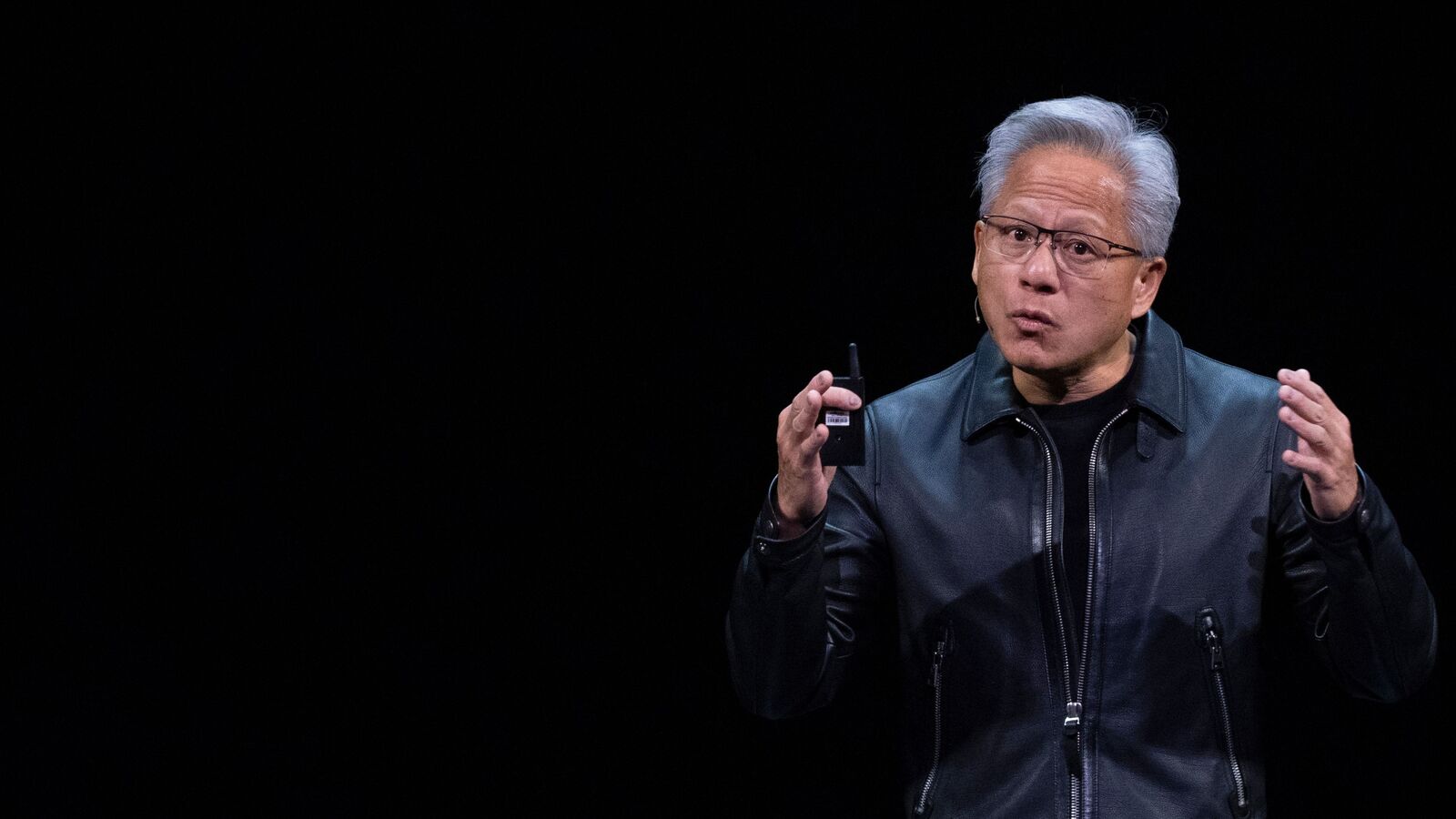

Nvidia Corp. Chief Executive Officer Jensen Huang dismissed worries about an AI bubble, saying the company’s latest chips are expected to generate half a trillion dollars in revenue.

“I don’t believe we’re in an AI bubble,” Huang said during a Bloomberg Television interview. “All of these different AI models we’re using — we’re using plenty of services and paying happily to do it,” he said.

Huang’s latest remarks lessened fears of an AI investment bubble, pushing shares of Nvidia up 5% to a record closing high of $201.03 on Tuesday.

What is an AI bubble?

An AI bubble typically refers to a situation when investor interest or expectations push the valuation of AI-related companies. This situation arises when expectations for future AI profits inflate stock prices. In case these high expectations are not met, the bubble could burst.

Notably, AI-related expenditures are climbing globally. According to US research firm Gartner, they are anticipated to hit about $1.5 trillion by 2025 and exceed $2 trillion in 2026, almost 2% of the world’s GDP.

Why AI bubble sparks concerns?

Since the artificial intelligence boom, concerns have been raised about a speculative bubble similar to the late 1990s dot-com craze, which ended with a dramatic crash and many bankruptcies.

Tech companies are investing heavily in advanced chips and data centres, not only to keep up with the growing popularity of chatbots such as ChatGPT, Gemini, and Claude, but also to prepare for a larger, more disruptive shift of economic activity from humans to machines. The total cost could even touch trillions. Funding comes from venture capital, debt, and increasingly, some unconventional arrangements that have attracted attention on Wall Street.

Supporters of AI recognise that the market is volatile but remain confident in the technology’s long-term promise. They argue that AI is set to transform various industries, find cures for diseases, and broadly advance human progress, Bloomberg reported.

Even with this rapid spending on AI, it is still somewhat unproven as a profitable business model. Tech industry executives who privately doubt the most enthusiastic claims about AI’s revolutionary potential, or at least find it hard to see how to monetise it, may feel they have little choice but to continue investing to keep pace with competitors or risk being overshadowed and sidelined in the future AI market, the report said.

“The numbers that are being thrown around are so extreme that it’s really, really hard to understand them,” David Einhorn, a prominent hedge fund manager and founder of Greenlight Capital told Bloomberg. “I’m sure it’s not zero, but there’s a reasonable chance that a tremendous amount of capital destruction is going to come through this cycle,” he said.