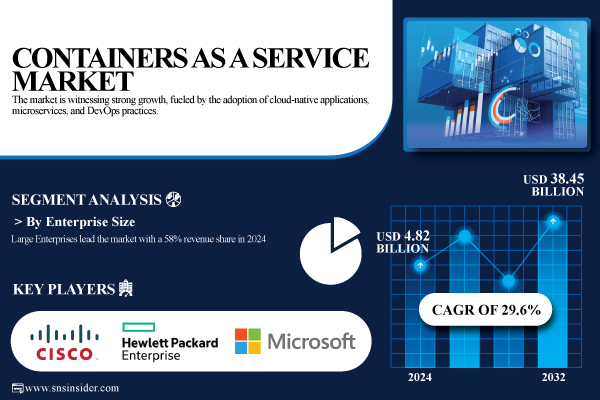

Austin, Sept. 15, 2025 (GLOBE NEWSWIRE) — The Containers As A Service Market (Container als Servicemarkt) Size was valued at USD 4.82 billion in 2024 and is expected to reach USD 38.45 billion by 2032 and grow at a CAGR of 29.6% over the forecast period 2025-2032.

As businesses are quickly implementing microservices and cloud-native apps, which call for scalable, portable, and effective infrastructure, the market for containers as a service is still expanding. This change has improved flexibility for executing workloads across hybrid and multi-cloud systems, decreased downtime, and accelerated application deployment cycles. Development teams may concentrate on innovation instead of manual infrastructure activities thanks to container orchestration features, which simplify operations.

Download PDF Sample of Containers As A Service Market @ https://www.snsinsider.com/sample-request/8219

Key Players:

Cisco Systems, Inc.Hewlett-Packard Enterprise CompanyIBM CorporationOracleHuawei Technologies Co., Ltd.Amazon Web ServicesGoogleMicrosoftVMWareDockerSUSERed HatTata CommunicationsAlibaba CloudDXC TechnologyRackspace TechnologyPlatform9 SystemsCloud Foundry FoundationApprendaJoyent

Containers As A Service Market Report Scope:

Report AttributesDetailsMarket Size in 2024USD 4.82 BillionMarket Size by 2032USD 38.45 BillionCAGRCAGR of 29.6% From 2025 to 2032Base Year2024Forecast Period2025-2032Historical Data2021-2023Report Scope & CoverageMarket Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast OutlookKey Segments• By Service Type (Management & Orchestration, Security, Monitoring and Analytics, Storage and Networking, Continuous Integration and Continuous Deployment (CI/CD), Training and Consulting, Support and Maintenance)

• By Deployment (Public Cloud, Private Cloud, Hybrid Cloud)

• By Enterprise Size (Small & Medium Enterprises, Large Enterprises)

• By End Use (IT & Telecommunication, BFSI, Healthcare, Retail, Manufacturing, Government, Transportation & Logistics, Others)Customization ScopeAvailable upon requestPricingAvailable upon request

If You Need Any Customization on Containers As A Service Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/8219

Segmentation Analysis:

By End-Use, IT & Telecommunication Led the Market with 24% Revenue Share

IT & Telecommunication dominates the market with a 24% revenue share in 2024, driven by the sector’s demand for high scalability, low latency, and rapid application deployment. Retail is expanding rapidly with a CAGR of 34.94% as businesses adapt to fluctuating consumer demand and omnichannel strategies.

By Enterprise Size, Large Enterprises Segment Dominated the Market in 2024

Large Enterprises lead the market with a 58% revenue share in 2024, largely due to their ability to invest in enterprise-grade orchestration platforms with advanced compliance, security, and scaling capabilities. Small & Medium Enterprises are growing at a CAGR of 30.59%, supported by cost-effective pay-as-you-go CaaS models that remove the need for heavy infrastructure investment.

By Deployment, Public Cloud Led the Market in 2024

Public Cloud holds the largest share with 47% of market revenue in 2024, due to its cost efficiency, global scalability, and minimal infrastructure management requirements. Hybrid Cloud is the fastest-growing segment with a CAGR of 33.12%, as organizations seek to balance regulatory compliance and legacy systems with cloud scalability.

By Service Type, the Market was Dominated by Management & Orchestration Segment in 2024

Management & Orchestration dominates with a 29% revenue share in 2024, driven by the necessity for coordinated container deployments at scale. Monitoring & Analytics is growing at a CAGR of 32.71%, fueled by the demand for real-time performance insights and predictive problem-solving.

In 2024, the Market was Led by North America Holding 38% Share; Asia Pacific is Projected to Witness Fastest CAGR Growth Over 2025-2032

North America held the largest share of the Containers as a Service Market in 2024, accounting for 38% of global revenue due to advanced cloud infrastructure, high enterprise adoption of DevOps practices, and strong demand for scalable, containerized application deployment across industries.

Asia Pacific is the fastest-growing region in the Containers as a Service Market, with a robust CAGR of 31.8% in 2024 fueled by rapid digital transformation, the expansion of e-commerce, and increasing cloud adoption across manufacturing, retail, and financial services.

Recent Developments:

March 2024 – IBM announced the general availability (GA) of its z/OS Container Platform (zOSCP), enabling containers and Kubernetes workloads directly on IBM z/OS mainframes, a notable advance in merging containerization with mainframe environments.March 24, 2024 – Oracle released Oracle Cloud Native Environment 1.8, a container-orchestration platform that supports ARM architecture and Kubernetes 1.28, and achieved CNCF Kubernetes conformance. This makes it a robust solution for deploying containerized applications across hybrid and cloud environments.

Buy Full Research Report on Containers As A Service Market 2025-2032 @ https://www.snsinsider.com/checkout/8219

Exclusive Sections of the Report (The USPs):

Deployment & Adoption Metrics

The report highlights a strong enterprise shift towards hybrid cloud environments within the Containers as a Service (CaaS) market. Over 60% of enterprises now deploy CaaS primarily for hybrid cloud use cases, as opposed to multi-cloud setups. This trend reflects the growing demand for cloud-native flexibility while maintaining better control over infrastructure. The preference for hybrid deployments underscores CaaS’s role in enabling agile, scalable, and secure application delivery across mixed cloud environments.

Technology Integration Statistics

CaaS platforms are increasingly defined by their tight integration with Kubernetes, which now powers 85% of all CaaS deployments. This widespread adoption confirms Kubernetes as the industry standard for orchestration. Furthermore, CaaS significantly accelerates application deployment, with average deployment times dropping to just 5 minutes, three times faster than traditional virtual machine (VM) environments. This speed advantage enhances developer productivity and supports continuous delivery pipelines in modern software development.

Security & Compliance Indicators

While adoption of CaaS continues to rise, security remains a critical focus. The report notes that 18% of CaaS environments have experienced container-related security breaches, pointing to the importance of robust security frameworks. Encouragingly, 72% of deployments now feature automated compliance checks, indicating a proactive shift toward continuous compliance and security governance. These trends suggest that enterprises are investing in securing their container environments as CaaS becomes more mainstream.

Cost & Performance Benchmarks

Organizations migrating to CaaS are realizing substantial financial and operational benefits. On average, enterprises report 25% cost savings after transitioning workloads to CaaS platforms, driven by improved resource utilization and reduced infrastructure overhead. In terms of performance, CaaS deployments offer 30–40% better CPU and memory utilization compared to traditional hosting environments. These efficiencies translate to lower operational costs and higher application performance, making CaaS a compelling option for modern IT strategies.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.