2h agoTue 25 Nov 2025 at 11:21pmMarket snapshotASX 200: +1% to 8,621 points

Australian dollar: +0.1% at 64.7 US centsWall Street: Dow Jones (+1.4%), S&P 500 (+0.9%), Nasdaq (+0.7%) Europe: FTSE (+0.8%), DAX (+1%), Stoxx 600 (+0.9%)Spot gold: -0.1% to $US4,133/ounceOil (Brent crude): -1.2% to $US62.64/barrelIron ore: +0.8% to $US105.90/tonneBitcoin: +0.8% at $US87,704

Prices current at 10:20am AEDT

Live updates on the major ASX indices:

6m agoWed 26 Nov 2025 at 1:39amNew Zealand slashes interest rates to three-year low

New Zealand’s central bank cut its official cash rate by 0.25 percentage points to 2.25%, its lowest level since mid-2022, but policymakers signalled the likely end to the easing cycle as the economy showed signs of picking up.

The New Zealand dollar rose sharply as traders sharply trimmed expectations for any further rate cuts.

The decision matched a Reuters poll in which all but four of the 36 economists surveyed forecast the Reserve Bank of New Zealand would cut the cash rate.

The central bank, which surprised markets by slashing rates by a bigger-than-expected 0.5 percentage points in October, has delivered 325 basis points worth of easing since August 2024 to shore up an economy that has contracted in three of the last five quarters.

“Future moves in the [official cash rate] will depend on how the outlook for medium-term inflation and the economy evolve,” the RBNZ said in its accompanying monetary policy statement — the last of the year and the final meeting under governor Christian Hawkesby, before Swedish economist Anna Breman takes over in December.

The central bank is now forecasting the cash rate will be at 2.2% in the first quarter of 2026 and 2.65% in the fourth quarter of 2027. This is lower than had been expected in August.

The statement said that while economic activity was weak over mid-2025, it is picking up and lower interest rates are encouraging household spending and the labour market is stablising will the risks to the inflation outlook are balanced.

The New Zealand dollar jumped 0.7% to its highest in over a week, as markets called an end to the easing cycle.

The minutes of the meeting said the committee had considered holding the cash rate unchanged at 2.5% or cutting by 25 basis points, with five of the six members voting to cut the cash rate.

Reporting with Reuters

12m agoWed 26 Nov 2025 at 1:33am

Take numbers with a grain of salt: Jardin

Micaela Fuchila, chief economist at Jardin, joined ABC News Channel as the data dropped.

She told Alicia Barry “the RBA and everybody should take these numbers with a grain of salt and wait for a few more releases to see what the momentum in inflation is”.

But Ms Barry added that “the main component” of inflation has been housing.

“That was largely expected … it went up by 5.8% in the year. And most of the drivers of this are related to electricity rebates being removed [with] electricity costs going up by 37% in the year-to-date,” Ms Fuchila said.

“There’s a little bit of momentum in those components which are related to the housing sector, and services in general.”

Ms Fuchila added that the monthly inflation reports, instead of quarterly, would give the RBA more information to assess potential rate cuts or rises.

“As soon as this data is released, it will become the target for inflation. So they will start looking at monthly inflation to set the rate,” she said.

“This is consistent with G20 and best practice for all advanced economies.”

21m agoWed 26 Nov 2025 at 1:24am’A central banker’s nightmare’ says Deloitte Access Economics

The Reserve Bank of Australia finds itself in the trickiest spot, facing accelerating inflation and softening economic growth, says Deloitte Access Economics partner Stephen Smith.

“This result follows September quarter inflation figures that came in higher than expected, while the unemployment rate remains low. Throw this inflation print on the pile and it is clear that the RBA cannot justify cutting rates right now,” he said.

Mr Smith argues that further complicating the picture for the RBA is that the September quarter GDP data due next week is likely to be soft, reflecting an economy that needs more support.

“The RBA now find itself in the unenviable position of being caught between needing to support economic growth while getting inflation back within the 2-3 per cent band. That tricky balancing act is a central banker’s nightmare,’ he said.

However, he says the good news is the new and improved CPI series will give the RBA a fuller picture, reducing the potential for a monetary policy misstep.

“On balance, Deloitte Access Economics still expects the next move in interest rates to be down. The timing of that move is in doubt and will depend on how the economy evolves relative to the RBA’s updated forecasts over the coming months.”

31m agoWed 26 Nov 2025 at 1:14am

‘All but certain’ RBA will leave rates on hold

Inflationary pressures are showing no signs of abating, says Capital Economics’ Abhijit Surya.

“Overall, today’s CPI release makes it all but certain that the RBA will leave rates on hold in the near term,” he said.

“If anything, there are growing risks to our view that the Bank will resume rate cuts in the second half of next year. If national accounts data due next week also show elevated capacity pressures, the easing cycle may well be at an end.”

The rise in headline inflation was due to higher housing costs, Mr Surya explains.

“The main culprit as usual was electricity inflation, which surged to a fresh high of 37% as ongoing federal energy rebates are much smaller than those provided last year,” he said.

“However, it’s worth noting that both rental inflation and new dwellings inflation also continued to accelerate amid a tightening property market. Elsewhere, the RBA’s concerns about persistent market services inflation also appear to have been borne out, with the latter rising from 2.7% to 3.2% in October.”

36m agoWed 26 Nov 2025 at 1:10amHow this month’s CPI will impact interest rate decisions

The Reserve Bank prefers to look at the trimmed mean inflation data when making decisions about interest rates.

For the year to October, the trimmed mean rose to 3.3%, which is above the RBA’s target range of 2-3 %.

However, since this is the first month using a new framework, there is less confidence than usual in this month’s CPI estimates.

So, the RBA has said it will continue to focus on the quarterly inflation report for now.

The trimmed mean CPI for the September quarter was 3%, up from 2.7% in the June quarter.

It means hopes for an interest rate cuts in the following months are fading.

The next RBA board meeting on interest rates will be on the 8-9th December.

41m agoWed 26 Nov 2025 at 1:04amHigher inflation expected throughout 2026

Headline inflation, at 3.8% came in higher than market expectations (at 3.6%).

“Inflation picked up in October, following the trend of rising inflation in the back half of this year. With headline inflation at 3.8%, which is higher than the market expectation of 3.6%, and underlying inflation (measured by the trimmed mean) at 3.3% (up from 3.2% in September), inflation is effectively back where it was a year ago,” Russel Chesler, Head of Investments at VanEck said in an analyst note.

He says there are several factors influencing the trajectory of inflation in Australia, including housing inflation and higher electricity costs.

“Some of the ‘disinflationary gains’ from previous years, such as falling goods prices and government subsidies, have fallen off, while the ‘sticky’ components — namely services, housing, and electricity prices — have continued to rise.

Services inflation is perhaps the main thorn in the RBA’s side, as this spans across a large portion of the CPI basket. Services inflation has been difficult to conquer given the persistently strong wage growth and tight labour market,” he said.

Mr Chesler says rising inflation is something to keep an eye on, particularly given the RBA’s revised projections of an elevated inflation environment throughout 2026.

“However, barring a sharp spike in either inflation or unemployment — neither of which we have seen in recent years — we think it will continue to be business as usual for Australians. What we’ve recently seen throughout the ‘higher for longer’ tightening cycle and cost-of-living crisis is that the Australian economy is remarkably resilient,” he said.

50m agoWed 26 Nov 2025 at 12:56amAussie dollar up, ASX off highs on hot inflation

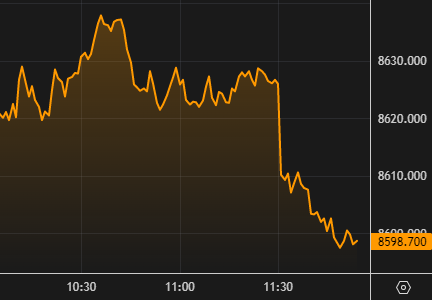

The market reaction to the first monthly consumer price index from the ABS was pretty clear to see on the charts.

Here’s the Aussie dollar:

AUDUSD (LSEG Refinitiv)

AUDUSD (LSEG Refinitiv)

And the ASX 200:

ASX 200 (LSEG Refinitiv)

ASX 200 (LSEG Refinitiv)

Despite coming off its early highs, the benchmark index is still around 0.7% higher.

1h agoWed 26 Nov 2025 at 12:43amUnderlying inflation also up

The headline CPI rose 3.8% in the year to October, despite no overall rise in prices during the month

It is confusing because it’s the first full set of monthly inflation figures published by the Bureau of Statistics that includes all goods and services in the CPI basket.

So, it’s going to be hard to compare data sets for the first few months of the new data.

The trimmed mean, a measure of underlying price changes closely watched by the Reserve Bank, picked up slightly to 3.3% over the year to October, above the RBA’s 2% to 3% target range.

1h agoWed 26 Nov 2025 at 12:32amHeadline annual inflation up 3.8%

The Consumer Price Index (CPI) rose 3.8% in the year to October, up from 3.6% in the 12 months to September.

It’s the first time the Australian Bureau of Statistics has released it’s first “full” monthly consumer price index (CPI).

The largest contributors to annual inflation were housing (+5.9%), food and non-alcoholic beverages (+3.2%) and recreation and culture (+3.2%).

More to come.

1h agoWed 26 Nov 2025 at 12:23am

What’s going on with Temple and Webster?

Hello there.

Emily Stewart here taking over the blog for the afternoon trading session.

David’s market update below points to Temple and Webster shares leading the falls today (down as much as almost 33%!!).

So, what’s going on?

Well, it’s down to their revenue growth coming in below analyst expectations and weaker than competitors.

The online homeware retailer posted an 18% revenue growth for the July – November period, which is slower than 28% growth in the previous period.

The weaker growth is consistent with a slowdown in web and app traffic.

Shares are at their lowest level in about nine years.

-Reporting with Reuters

1h agoWed 26 Nov 2025 at 12:08amLower fuel and electricity prices to weigh on Australian inflation

The ABS will release its October inflation figures in less than half an hour — but this month will be different.

The Statistics Bureau will be releasing its first-ever “full” monthly CPI (consumer price index).

It had been releasing inflation “indicators” in previous months. But they’re not seen as authoritative because they don’t include the “full basket” of consumer goods that are scrutinised in the quarterly CPI figures.

So the monthly inflation figures should be more reliable from now on.

Now that we’ve got the ‘economic nerdspeak’ out of the way, here’s what economists are predicting.

Commonwealth Bank senior economist Trent Saunders:

“We expect headline inflation fell by 0.2% in October, taking the annual rate to 3.6%.

“Softer electricity and fuel prices are the main drivers of the decline in the month.

“Market services inflation is also expected to slow a little, while rents and new dwelling price inflation are likely to remain firm. “The risks are tilted towards a slightly weaker outcome, with the potential for a sharper reversal in market services following the September quarter spike.”

AMP deputy chief economist Diana Mousina:

“We expect a monthly increase of 3.6% over the year and 2.8% for the trimmed mean.

“Prices for dwelling construction and rents are likely to be up, food and goods prices are likely to be slightly higher while electricity and petrol will be down.”

NAB senior FX strategist Rodrigo Catril:

“We expect headline CPI of 3.6% y/y, a tenth higher than our estimate of the September print. Among key swing factors for headline, a modest fall in fuel prices should have little effect.

“Electricity prices will fall in the month as NSW and ACT customers receive overlapping rebates due to the delayed start of their Q3 payment and as WA customers started receiving their rebate from mid-month.

“That sets up a subtraction from electricity in the fourth quarter, but a similar dynamic a year ago means it will have little influence on the year-ended rate in October.

“Looking ahead, electricity rebate timing will pull year-ended inflation lower in November and December due to base effects, before adding again in Q1 if the Commonwealth rebate extension ends as scheduled.”

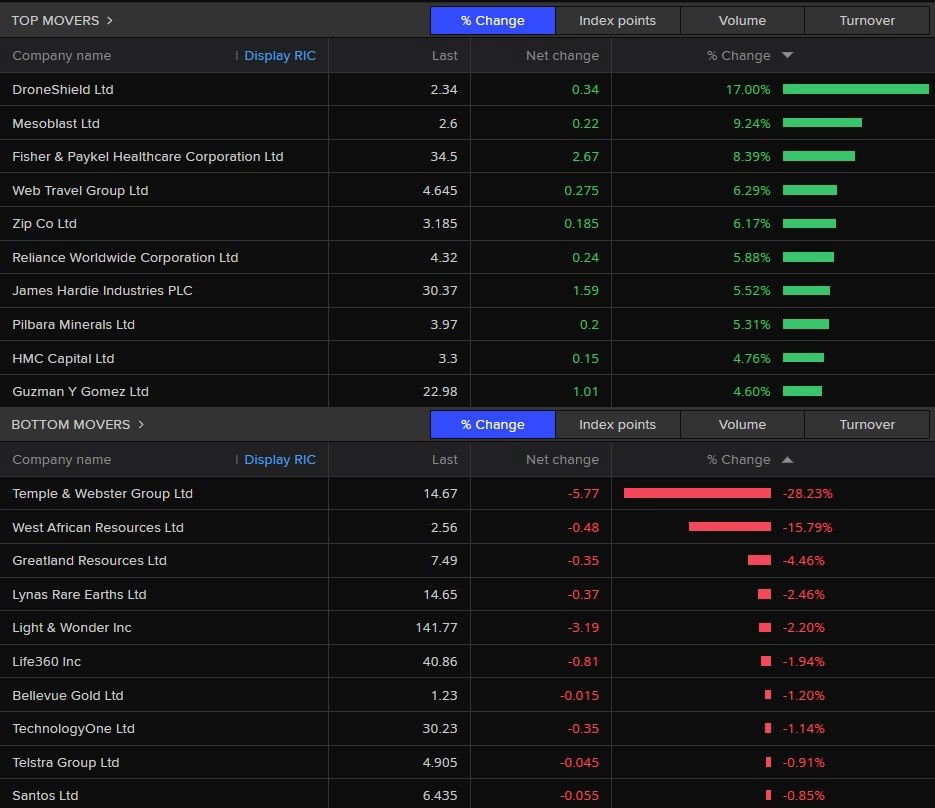

2h agoTue 25 Nov 2025 at 11:42pmHealthcare and consumer stocks lead ASX surge

It’s very much a “risk on” day for the local share market with every sector trading higher.

The ASX 200 was up 1.2% to 8,637 points by 10:40am AEDT, led by gains in the healthcare, consumer discretionary and real estate sectors.

Around 160 out of 200 stocks have also risen (ie. most of them are doing quite well).

Some of today’s best performing stocks include Mesoblast (+9,2%), Fisher & Paykel Healthcare (+8.4%) and Web Travel (+6.3%).

Their gains pale in comparison to DroneShield, which is seeing a 17% surge in its share price.

Investors are buying the dip after the anti-drone tech company’s share price were heavily sold off these past few weeks — largely due to a lack of transparency from DroneShield on why its CEO, chairman and a director sold all their shares.

On the flip side, today’s worst performing stocks include Temple & Webster (-28.2%), West African Resources (-15.8%) and Lynas Rare Earths (-2.5%).

Most stocks on the ASX 200 are trading higher. (Refinitiv)

Most stocks on the ASX 200 are trading higher. (Refinitiv)

2h agoTue 25 Nov 2025 at 11:31pm

ASIC sues founder of anti-drone laser maker

Homegrown space tech firm Electro Optic Systems is often mentioned as one of the hot Australian defence stocks.

This year, its share price skyrocketed from a little over a dollar to more than $8 in early October, off the back of some massive contracts including a $125 million order for one of its drone-burning lasers to a western European NATO country.

But it’s now in hot water with ASIC.

The space, communications and defence systems manufacturer has admitted breaching its continuous disclosure obligations by failing to disclose to the ASX a materially significant decline worth tens of millions of dollars in its 2022 annual revenue forecasts.

The corporate watchdog now is separately suing the company’s founder, director and former CEO, space expert Dr Ben Greene, claiming he breached his director’s duties in relation to that failure.

“ASIC will allege that Dr Greene was aware of a material change in the company’s guidance, but fell short in his consideration of these financials and EOS’s requirements to disclose them to the ASX,” ASIC chair Joe Longo has said.

The regulator is seeking declarations of contravention from the company itself, and in its separate action against Dr Greene, it is seeking civil penalties, disqualification orders and declarations against him.

You can read more about the rise of EOS in this piece from last month.

2h agoTue 25 Nov 2025 at 11:19pmASX jumps 1 per cent in early trade

The Australian trading day is off to a strong start!

The ASX 200 was up 1% to 8,622 points by 10:20am AEDT.

Meanwhile, the broader All Ords index also jumped 1% to 8,91 points.

I’ll have more details for you shortly.

2h agoTue 25 Nov 2025 at 10:57pmNvidia’s share price falling on reports Google is threatening its AI dominance

It turned out to be a strong day for Wall Street despite its most valuable company Nvidia experiencing a 2.6% drop in its share price.

That was after The Information reported the artificial intelligence (AI) chipmaker’s Nvidia’s dominance may be under threat.

In particular, the tech news website says Meta (Facebook’s parent company) is considering spending billions of dollars to purchase AI chips from Alphabet (Google’s parent), citing unnamed sources.

In addition, Alphabet’s share price has been surging after last week’s announcement about its upgraded AI model known as Gemini 3.

Nvidia shares, on the other hand, have been plummeting despite the fact it reported better-than-expected quarterly earnings last week.

The company is worth $US4.3 trillion on the market as concerns about its shares being overvalued (compared to its profits) persist.

This chart shows the widening gap between the performance of Nvidia’s and Alphabet’s shares on the market.

In the past two weeks, Nvidia’s share price has dropped almost 8%, while Alphabet has surged by around 12%.

Alphabet’s share price has surged in the past two weeks. (Refinitiv)3h agoTue 25 Nov 2025 at 10:43pmOptus investigating ‘significant’ outage in Frankston and the Mornington Peninsula

Alphabet’s share price has surged in the past two weeks. (Refinitiv)3h agoTue 25 Nov 2025 at 10:43pmOptus investigating ‘significant’ outage in Frankston and the Mornington Peninsula

More than 14,000 Optus customers south-east of Melbourne have lost service, with the telco warning calls to emergency services have been impacted.

Approximately 14,096 services have been impacted in the Frankston and Mornington Peninsula areas.

According to the Optus website, the issue has been caused by an “aerial fibre break” and is currently under investigation.

You can follow the latest updates in this article:

3h agoTue 25 Nov 2025 at 10:31pm

Market recap: Alan Kohler’s finance report

In case you need a market refresher before the ASX trading day begins, I can certainly recommend Alan Kohler’s finance report.

On last night’s 7pm News bulletin, Alan discussed Bendigo and Adelaide Bank’s problems dealing with money laundering and this week’s tech rebound on Wall Street:

Loading…3h agoTue 25 Nov 2025 at 10:18pmOptus outage affecting emergency calls in parts of Melbourne

An Optus outage is affecting calls to emergency services in Melbourne’s southeast.

An alert about an “aerial fibre break” has caused an outage to more than 14,000 services in Frankston and the Mornington Peninsula.

“Calls to Emergency Services are impacted by this outage,” according to the alert.

“Optus customers will only be able to call Emergency Services if they are within coverage of another mobile network or are able to call via WiFi”.

It does not list an “estimated time to fix” but says the issue is “under investigation”.

Optus has been contacted for comment.

More to come.

3h agoTue 25 Nov 2025 at 10:16pmUber Eats and DoorDash deal could set minimum pay for delivery workers

The Transport Workers Union has reached an agreement with Uber Eats and DoorDash for minimum safety net pay rates and other conditions for delivery drivers and riders.

The union says it is a “significant step” towards improving fairness in the gig economy.

Minimum safety net pay rates would put a floor beneath what have been wildly variable earnings for delivery workers.

Delivery workers tend to earn far less than Australia’s minimum wage as they are paid per delivery, not for time worked.

The deal requires approval from the Fair Work Commission.

Here’s the story by Emilia Terzon:

Loading…

ASX 200: +1% to 8,621 points

ASX 200: +1% to 8,621 points