Economists attribute this decline mainly to stagnation in new business activities and a drop in private investment

TBS Report

03 November, 2025, 02:55 pm

Last modified: 04 November, 2025, 09:44 am

Representational image: Photo: Collected

“>

Representational image: Photo: Collected

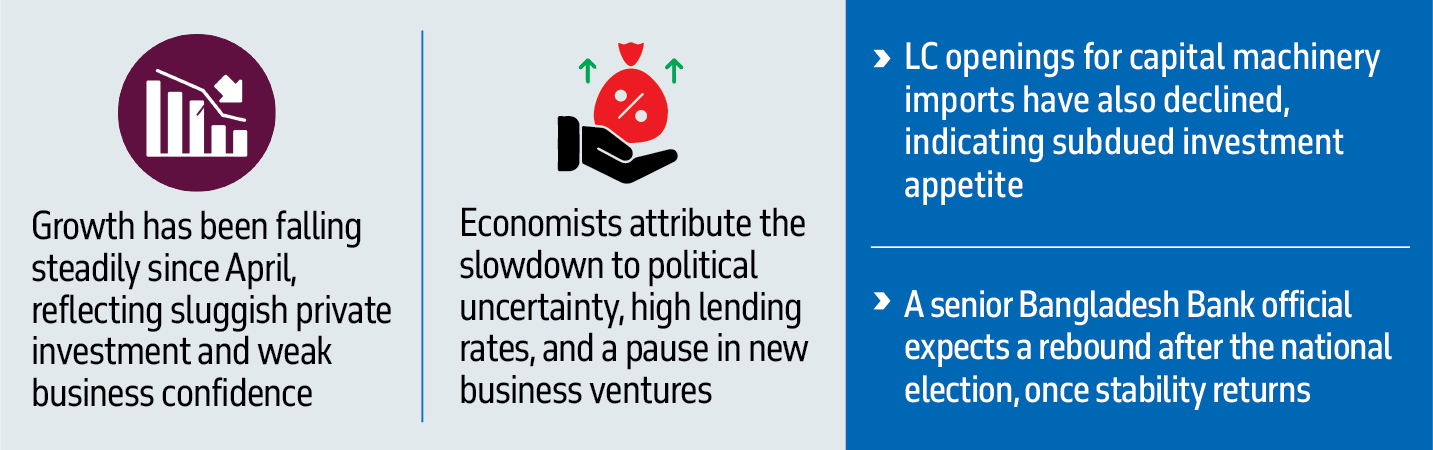

Private sector credit growth in Bangladesh fell to 6.29% in September, marking the lowest level in four years, according to the latest data from Bangladesh Bank.

TBS Infograph

“>

TBS Infograph

The slowdown has been consistent since 5 August 2024, as private sector lending continues to lose momentum.

The central bank data shows a consistent monthly decline — 6.35% in August, 6.52 % in July, 6.40% in June, 7.17% in May, and 7.5% in April.

Keep updated, follow The Business Standard’s Google news channel

Economists attribute this decline mainly to stagnation in new business activities and a drop in private investment.

Foreign investors consider the overall stability of a country before investing, economists noted.

Although the recent improvement in foreign exchange reserves is a positive sign, political uncertainty remains a key concern, they added.

A senior official at Bangladesh Bank said that private investment is likely to rebound once the country’s political situation stabilises after the election and a new government takes office.

“When new investments begin, the import of capital machinery will rise, leading to higher demand for bank loans and a recovery in credit growth,” the official added.

Meanwhile, the opening of letters of credit (LCs) for importing capital machinery has also declined, reflecting subdued business confidence and investment sentiment.

Business leaders have stressed the need to foster a more investment-friendly environment and lower high lending rates, warning that the current interest rates discourage entrepreneurs from borrowing to expand their operations.

Without lowering the cost of borrowing and improving the overall business climate, it will be difficult to revive private investment and restore credit growth, said business representatives.