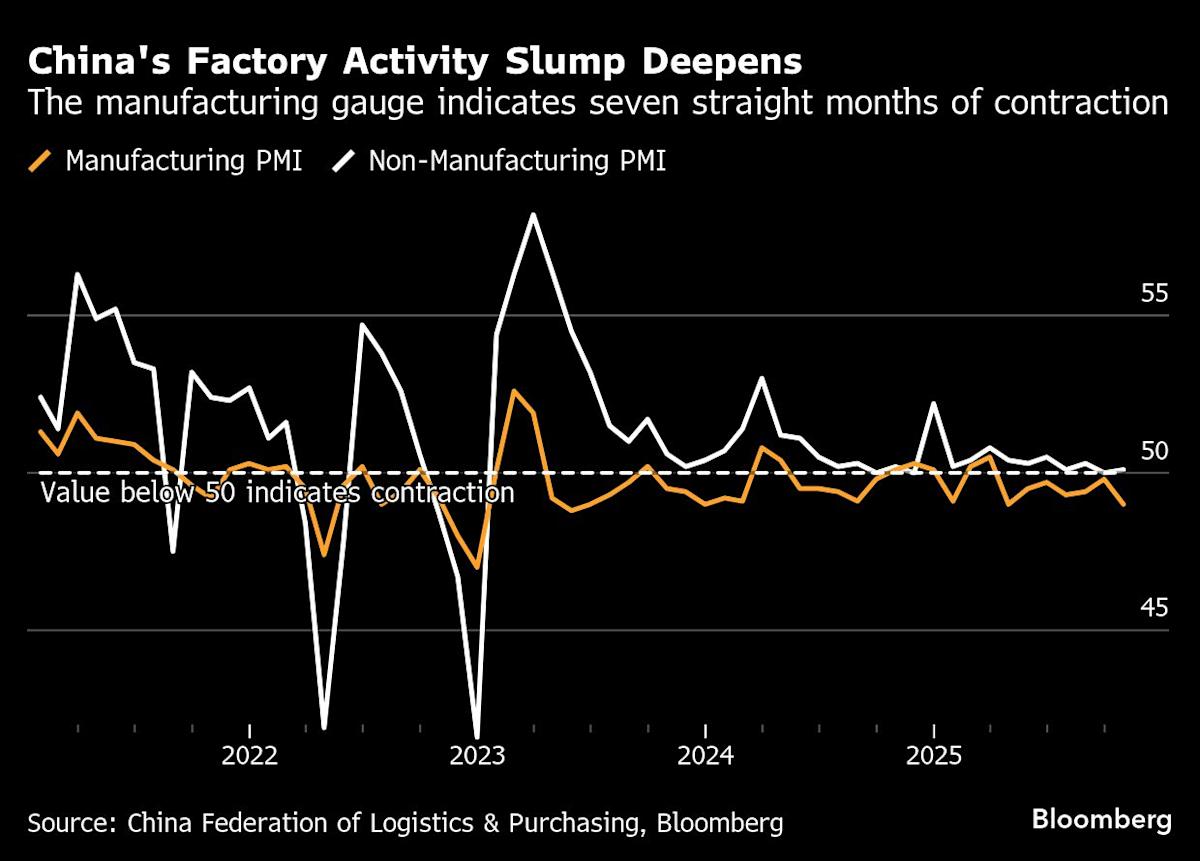

(Bloomberg) — China’s factory activity slumped for the longest streak in more than nine years, prompting fresh calls for greater policy support even as the country reached a trade truce with the US.

The official manufacturing purchasing managers’ index fell more than expected to 49 in October, suggesting activity dropped the most in six months just before a leaders’ meeting stabilized ties this week. New orders shrank the most since 2023 as demand took a hit from trade barriers and weak sentiment at home.

Most Read from Bloomberg

“It is a discouraging start to the fourth quarter,” said Lynn Song, chief Greater China economist at ING Bank NV. The data released Friday is “a reminder that policy support is still needed” to shore up areas of weakness in the economy.

Huo Lihui, a statistician at the National Bureau of Statistics, blamed the sluggish activity on the fewer working days in October because of national holidays and “increased complexity in global environment.” Tensions between the world’s largest economies escalated that month over export controls, with US President Donald Trump threatening additional 100% tariffs on imports from China.

The output sub-index fell below the 50 mark that separates contraction from growth for the first time since April, when Trump unleashed his so-called Liberation Day tariffs. The new export order sub-index also recorded its worst reading since then.

What Bloomberg Economics Says…

“Despite the soft data, more stimulus in the fourth quarter looks unlikely. Improving external environment — helped by recent trade agreements with the US — and progress toward meeting the growth target reduce the need for additional easing.”

— Chang Shu and Eric Zhu

Read the full note here.

Given the broad slowdown in factory activity, manufacturers will likely find relief from the deal reached between Trump and Chinese President Xi Jinping that reduced tariffs on made-in-China products. But weak domestic demand and uncertainties in US-China relations will continue to cast a shadow over their outlook.

The non-manufacturing measure in construction and services inched up to 50.1. Unlike factories, the services sector probably benefited from the eight-day National Day holidays.

Some Chinese exporters who spoke with Bloomberg News expressed optimism the deal will boost orders for their goods, although that prospect no longer excites them as it once did. Many said they’ve learned their lessons from Trump’s trade brinkmanship and now realize they can’t rely solely on access to the world’s biggest consumer market.

With net exports making up nearly a third of China’s growth this year, these companies’ ability in finding new customers outside the US has helped put the economy on track to reach the annual expansion target of around 5%. However, many analysts predict the final three months of 2025 will see the slowest performance since zero-Covid lockdowns roiled production in 2022.

“The latest result from the Trump-Xi summit may provide some positives going forward. But policy support will be necessary to stop the deteriorating momentum,” said Zhaopeng Xing, senior China strategist at Australia & New Zealand Banking Group.

China already injected additional stimulus worth 1 trillion yuan ($141 billion) since late September, including unused bond quota for provinces to expand investment and repay arrears owed to companies, as well as new funding for policy banks to spur investment.

The People’s Bank of China is still expected to cut its policy interest rate and lower the amount of cash banks need to set in reserves, which would unleash liquidity, based on Bloomberg’s survey of economists this month.

Looking over the next five years, Beijing has made clear it plans to keep tech and manufacturing as the top priorities even as it pledged to “significantly” boost the share of consumption in its economy.

Officials plan to take “extraordinary measures” to achieve breakthroughs in core technology and strengthen export controls, according to a readout from a key policy meeting in October that discussed China’s next five-year plan.

“The reality of a bifurcated global landscape is now undeniable,” said Carlos Casanova, senior Asia economist at Union Bancaire Privee in Hong Kong. Both investors and manufacturers need to “adjust and strategically align themselves to succeed in a new world order where the US and China stand as dominant technological powers within their respective spheres of influence.”

(Updates with additional detail and comments throughout.)

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.