Nifty 50 slumps over U.S. tariff concerns

사진 확대 A view of the National Stock Exchange in Mumbai, India. Reuters Union

사진 확대 A view of the National Stock Exchange in Mumbai, India. Reuters Union

The Indian stock market, which once attracted investors’ attention with a high rise, has been turned away by local investors as it has been locked in a box.

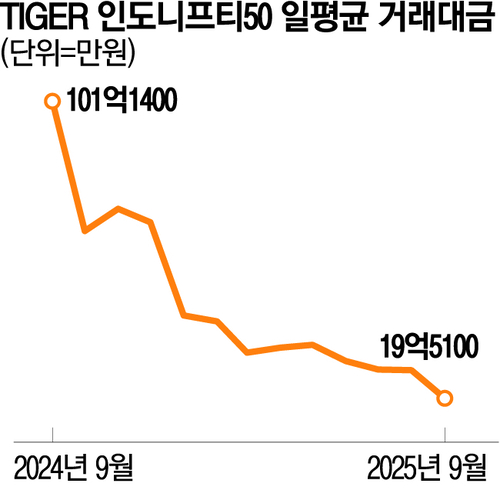

According to the Korea Exchange’s information data system on the 14th, the TIGER India Nifty 50 Exchange Traded Fund (ETF) traded an average of 1.951 billion won per day from the 1st to the 12th of this month. In September 2024, a year ago, it was traded at 10.114 billion won, but the transaction value gradually decreased and now it is one-fifth.

Low returns are cited as a key reason for this decrease in transaction value. In fact, the ETF’s three-month yield is -2.59% and its one-year yield is -1.56% low.

The biggest reason for such a low performance in the Indian stock market is trade negotiations with the United States, which have rarely progressed. As the Indian government has not given up on Russian oil imports, the U.S. is imposing tariffs of as much as 50% on Indian exports.

사진 확대

사진 확대

As a result, the Nifty 50 index was trapped in the box due to growing concerns over its performance, mainly by automobile and pharmaceutical companies such as Tata Motors and Sun Pharma, which account for a large portion of the Indian stock market.

ETF transactions also fall sharply, seeking to rebound consumption through tax reform

In this situation, the Indian government is trying to reverse the situation with measures to boost domestic demand. From the 22nd, the GST (Goods and Services Tax) tax reform plan will simplify the tax rate structure and implement a tax cut policy for major items.

For example, the tax rate for automobiles and home appliances will be reduced from 28% to 18%, and the tax rate for daily goods such as cosmetics and shampoos and food and dairy products will be lowered to between 0 and 5%. In addition, a high tax rate of 40% will be applied to luxury goods and harmful goods such as cigarettes and carbonated drinks, but the actual application will be suspended.

The market is also reacting to these measures, with the Nifty 50 index rising 2.81% this month, showing a modest rise.

Kim Geun-ah, a researcher at Hana Securities, said, “The policy is the strongest economic stimulus after the government’s income tax cut policy announced in February and a cumulative interest rate cut of 100bp. This measure will serve as a buffer to absorb the impact of tariffs on the United States.”