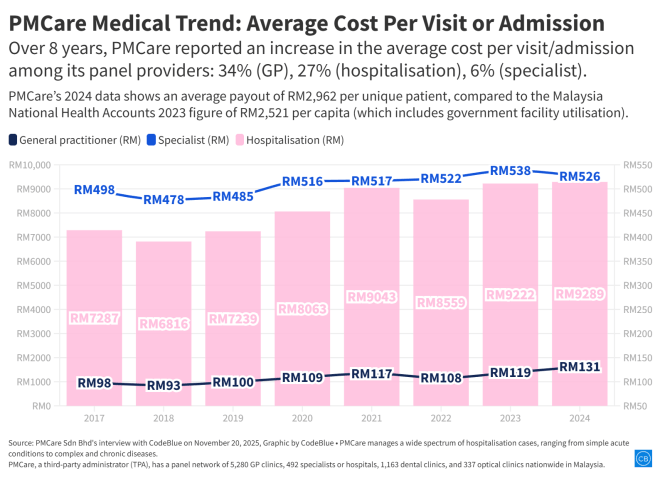

SUBANG JAYA, Nov 28 — PMCare Sdn Bhd reported the average cost of an admission for hospitalisation and a general practitioner (GP) visit at RM9,289 and RM131 respectively last year.

The oldest third-party administrator (TPA) in Malaysia, which pioneered managed care in 1995 for private health care, also reported the average cost of specialist fees at RM526 in 2024.

Data from PMCare – which was disclosed by the company in an interview with CodeBlue last November 20 – showed that the average cost per visit or admission for GPs, hospitalisation, and specialists increased by 34 per cent, 27 per cent, and 6 per cent respectively in an eight-year period.

From 2017 to 2024, PMCare’s average costs from hospitalisation increased from RM7,287 to RM9,289 per admission, while costs from specialist fees rose from RM498 to RM526. The average cost of a GP visit increased from RM98 to RM131.

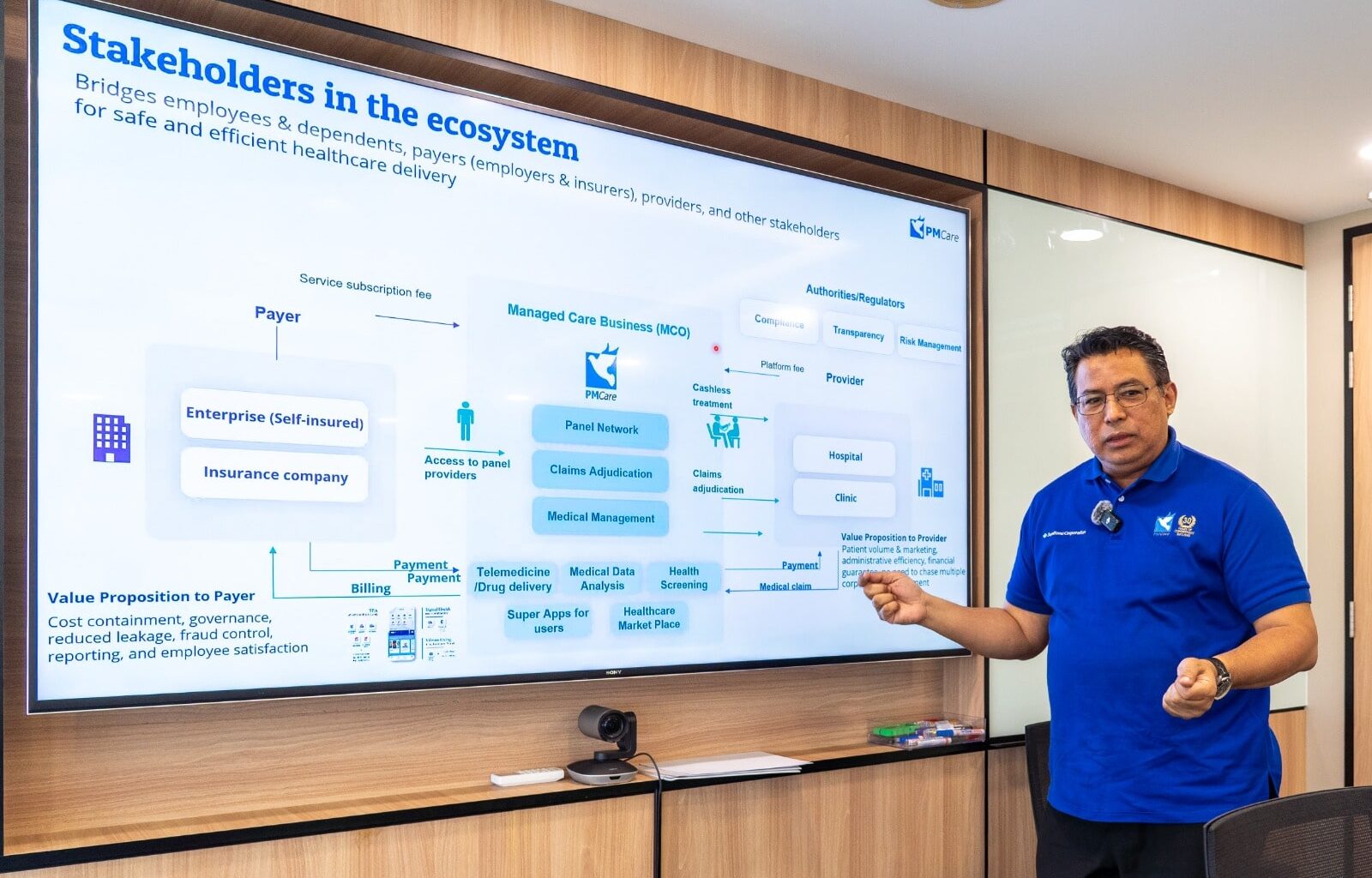

PMCare chief executive officer Kamal Aryf Baharuddin said his company’s clients comprise a mix of insured corporate groups, whose hospitalisation benefits are underwritten by insurers or takaful operators (ITOs), as well as administrative services only (ASO) clients who are self-funded.

“PMCare’s flexible benefit plan design is one of the key reasons many corporates choose us as their preferred MCO (managed care organisation) or TPA,” said Kamal.

“Most clients emphasise strong primary care as the ‘gatekeeper’ of the health care journey. Under this model, referrals to secondary or tertiary care are only initiated when clinically necessary and must be issued by our panel primary care providers, followed by validation by our Call Centre before any Guarantee Letter is issued.”

PMCare manages a wide spectrum of hospitalisation cases, ranging from simple acute conditions to complex and chronic diseases.

“With advancements in medical technology and stronger capability at the primary care level, more conditions can now be effectively managed in GP settings. This helps slow disease progression and reduces the need for tertiary-level intervention.”

Hospitalisation Inflation Under 1% In 2024

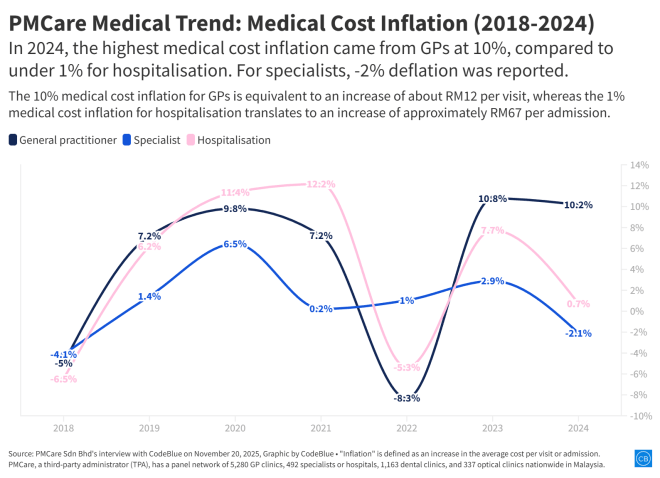

Despite reports from research firms claiming high double-digit medical cost inflation in Malaysia, PMCare – which boasts the largest network of medical providers in the country at nearly 7,300 – reported only 0.7 per cent medical cost inflation for hospitalisation and 10.2 per cent for GPs in 2024.

The majority of PMCare’s panel providers are GP clinics at 5,280 nationwide. The TPA also has 492 panel specialists or hospitals, besides 1,163 dental clinics and 337 optical clinics across the country.

In fact, for PMCare, medical cost inflation for hospitalisation declined by 7 percentage points from 7.7 per cent in 2023. GPs’ medical inflation moderated slightly from 10.8 per cent in 2023. PMCare even reported deflation in medical costs from specialists at -2.1 per cent last year, dropping from 2.9 per cent inflation in 2023.

Bank Negara Malaysia (BNM) previously reported 15 per cent medical cost inflation in 2024, which it said then was well above the global and Asia Pacific average of 10 per cent.

Professional services firm Aon projected an increase in Malaysia’s medical inflation from 15 per cent in 2025 to 16 per cent in 2026. Separately, MBSB Research also predicted 16 per cent medical cost inflation for Malaysia next year.

Kamal noted that his company’s medical cost inflation numbers at about 10 per cent for GPs (approximately an increase of RM12 per visit) and under 1 per cent for hospitalisation (approximately an increase of RM67 per admission) were significantly lower than the 15 per cent national benchmark.

“Inflation” is defined internally by PMCare as an increase in the average cost per visit or admission, not total utilisation.

“The reason our figures differ so widely from the national 15 per cent inflation rate is that our members’ medical charges remained largely consistent between 2023 and 2024. While the market saw a surge in pricing, our cost control/pricing structure kept the average cost per visit stable, with only a slight rise in GP costs,” Kamal told CodeBlue.

“By leveraging our one million-member base, PMCare negotiates corporate rates and package-based pricing with hospitals on behalf of insurers and employer groups. These negotiated terms help moderate cost escalation.

“In contrast, the macro-level medical inflation figures published by BNM may include general walk-in patients and cash-paying individuals, where price pressure tends to be higher, resulting in higher headline inflation rates.

“We expect PMCare’s medical inflation trajectory for 2026 to remain below the market projection of 16 per cent, while we continue to closely monitor external circumstances.”

Kamal also said PMCare wasn’t concerned about the approximate RM12 increase per GP visit last year that he described as being broadly in line with inflation.

“Additionally, part of the increase stems from the cost-shifting arrangement for stable chronic patients who previously obtained long-term medications from hospitals, but are now redirected to GP clinics or participating pharmacies. This improves patient convenience while reducing tertiary care burden.”

Payments For GPs, Specialists, Hospitalisation Rose To RM1.6 Billion In 2024

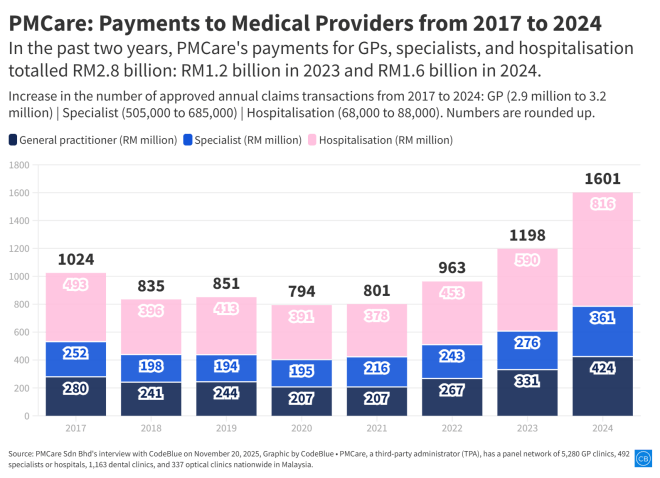

PMCare’s payments to medical providers (GPs, specialists, and hospitalisation) saw an increase from about RM1 billion in 2017 to RM1.6 billion in 2024, amid a rise in approved annual claims transactions in that period.

From 2017 to 2024, yearly approved claims transactions increased from 2.9 million to 3.2 million for GPs, 505,168 to 685,451 for specialists, and 67,665 to 87,789 for hospitalisation.

The biggest payments went to hospitalisation, followed by GPs and specialists for all of the years, except in 2021 when payments for specialists exceeded GPs.

PMCare’s annual payments for GPs, specialists, and hospitalisation saw a dip in 2020 at RM794 million during the Covid-19 pandemic, before climbing annually to exceed RM1 billion in 2023 and 2024.

Kamal said the rise in total utilisation was mainly driven by higher patient volumes, rather than increased medical service prices. “More members are seeking treatment, while the average cost per visit has remained relatively stable.”

The increase in GP expenditure, from about RM207 million in 2021 to RM424 million in 2024, was similarly attributed to a utilisation-driven trend, as more PMCare members sought treatment at the primary care level, both for acute issues and continued follow-up care.

“This reflects easier and more convenient access to GP services, effective treatment outcomes at the primary care level, and relatively more affordable cost-per-episode compared to hospital-based care,” said Kamal.

Average GP Cost: RM134 (RM100 Drugs, RM34 Consultation)

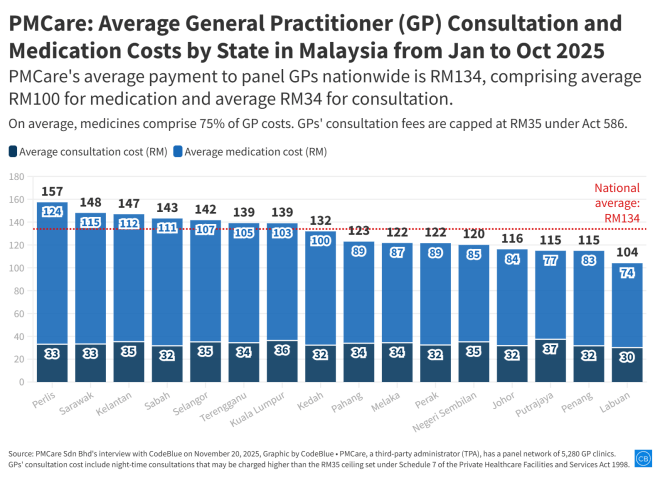

This year, from January to October, PMCare’s average payment to panel GPs nationwide was RM134, comprising an average RM100 for medication and average RM34 for consultation, near the RM35 ceiling consultation fee set under Schedule 7 of the Private Healthcare Facilities and Services Act 1998 (Act 586).

States reporting GP costs (consultation and medication) above the RM134 national average included Perlis, the highest, at an average of RM157, followed by Sarawak (RM148), Kelantan (RM147), Sabah (RM143), Selangor (RM142), Terengganu (RM139), and Kuala Lumpur (RM139).

Surprisingly, Labuan, an island near Sabah, reported the lowest GP costs at average RM104. With the exception of Selangor, the country’s most developed state, the other states reporting the highest GP costs are among the poorest in the country.

The lowest GP consultation cost was reported in Labuan at RM30 on average, while the highest was in Putrajaya at average RM37. Consultation costs include night-time consultations.

PMCare explained that it doesn’t impose a single fixed consultation fees across all GPs within a state, but adheres to the maximum rates set under Schedule 7. “GPs may charge any amount within this regulated range, and PMCare reimburses them accordingly. This is why consultation fees may vary even among clinics located in the same state.”

“While consultation fees follow the regulatory framework, PMCare exercises strict controls over medication pricing, medication–diagnosis appropriateness, and dispensing quantities to prevent abuse, ensure clinical appropriateness, and minimise wastage,” Kamal added.

He also said the new RM80 GP consultation fee ceiling, which was announced by Prime Minister Anwar Ibrahim during tabling of Budget 2026 last October, has yet to be officially gazetted into law. The government did not change the RM10 consultation floor rate.

“During discussions with the PAC (Public Accounts Committee) and the Ministry of Health earlier this year, PMCare also proposed not to impose a floor price for GP consultation fees, maintaining flexibility for fair and market-driven reimbursement,” said Kamal.

“As of now, no panel GPs have formally requested an increase in consultation fees.

On average nationwide, medicines comprised 75 per cent of a GP’s costs to PMCare.

Medication costs ranged from average RM74 in Labuan to average RM124 in Perlis. States reporting average medication costs at RM100 and above included Perlis (RM124), Sarawak (RM115), Kelantan (RM112), Sabah (RM111), Selangor (RM107), Terengganu (RM105), Kuala Lumpur (RM103), and Kedah (RM100).

Kamal attributed the lowest medication costs reported in Labuan versus the highest in states like Perlis and Kelantan to patient demographics and patient profiles, noting that Labuan has a relatively younger patient population.

Most patients in Labuan seek treatment for acute, short-term illnesses like upper respiratory tract infections or eye infections. On the other hand, states like Perlis and Kelantan have higher proportions of older patients managing chronic conditions, such as diabetes, hypertension, and hyperlipidaemia. Long-term management of these conditions often involves more expensive medications and combination therapies.

“Chronic disease management in these states leads to recurring and higher cumulative medication costs, whereas treatment in Labuan is generally episodic and short-term,” said Kamal.

“These observations help explain why Labuan shows lower average medication costs, while poorer states report higher GP medication costs, reflecting the combination of patient age, chronic disease prevalence, and treatment complexity.”

Over RM2 Billion Paid Out In 2024 For 653,000 Unique Patients

PMCare paid out more than RM2 billion in medical claims in 2024 from over 4.2 million approved claims transactions. The payouts were for 653,105 unique patients, out of 983,931 total members that year.

The payouts by the TPA amounted to nearly 5 per cent of the Ministry of Health’s (MOH) RM41.2 billion budget last year.

“About 99 per cent of claims were approved,” said Kamal.

This year, as of November 3, PMCare reported about RM1.7 billion approved claims from some four million approved transactions. PMCare’s claims denial rate so far this year was about 1.3 per cent, involving 41,444 claims transactions worth RM23.5 million.

Kamal opined that the RM2 billion payout last year appeared to be both affordable and sustainable for the population covered by PMCare.

“PMCare has consistently managed clients’ medical benefits with annual medical inflation kept at or below 10 per cent, which is widely viewed as a sustainable benchmark in the Malaysian private health care market. While rising treatment costs have required some cost transfer to clients, these adjustments have been both justified and appropriate in line with actual health care cost trends,” said the PMCare CEO.

“Importantly, PMCare’s efforts extend beyond managing ‘sick care’ claims. We actively invest in healthcare, prevention, and early detection, including disease screening and health promotion programmes.

“These initiatives help reduce long-term disease burden and support a healthier, more cost-conscious member population, which ultimately contributes to affordability and sustainability.”

Kamal also noted that based on 2024 data, PMCare made an average payout of RM2,962 per unique patient, comparing it to the Malaysia National Health Accounts (MNHA) 2023 figure of RM2,521 per capita (which includes government facility utilisation).

“PMCare’s utilisation level is broadly aligned with national trends. This suggests that the spending level is not excessive, given that PMCare predominantly manages claims within the private health care sector, where cost structures are typically higher.”